Q1 Earnings Outperformers: OneWater (NASDAQ:ONEW) And The Rest Of The Automotive and Marine Retail Stocks

Let’s dig into the relative performance of OneWater (NASDAQ: ONEW) and its peers as we unravel the now-completed Q1 automotive and marine retail earnings season.

At their essence, cars and boats get you from point A to point B, but the former is usually a necessity in everyday life while the latter is a luxury or leisure product. The retailers that sell these vehicles therefore cater to different needs and populations. There are also retailers that may not sell cars and boats themselves but the parts and accessories needed to keep these complex machines in tip top shape.

The 11 automotive and marine retail stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.4%.

Luckily, automotive and marine retail stocks have performed well with share prices up 11.8% on average since the latest earnings results.

Weakest Q1: OneWater (NASDAQ: ONEW)

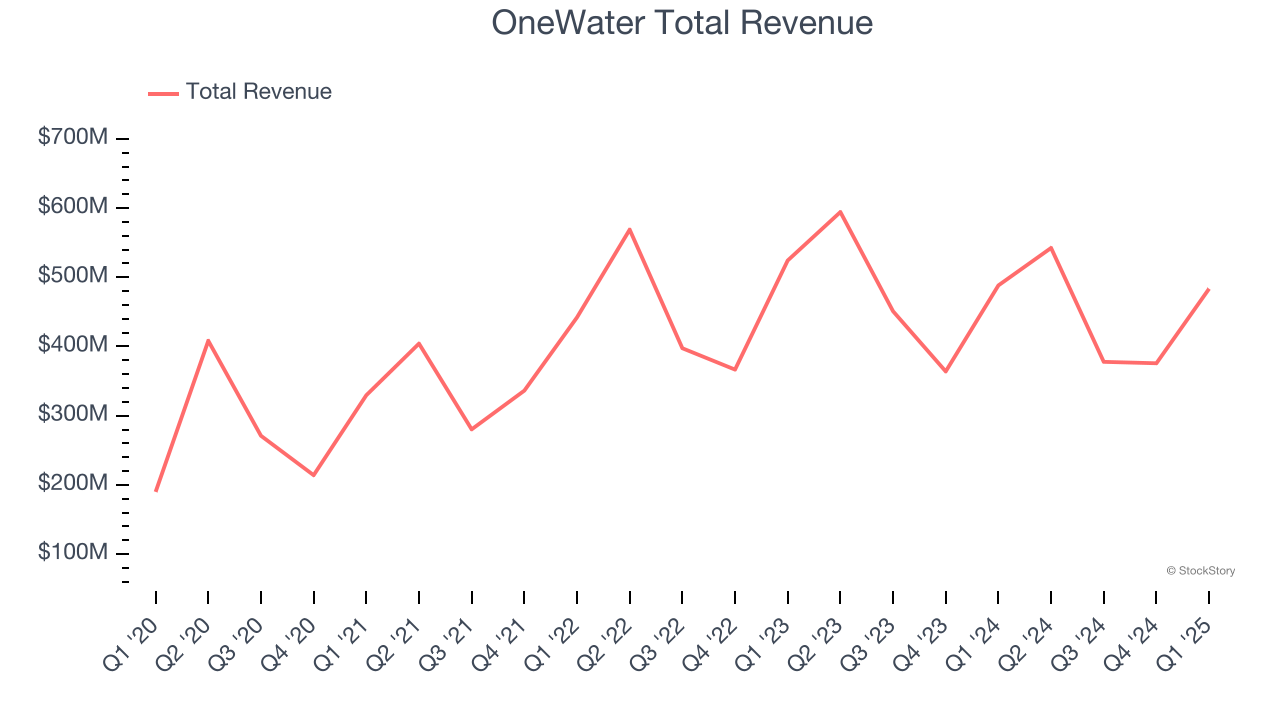

A public company since early 2020, OneWater Marine (NASDAQ: ONEW) sells boats, yachts, and other marine products.

OneWater reported revenues of $483.5 million, flat year on year. This print fell short of analysts’ expectations by 2.8%. Overall, it was a disappointing quarter for the company with full-year EBITDA guidance missing analysts’ expectations.

“Our teams executed well in a challenging environment. Same store sales decreased 2%, driven primarily by lower sales in the West Coast of Florida which is still recovering from Hurricanes Helene and Milton,” commented Austin Singleton, Chief Executive Officer at OneWater.

OneWater delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. The stock is down 7.7% since reporting and currently trades at $13.84.

Read our full report on OneWater here, it’s free.

Best Q1: America's Car-Mart (NASDAQ: CRMT)

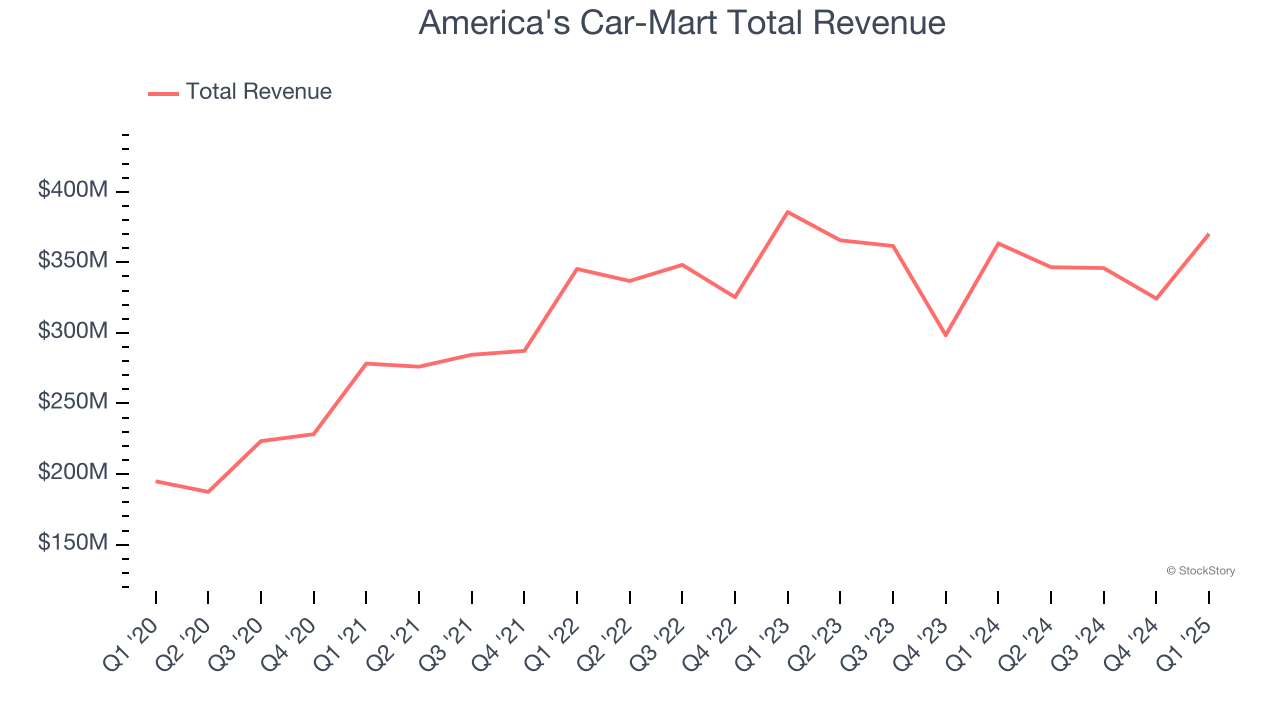

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ: CRMT) sells used cars to budget-conscious consumers.

America's Car-Mart reported revenues of $370.2 million, up 1.9% year on year, outperforming analysts’ expectations by 7.8%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems unhappy with the results as the stock is down 11% since reporting. It currently trades at $51.41.

Is now the time to buy America's Car-Mart? Access our full analysis of the earnings results here, it’s free.

Monro (NASDAQ: MNRO)

Started as a single location in Rochester, New York, Monro (NASDAQ: MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

Monro reported revenues of $295 million, down 4.9% year on year, exceeding analysts’ expectations by 1.3%. Still, it was a softer quarter as it posted a significant miss of analysts’ EBITDA and gross margin estimates.

Interestingly, the stock is up 11.9% since the results and currently trades at $14.28.

Read our full analysis of Monro’s results here.

Genuine Parts (NYSE: GPC)

Largely targeting the professional customer, Genuine Parts (NYSE: GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

Genuine Parts reported revenues of $5.87 billion, up 1.4% year on year. This result surpassed analysts’ expectations by 0.5%. Overall, it was a strong quarter as it also produced a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ gross margin estimates.

The stock is up 7.1% since reporting and currently trades at $119.77.

Read our full, actionable report on Genuine Parts here, it’s free.

MarineMax (NYSE: HZO)

Appropriately headquartered in Clearwater, Florida, MarineMax (NYSE: HZO) sells boats, yachts, and other marine products.

MarineMax reported revenues of $631.5 million, up 8.3% year on year. This number topped analysts’ expectations by 8.8%. It was a strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ EPS estimates.

MarineMax scored the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 31.2% since reporting and currently trades at $25.25.

Read our full, actionable report on MarineMax here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.