Unpacking Q4 Earnings: Cisco (NASDAQ:CSCO) In The Context Of Other IT Services & Other Tech Stocks

Let’s dig into the relative performance of Cisco (NASDAQ: CSCO) and its peers as we unravel the now-completed Q4 it services & other tech earnings season.

The IT and tech services subsector is poised for growth as businesses accelerate cloud adoption, AI-driven network automation, and edge computing deployments. While these seem like big, nebulous trends, they require very real products like switches and firewalls as well as implementation services. On the other hand, challenges on the horizon include intensifying competition from cloud-native networking providers, regulatory scrutiny over data privacy and cybersecurity, and potential supply chain constraints for networking hardware. While AI and automation will enhance network efficiency and security, they also introduce risks related to algorithmic bias, compliance complexity, and increased energy consumption.

The 21 it services & other tech stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 19.6% since the latest earnings results.

Cisco (NASDAQ: CSCO)

Founded in 1984 by a husband and wife team who wanted computers at Stanford to talk to computers at UC Berkeley, Cisco (NASDAQ: CSCO) designs and sells networking equipment, security solutions, and collaboration tools that help businesses connect their systems and secure their digital operations.

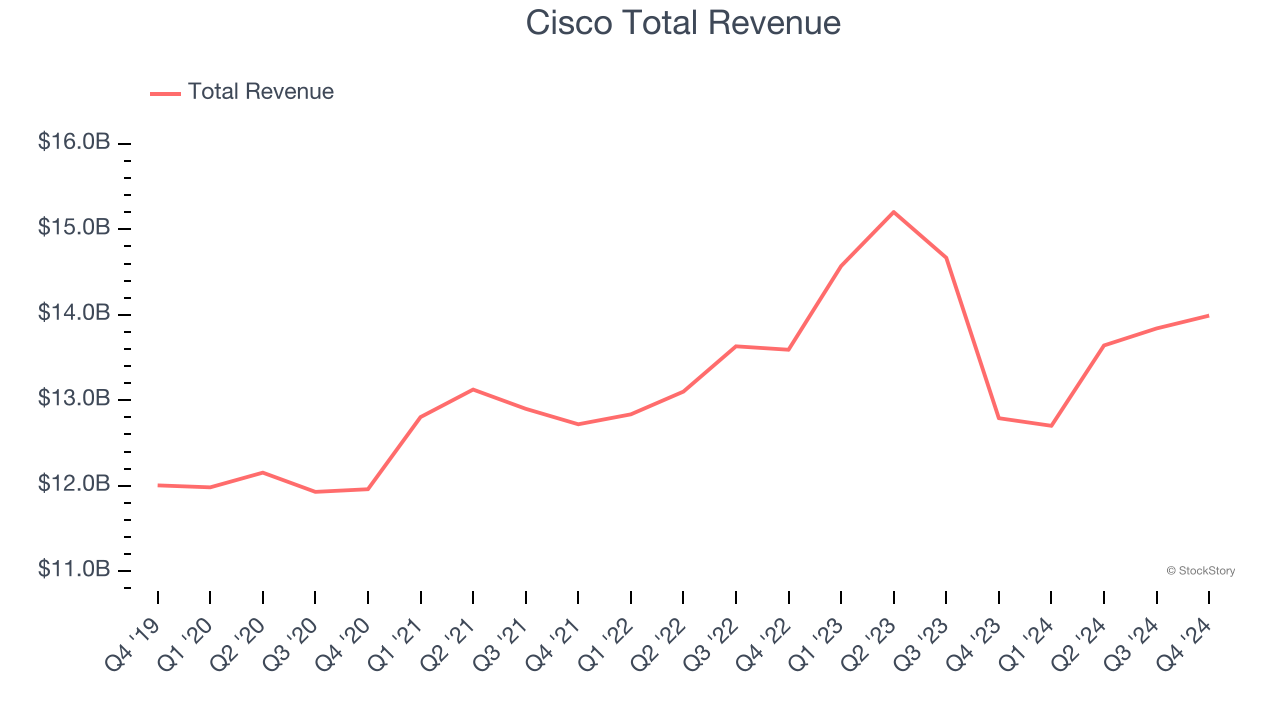

Cisco reported revenues of $13.99 billion, up 9.4% year on year. This print exceeded analysts’ expectations by 0.7%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ billings estimates.

The stock is down 3.3% since reporting and currently trades at $60.38.

Is now the time to buy Cisco? Access our full analysis of the earnings results here, it’s free.

Best Q4: Applied Digital (NASDAQ: APLD)

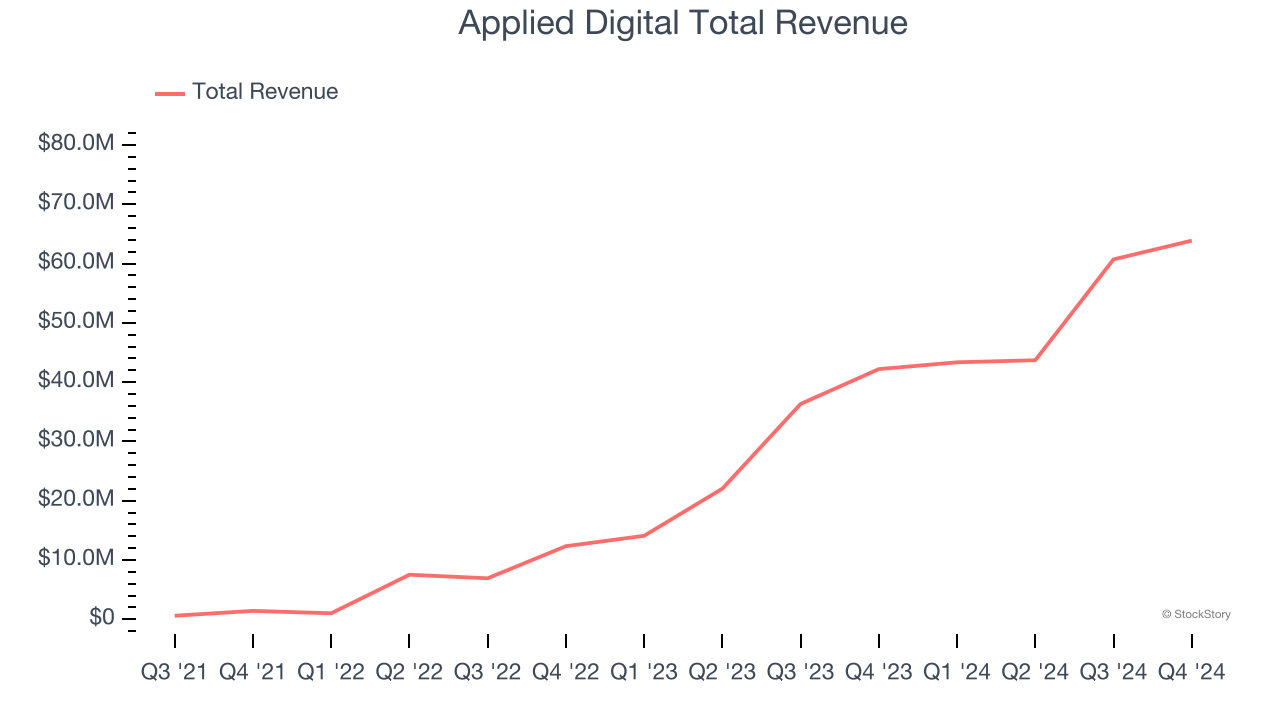

Pivoting from its origins in cryptocurrency mining to become a key player in the AI infrastructure boom, Applied Digital (NASDAQ: APLD) designs and operates specialized data centers that provide high-performance computing infrastructure for artificial intelligence and blockchain applications.

Applied Digital reported revenues of $63.87 million, up 51.3% year on year, outperforming analysts’ expectations by 4.3%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 31.3% since reporting. It currently trades at $5.86.

Is now the time to buy Applied Digital? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: CompoSecure (NASDAQ: CMPO)

Pioneer of the luxury metal credit card that's in the wallets of affluent consumers worldwide, CompoSecure (NASDAQ: CMPO) designs and manufactures premium metal payment cards and secure authentication solutions for financial institutions and digital asset storage.

CompoSecure reported revenues of $100.9 million, flat year on year, falling short of analysts’ expectations by 1.6%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 13% since the results and currently trades at $10.45.

Read our full analysis of CompoSecure’s results here.

Gartner (NYSE: IT)

With over 2,500 research experts guiding organizations through complex technology landscapes, Gartner (NYSE: IT) provides research, advisory services, and conferences that help executives make better decisions about technology and other business priorities.

Gartner reported revenues of $1.72 billion, up 8.1% year on year. This print beat analysts’ expectations by 1.4%. Overall, it was an exceptional quarter as it also put up a solid beat of analysts’ EPS estimates and a narrow beat of analysts’ constant currency revenue estimates.

The stock is down 25% since reporting and currently trades at $411.01.

Read our full, actionable report on Gartner here, it’s free.

Hewlett Packard Enterprise (NYSE: HPE)

Born from the 2015 split of the iconic Silicon Valley pioneer Hewlett-Packard, Hewlett Packard Enterprise (NYSE: HPE) provides edge-to-cloud technology solutions that help businesses capture, analyze, and act upon their data across hybrid IT environments.

Hewlett Packard Enterprise reported revenues of $7.85 billion, up 16.3% year on year. This result topped analysts’ expectations by 0.5%. Zooming out, it was a slower quarter as it logged a miss of analysts’ EPS estimates.

The stock is down 13.4% since reporting and currently trades at $15.54.

Read our full, actionable report on Hewlett Packard Enterprise here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.