3 ETFs for the Conservative Investor to Buy and Hold

For a conservative investor seeking exposure to the equity markets while prioritizing stability and long-term wealth preservation, investing in Exchange-Traded Funds (ETFs) or indices can be an attractive strategy and might make the most sense.

ETFs offer a unique combination of diversification, cost-effectiveness, and liquidity, making them an ideal choice for those who prefer a buy-and-hold approach. When selecting an ETF, several important factors must be considered, including the net expense ratio, diversification of holdings, a potential dividend yield, and overall liquidity.

Let's take a closer look at three ETFs: Vanguard S&P 500 (NYSE: VOO), Utilities Select Sector SPDR Fund (NYSE: XLU), and SPDR Gold Shares (NYSE: GLD). Each of these funds may be a suitable choice for conservative investors looking to build and maintain wealth for the long term and gain exposure to a basket of blue chip stocks.

Vanguard S&P 500 (NYSE: VOO)

VOO is an ETF aiming to mirror the S&P 500 Index, one of the most widely followed benchmarks for the U.S. stock market. VOO offers investors a cost-effective and diversified way to invest in large US companies, closely matching the index's composition and performance.

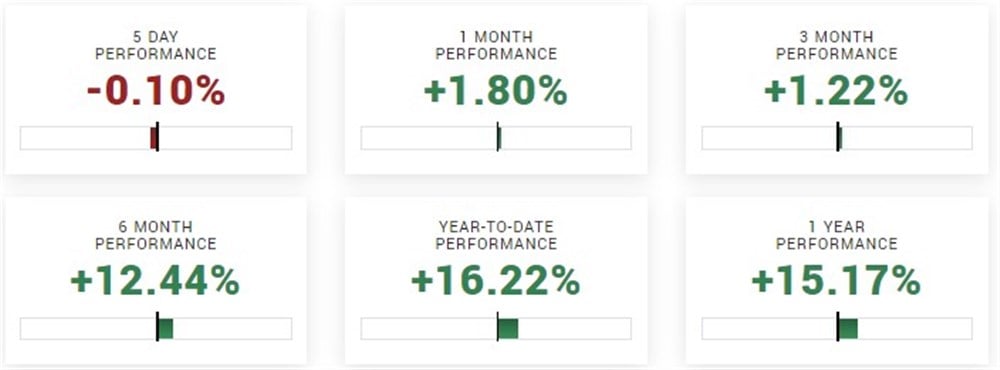

Year-to-date, VOO is up 16.22%, consolidating near its 52-week highs. Since the launch of the ETF in 2011, it has risen almost 304%, not including dividends. The ETF currently has a 1.46% dividend yield and a meager net expense ratio of just 0.03%. VOO has a market capitalization of $326.67 billion and an average volume of 3.78 million shares.

Conservative investors will appreciate VOO for its stability, as it mirrors the overall market's performance, providing exposure to well-established and financially stable companies, predominantly in the U.S., with a 95.9% exposure.

Utilities Select Sector SPDR Fund (NYSE: XLU)

The XLU, which focuses on the utilities sector, is known for its defensive and income-generating characteristics. The fund aims to match the performance of the Utilities Select Sector within the S&P 500 Index. This sector includes companies in electric utilities, multi-utilities, independent power producers, energy traders, and gas utilities.

The ETF is in the red year-to-date, down just over 9%. However, the ETF is up almost 27% over the last five years, not including its current dividend yield of 3.22%. The net expense ratio of XLU is considerably higher than VOO, at 0.10%. XLU has a market capitalization of just under $15 billion and an average daily volume of 13.24 million shares.

The XLU tends to offer higher dividend yields than broader market ETFs, which might make up for the less impressive growth and share appreciation of other sectors.

SPDR Gold Shares (NYSE: GLD)

GLD is an ETF that tracks the price of gold, a precious metal widely considered a safe-haven asset. Conservative investors have often turned to GLD for its stability to hedge against inflation, currency fluctuations, and overall market volatility.

While the ETF does not offer a dividend and possesses a relatively high net expense ratio of 0.40%, its recent and longer-term performance might compensate for it. Year-to-date, the ETF is up almost 6% and nearly 16% over the last year. GLD has risen almost 57% in the previous five years, providing an attractive return to its long-term shareholders.

As an asset uncorrelated with equities, GLD could provide added diversification and reduce overall portfolio risk.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.