Three Reasons to Avoid PTON and One Stock to Buy Instead

What a fantastic six months it’s been for Peloton. Shares of the company have skyrocketed 171%, hitting $9.39. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Peloton, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Despite the momentum, we don't have much confidence in Peloton. Here are three reasons why we avoid PTON and a stock we'd rather own.

Why Do We Think Peloton Will Underperform?

Started as a Kickstarter campaign, Peloton (NASDAQ: PTON) is a fitness technology company known for its at-home exercise equipment and interactive online workout classes.

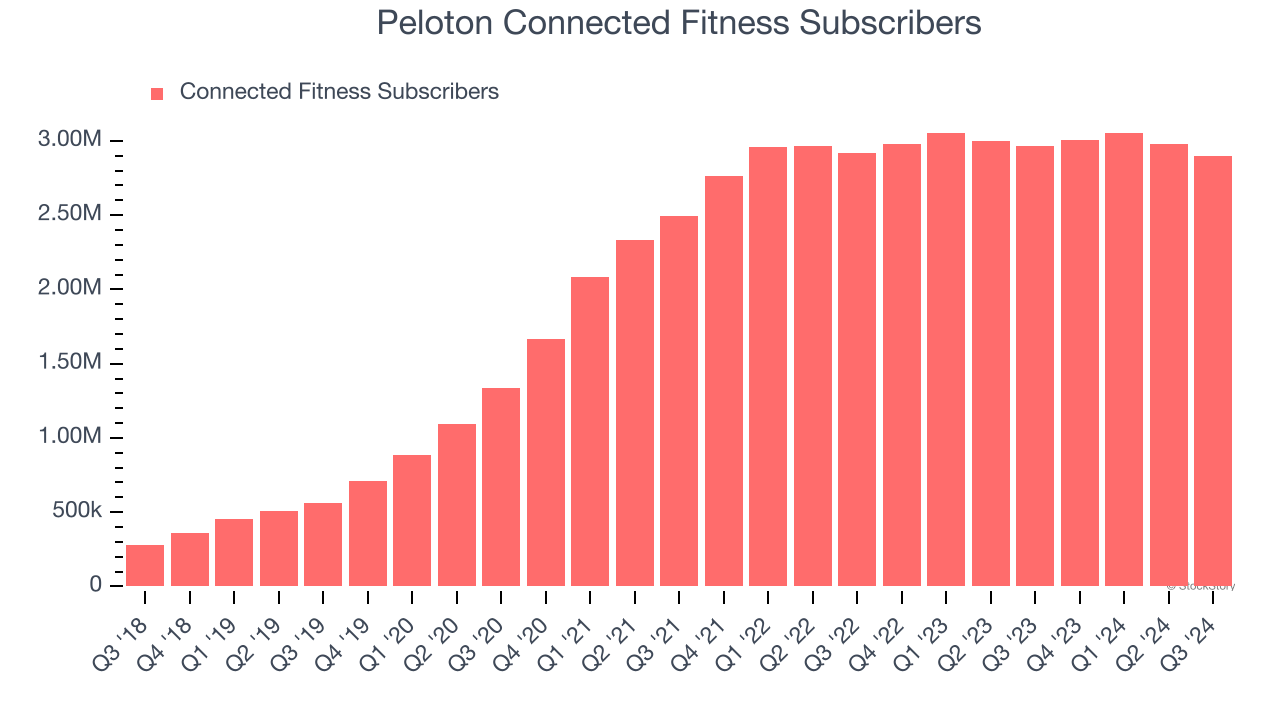

1. Weak Growth in Connected Fitness Subscribers Points to Soft Demand

Revenue growth can be broken down into changes in price and volume (for companies like Peloton, our preferred volume metric is connected fitness subscribers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Peloton’s connected fitness subscribers came in at 2.9 million in the latest quarter, and over the last two years, averaged 1.5% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

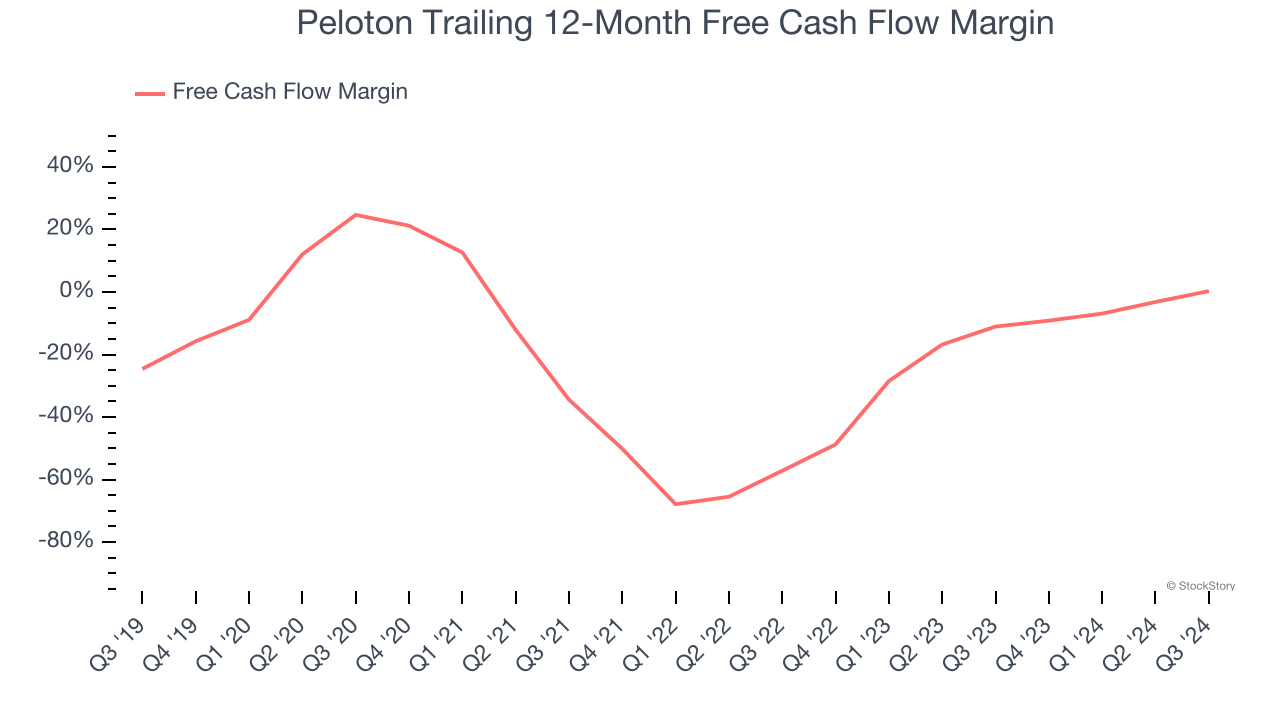

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Peloton posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Peloton’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 5.5%, meaning it lit $5.46 of cash on fire for every $100 in revenue.

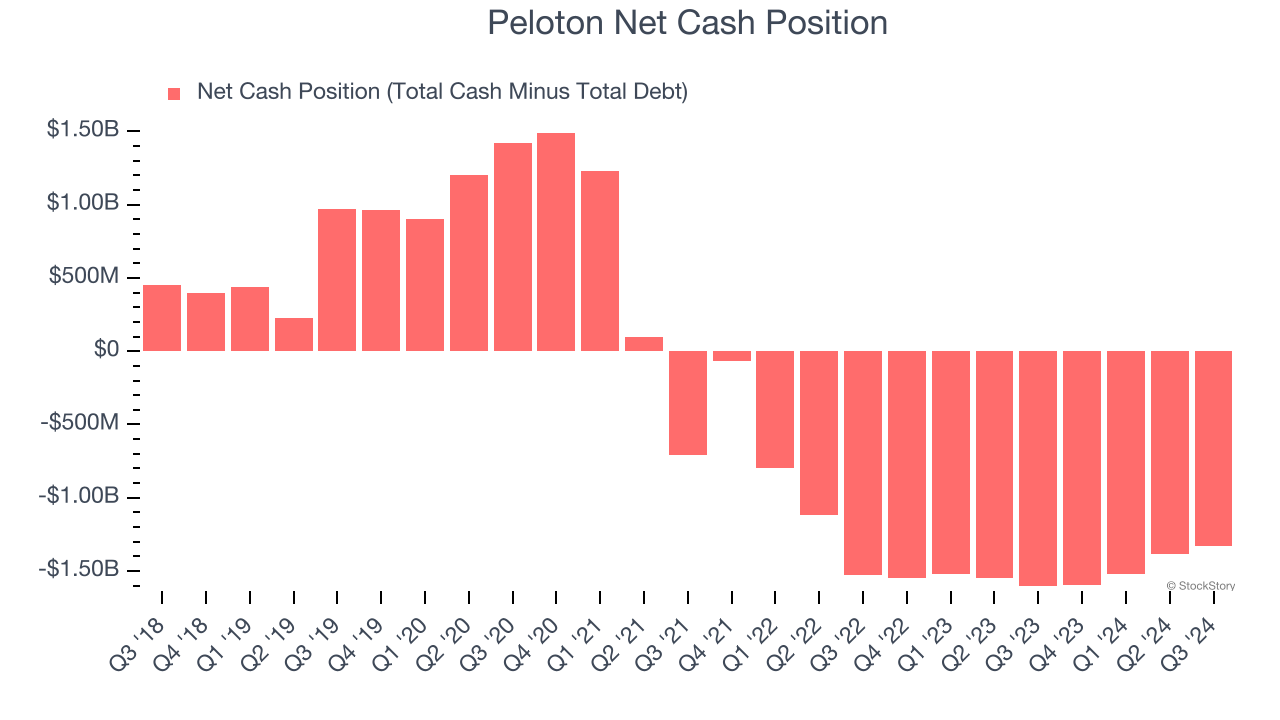

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Peloton’s $2.05 billion of debt exceeds the $722.3 million of cash on its balance sheet. Furthermore, its 12× net-debt-to-EBITDA ratio (based on its EBITDA of $110.2 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Peloton could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Peloton can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Peloton doesn’t pass our quality test. Following the recent rally, the stock trades at 14.3× forward EV-to-EBITDA (or $9.39 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Peloton

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.