A Look Back at HVAC and Water Systems Stocks’ Q4 Earnings: AAON (NASDAQ:AAON) Vs The Rest Of The Pack

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at AAON (NASDAQ: AAON) and the best and worst performers in the hvac and water systems industry.

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 9 hvac and water systems stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.9% since the latest earnings results.

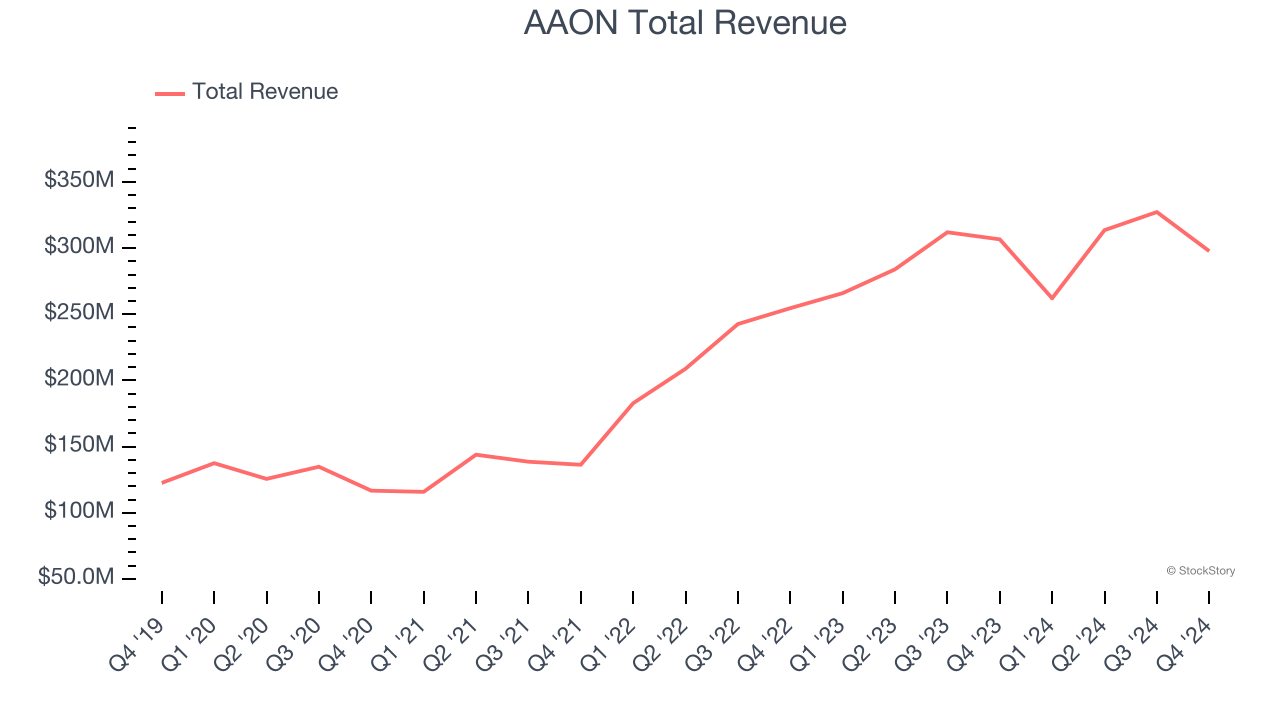

Weakest Q4: AAON (NASDAQ: AAON)

Backed by two million square feet of lab testing space, AAON (NASDAQ: AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

AAON reported revenues of $297.7 million, down 2.9% year on year. This print fell short of analysts’ expectations by 7.1%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

Gary Fields, CEO, stated, "As we anticipated early in the year, 2024 had its share of triumphs and obstacles for AAON. The BASX brand made a significant impact on the data center market with the industry's first large-scale development and sale of a custom-designed liquid cooling solution. Along with strong demand for BASX's air-side data center cooling equipment, this drove the Company's total backlog to finish the year up 70.0% from the end of 2023. To meet a strengthening pipeline of demand beyond the backlog, we also successfully increased production capacity in 2024 with the completion of our 245,000 square foot addition at our Longview, Texas location and the purchase of our new 787,000 square foot building in Memphis, Tennessee. Conversely, the Company's AAON brand faced two major challenges: an industry-regulated refrigerant transition and nonresidential construction activity that weakened throughout the year. Despite the challenges, sales of AAON-branded equipment were down only modestly in 2024. Bookings and year-end backlog of this equipment were up year-over-year in the mid-to-high teens. All in, we deem the year to be a success."

AAON delivered the weakest performance against analyst estimates of the whole group. The stock is down 19.4% since reporting and currently trades at $82.21.

Is now the time to buy AAON? Access our full analysis of the earnings results here, it’s free.

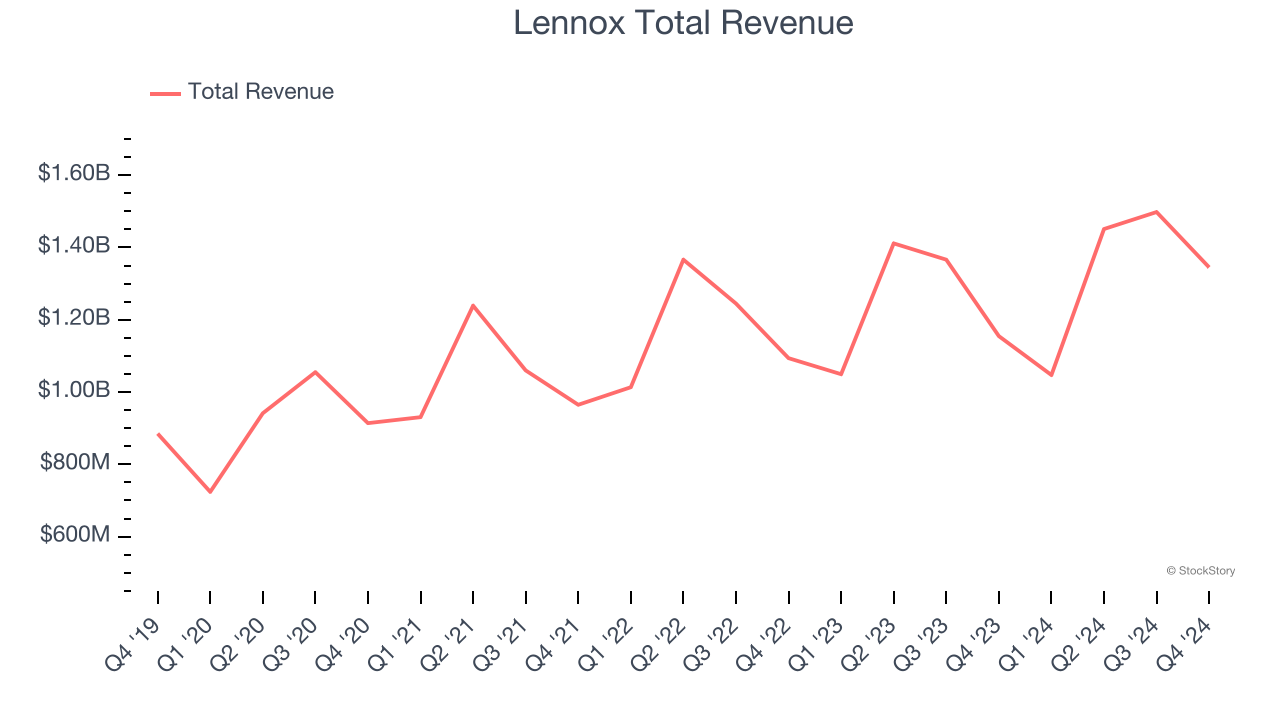

Best Q4: Lennox (NYSE: LII)

Based in Texas and founded over a century ago, Lennox (NYSE: LII) is a climate control solutions company offering heating, ventilation, air conditioning, and refrigeration (HVACR) goods.

Lennox reported revenues of $1.35 billion, up 16.5% year on year, outperforming analysts’ expectations by 8.9%. The business had an exceptional quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EPS estimates.

Lennox delivered the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 11.5% since reporting. It currently trades at $586.09.

Is now the time to buy Lennox? Access our full analysis of the earnings results here, it’s free.

A. O. Smith (NYSE: AOS)

Credited with the invention of the glass-lined water heater, A.O. Smith (NYSE: AOS) manufactures water heating and treatment products for various industries.

A. O. Smith reported revenues of $912.4 million, down 7.7% year on year, falling short of analysts’ expectations by 4.7%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

A. O. Smith delivered the slowest revenue growth and weakest full-year guidance update in the group. As expected, the stock is down 3.9% since the results and currently trades at $66.55.

Read our full analysis of A. O. Smith’s results here.

Zurn Elkay (NYSE: ZWS)

Claiming to have saved more than 30 billion gallons of water, Zurn Elkay (NYSE: ZWS) provides water management solutions to various industries.

Zurn Elkay reported revenues of $370.7 million, up 3.9% year on year. This number topped analysts’ expectations by 0.9%. Zooming out, it was a mixed quarter as it also recorded a solid beat of analysts’ EPS estimates but a significant miss of analysts’ organic revenue estimates.

The stock is down 15.2% since reporting and currently trades at $33.48.

Read our full, actionable report on Zurn Elkay here, it’s free.

Northwest Pipe (NASDAQ: NWPX)

Playing a large role in the Integrated Pipeline (IPL) project in Texas to deliver ~350 million gallons of water per day, Northwest Pipe (NASDAQ: NWPX) is a manufacturer of pipeline systems for water infrastructure.

Northwest Pipe reported revenues of $119.6 million, up 8.6% year on year. This result missed analysts’ expectations by 0.6%. Taking a step back, it was a mixed quarter as it also produced a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ EPS estimates.

The stock is down 16.7% since reporting and currently trades at $40.01.

Read our full, actionable report on Northwest Pipe here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.