4 Golden Crosses With Double-Digit Upside Ahead

Marketbeat's numerous tools for investors include screens and analyses of fundamental and technical factors. The tool we're looking at today is a technical screen for golden crosses. A golden cross is when a shorter-term EMA, such as a 30-day or 50-day average, crosses above a longer-term EMA. Longer-term EMAs could run from 100 to 300 days, but the crossover is what matters.

Technical analysis assumes the shorter EMA represents activity by short-term oriented traders and the more extended activity by long-term oriented traders; when the short crosses over the long, it signals a convergence of markets that can lead to accelerated share price action. A convergence of markets is when one or more technical factors signal a buy, suggesting a high degree of commitment from the market. The higher the degree of commitment, the higher the price action can move.

Allot Communications, Ltd Is Pivoting Back to Growth

Allot, Ltd (NASDAQ: ALLT) is a technology company focused on network security for enterprises and ISPs. Its stock price has fallen significantly over the last year as business contracted and analysts cut their price targets. The takeaway today is that a Golden Cross of the 30-day and 150-day EMA signals a bottom, and there is a high probability that the stock will enter a complete reversal within the next 12 months.

The bottom and Golden Cross aligned with recent results, which were better than expected and provided favorable guidance. The guidance isn't robust but expects flat revenue and break-even conditions in 2024, and analysts are forecasting a return to growth by year-end. Marketbeat.com tracks three analysts with reports on Allot; they rate the stock as Moderate Buy and view it as undervalued, trading below the low end of their target range.

Datasea Inc. is Growing at a Hyper-Pace

Datasea (NASDAQ: DTSS) is a smaller 5G operator in China providing services to mobile operators, smart cities, and enterprise security. Its Golden Cross is driven by two recent news events that support the outlook for quadruple-digit growth and the potential for outperformance. The latest news was released in early March and helped confirm the technical price action.

The company is guiding for 1100% revenue growth this year, and the market expects growth to continue in the next fiscal year. No analysts have rated this stock, but the institutional activity is noteworthy. Institutions, including insiders and large shareholders, own more than 80% of the stock and have been buying it recently.

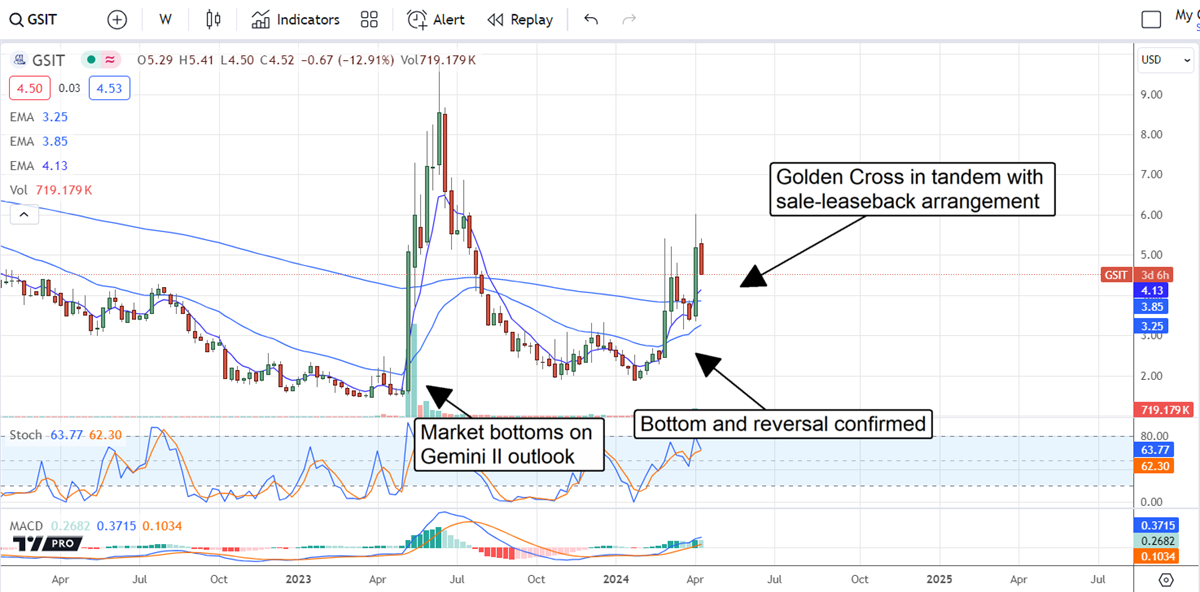

GSI Technology: An AI-Powered Golden Crossover

GSI Technology (NASDAQ: GSIT) is a niche semiconductor manufacturer focused on memory solutions and computer vision applications for industrial, enterprise, and government use. The company's offerings are in demand, fueling growth with a chance for hypergrowth over the next few years. A recent announcement drove the Golden Cross. The company is entering a sale-leaseback arrangement for its Sunnyvale property, which will raise $11.85 million in capital. The capital raise will help the company sustain operations as it works to launch its Gemini-II product and maintain a fortress balance sheet. The company has no debt.

IAC Is Turning a Corner

IAC (NASDAQ: IAC) is an omnichannel media giant with brands like Ask.com and Angi (formerly Angie's List) in its portfolio. The stock recently fired a Golden Cross in tandem with Q4 results, which were weaker than expected but pointed to a shift in business. The company intends to return to growth and profitability this year and to produce a full year of profits in 2025. Analysts like the stock and have it ranked on Marketbeat's list of Top Rated Stocks. They have it pegged at Moderate Buy and view it as a deep value, trading below the low end of their target range.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.