Business Services & Supplies Q4 Earnings: RB Global (NYSE:RBA) Simply the Best

As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the business services & supplies industry, including RB Global (NYSE: RBA) and its peers.

This is a sector that encompasses many types of business, and so it follows that a number of trends will impact the space. For industrial and environmental services companies, for example, trends around environmental compliance and increasing corporate ESG commitments matter while for safety and security services companies, the intersection of physical security, cybersecurity, and workplace safety regulations are the topics du jour. Broadly, AI and automation could be tailwinds for companies in the space that invest wisely. On the other hand, shifting regulatory frameworks could force continual changes in go-to-market and costly investments.

The 16 business services & supplies stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was 1.3% below.

While some business services & supplies stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.8% since the latest earnings results.

Best Q4: RB Global (NYSE: RBA)

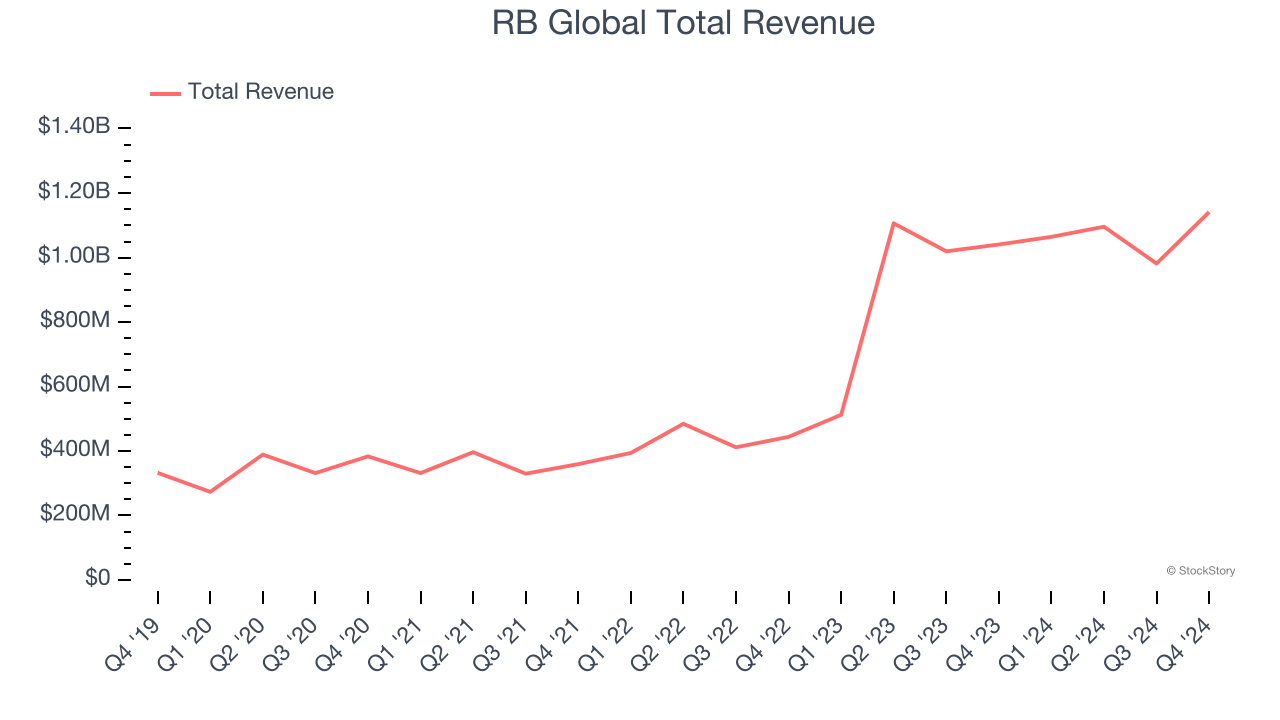

Formed through the 2023 merger of Ritchie Bros. Auctioneers and IAA, RB Global (NYSE: RBA) operates a global marketplace that connects buyers and sellers of commercial assets and vehicles, primarily in the automotive, construction, and transportation sectors.

RB Global reported revenues of $1.14 billion, up 9.7% year on year. This print exceeded analysts’ expectations by 7.9%. Overall, it was an incredible quarter for the company with an impressive beat of analysts’ EPS estimates.

The stock is up 3% since reporting and currently trades at $99.51.

We think RB Global is a good business, but is it a buy today? Read our full report here, it’s free.

Vestis (NYSE: VSTS)

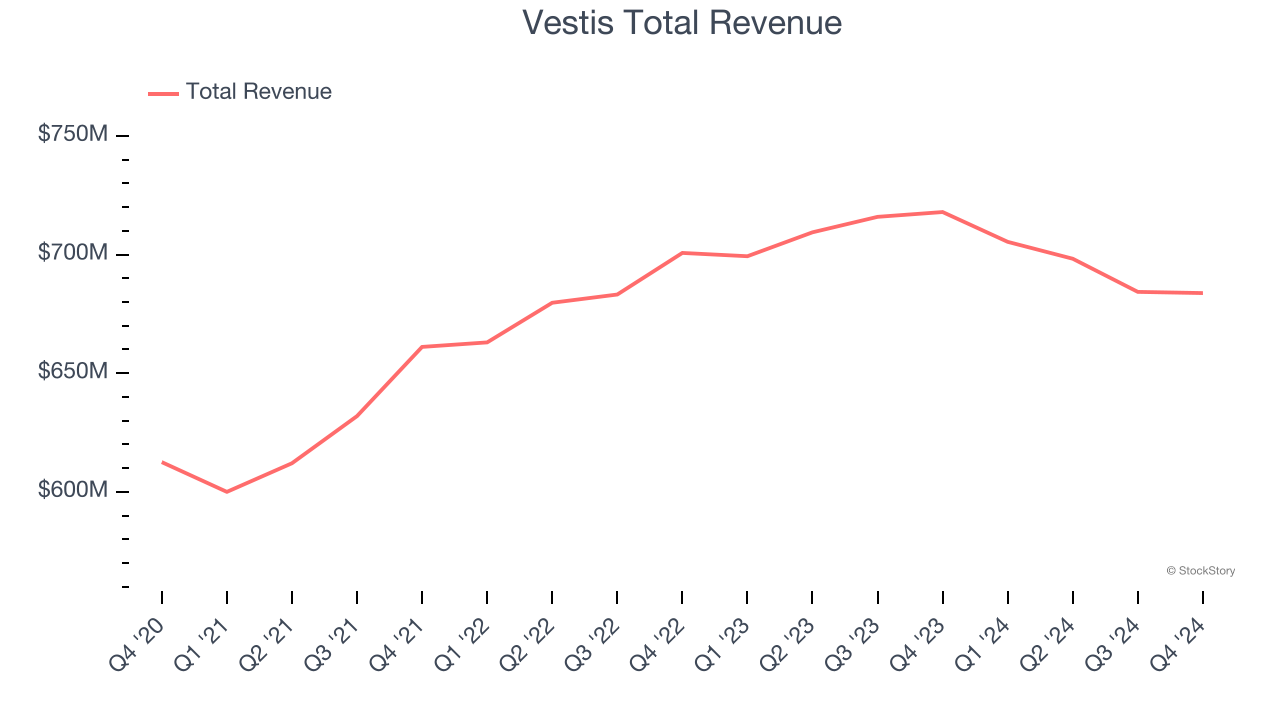

With roots dating back to 1936 and a network of more than 350 facilities, Vestis Corporation (NYSE: VSTS) provides uniform rentals, workplace supplies, and facility services to over 300,000 customer locations across the United States and Canada.

Vestis reported revenues of $683.8 million, down 4.8% year on year, falling short of analysts’ expectations by 0.7%. However, the business still had a satisfactory quarter with a solid beat of analysts’ EPS estimates but full-year revenue guidance meeting analysts’ expectations.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 31.9% since reporting. It currently trades at $10.80.

Is now the time to buy Vestis? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Brady (NYSE: BRC)

Founded over a century ago in 1914 and evolving from its roots in printed identification materials, Brady Corporation (NYSE: BRC) manufactures and supplies identification solutions and workplace safety products that help companies identify and protect their premises, products, and people.

Brady reported revenues of $356.7 million, up 10.6% year on year, falling short of analysts’ expectations by 0.7%. It was a softer quarter as it posted a miss of analysts’ EPS estimates.

As expected, the stock is down 4.7% since the results and currently trades at $71.15.

Read our full analysis of Brady’s results here.

Tetra Tech (NASDAQ: TTEK)

With its "Leading with Science" approach guiding over 100,000 projects annually across 100+ countries, Tetra Tech (NASDAQ: TTEK) provides high-end consulting and engineering services focused on water management, environmental solutions, and sustainable infrastructure projects worldwide.

Tetra Tech reported revenues of $1.20 billion, up 17.9% year on year. This print surpassed analysts’ expectations by 8.6%. Overall, it was a strong quarter as it also logged revenue guidance for next quarter slightly topping analysts’ expectations and a decent beat of analysts’ EPS estimates.

Tetra Tech achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 20.2% since reporting and currently trades at $30.05.

Read our full, actionable report on Tetra Tech here, it’s free.

Steelcase (NYSE: SCS)

Founded in 1912 and evolving from a metal office furniture maker to a workplace innovation leader, Steelcase (NYSE: SCS) is a global office furniture manufacturer that designs and produces workplace solutions including seating, desks, storage, and architectural products.

Steelcase reported revenues of $794.9 million, up 2.2% year on year. This number was in line with analysts’ expectations. Zooming out, it was a slower quarter as it logged revenue guidance for next quarter missing analysts’ expectations.

The stock is down 6.6% since reporting and currently trades at $11.64.

Read our full, actionable report on Steelcase here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.