WisdomTree (WT): Buy, Sell, or Hold Post Q2 Earnings?

WisdomTree has been on fire lately. In the past six months alone, the company’s stock price has rocketed 74.1%, reaching $13.35 per share. This performance may have investors wondering how to approach the situation.

Is now still a good time to buy WT? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free for active Edge members.

Why Is WT a Good Business?

Originally founded as a financial media company before pivoting to ETF management in 2006, WisdomTree (NYSE: WT) is a financial services company that creates and manages exchange-traded funds (ETFs) and other investment products for individual and institutional investors.

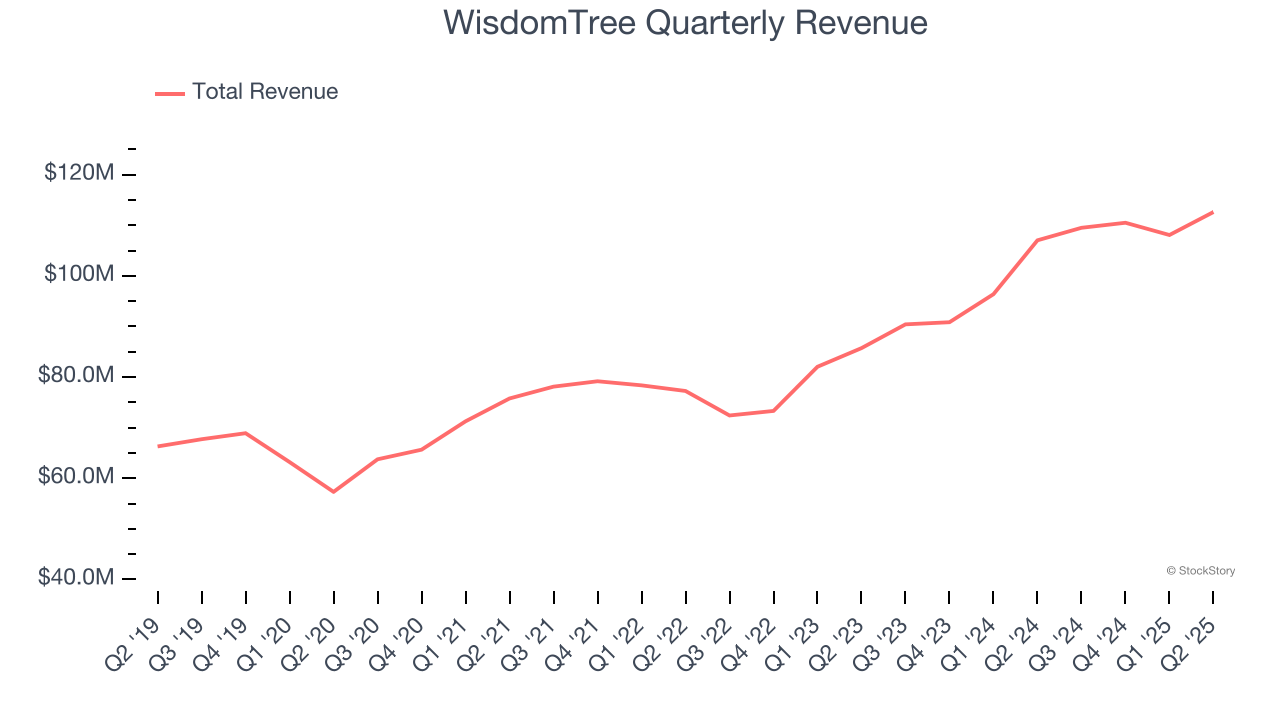

1. Long-Term Revenue Growth Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

Over the last five years, WisdomTree grew its revenue at a solid 11.4% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

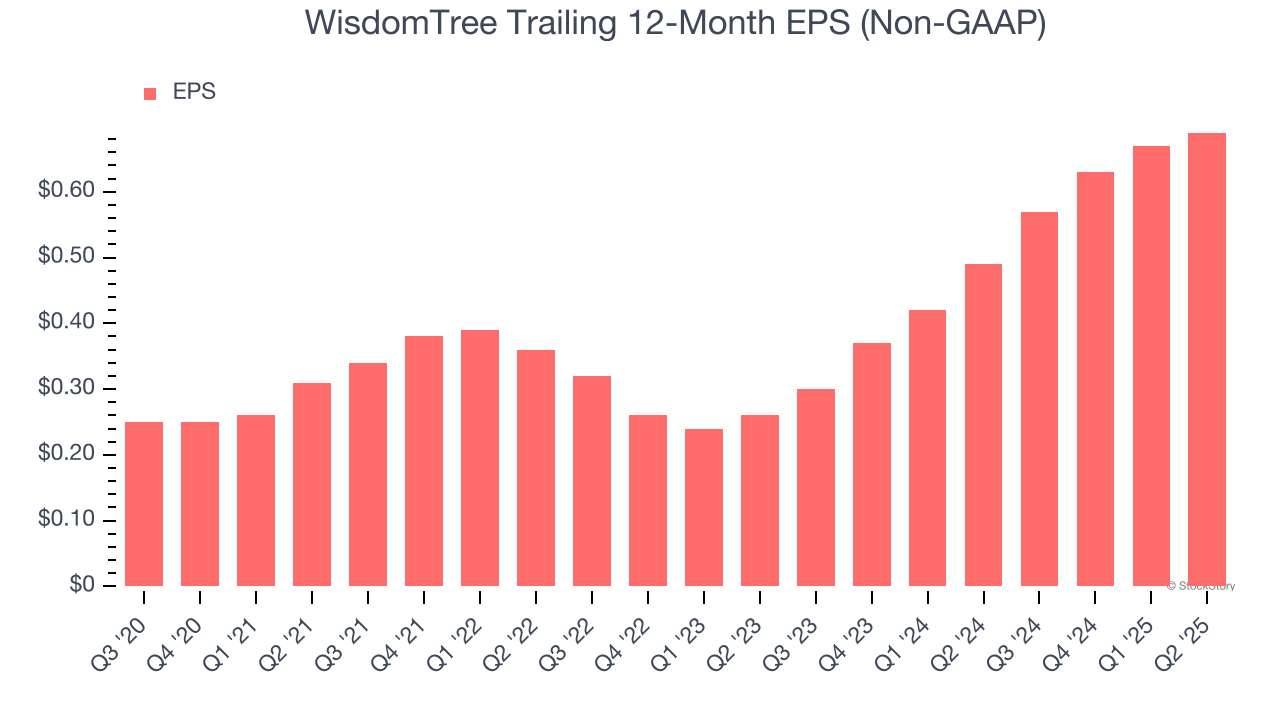

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

WisdomTree’s EPS grew at a spectacular 23.2% compounded annual growth rate over the last five years, higher than its 11.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. Market-Beating ROE Showcases Attractive Growth Opportunities

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, WisdomTree has averaged an ROE of 13.3%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows WisdomTree has a decent competitive moat.

Final Judgment

These are just a few reasons why WisdomTree is a cream-of-the-crop financials company, and with the recent surge, the stock trades at 16.5× forward P/E (or $13.35 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.