Q4 Earnings Highlights: Tapestry (NYSE:TPR) Vs The Rest Of The Apparel and Accessories Stocks

As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the apparel and accessories industry, including Tapestry (NYSE: TPR) and its peers.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel and accessories stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 18% since the latest earnings results.

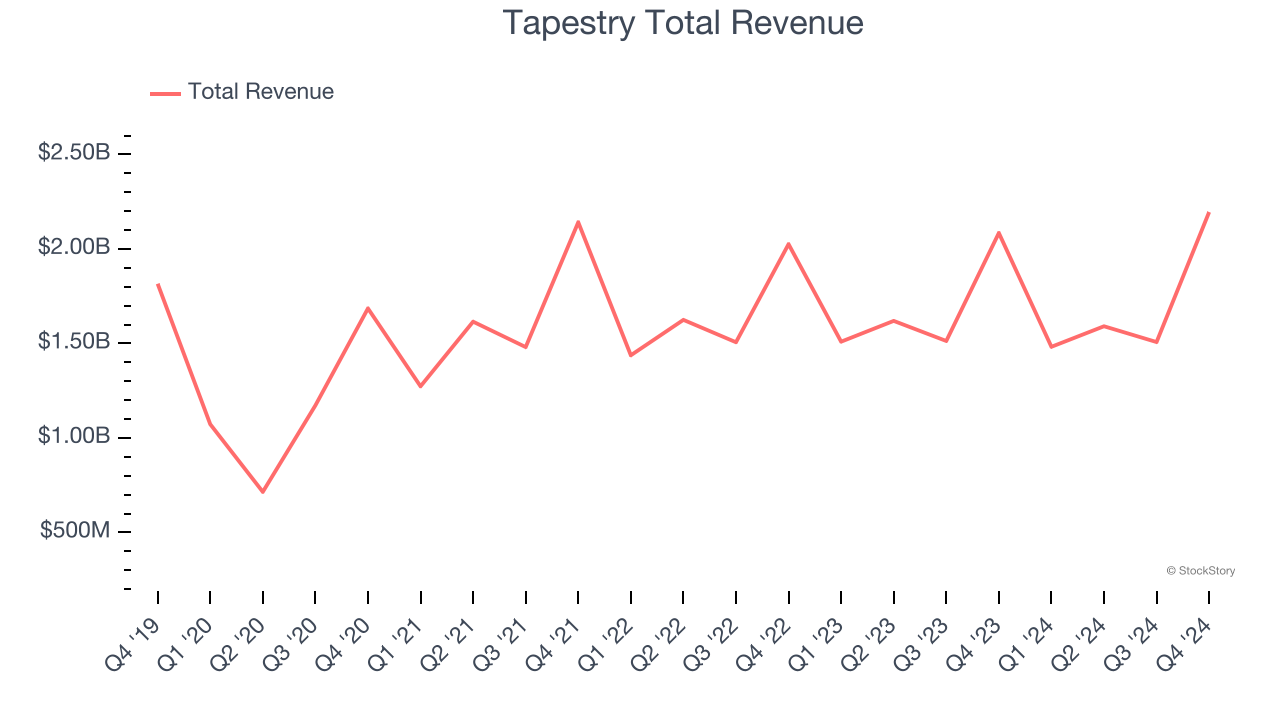

Tapestry (NYSE: TPR)

Originally founded as Coach, Tapestry (NYSE: TPR) is an American fashion conglomerate with a portfolio of luxury brands offering high-quality accessories and fashion products.

Tapestry reported revenues of $2.20 billion, up 5.3% year on year. This print exceeded analysts’ expectations by 4.2%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ constant currency revenue estimates and full-year EPS guidance exceeding analysts’ expectations.

“Our strong second quarter outperformance is a testament to our exceptional teams and our collective commitment to disciplined brand building,” said Joanne Crevoiserat, Chief Executive Officer of Tapestry,

The stock is down 13.4% since reporting and currently trades at $63.50.

Is now the time to buy Tapestry? Access our full analysis of the earnings results here, it’s free.

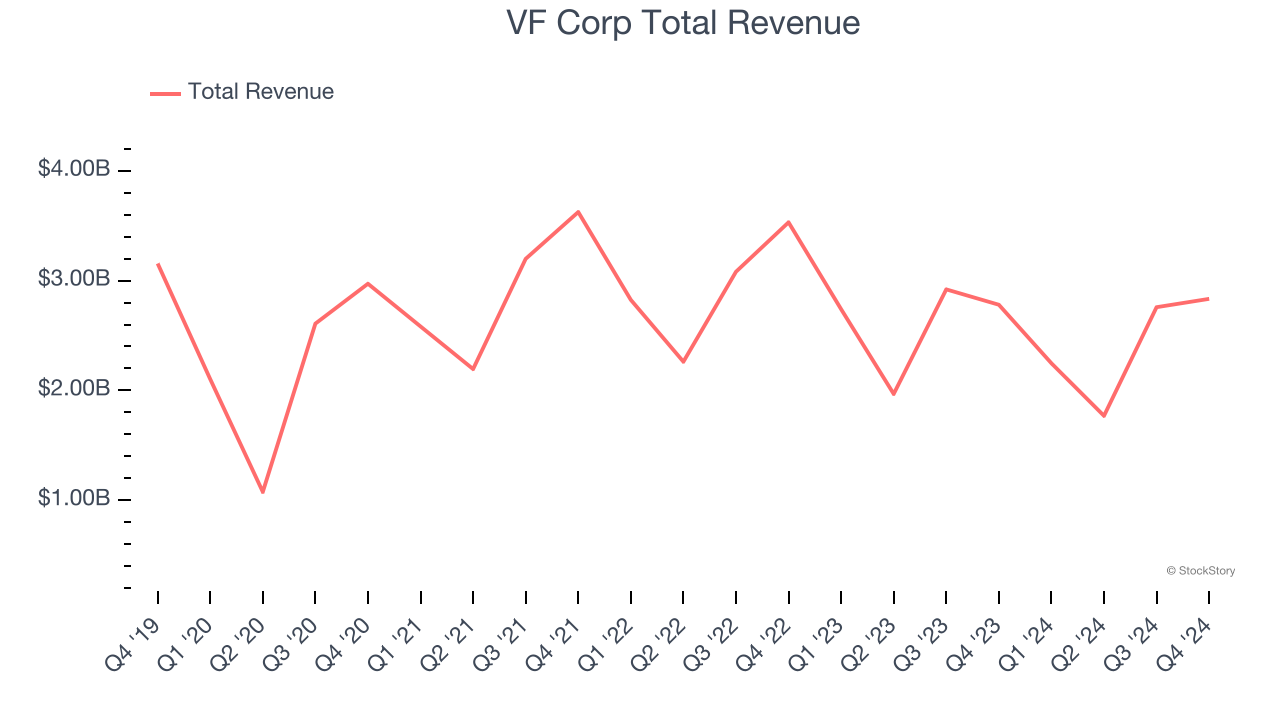

Best Q4: VF Corp (NYSE: VFC)

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE: VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

VF Corp reported revenues of $2.83 billion, up 1.9% year on year, outperforming analysts’ expectations by 1.2%. The business had a stunning quarter with a solid beat of analysts’ constant currency revenue and EPS estimates.

The stock is down 60.7% since reporting. It currently trades at $10.45.

Is now the time to buy VF Corp? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Movado (NYSE: MOV)

With its watches displayed in 20 museums around the world, Movado (NYSE: MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado reported revenues of $181.5 million, up 1% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a miss of analysts’ EPS estimates.

Interestingly, the stock is up 5.3% since the results and currently trades at $13.69.

Read our full analysis of Movado’s results here.

Under Armour (NYSE: UAA)

Founded in 1996 by a former University of Maryland football player, Under Armour (NYSE: UAA) is an apparel brand specializing in sportswear designed to improve athletic performance.

Under Armour reported revenues of $1.40 billion, down 5.7% year on year. This number topped analysts’ expectations by 4.5%. It was an exceptional quarter as it also produced a solid beat of analysts’ constant currency revenue estimates and an impressive beat of analysts’ EPS estimates.

Under Armour had the slowest revenue growth among its peers. The stock is down 32.6% since reporting and currently trades at $5.55.

Read our full, actionable report on Under Armour here, it’s free.

Kontoor Brands (NYSE: KTB)

Founded in 2019 after separating from VF Corporation, Kontoor Brands (NYSE: KTB) is a clothing company known for its high-quality denim products.

Kontoor Brands reported revenues of $699.3 million, up 4.4% year on year. This print was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it also produced constant currency revenue in line with analysts’ estimates but a miss of analysts’ adjusted operating income estimates.

The stock is down 36.8% since reporting and currently trades at $54.49.

Read our full, actionable report on Kontoor Brands here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.