The Fed Is More Likely to Hike Than Cut Rates in 2025

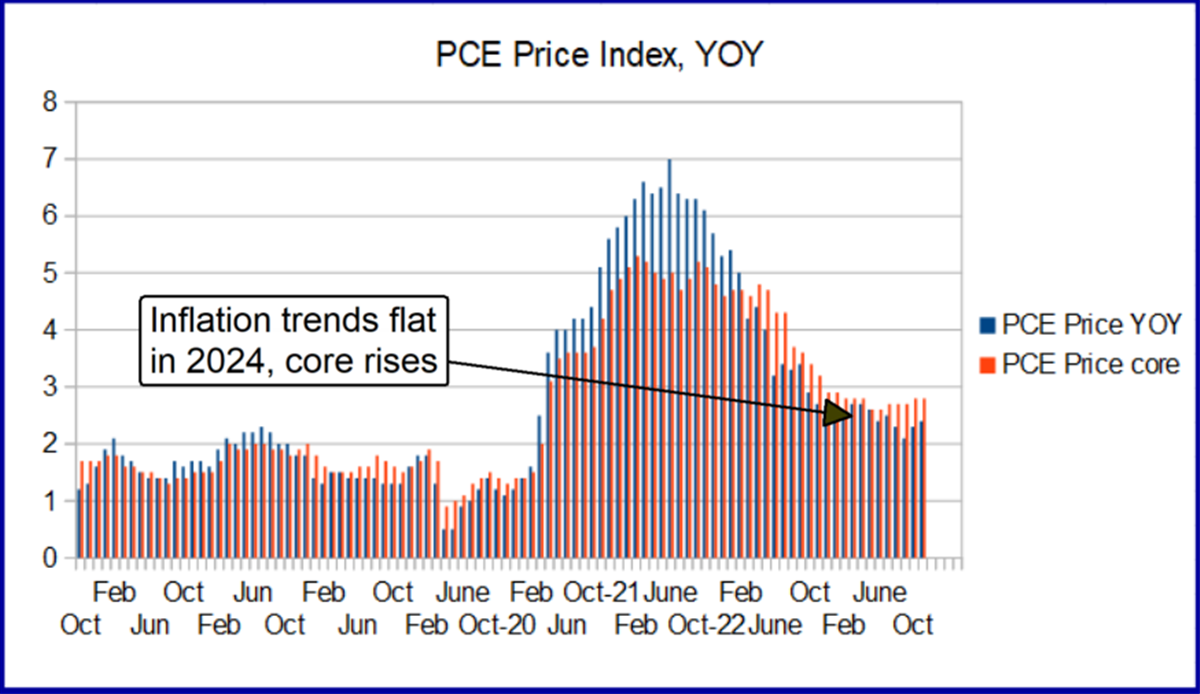

The market continues to price in the chance for a rate cut in 2025, which could be a big mistake. Despite inflation’s fall from the COVID-induced highs, it remains hot and is not cooperating. Even if the January and February data are weaker than expected, the trend in inflation is flat, not downward, and does not align with the idea of lower interest rates. Other factors that point to higher interest rates are the labor markets, consumer spending, oil prices, GDP expectations, and the 10-year Treasury. This is a look at why.

The Fed’s Mandates Are Not in Balance

The Fed’s mandate is dual: support the economy while protecting the labor market and keeping interest rates low. The trend in inflation data is undeniable: it’s not cooperating, and the trend in labor data is one reason. The labor market has cooled from its peak in 2022/2023. Still, it remains healthy, strong, and resilient, with job gains averaging 191,000 in 2024, unemployment averaging 4%, wages rising by 4%, ample job availability, and historically low jobless claims.

Some red flags include the Challenger, Gray, & Christmas data on layoffs and hiring plans and the total jobless claims data. Still, even they are better than they look at face value, revealing volatility within a shifting labor market environment and not deteriorating conditions.

Consumer trends in 2024 are equally strong. They are expected to average over a 3% gain compared to the prior year. This is sufficient to outpace core consumer inflation growth relative to the PCE price index, showing a slight increase in demand. The forecast for 2025 is for retail sales to accelerate to 3.5% or higher, increasing upward pressure on prices, and tailwinds may develop in the back half as the Trump policy comes into effect. Coincidentally, the FOMC made note of the same fact at their last meeting.

Oil Prices Rise: To Drive Inflation Gains in Q1

Oil prices compound inflation, impacting input costs at every system level. The oil price fell in 2024, hitting a long-term low in Q4, but has rebounded strongly. It was 17% off its lows in mid-January, indicated higher by price action and indicators, including moving averages, stochastics, and MACD. Trading near $78.25, the price of WTI aligns with the mid-point of a multiyear trading range with plenty of room to move higher. The takeaway is that oil prices will drive inflation in Q1 and potential for the year, assuming there is no price correction.

The CME FedWatch Tool, a gauge of Fed probability based on futures contracts, still indicates a chance for cuts in 2025, but the odds are falling sharply. According to it, a cut is unlikely to happen before July, and one by the end of the year is questionable. At 75%, it won’t take much more to cement the idea of no cuts this year into the market’s mind, an event likely leading to a stock market correction. The good news is that an S&P 500 (NYSEARCA: SPY) correction is unlikely to lead to a sustained downturn because of underlying economic health, the cause of higher inflation.

The 10-year Treasury Adjusts to a Higher-for-Longer-Than-Expected Environment

The 10-year Treasury yield is rising and realigning with the evolving FOMC outlook. The yield advanced significantly in the year's first two weeks, rising to an 18-month high supported by the short-term 30-day and longer-term 150-day EMAs. The yield will likely continue rising because the spread at 4.8%, relative to the expected year-end 4% FOMC base rate, is well below the long-term average. In this environment, the yield could rise another 40 bps or more before topping out, and the Fed cutting to 4% is questionable.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.