Software Development Stocks Q4 Results: Benchmarking Twilio (NYSE:TWLO)

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Twilio (NYSE: TWLO) and the rest of the software development stocks fared in Q4.

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 11 software development stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2.4% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 20.5% since the latest earnings results.

Twilio (NYSE: TWLO)

Founded in 2008 by Jeff Lawson, a former engineer at Amazon, Twilio (NYSE: TWLO) is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps.

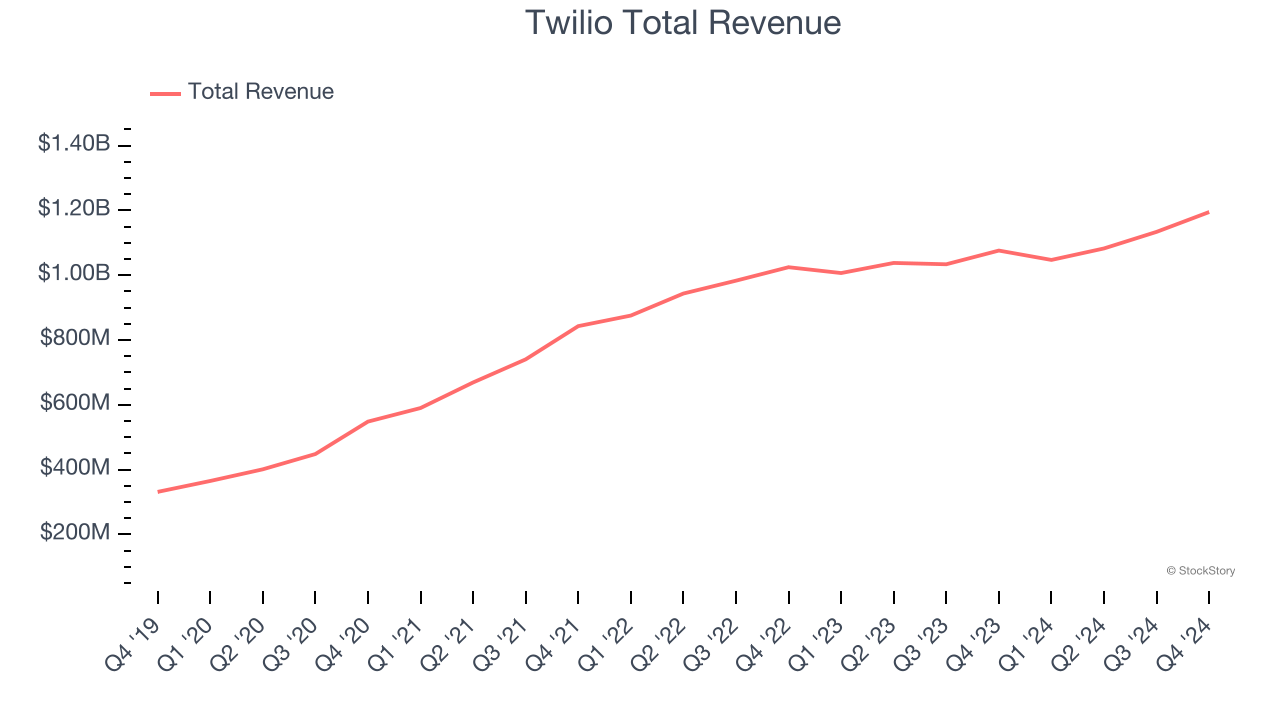

Twilio reported revenues of $1.19 billion, up 11% year on year. This print exceeded analysts’ expectations by 1.5%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ billings estimates but EPS guidance for next quarter missing analysts’ expectations.

The stock is down 36.4% since reporting and currently trades at $93.68.

Read our full report on Twilio here, it’s free.

Best Q4: F5 (NASDAQ: FFIV)

Initially started as a hardware appliances company in the late 1990s, F5 (NASDAQ: FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting them from cyberattacks.

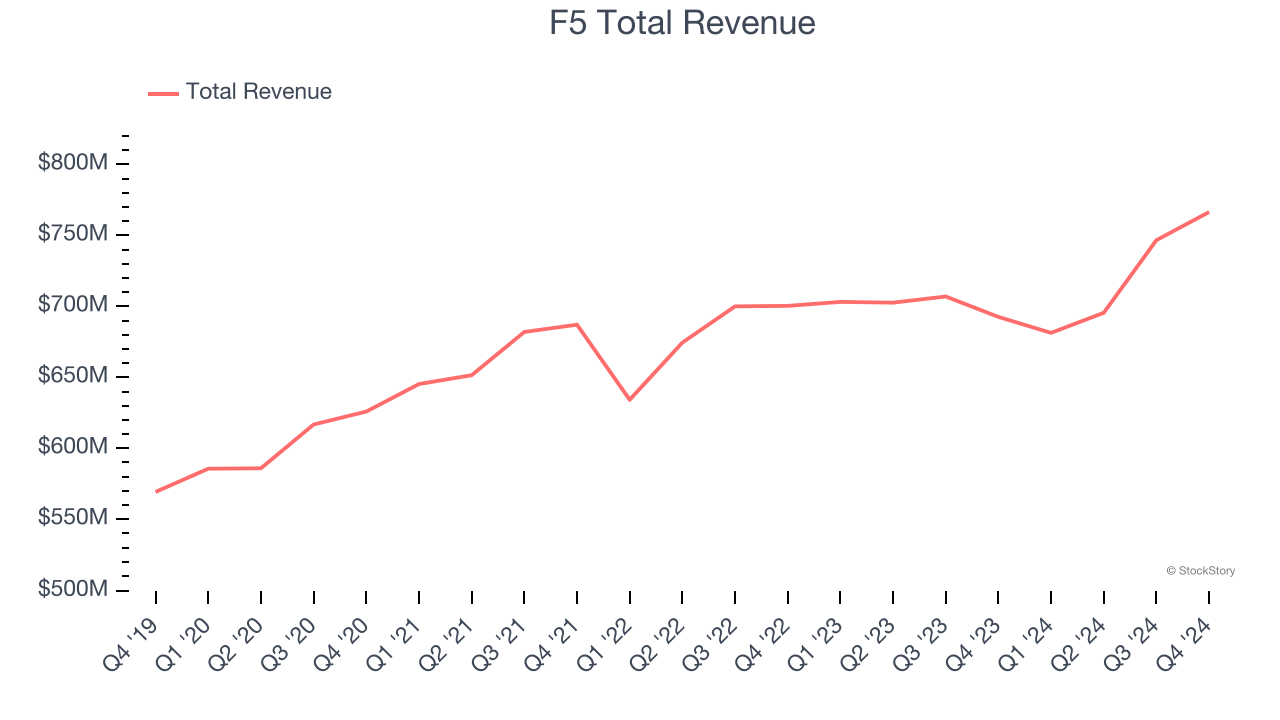

F5 reported revenues of $766.5 million, up 10.7% year on year, outperforming analysts’ expectations by 7.2%. The business had a strong quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

F5 pulled off the biggest analyst estimates beat among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $269.09.

Is now the time to buy F5? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Akamai (NASDAQ: AKAM)

Founded in 1999 by two engineers from MIT, Akamai (NASDAQ: AKAM) provides software for organizations to efficiently deliver web content to their customers.

Akamai reported revenues of $1.02 billion, up 2.5% year on year, in line with analysts’ expectations. It was a softer quarter as it posted full-year guidance of slowing revenue growth.

Akamai delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 18.6% since the results and currently trades at $79.81.

Read our full analysis of Akamai’s results here.

GitLab (NASDAQ: GTLB)

Founded as an open-source project in 2011, GitLab (NASDAQ: GTLB) is a leading software development tools platform.

GitLab reported revenues of $211.4 million, up 29.1% year on year. This number beat analysts’ expectations by 2.6%. Taking a step back, it was a slower quarter as it produced full-year EPS guidance missing analysts’ expectations.

GitLab delivered the fastest revenue growth among its peers. The stock is down 18.3% since reporting and currently trades at $46.

Read our full, actionable report on GitLab here, it’s free.

Bandwidth (NASDAQ: BAND)

Started in 1999 by David Morken who was later joined by Henry Kaestner as co-founder in 2001, Bandwidth (NASDAQ: BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

Bandwidth reported revenues of $210 million, up 27% year on year. This result surpassed analysts’ expectations by 3%. More broadly, it was a slower quarter as it recorded full-year guidance of slowing revenue growth and a poor net revenue retention rate.

The stock is down 30.4% since reporting and currently trades at $12.73.

Read our full, actionable report on Bandwidth here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.