Ally Financial (NYSE:ALLY) Beats Expectations in Strong Q3

Digital banking company Ally Financial (NYSE: ALLY) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 3% year on year to $2.2 billion. Its non-GAAP profit of $1.15 per share was 14.1% above analysts’ consensus estimates.

Is now the time to buy Ally Financial? Find out by accessing our full research report, it’s free for active Edge members.

Ally Financial (ALLY) Q3 CY2025 Highlights:

- Revenue: $2.2 billion vs analyst estimates of $2.11 billion (3% year-on-year growth, 4.1% beat)

- Efficiency Ratio: 50% vs analyst estimates of 56.3% (628.3 basis point beat)

- Adjusted EPS: $1.15 vs analyst estimates of $1.01 (14.1% beat)

- Tangible Book Value per Share: $39.19 vs analyst estimates of $39.40 (2.3% year-on-year growth, 0.5% miss)

- Market Capitalization: $11.84 billion

Company Overview

Born from the former GMAC (General Motors Acceptance Corporation) and rebranded in 2010, Ally Financial (NYSE: ALLY) operates a digital-first bank offering auto financing, insurance, mortgage lending, and investment services to consumers and commercial clients.

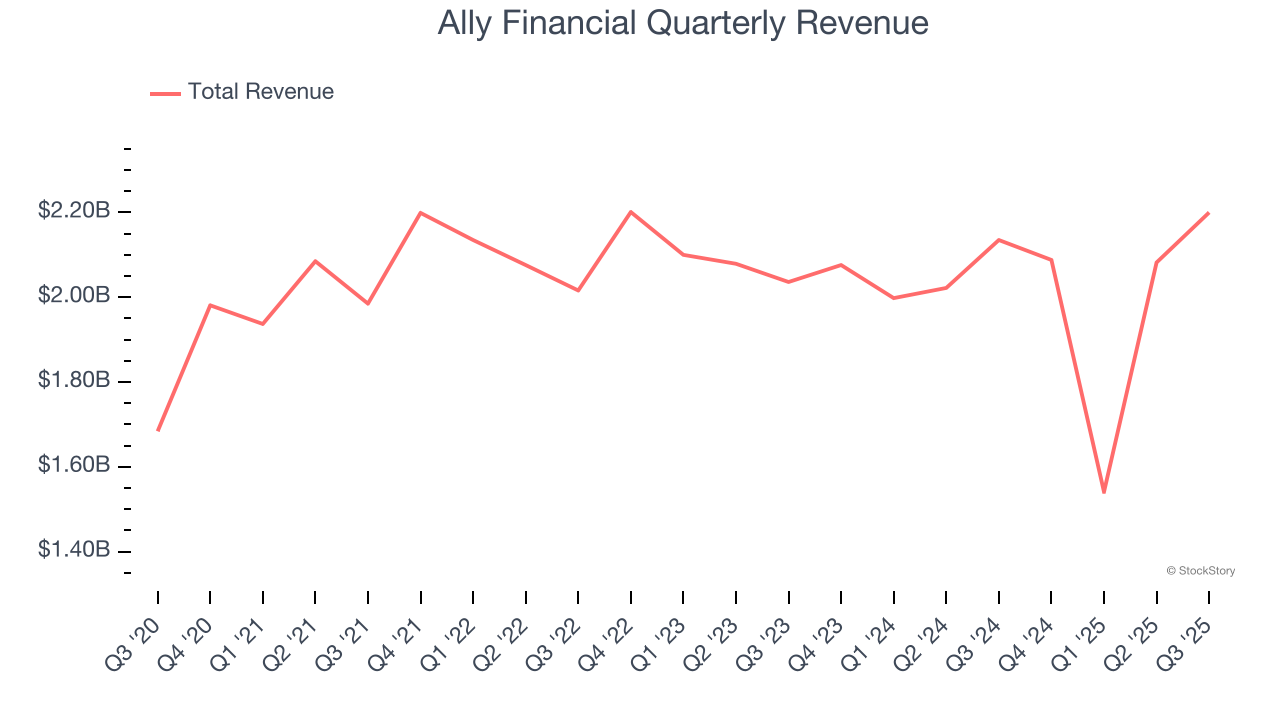

Revenue Growth

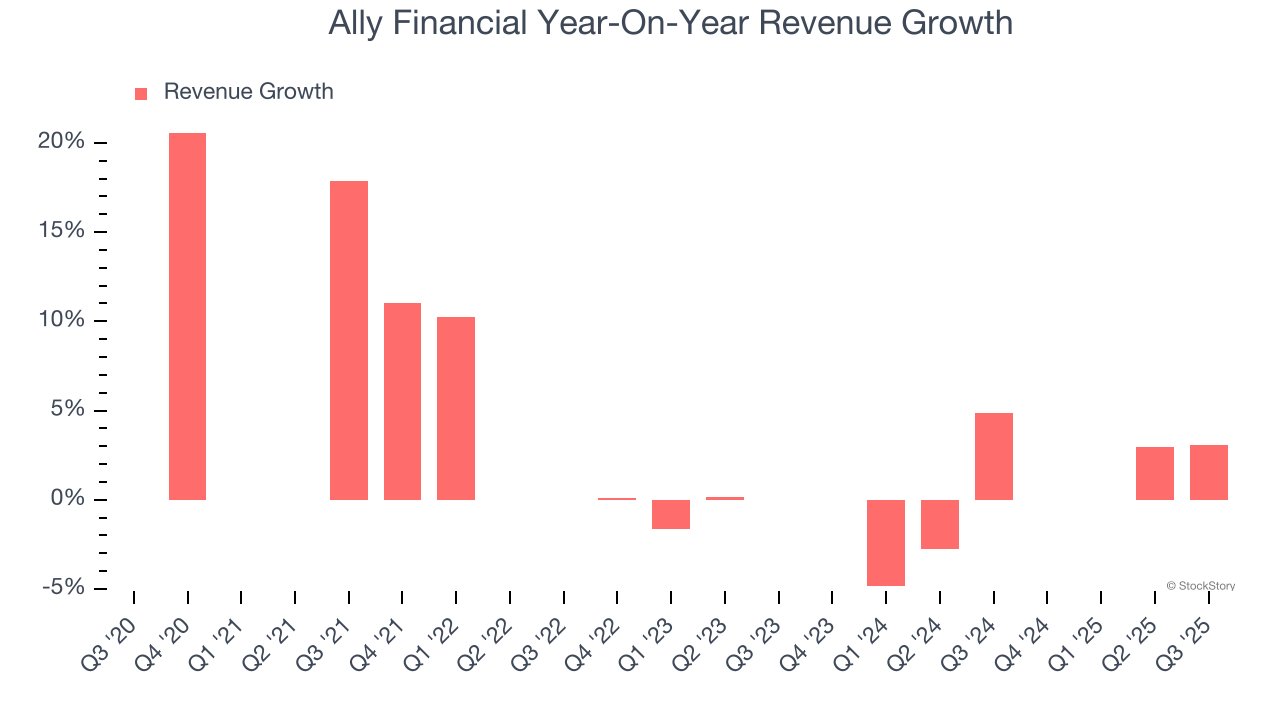

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Ally Financial’s 4.5% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the financials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Ally Financial’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3% annually.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Ally Financial reported modest year-on-year revenue growth of 3% but beat Wall Street’s estimates by 4.1%.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

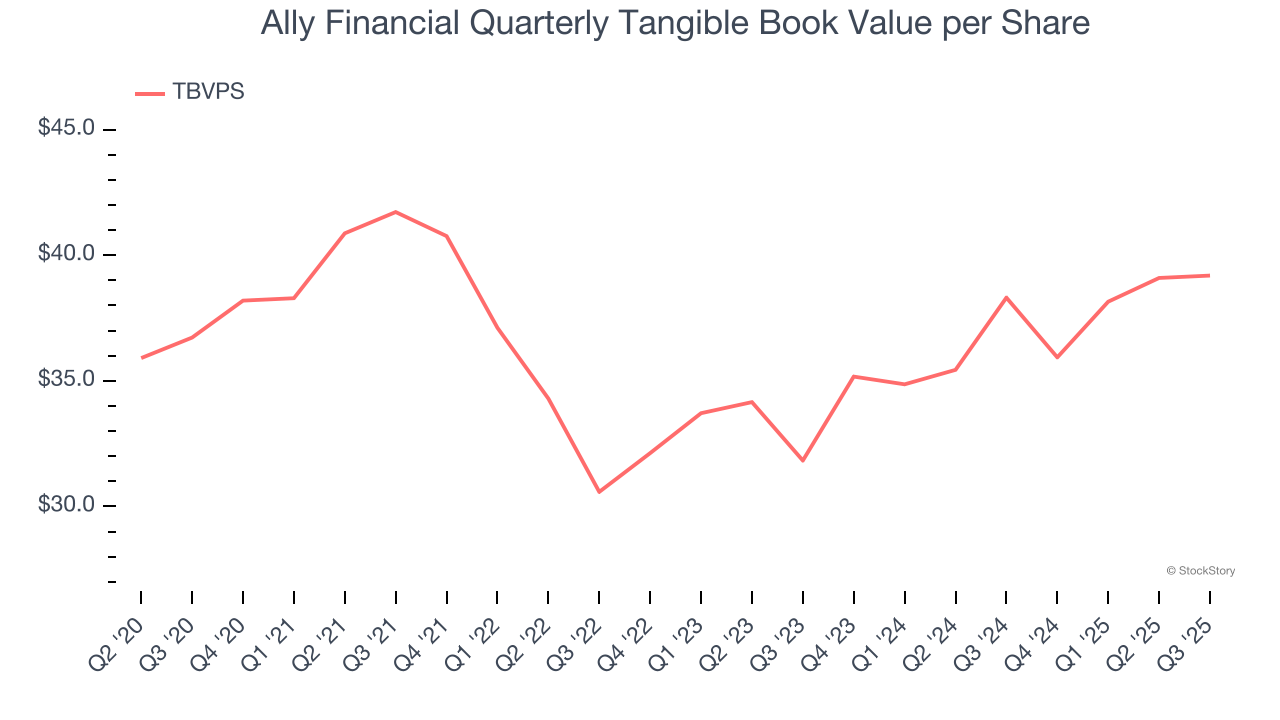

Tangible Book Value Per Share (TBVPS)

Diversified financial companies operate across multiple business segments, from investment banking and trading to wealth management and specialized lending. Their valuations hinge on balance sheet quality and the ability to compound shareholder equity across these diverse operations.

This explains why tangible book value per share (TBVPS) is a premier metric for the sector. TBVPS provides concrete per-share net worth that investors can trust when evaluating companies with complex, multi-faceted business models. EPS can become murky due to the complexity of multiple revenue streams, acquisition impacts, or accounting flexibility across different financial services, and book value resists financial engineering manipulation.

Ally Financial’s TBVPS grew at a weak 1.3% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 11% annually over the last two years from $31.83 to $39.19 per share.

Tangible Book Value Per Share (TBVPS)

Financial firms are valued based on their balance sheet strength and ability to compound book value across diverse business lines.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark for the sector. This metric captures real, liquid net worth per share that reflects the institution’s overall financial health across all business lines. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to the complexity of multiple business lines, M&A activity, or accounting rules that vary across different financial services segments.

Ally Financial’s TBVPS grew at a weak 1.3% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 11% annually over the last two years from $31.83 to $39.19 per share.

Key Takeaways from Ally Financial’s Q3 Results

It was good to see Ally Financial beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its efficiency ratio missed. Zooming out, we think this quarter featured some important positives. The stock traded up 3.5% to $39.79 immediately after reporting.

Ally Financial had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.