Q1 Rundown: Badger Meter (NYSE:BMI) Vs Other Inspection Instruments Stocks

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the inspection instruments stocks, including Badger Meter (NYSE: BMI) and its peers.

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

The 5 inspection instruments stocks we track reported a very strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was in line.

Luckily, inspection instruments stocks have performed well with share prices up 26.6% on average since the latest earnings results.

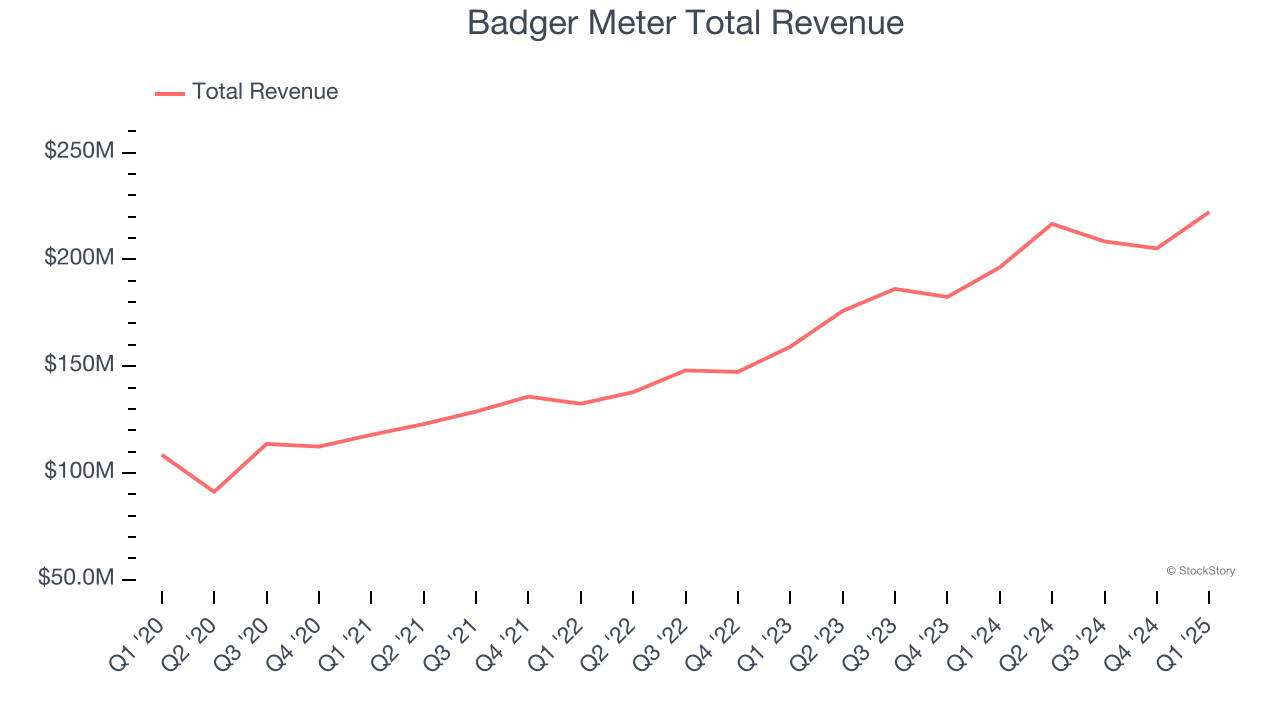

Badger Meter (NYSE: BMI)

The developer of the world’s first frost-proof water meter in 1905, Badger Meter (NYSE: BMI) provides water control and measure equipment to various industries.

Badger Meter reported revenues of $222.2 million, up 13.2% year on year. This print was in line with analysts’ expectations, and overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EBITDA estimates.

“Steady customer demand and disciplined operating execution drove solid revenue growth and record margins in a strong start to 2025. Our ability to build upon record results reflects the underlying stability of our business model as favorable industry fundamentals drive the need for our innovative smart water solutions,” said Kenneth C. Bockhorst, Chairman, President and Chief Executive Officer.

Badger Meter pulled off the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 29.2% since reporting and currently trades at $237.68.

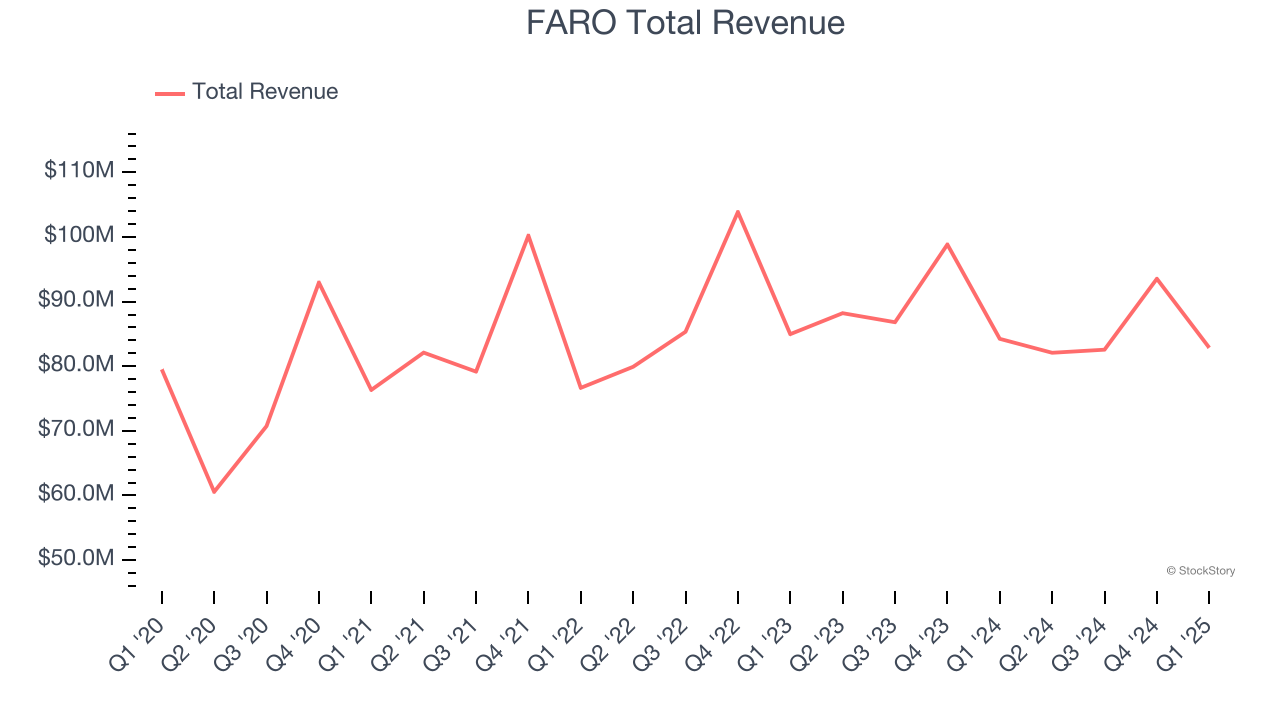

Best Q1: FARO (NASDAQ: FARO)

Launched by two PhD students in a garage, FARO (NASDAQ: FARO) provides 3D measurement and imaging systems for the manufacturing, construction, engineering, and public safety industries.

FARO reported revenues of $82.86 million, down 1.6% year on year, outperforming analysts’ expectations by 3.3%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EPS estimates.

FARO scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 66.3% since reporting. It currently trades at $43.89.

Is now the time to buy FARO? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Keysight (NYSE: KEYS)

Spun off from Hewlett-Packard in 2014, Keysight (NYSE: KEYS) offers electronic measurement products for use in various sectors.

Keysight reported revenues of $1.31 billion, up 7.4% year on year, exceeding analysts’ expectations by 1.8%. It was a satisfactory quarter as it also posted a decent beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

The stock is flat since the results and currently trades at $161.96.

Read our full analysis of Keysight’s results here.

Itron (NASDAQ: ITRI)

Founded by a small group of engineers who wanted to build a more efficient way to read utility meters, Itron (NASDAQ: ITRI) offers energy and water management products for the utility industry, municipalities, and industrial customers.

Itron reported revenues of $607.2 million, flat year on year. This result missed analysts’ expectations by 1.1%. More broadly, it was actually a strong quarter as it produced a solid beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EBITDA estimates.

Itron had the weakest performance against analyst estimates among its peers. The stock is up 22.6% since reporting and currently trades at $136.50.

Read our full, actionable report on Itron here, it’s free.

Teledyne (NYSE: TDY)

Playing a role in mapping the ocean floor as we know it today, Teledyne (NYSE: TDY) offers digital imaging and instrumentation products for various industries.

Teledyne reported revenues of $1.45 billion, up 7.4% year on year. This print topped analysts’ expectations by 1.5%. It was a strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 15.1% since reporting and currently trades at $530.50.

Read our full, actionable report on Teledyne here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.