3 Reasons to Sell BAC and 1 Stock to Buy Instead

Bank of America’s 35.7% return over the past six months has outpaced the S&P 500 by 10.9%, and its stock price has climbed to $50.49 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy Bank of America, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Bank of America Not Exciting?

Despite the momentum, we're swiping left on Bank of America for now. Here are three reasons there are better opportunities than BAC and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

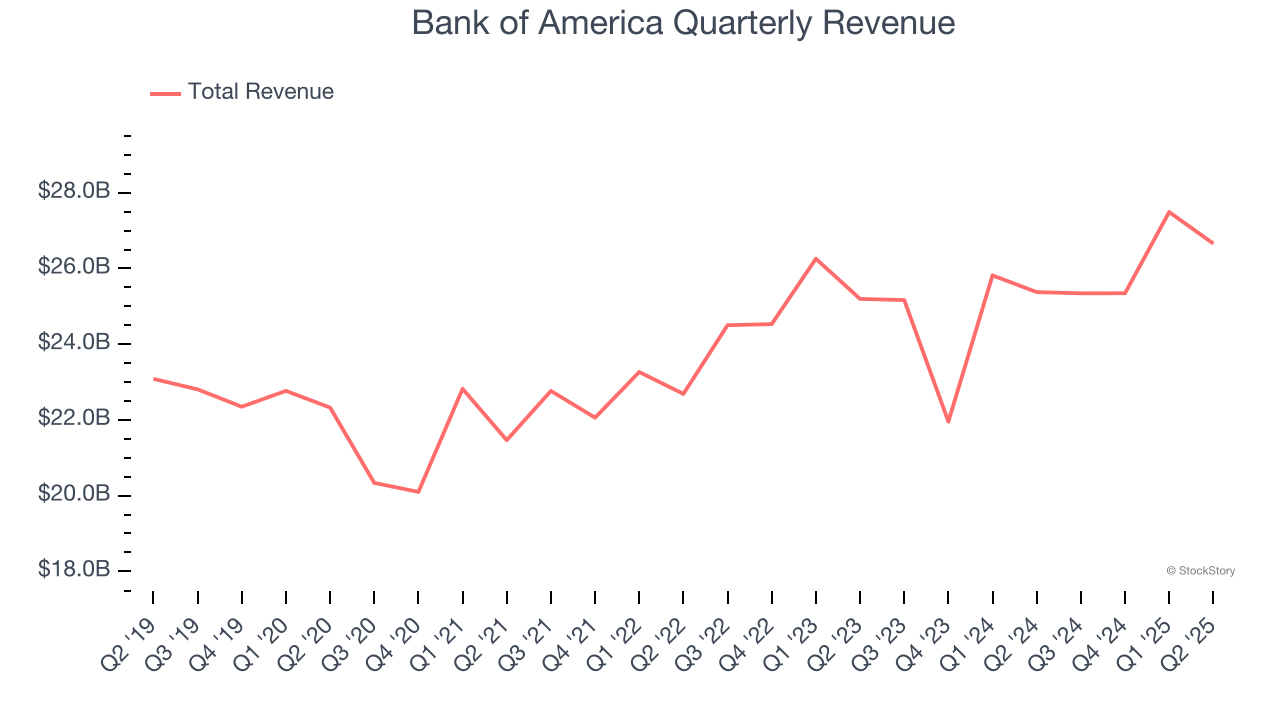

Over the last five years, Bank of America grew its revenue at a mediocre 3% compounded annual growth rate. This fell short of our benchmark for the banking sector.

2. Net Interest Income Points to Soft Demand

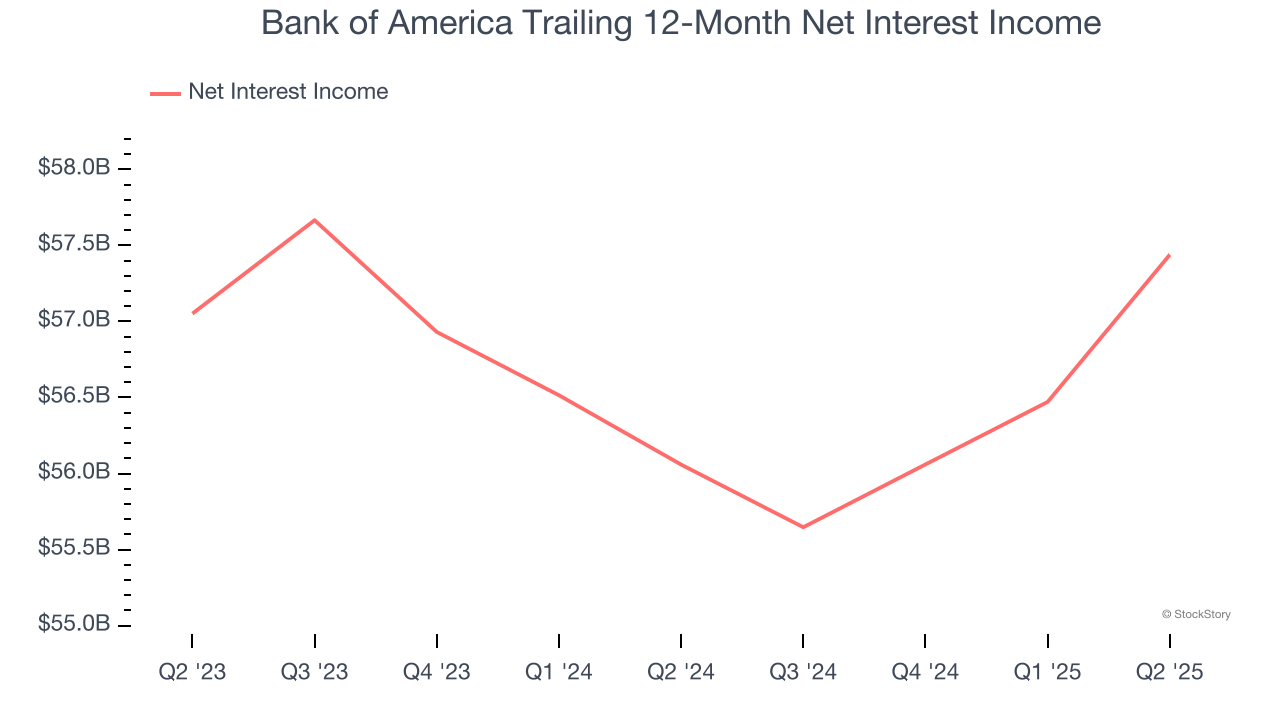

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Bank of America’s net interest income has grown at a 4.8% annualized rate over the last five years, worse than the broader banking industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

3. Low Net Interest Margin Reveals Weak Loan Book Profitability

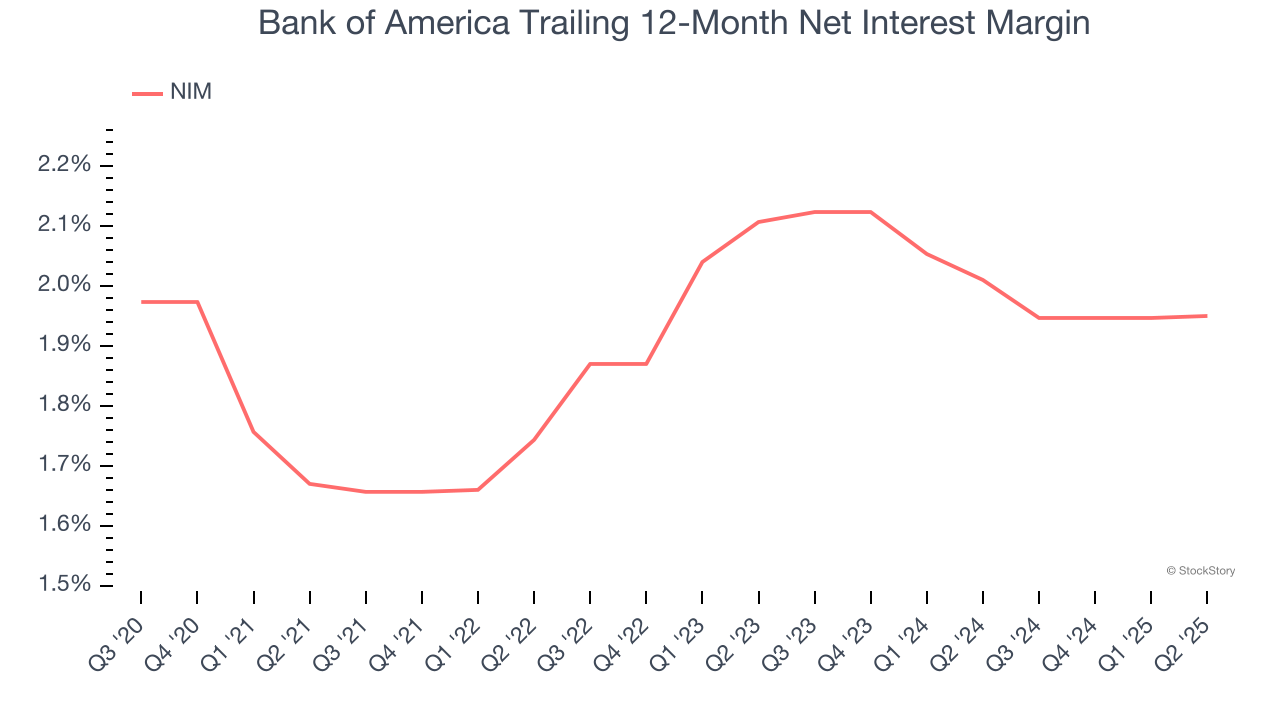

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, we can see that Bank of America’s net interest margin averaged a poor 2%, reflecting its high servicing and capital costs.

Final Judgment

Bank of America isn’t a terrible business, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 1.3× forward P/B (or $50.49 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.