Meritage Homes’s (NYSE:MTH) Q4 Sales Beat Estimates But Full-Year Sales Guidance Misses Expectations

Homebuilder Meritage Homes (NYSE: MTH) announced better-than-expected revenue in Q4 CY2024, but sales fell by 2.8% year on year to $1.61 billion. On the other hand, the company’s full-year revenue guidance of $6.75 billion at the midpoint came in 1.7% below analysts’ estimates. Its non-GAAP profit of $4.72 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Meritage Homes? Find out by accessing our full research report, it’s free.

Meritage Homes (MTH) Q4 CY2024 Highlights:

- Revenue: $1.61 billion vs analyst estimates of $1.58 billion (2.8% year-on-year decline, 2.4% beat)

- EPS: $4.72 vs analyst estimates of $4.48 (5.4% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $6.75 billion at the midpoint, missing analyst estimates by 1.7% and implying 5.7% growth (vs 4.7% in FY2024)

- Free Cash Flow was -$107 million compared to -$111.4 million in the same quarter last year

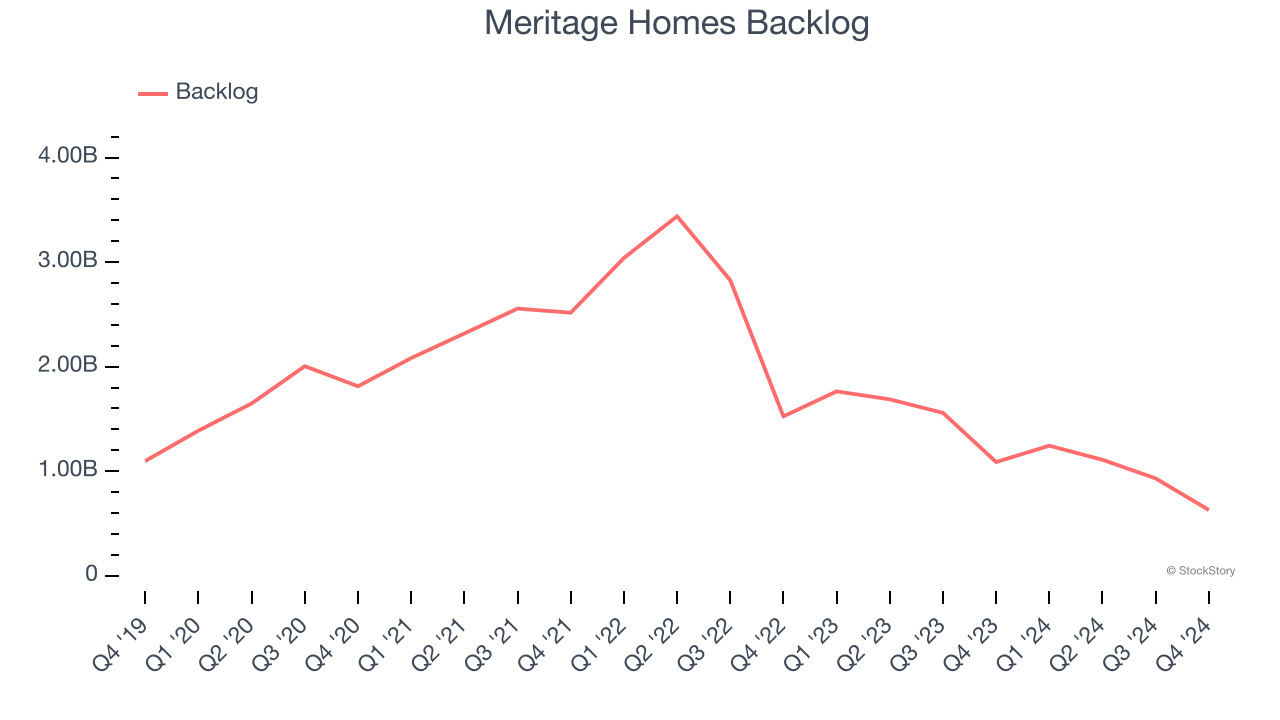

- Backlog: $629.5 million at quarter end, down 42.1% year on year

- Market Capitalization: $5.85 billion

MANAGEMENT COMMENTS"2024 was another record-setting year for Meritage as we began to roll out our new move-in ready strategy and were able to capitalize on continuing demand for affordable, immediately available homes. For the full year 2024, we generated our highest annual closing volume of 15,611 homes and, despite a pullback in average sales price, we achieved a company-high home closing revenue of $6.3 billion," said Steven J. Hilton, executive chairman of Meritage Homes.

Company Overview

Originally founded in 1985 in Arizona as Monterey Homes, Meritage Homes (NYSE: MTH) is a homebuilder specializing in designing and constructing energy-efficient and single-family homes in the US.

Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

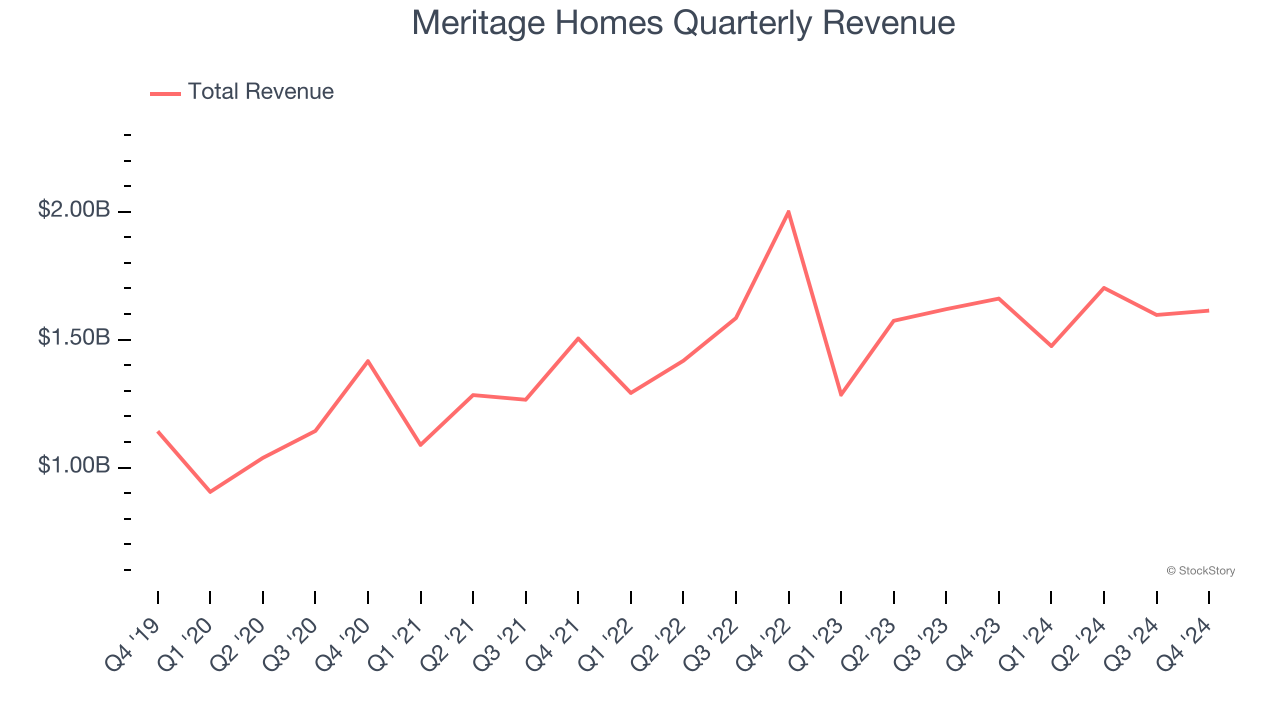

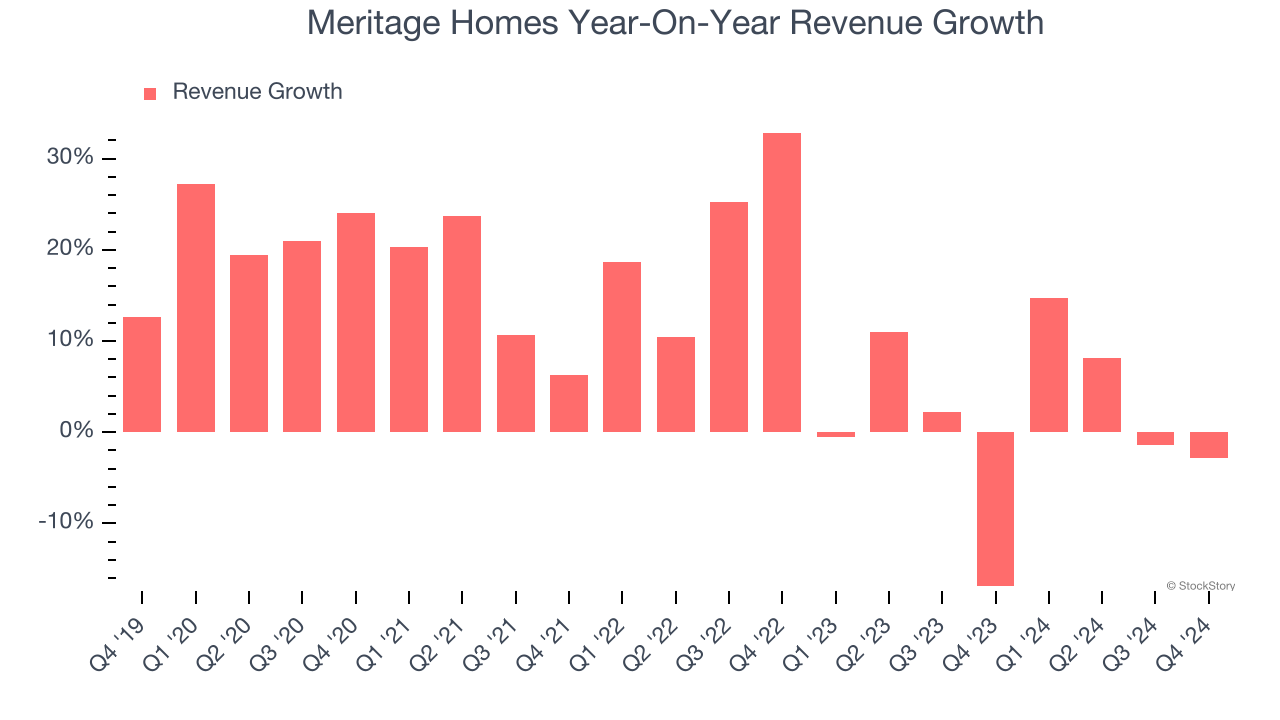

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Meritage Homes’s sales grew at an impressive 11.7% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Meritage Homes’s recent history shows its demand slowed significantly as its revenue was flat over the last two years.

Meritage Homes also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Meritage Homes’s backlog reached $629.5 million in the latest quarter and averaged 39.1% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Meritage Homes’s revenue fell by 2.8% year on year to $1.61 billion but beat Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to grow 8.9% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

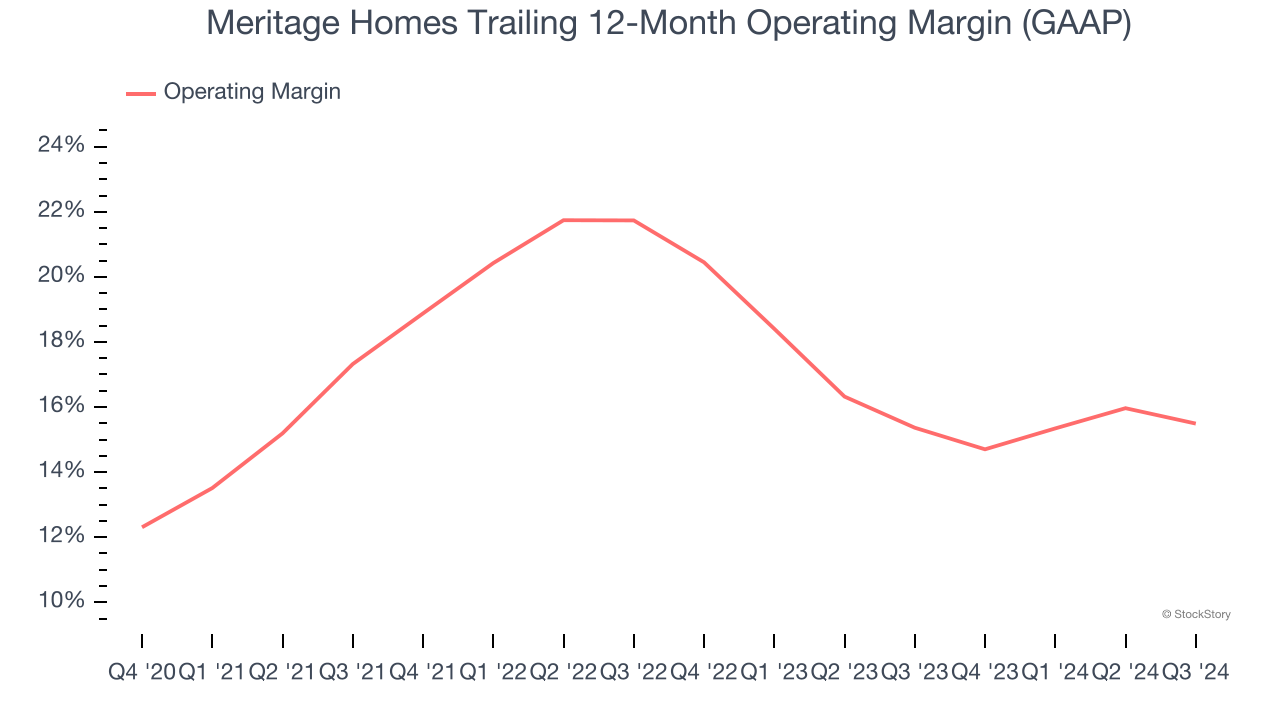

Operating Margin

Meritage Homes has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.6%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Meritage Homes’s operating margin rose by 4.8 percentage points over the last five years, as its sales growth gave it operating leverage.

Key Takeaways from Meritage Homes’s Q4 Results

We liked how Meritage Homes beat analysts’ revenue and EPS expectations this quarter. On the other hand, its backlog was down significantly year on year and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 2% to $80.46 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.