Consumer Retail Stocks Q1 In Review: Walgreens (NASDAQ:WBA) Vs Peers

As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer retail industry, including Walgreens (NASDAQ: WBA) and its peers.

Consumer retail companies operate the brick-and-mortar stores where consumers have shopped for centuries. The way people shop is changing with increased penetration of technology, but these retailers are adapting and still very much a part of the consumer fabric.

The 55 consumer retail stocks we track reported a mixed Q1. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 4.2% above.

Thankfully, share prices of the companies have been resilient as they are up 5.9% on average since the latest earnings results.

Walgreens (NASDAQ: WBA)

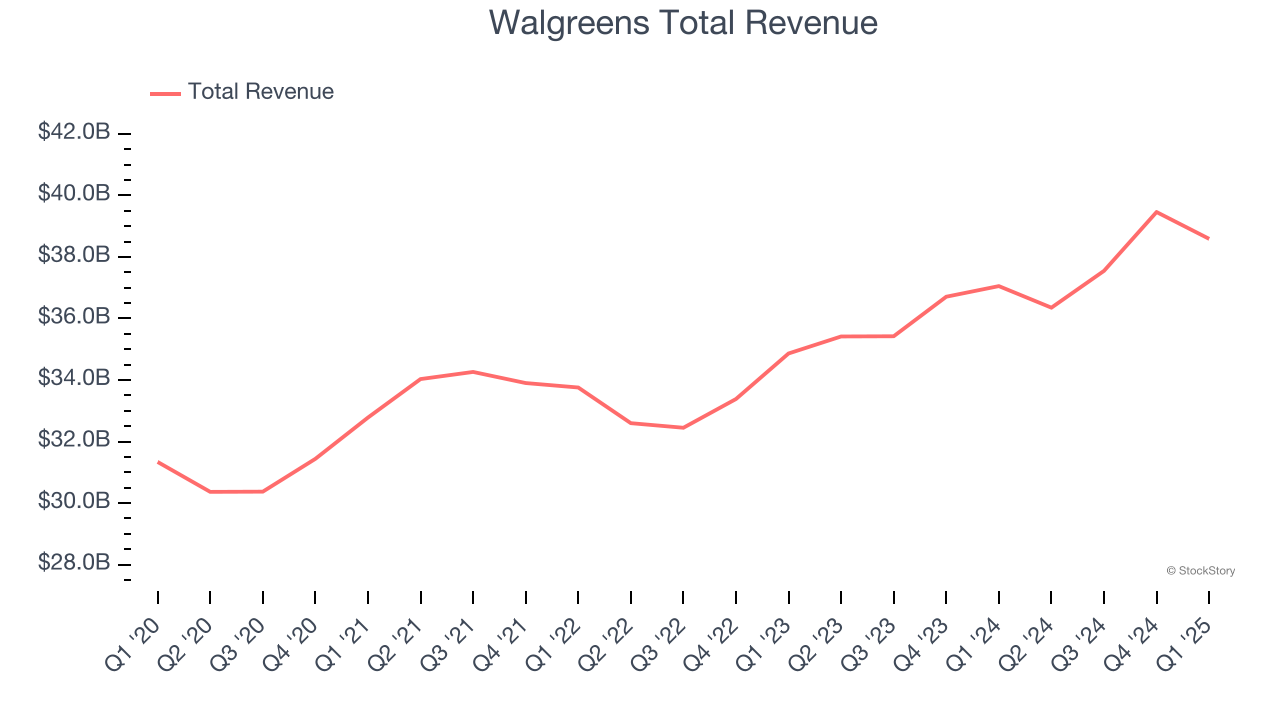

Primarily offering prescription medicine, health, and beauty products, Walgreens Boots Alliance (NASDAQ: WBA) is a pharmacy chain formed through the 2014 major merger of American company Walgreens and European company Alliance Boots.

Walgreens reported revenues of $38.59 billion, up 4.1% year on year. This print exceeded analysts’ expectations by 2.2%. Overall, it was a stunning quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ same-store sales estimates.

The stock is up 5.4% since reporting and currently trades at $11.31.

Is now the time to buy Walgreens? Access our full analysis of the earnings results here, it’s free.

Best Q1: Urban Outfitters (NASDAQ: URBN)

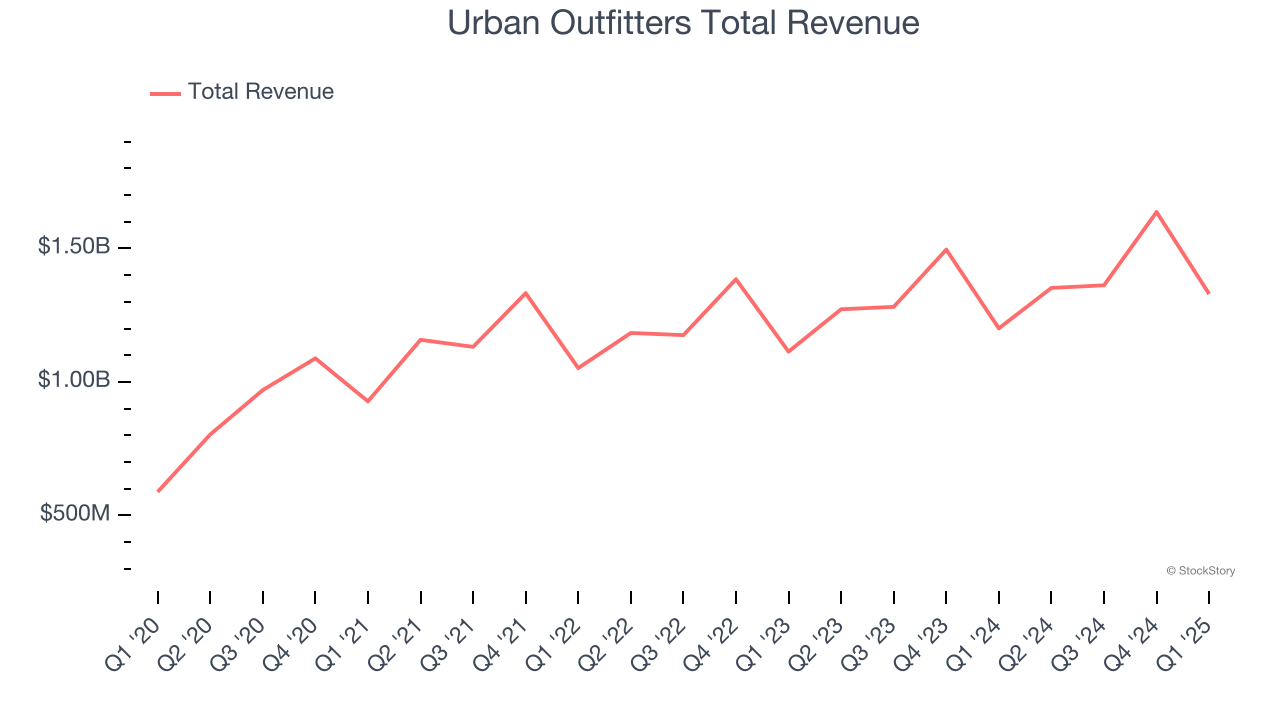

Founded as a purveyor of vintage items, Urban Outfitters (NASDAQ: URBN) now largely sells new apparel and accessories to teens and young adults seeking on-trend fashion.

Urban Outfitters reported revenues of $1.33 billion, up 10.7% year on year, outperforming analysts’ expectations by 2.5%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 16.9% since reporting. It currently trades at $69.71.

Is now the time to buy Urban Outfitters? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: OneWater (NASDAQ: ONEW)

A public company since early 2020, OneWater Marine (NASDAQ: ONEW) sells boats, yachts, and other marine products.

OneWater reported revenues of $483.5 million, flat year on year, falling short of analysts’ expectations by 2.8%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

Interestingly, the stock is up 3.3% since the results and currently trades at $15.50.

Read our full analysis of OneWater’s results here.

Costco (NASDAQ: COST)

Designed to be a one-stop shop for the suburban consumer, Costco (NASDAQ: COST) is a membership-only retail chain that sells groceries, apparel, toys, and household items, often in bulk quantities.

Costco reported revenues of $63.21 billion, up 8% year on year. This print met analysts’ expectations. Overall, it was a satisfactory quarter as it also logged a solid beat of analysts’ gross margin estimates.

The stock is flat since reporting and currently trades at $1,006.

Read our full, actionable report on Costco here, it’s free.

Petco (NASDAQ: WOOF)

Historically known for its window displays of pets for sale or adoption, Petco (NASDAQ: WOOF) is a specialty retailer of pet food and supplies as well as a provider of services such as wellness checks and grooming.

Petco reported revenues of $1.49 billion, down 2.3% year on year. This number was in line with analysts’ expectations. Overall, it was a strong quarter as it also produced a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is down 27.7% since reporting and currently trades at $2.64.

Read our full, actionable report on Petco here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.