Q1 Rundown: Copart (NASDAQ:CPRT) Vs Other Business Services & Supplies Stocks

Let’s dig into the relative performance of Copart (NASDAQ: CPRT) and its peers as we unravel the now-completed Q1 business services & supplies earnings season.

This is a sector that encompasses many types of business, and so it follows that a number of trends will impact the space. For industrial and environmental services companies, for example, trends around environmental compliance and increasing corporate ESG commitments matter while for safety and security services companies, the intersection of physical security, cybersecurity, and workplace safety regulations are the topics du jour. Broadly, AI and automation could be tailwinds for companies in the space that invest wisely. On the other hand, shifting regulatory frameworks could force continual changes in go-to-market and costly investments.

The 19 business services & supplies stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 2.7% on average since the latest earnings results.

Copart (NASDAQ: CPRT)

Starting as a single salvage yard in California in 1982, Copart (NASDAQ: CPRT) operates an online auction platform that connects sellers of damaged and salvage vehicles with buyers ranging from dismantlers and rebuilders to used car dealers and exporters.

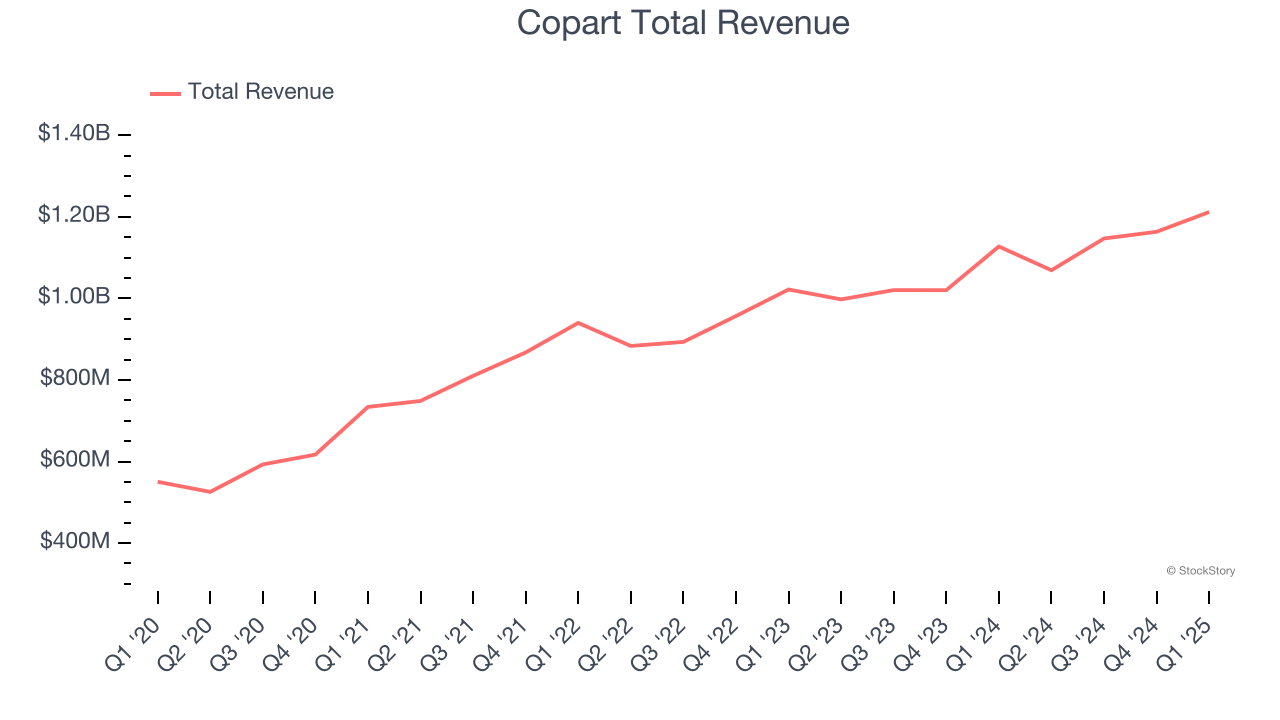

Copart reported revenues of $1.21 billion, up 7.5% year on year. This print fell short of analysts’ expectations by 1%. Overall, it was a slower quarter for the company with some shareholders anticipating a better outcome.

The stock is down 14.6% since reporting and currently trades at $51.77.

Is now the time to buy Copart? Access our full analysis of the earnings results here, it’s free.

Best Q1: CECO Environmental (NASDAQ: CECO)

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ: CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

CECO Environmental reported revenues of $176.7 million, up 39.9% year on year, outperforming analysts’ expectations by 17%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and full-year revenue guidance beating analysts’ expectations.

CECO Environmental pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 40.1% since reporting. It currently trades at $26.89.

Is now the time to buy CECO Environmental? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: GEO Group (NYSE: GEO)

With a global footprint spanning three continents and approximately 81,000 beds across 100 facilities, GEO Group (NYSE: GEO) operates secure facilities, processing centers, and reentry services for government agencies in the United States, Australia, and South Africa.

GEO Group reported revenues of $604.6 million, flat year on year, falling short of analysts’ expectations by 2%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

GEO Group delivered the weakest full-year guidance update in the group. As expected, the stock is down 10.1% since the results and currently trades at $27.23.

Read our full analysis of GEO Group’s results here.

Cintas (NASDAQ: CTAS)

Starting as a family business collecting and cleaning shop rags in Cincinnati, Cintas (NASDAQ: CTAS) provides corporate identity uniforms, facility services, and safety products to over one million businesses across North America.

Cintas reported revenues of $2.61 billion, up 8.4% year on year. This result was in line with analysts’ expectations. Overall, it was a strong quarter as it also logged an impressive beat of analysts’ EPS estimates and a narrow beat of analysts’ full-year EPS guidance estimates.

The stock is up 17% since reporting and currently trades at $226.45.

Read our full, actionable report on Cintas here, it’s free.

RB Global (NYSE: RBA)

Born from the 1958 founding of Ritchie Bros. Auctioneers and rebranded in 2023, RB Global (NYSE: RBA) operates global marketplaces that connect buyers and sellers of commercial assets, vehicles, and equipment across multiple industries.

RB Global reported revenues of $1.11 billion, up 4.1% year on year. This print surpassed analysts’ expectations by 6.9%. Overall, it was an exceptional quarter as it also produced a solid beat of analysts’ EPS estimates.

The stock is up 3% since reporting and currently trades at $105.30.

Read our full, actionable report on RB Global here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.