Unpacking Q2 Earnings: Getty Images (NYSE:GETY) In The Context Of Other Digital Media & Content Platforms Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how digital media & content platforms stocks fared in Q2, starting with Getty Images (NYSE: GETY).

AI-driven content creation, personalized media experiences, and digital advertising are evolving, which could benefit companies investing in these themes. For example, companies with a portfolio of licensed visual content or platforms facilitating direct monetization models could see increased demand for years. On the other hand, headwinds include growing regulatory scrutiny on AI-generated content, with many publishers balking at anything that gets no human oversight. Additional areas to navigate include the phasing out of third-party cookies, which could make traditional ways of tracking the online behavior of consumers (a secret sauce in digital marketing) much less effective.

The 7 digital media & content platforms stocks we track reported a satisfactory Q2. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Luckily, digital media & content platforms stocks have performed well with share prices up 32% on average since the latest earnings results.

Getty Images (NYSE: GETY)

With a vast library of over 562 million visual assets documenting everything from breaking news to iconic historical moments, Getty Images (NYSE: GETY) is a global visual content marketplace that licenses photos, videos, illustrations, and music to businesses, media outlets, and creative professionals.

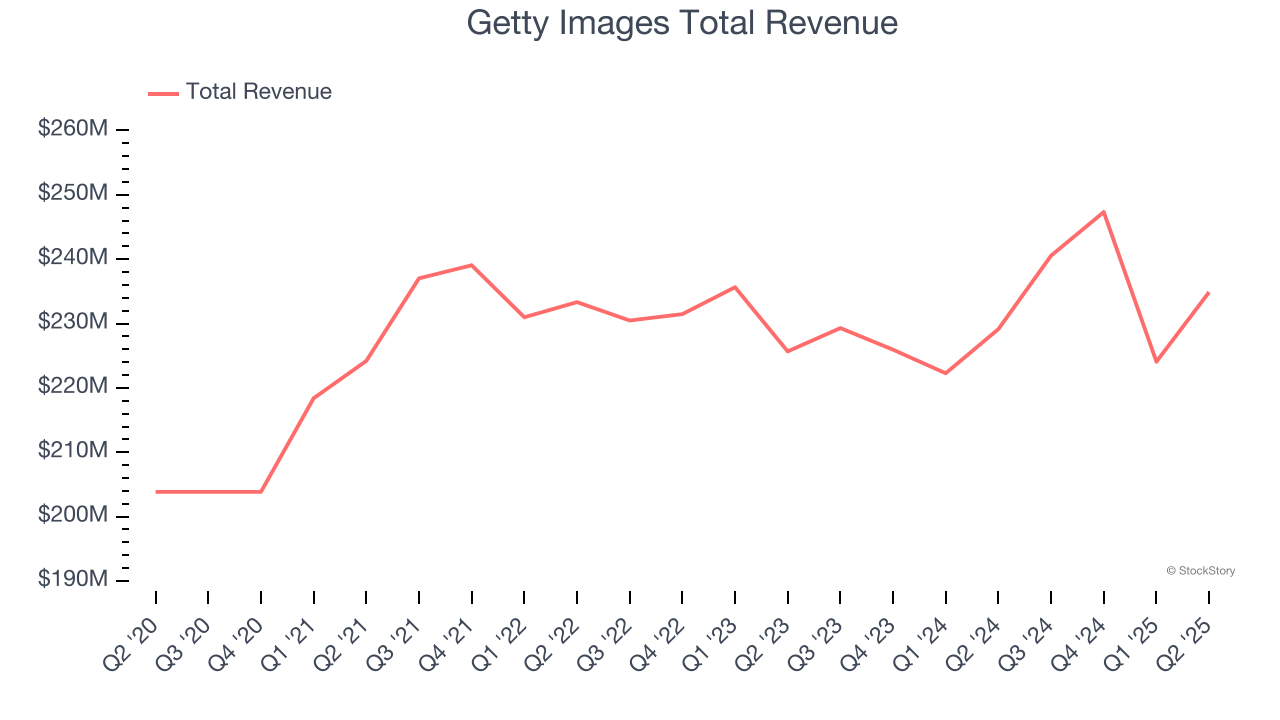

Getty Images reported revenues of $234.9 million, up 2.5% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates and full-year revenue guidance meeting analysts’ expectations.

“We delivered solid growth in the second quarter, driven by continued momentum in our subscription business and strong demand for our content and services with acceleration across Corporate, and a return to growth in Media," said Craig Peters, Chief Executive Officer at Getty Images.

Getty Images scored the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 28.5% since reporting and currently trades at $2.21.

Is now the time to buy Getty Images? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q2: Stride (NYSE: LRN)

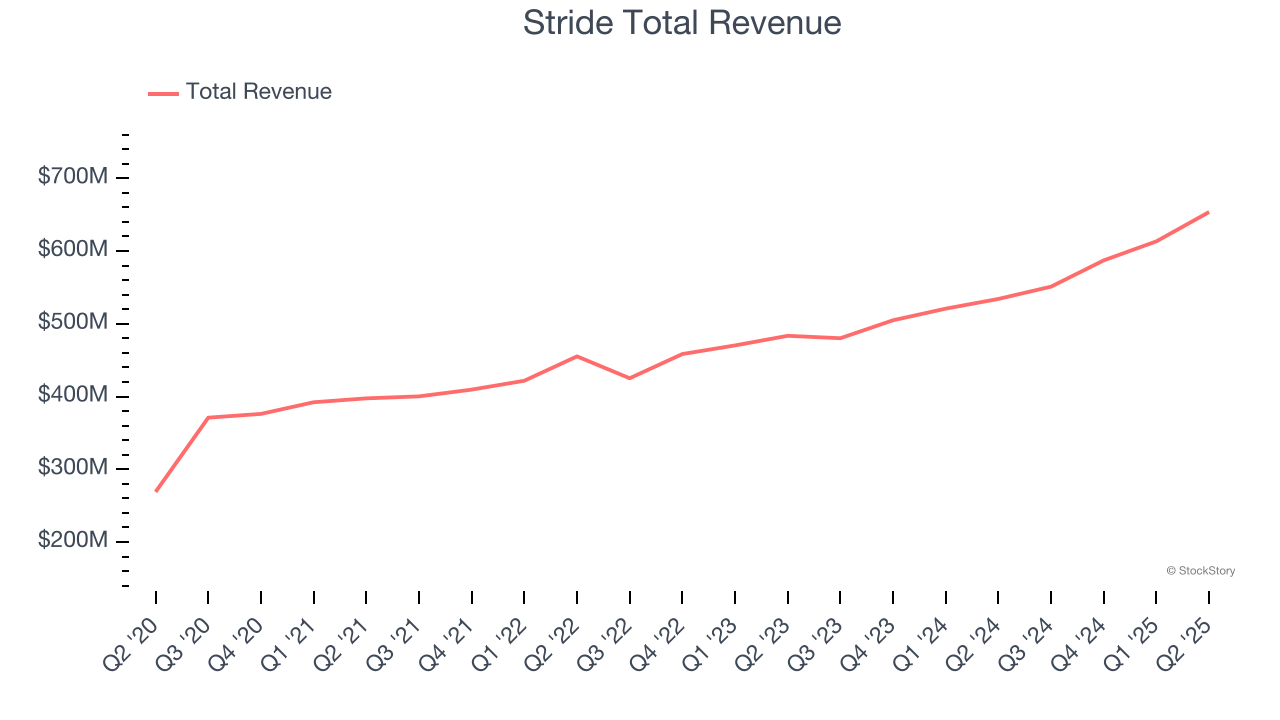

Formerly known as K12, Stride (NYSE: LRN) is an education technology company providing education solutions through digital platforms.

Stride reported revenues of $653.6 million, up 22.4% year on year, outperforming analysts’ expectations by 4.2%. The business had a stunning quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

Stride delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 9.1% since reporting. It currently trades at $140.

Is now the time to buy Stride? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: IAC (NASDAQ: IAC)

Originally known as InterActiveCorp and built through Barry Diller's strategic acquisitions since the 1990s, IAC (NASDAQ: IAC) operates a portfolio of category-leading digital businesses including Dotdash Meredith, Angi, and Care.com, focusing on digital publishing, home services, and caregiving platforms.

IAC reported revenues of $586.9 million, down 7.5% year on year, falling short of analysts’ expectations by 2.4%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue and EPS estimates.

IAC delivered the slowest revenue growth in the group. As expected, the stock is down 15.2% since the results and currently trades at $33.49.

Read our full analysis of IAC’s results here.

Vimeo (NASDAQ: VMEO)

Originally launched in 2004 as a platform for filmmakers seeking a high-quality alternative to YouTube, Vimeo (NASDAQ: VMEO) provides cloud-based video creation, editing, hosting, and distribution software that helps businesses and creators make, manage, and share professional-quality videos.

Vimeo reported revenues of $104.7 million, flat year on year. This print lagged analysts' expectations by 1%. In spite of that, it was a strong quarter as it logged a beat of analysts’ EPS estimates.

The stock is up 102% since reporting and currently trades at $7.75.

Read our full, actionable report on Vimeo here, it’s free for active Edge members.

Ziff Davis (NASDAQ: ZD)

Originally a pioneering technology publisher founded in 1927 that became famous for PC Magazine, Ziff Davis (NASDAQ: ZD) operates a portfolio of digital media brands and subscription services across technology, shopping, gaming, healthcare, and cybersecurity markets.

Ziff Davis reported revenues of $352.2 million, up 9.8% year on year. This result topped analysts’ expectations by 4.5%. Overall, it was a very strong quarter as it also produced an impressive beat of analysts’ revenue estimates and a solid beat of analysts’ full-year EPS guidance estimates.

Ziff Davis pulled off the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is up 17.4% since reporting and currently trades at $36.50.

Read our full, actionable report on Ziff Davis here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.