Enova (ENVA): 3 Reasons We Love This Stock

Enova has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 19.8% to $110.40 per share while the index has gained 23.2%.

Is ENVA a buy right now? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Enova?

Pioneering online lending since 2004 with a massive database of over 65 terabytes of customer behavior data, Enova International (NYSE: ENVA) provides online financial services including installment loans and lines of credit to non-prime consumers and small businesses in the United States and Brazil.

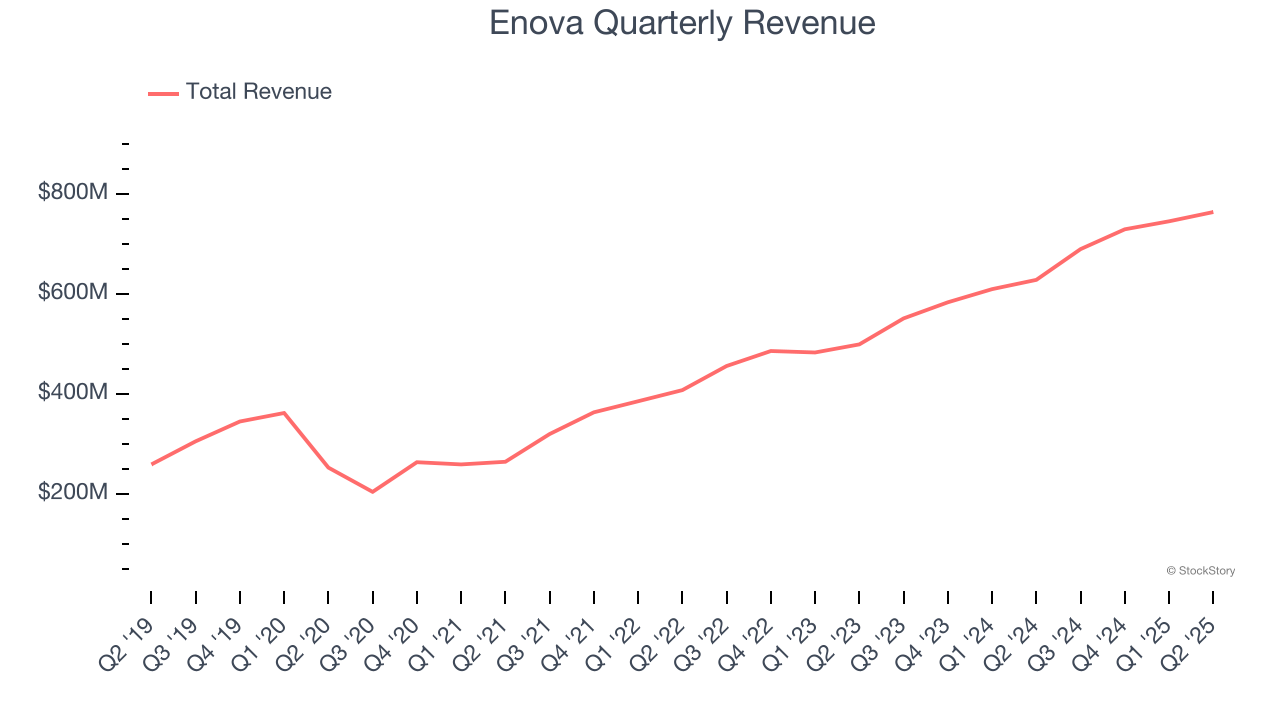

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Thankfully, Enova’s 18.3% annualized revenue growth over the last five years was excellent. Its growth surpassed the average financials company and shows its offerings resonate with customers.

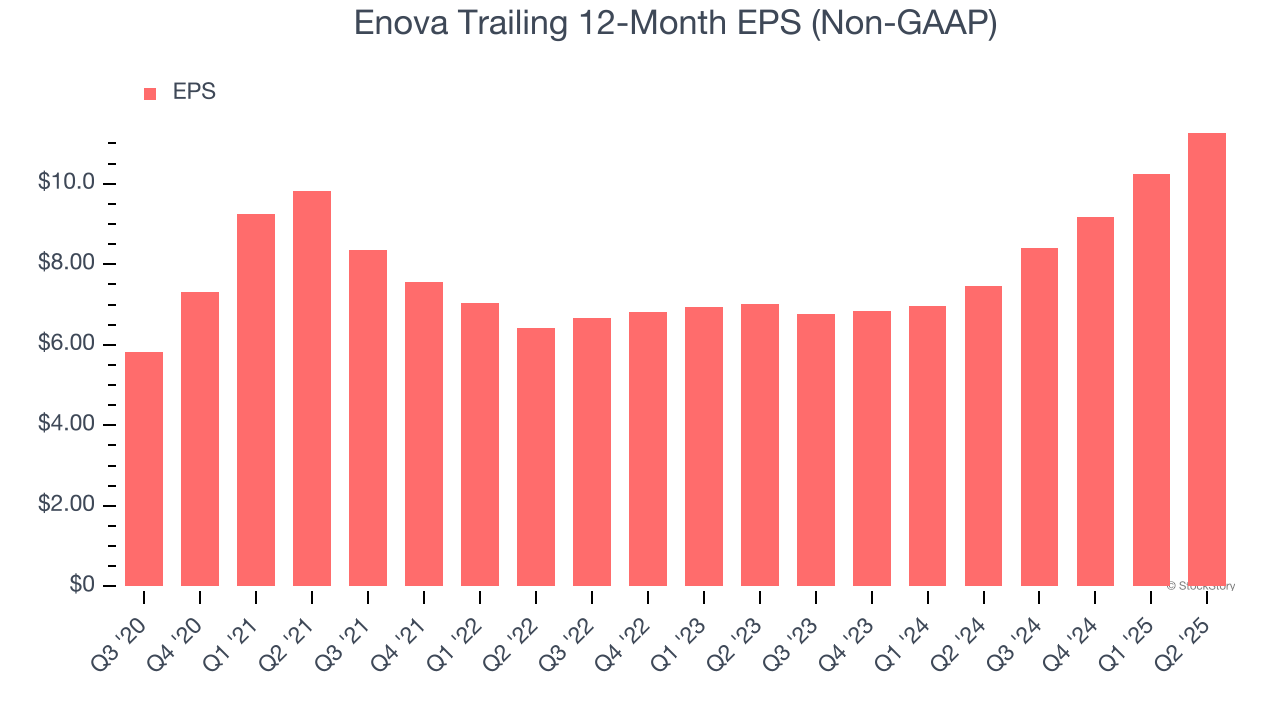

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Enova’s EPS grew at an astounding 25.3% compounded annual growth rate over the last five years, higher than its 18.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

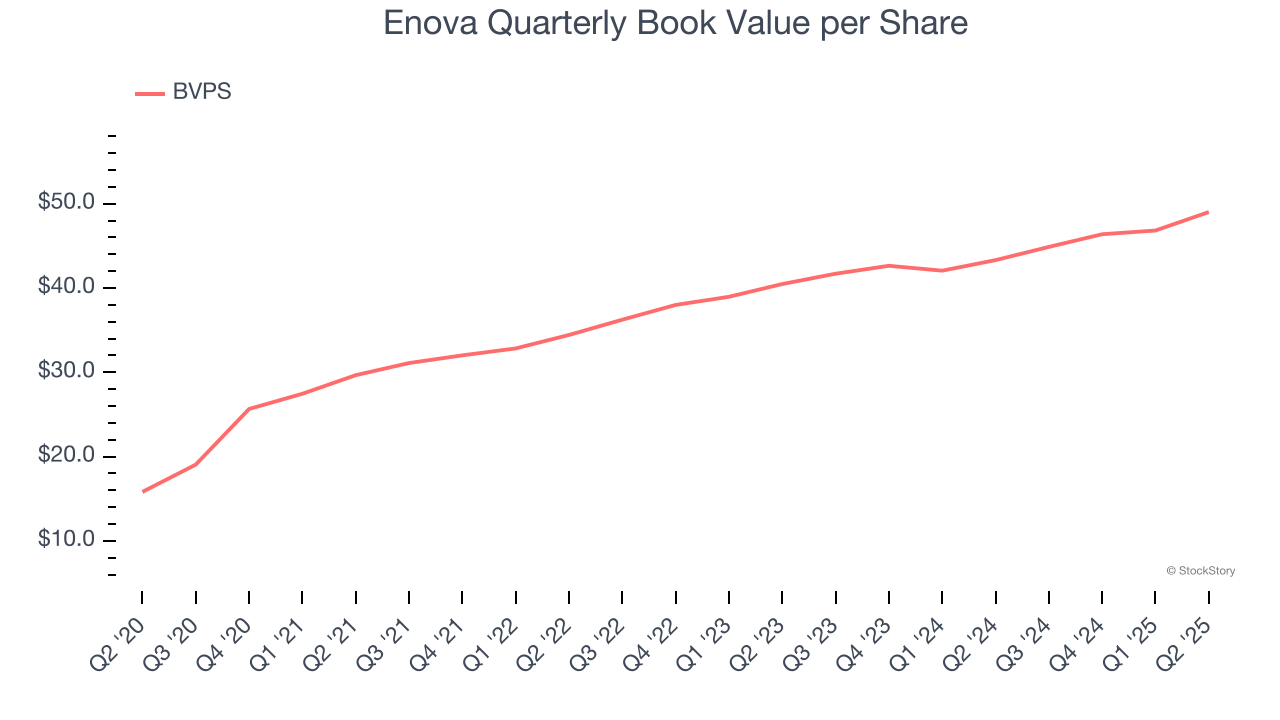

3. Steady Increase in BVPS Highlights Solid Asset Growth

Book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities.

Enova’s BVPS increased by 25.4% annually over the last five years, and although its annualized growth has recently decelerated to 10% over the last two years (from $40.47 to $49.01 per share), we still think its performance was solid.

Final Judgment

These are just a few reasons why Enova ranks near the top of our list, but at $110.40 per share (or 8.5× forward P/E), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Enova

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.