Diversified Financial Services Stocks Q2 Recap: Benchmarking Euronet Worldwide (NASDAQ:EEFT)

Wrapping up Q2 earnings, we look at the numbers and key takeaways for the diversified financial services stocks, including Euronet Worldwide (NASDAQ: EEFT) and its peers.

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

The 12 diversified financial services stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.2%.

While some diversified financial services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.4% since the latest earnings results.

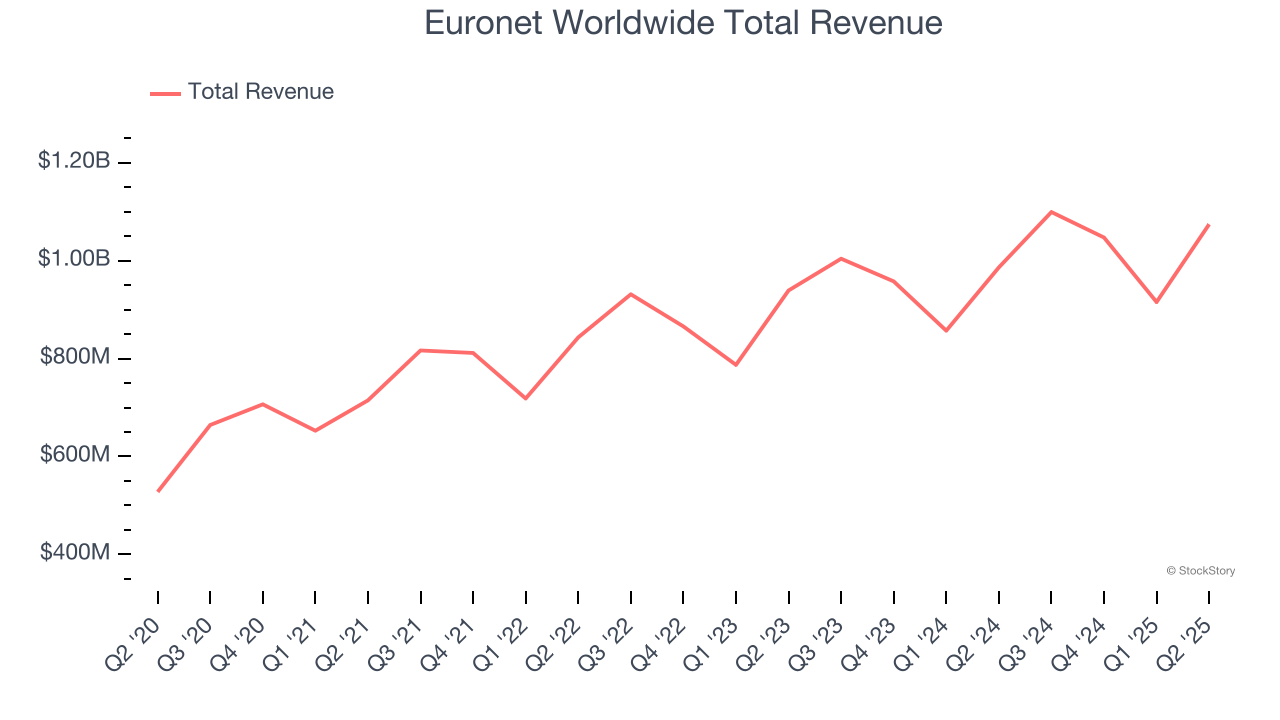

Euronet Worldwide (NASDAQ: EEFT)

Operating a global network of over 47,000 ATMs and 821,000 point-of-sale terminals across more than 60 countries, Euronet Worldwide (NASDAQ: EEFT) provides electronic payment solutions including ATM services, prepaid product processing, and international money transfer services.

Euronet Worldwide reported revenues of $1.07 billion, up 8.9% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ EPS estimates and revenue in line with analysts’ estimates.

Not only did we advance our digital agenda with the credit issuing platform, we just signed an agreement with one of the top three banks in the United States for the deployment of our Ren ATM operating and switching product. While we have had many successes with Ren outside the US, this is not just the first agreement in the US we’ve signed, but it is with super impressive top-tiered bank – a real testament to the value proposition of Ren”, said Michael J. Brown, Euronet's Chairman and Chief Executive Officer.

Unsurprisingly, the stock is down 11.4% since reporting and currently trades at $87.71.

Is now the time to buy Euronet Worldwide? Access our full analysis of the earnings results here, it’s free for active Edge members.

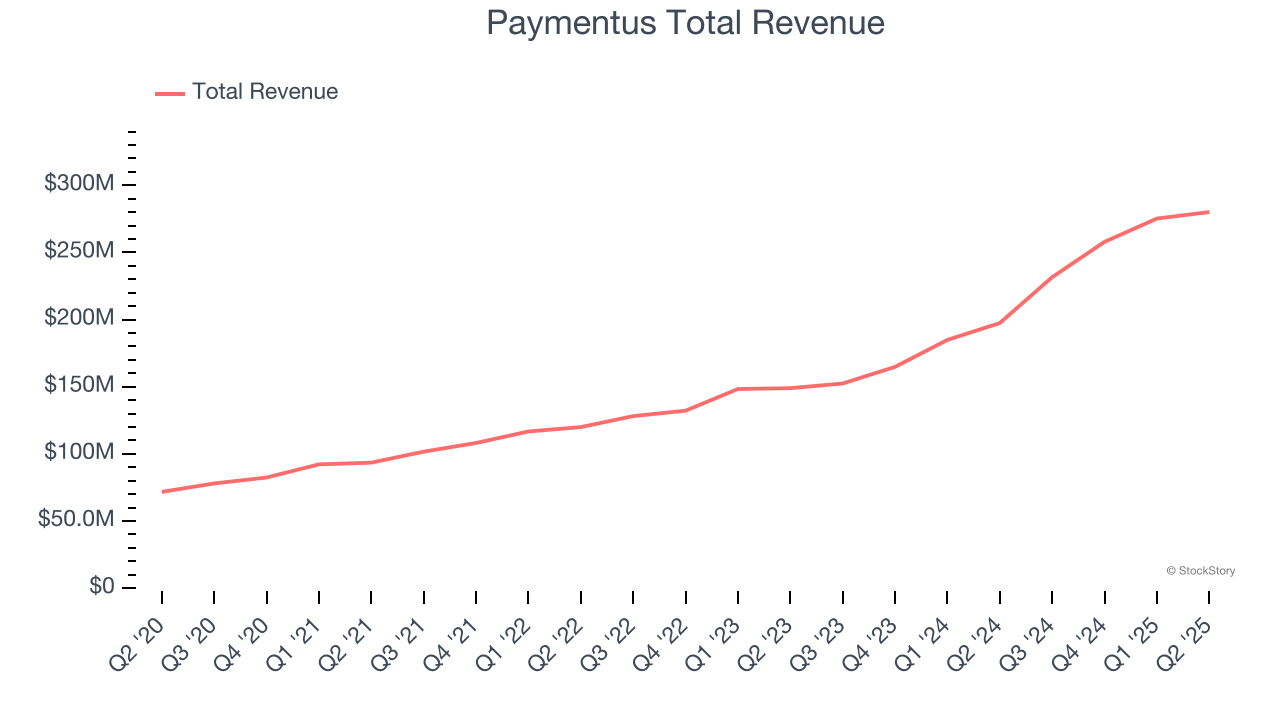

Best Q2: Paymentus (NYSE: PAY)

Founded in 2004 to simplify the complex world of bill payments, Paymentus (NYSE: PAY) provides a cloud-based platform that helps utilities, municipalities, and service providers automate billing and payment processes.

Paymentus reported revenues of $280.1 million, up 41.9% year on year, outperforming analysts’ expectations by 8.7%. The business had an incredible quarter with a beat of analysts’ EPS and revenue estimates.

Paymentus scored the biggest analyst estimates beat and fastest revenue growth among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $29.50.

Is now the time to buy Paymentus? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: NerdWallet (NASDAQ: NRDS)

Born from founder Tim Chen's frustration with the lack of transparent credit card information when helping his sister in 2009, NerdWallet (NASDAQ: NRDS) is a digital platform that provides financial guidance to help consumers and small businesses make smarter decisions about credit cards, loans, insurance, and other financial products.

NerdWallet reported revenues of $186.9 million, up 24.1% year on year, falling short of analysts’ expectations by 4.4%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

NerdWallet delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 3.8% since the results and currently trades at $10.67.

Read our full analysis of NerdWallet’s results here.

PayPal (NASDAQ: PYPL)

Originally spun off from eBay in 2015 after being acquired by the auction giant in 2002, PayPal (NASDAQ: PYPL) operates a global digital payments platform that enables consumers and merchants to send, receive, and process payments online and in person.

PayPal reported revenues of $8.29 billion, up 5.1% year on year. This result beat analysts’ expectations by 2.8%. Overall, it was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ transaction volumes estimates.

The stock is down 11.6% since reporting and currently trades at $69.20.

Read our full, actionable report on PayPal here, it’s free for active Edge members.

WEX (NYSE: WEX)

Originally founded in 1983 as Wright Express to serve the fleet card market, WEX (NYSE: WEX) provides payment processing and business solutions across fleet management, employee benefits, and corporate payments sectors.

WEX reported revenues of $659.6 million, down 2.1% year on year. This print topped analysts’ expectations by 1%. It was a strong quarter as it also produced an impressive beat of analysts’ Account Servicing segment estimates and a solid beat of analysts’ EBITDA estimates.

The stock is down 7.3% since reporting and currently trades at $152.24.

Read our full, actionable report on WEX here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.