Q3 Earnings Outperformers: Cadre (NYSE:CDRE) And The Rest Of The Aerospace and Defense Stocks

As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the aerospace and defense industry, including Cadre (NYSE: CDRE) and its peers.

Emissions and automation are important in aerospace, so companies that boast advances in these areas can take market share. On the defense side, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression toward Taiwan–have highlighted the need for consistent or even elevated defense spending. As for challenges, demand for aerospace and defense products can ebb and flow with economic cycles and national defense budgets, which are unpredictable and particularly painful for companies with high fixed costs.

The 29 aerospace and defense stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 1.3% above.

In light of this news, share prices of the companies have held steady as they are up 2.6% on average since the latest earnings results.

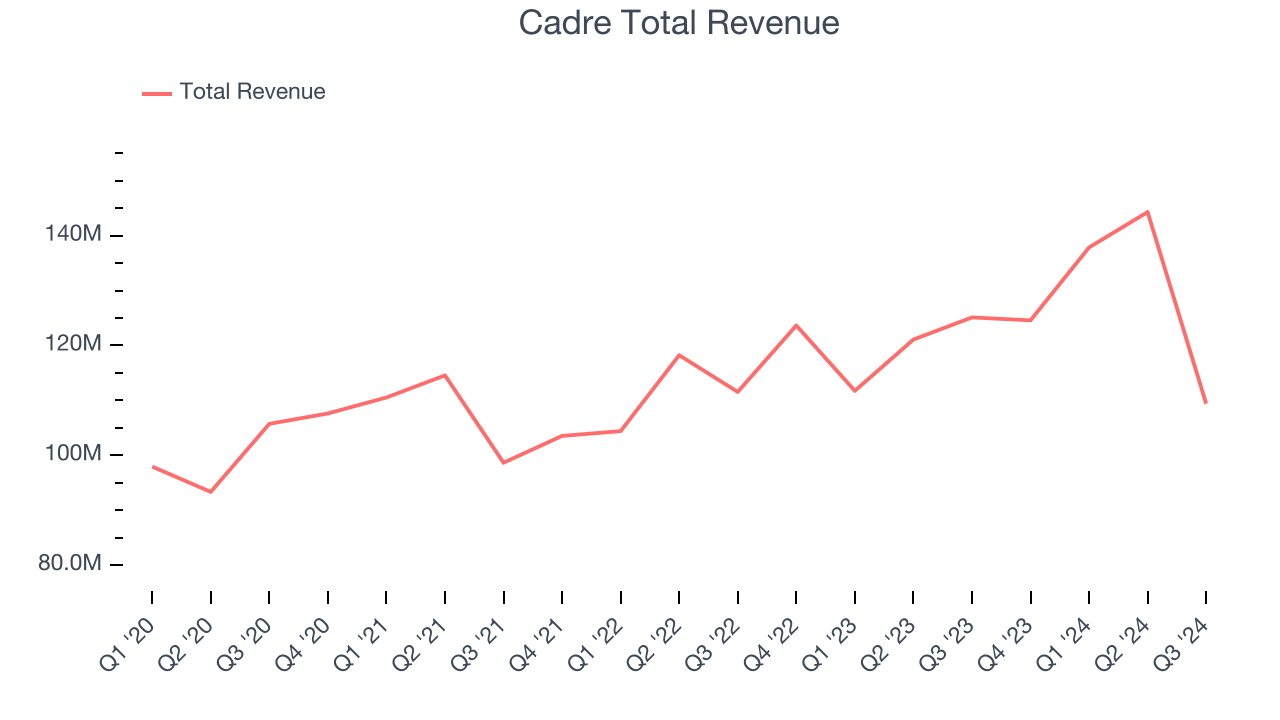

Cadre (NYSE: CDRE)

Originally known as Safariland, Cadre (NYSE: CDRE) specializes in manufacturing and distributing safety and survivability equipment for first responders.

Cadre reported revenues of $109.4 million, down 12.6% year on year. This print fell short of analysts’ expectations by 13.4%. Overall, it was a softer quarter for the company with a miss of analysts’ adjusted operating income estimates.

“During the third quarter we continued to see strong and recurring demand for Cadre’s best-in-class, mission-critical safety equipment,” said Warren Kanders, CEO and Chairman.

Cadre delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 11.7% since reporting and currently trades at $32.80.

Read our full report on Cadre here, it’s free.

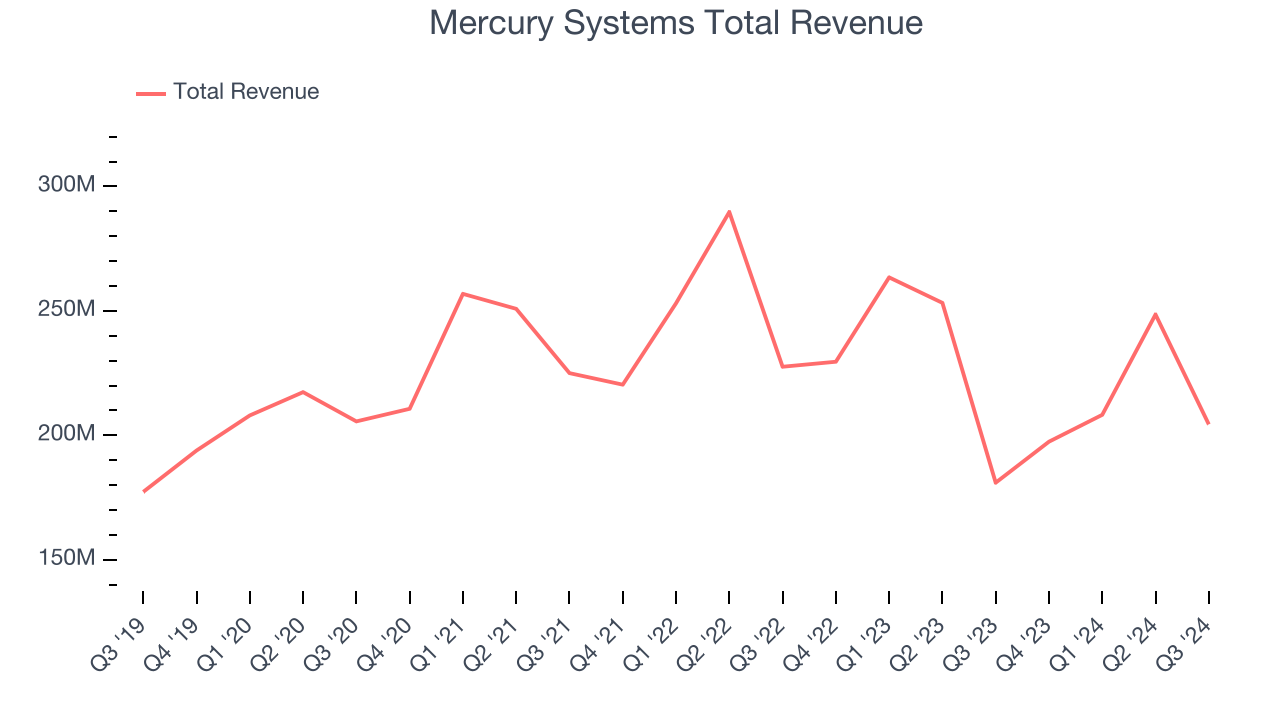

Best Q3: Mercury Systems (NASDAQ: MRCY)

Founded in 1981, Mercury Systems (NASDAQ: MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems reported revenues of $204.4 million, up 13% year on year, outperforming analysts’ expectations by 12.5%. The business had an incredible quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EPS estimates.

Mercury Systems pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 18.2% since reporting. It currently trades at $40.47.

Is now the time to buy Mercury Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Huntington Ingalls (NYSE: HII)

Building Nimitz-class aircraft carriers used in active service, Huntington Ingalls (NYSE: HII) develops marine vessels and their mission systems and maintenance services.

Huntington Ingalls reported revenues of $2.75 billion, down 2.4% year on year, falling short of analysts’ expectations by 4%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 22.2% since the results and currently trades at $195.30.

Read our full analysis of Huntington Ingalls’s results here.

Astronics (NASDAQ: ATRO)

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ: ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

Astronics reported revenues of $203.7 million, up 25% year on year. This result surpassed analysts’ expectations by 2.6%. Overall, it was a very strong quarter as it also logged a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is down 15.7% since reporting and currently trades at $17.35.

Read our full, actionable report on Astronics here, it’s free.

KBR (NYSE: KBR)

Known for projects like the construction of Guantanamo Bay, KBR provides professional services and technologies, specializing in engineering, construction, and government services sectors.

KBR reported revenues of $1.95 billion, up 10% year on year. This number was in line with analysts’ expectations. It was a strong quarter as it also produced a solid beat of analysts’ backlog estimates and a decent beat of analysts’ adjusted operating income estimates.

The stock is down 13.6% since reporting and currently trades at $60.79.

Read our full, actionable report on KBR here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September, a quarter in November) have kept 2024 stock markets frothy, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there's still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.