Spotting Winners: Qualys (NASDAQ:QLYS) And Cybersecurity Stocks In Q4

Let’s dig into the relative performance of Qualys (NASDAQ: QLYS) and its peers as we unravel the now-completed Q4 cybersecurity earnings season.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.3% since the latest earnings results.

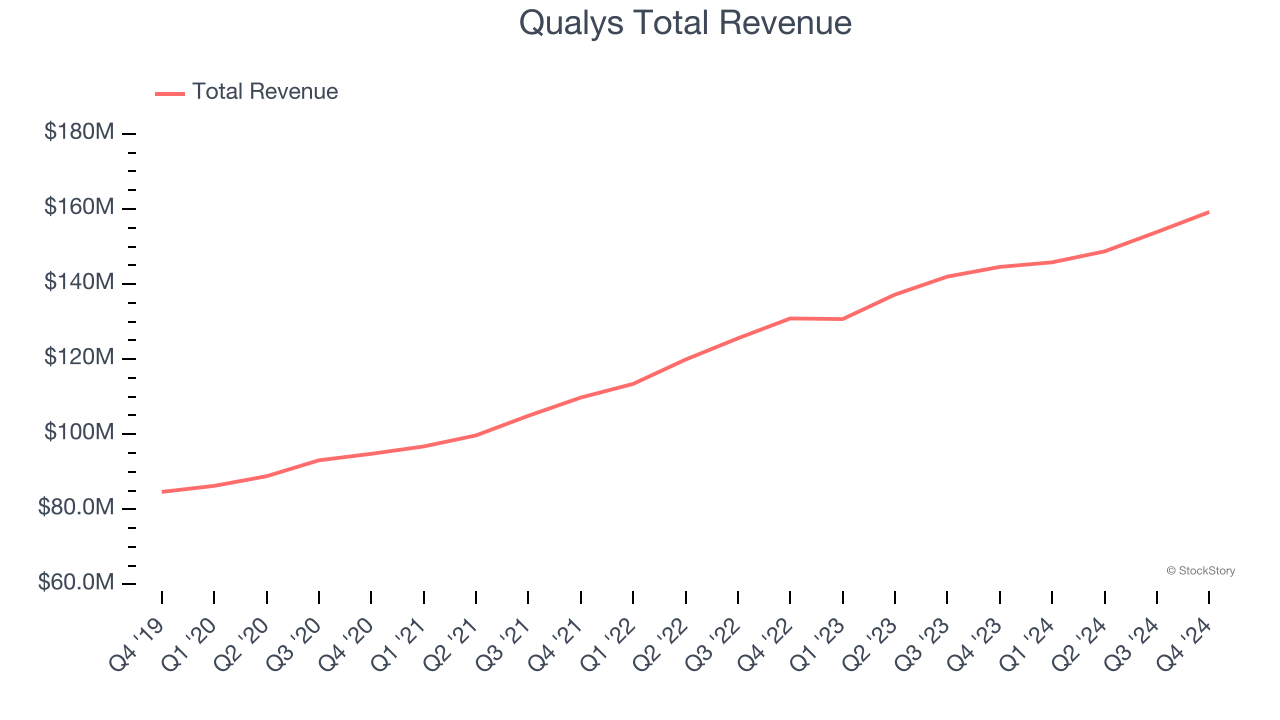

Qualys (NASDAQ: QLYS)

Founded in 1999 as one of the first subscription security companies, Qualys (NASDAQ: QLYS) provides organizations with software to assess their exposure to cyber-attacks.

Qualys reported revenues of $159.2 million, up 10.1% year on year. This print exceeded analysts’ expectations by 1.9%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but full-year EPS guidance missing analysts’ expectations significantly.

"Customers are starting to leverage the breadth and depth of the Qualys Enterprise TruRisk Platform as they look to rearchitect and transform their security stacks," said Sumedh Thakar, Qualys' president and CEO.

Unsurprisingly, the stock is down 11.6% since reporting and currently trades at $124.50.

Is now the time to buy Qualys? Access our full analysis of the earnings results here, it’s free.

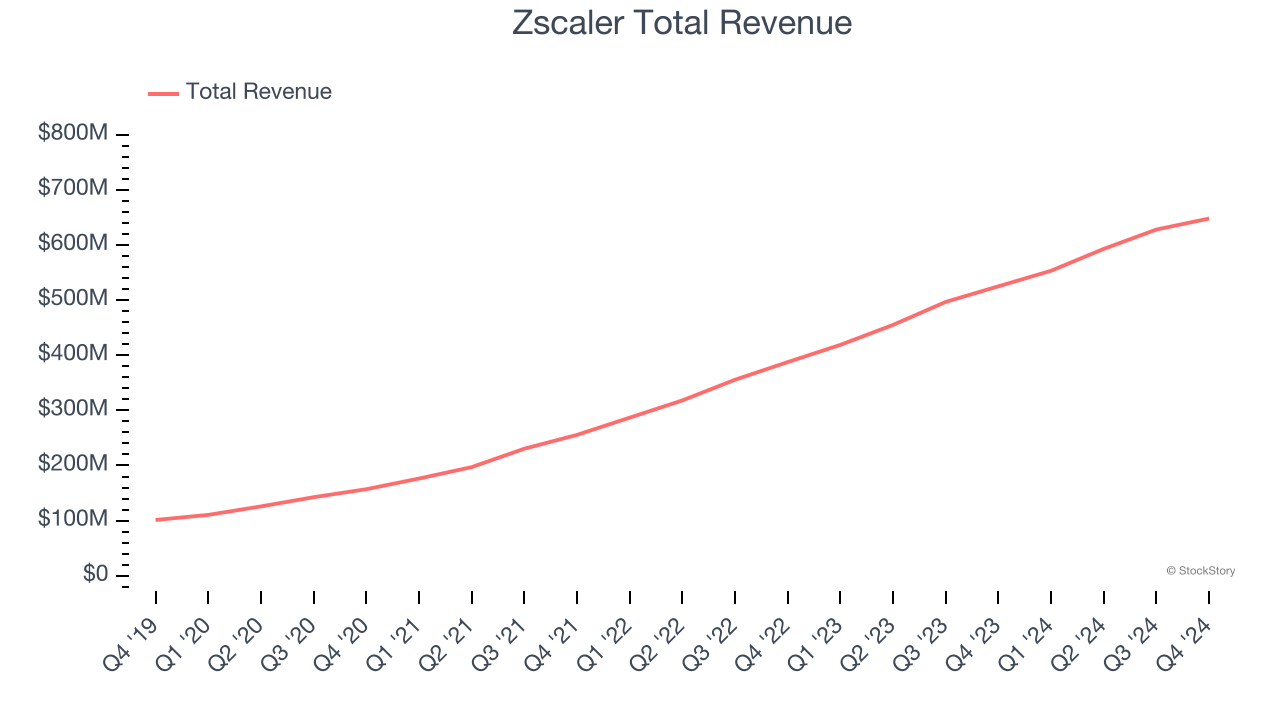

Best Q4: Zscaler (NASDAQ: ZS)

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ: ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

Zscaler reported revenues of $647.9 million, up 23.4% year on year, outperforming analysts’ expectations by 2.1%. The business had a very strong quarter with a solid beat of analysts’ annual recurring revenue and EBITDA estimates.

The market seems happy with the results as the stock is up 7.1% since reporting. It currently trades at $210.54.

Is now the time to buy Zscaler? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Varonis (NASDAQ: VRNS)

Founded by a duo of former Israeli Defense Forces cyber warfare engineers, Varonis (NASDAQ: VRNS) offers software-as-service that helps customers protect data from cyber threats and gain visibility into how enterprise data is being used.

Varonis reported revenues of $158.5 million, up 2.9% year on year, falling short of analysts’ expectations by 4.2%. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations.

Varonis delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 12% since the results and currently trades at $41.28.

Read our full analysis of Varonis’s results here.

Okta (NASDAQ: OKTA)

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ: OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

Okta reported revenues of $682 million, up 12.7% year on year. This print topped analysts’ expectations by 2.1%. It was a strong quarter as it also logged a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Okta delivered the highest full-year guidance raise among its peers. The stock is up 15.2% since reporting and currently trades at $100.53.

Read our full, actionable report on Okta here, it’s free.

Palo Alto Networks (NASDAQ: PANW)

Founded in 2005 by cybersecurity engineer Nir Zuk, Palo Alto Networks (NASDAQ: PANW) makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches, and malware threats.

Palo Alto Networks reported revenues of $2.26 billion, up 14.3% year on year. This result beat analysts’ expectations by 0.8%. More broadly, it was a mixed quarter as it also recorded an impressive beat of analysts’ EBITDA estimates but a miss of analysts’ billings estimates.

The stock is down 13% since reporting and currently trades at $175.65.

Read our full, actionable report on Palo Alto Networks here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.