3 Reasons to Avoid STWD and 1 Stock to Buy Instead

Since April 2025, Starwood Property Trust has been in a holding pattern, posting a small return of 1.5% while floating around $18.89. The stock also fell short of the S&P 500’s 22.7% gain during that period.

Is now the time to buy Starwood Property Trust, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Starwood Property Trust Will Underperform?

We're cautious about Starwood Property Trust. Here are three reasons why STWD doesn't excite us and a stock we'd rather own.

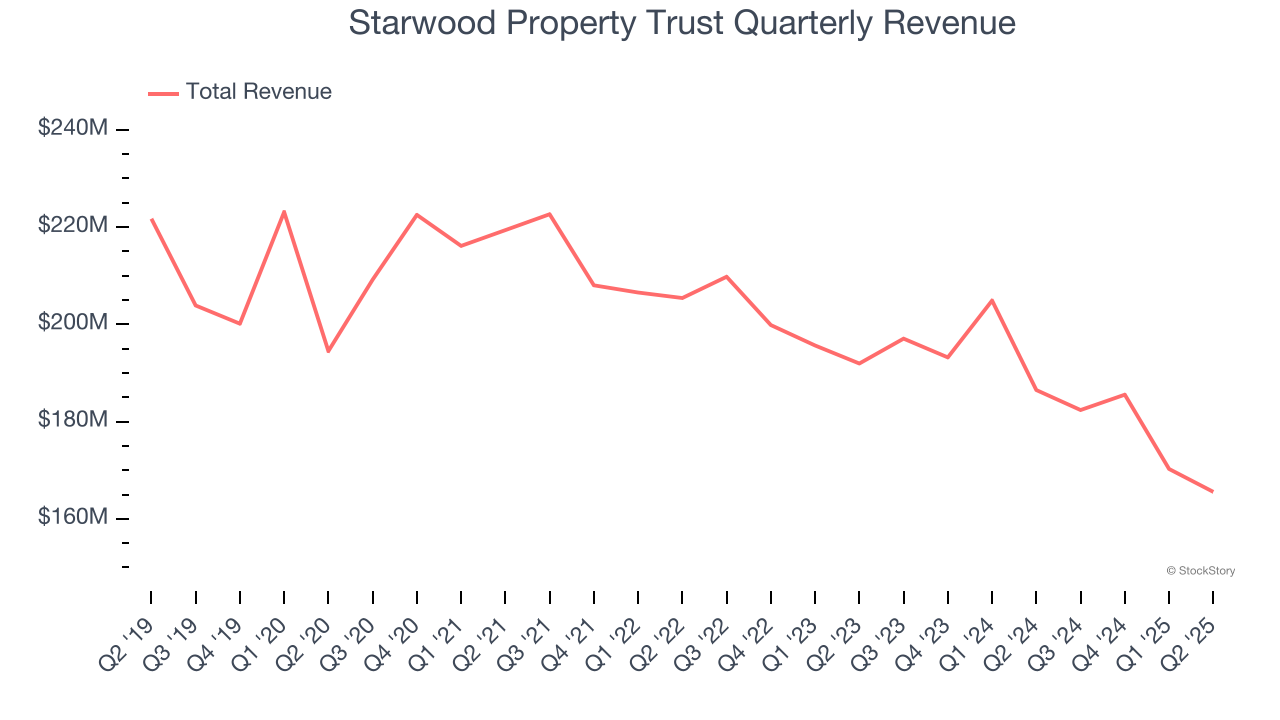

1. Revenue Spiraling Downwards

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

Starwood Property Trust struggled to consistently generate demand over the last five years as its revenue dropped at a 3% annual rate. This was below our standards and signals it’s a low quality business.

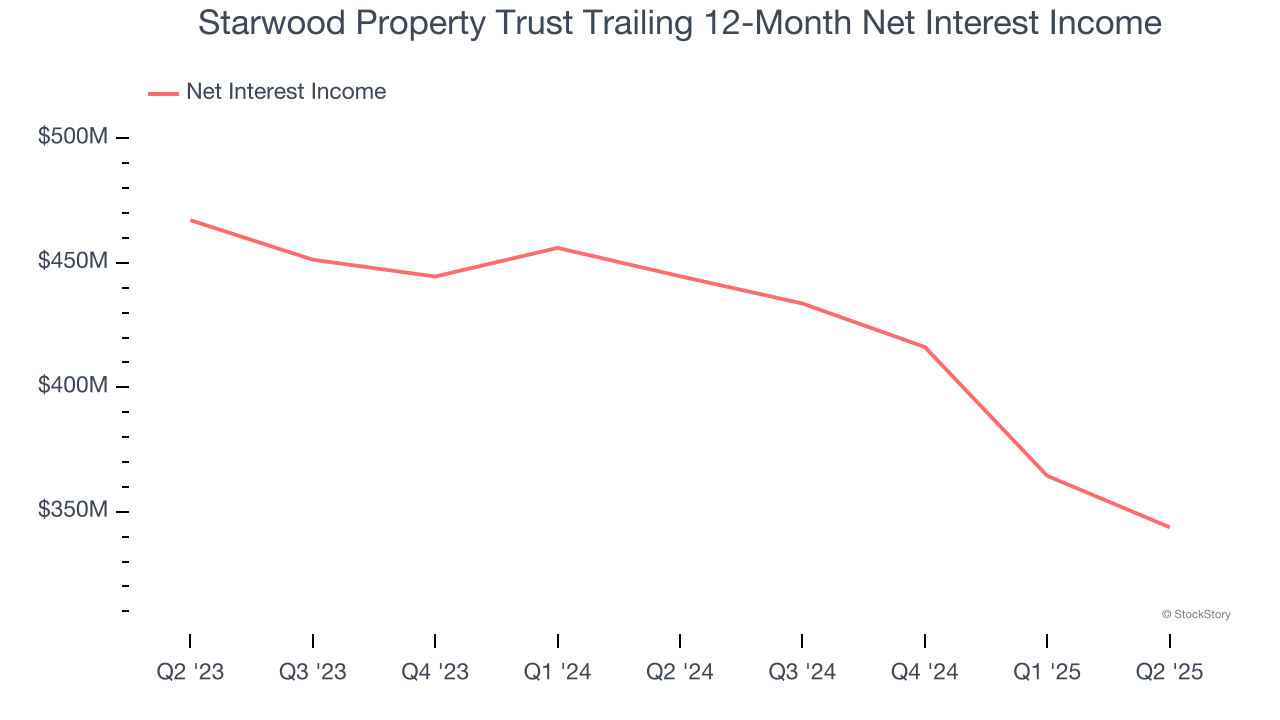

2. Declining Net Interest Income Reflects Weakness

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Starwood Property Trust’s net interest income has declined by 2.5% annually over the last four years, much worse than the broader banking industry.

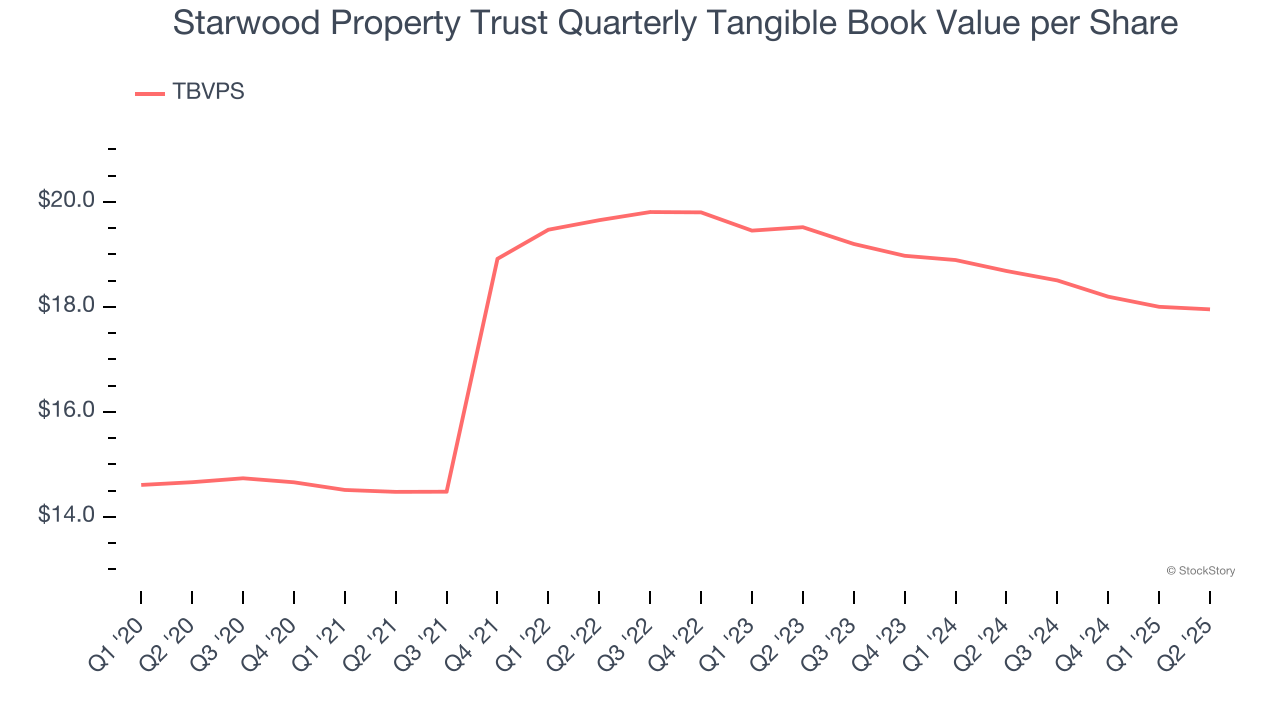

3. Declining TBVPS Reflects Erosion of Asset Value

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Although Starwood Property Trust’s TBVPS increased by 4.1% annually over the last five years, the past two years show the tide has turned as TBVPS declined at a -4.1% annual clip (from $19.52 to $17.95 per share).

Final Judgment

We cheer for all companies supporting the economy, but in the case of Starwood Property Trust, we’ll be cheering from the sidelines. With its shares underperforming the market lately, the stock trades at 1× forward P/B (or $18.89 per share). This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere. Let us point you toward one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.