Three Reasons Why RELL is Risky and One Stock to Buy Instead

Richardson Electronics currently trades at $12.05 per share and has shown little upside over the past six months, posting a middling return of 4.1%. This is close to the S&P 500’s 8.8% gain during that period.

Is now the time to buy Richardson Electronics, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We're cautious about Richardson Electronics. Here are three reasons why there are better opportunities than RELL and a stock we'd rather own.

Why Do We Think Richardson Electronics Will Underperform?

Founded in 1947, Richardson Electronics (NASDAQ: RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

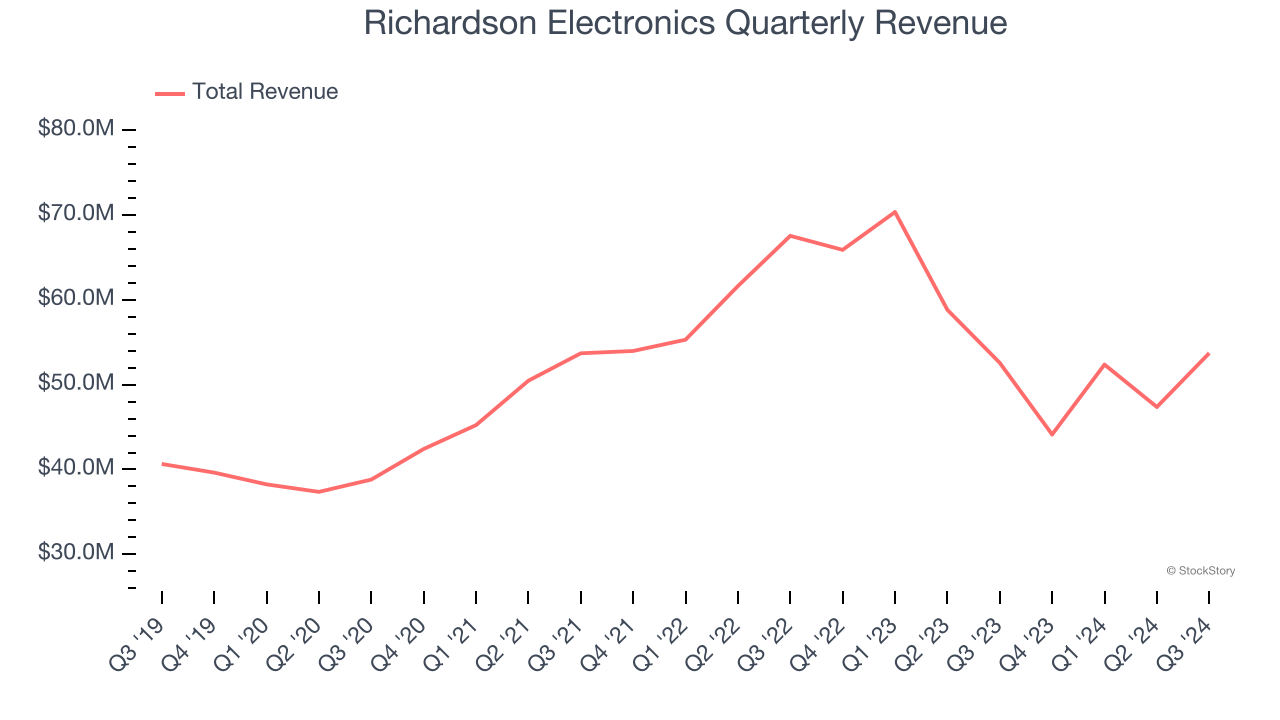

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Richardson Electronics’s sales grew at a tepid 4.7% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector.

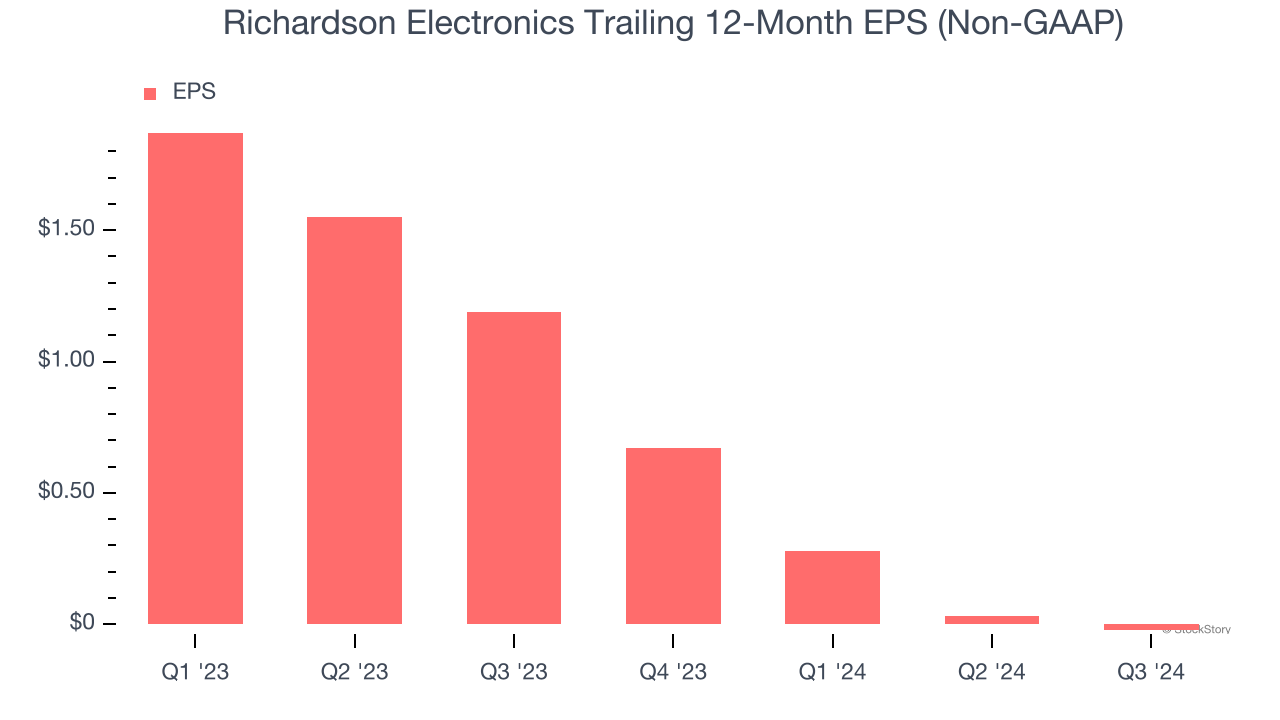

2. EPS Trending Down

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Richardson Electronics’s full-year EPS turned negative over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Richardson Electronics’s low margin of safety could leave its stock price susceptible to large downswings.

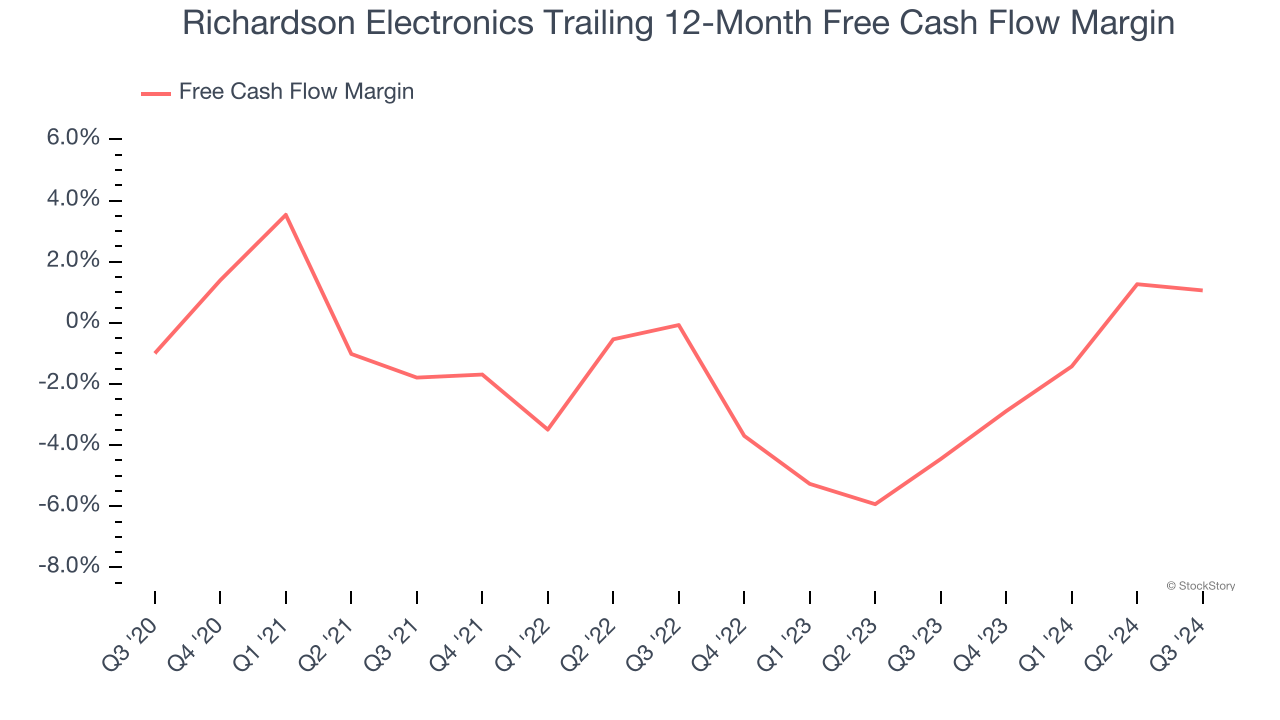

3. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Richardson Electronics’s free cash flow broke even this quarter, the broader story hasn’t been so clean. Richardson Electronics’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.4%, meaning it lit $1.37 of cash on fire for every $100 in revenue.

Final Judgment

We see the value of companies helping their customers, but in the case of Richardson Electronics, we’re out. That said, the stock currently trades at 21× forward price-to-earnings (or $12.05 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. We’d recommend looking at KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Would Buy Instead of Richardson Electronics

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.