3 Reasons to Sell COLM and 1 Stock to Buy Instead

Even though Columbia Sportswear (currently trading at $87.20 per share) has gained 5.2% over the last six months, it has lagged the S&P 500’s 14.2% return during that period. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Columbia Sportswear, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We're sitting this one out for now. Here are three reasons why we avoid COLM and a stock we'd rather own.

Why Do We Think Columbia Sportswear Will Underperform?

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ: COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

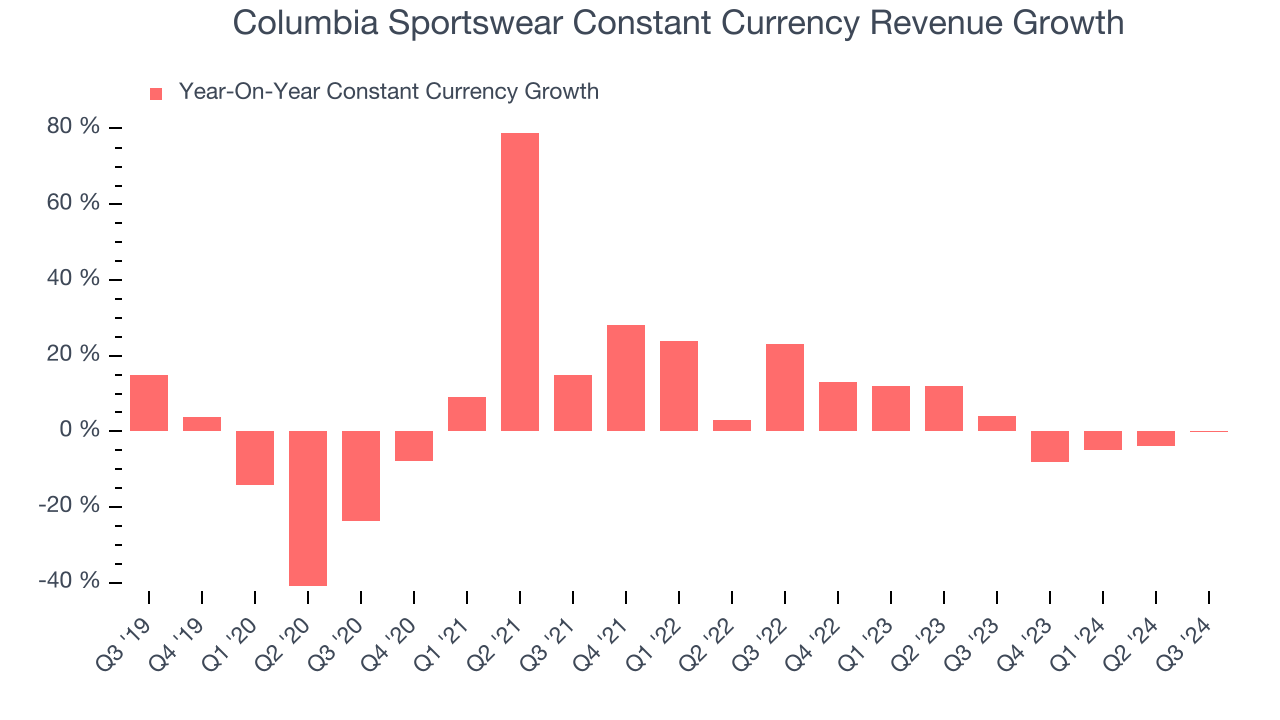

1. Weak Constant Currency Growth Points to Soft Demand

We can better understand Apparel and Accessories companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of Columbia Sportswear’s control and are not indicative of underlying demand.

Over the last two years, Columbia Sportswear’s constant currency revenue averaged 3% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

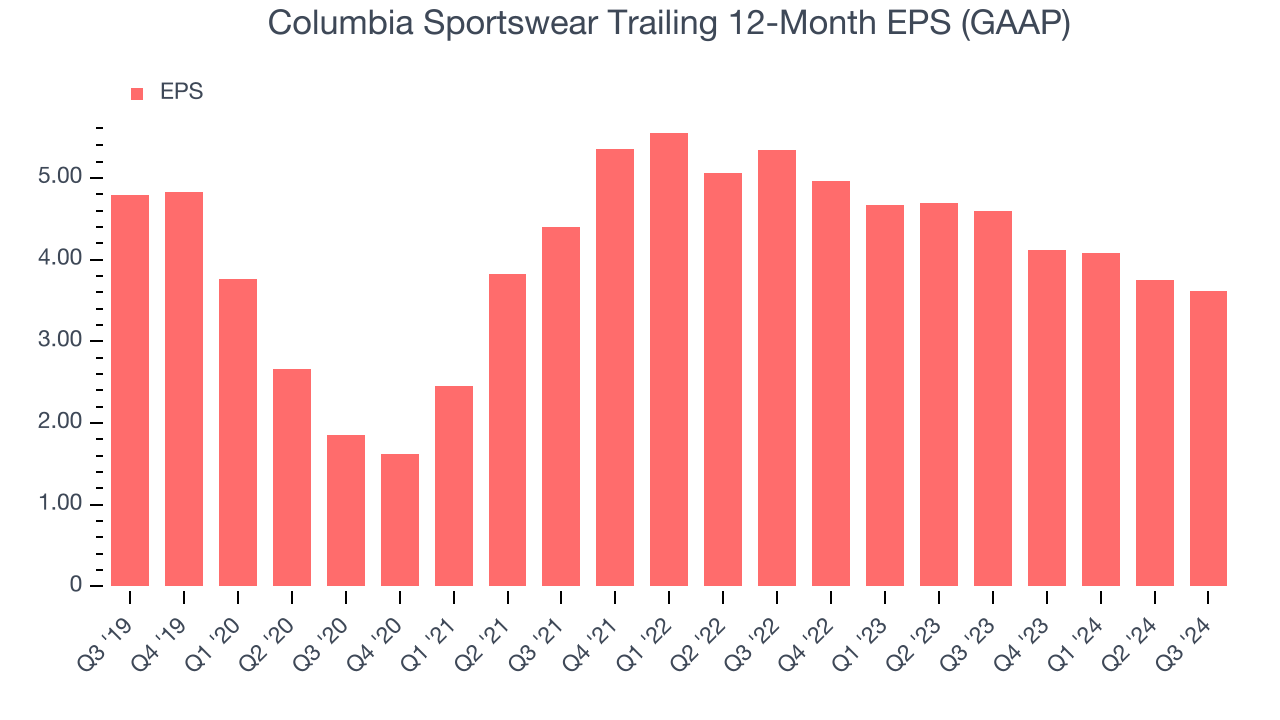

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Columbia Sportswear, its EPS declined by 5.5% annually over the last five years while its revenue grew by 2.1%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Cash Flow Margin Set to Decline

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the next year, analysts predict Columbia Sportswear’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 14.5% for the last 12 months will decrease to 7.2%.

Final Judgment

Columbia Sportswear doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 21.8x forward price-to-earnings (or $87.20 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d recommend looking at FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Like More Than Columbia Sportswear

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.