Reinsurance Stocks Q1 Teardown: Reinsurance Group of America (NYSE:RGA) Vs The Rest

Let’s dig into the relative performance of Reinsurance Group of America (NYSE: RGA) and its peers as we unravel the now-completed Q1 reinsurance earnings season.

This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. The primary headwind remains the immense and concentrated exposure to large-scale catastrophe losses, as the growing impact of climate change challenges traditional risk models and creates significant earnings volatility. Additionally, they face the risk of adverse prior-year reserve development, where claims prove more costly than anticipated, while the eventual influx of new capital from alternative sources threatens to soften the market and compress future returns.

The 7 reinsurance stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 4.9%.

While some reinsurance stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.2% since the latest earnings results.

Reinsurance Group of America (NYSE: RGA)

Operating behind the scenes of the insurance industry since 1973, Reinsurance Group of America (NYSE: RGA) provides life and health reinsurance services to insurance companies, helping them manage risk and meet regulatory requirements.

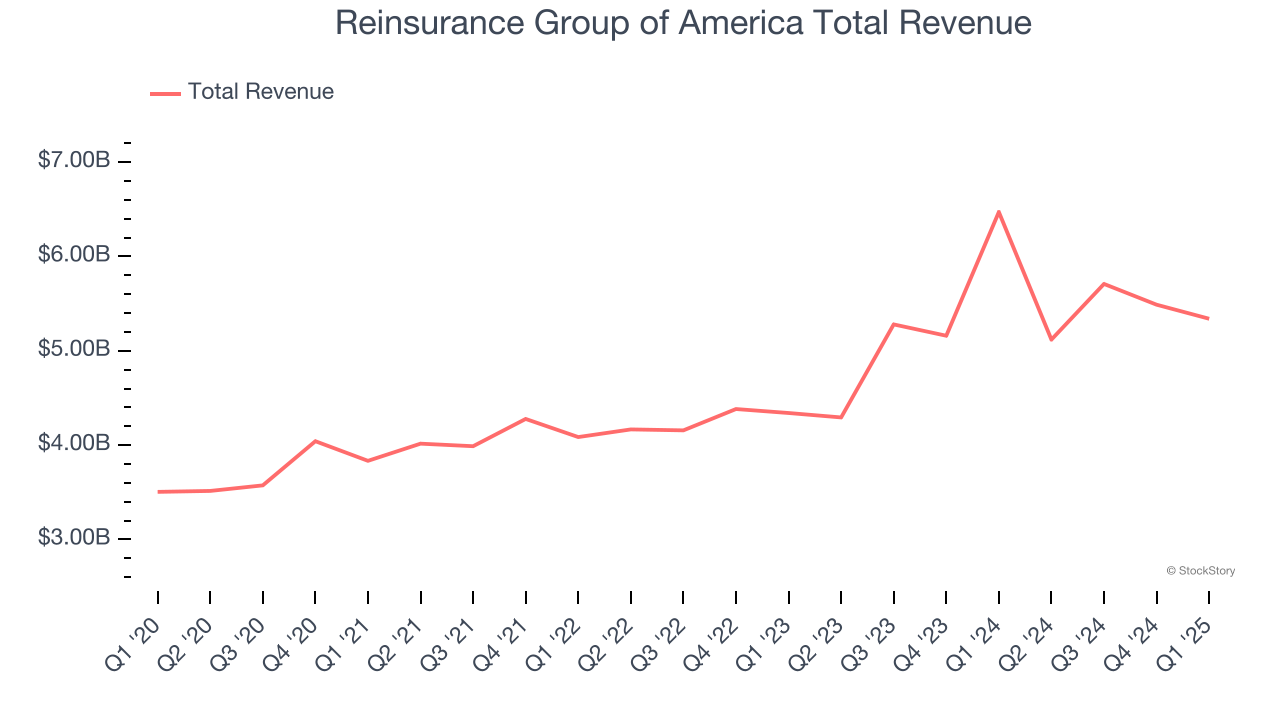

Reinsurance Group of America reported revenues of $5.34 billion, down 17.5% year on year. This print fell short of analysts’ expectations by 2.9%. Overall, it was a mixed quarter for the company with an impressive beat of analysts’ book value per share estimates but a significant miss of analysts’ net premiums earned estimates.

Reinsurance Group of America delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 2.5% since reporting and currently trades at $194.81.

Is now the time to buy Reinsurance Group of America? Access our full analysis of the earnings results here, it’s free.

Best Q1: Hamilton Insurance Group (NYSE: HG)

Founded in 2013 and operating through three distinct underwriting platforms across four countries, Hamilton Insurance Group (NYSE: HG) operates global specialty insurance and reinsurance platforms across Lloyd's, Ireland, Bermuda, and the United States.

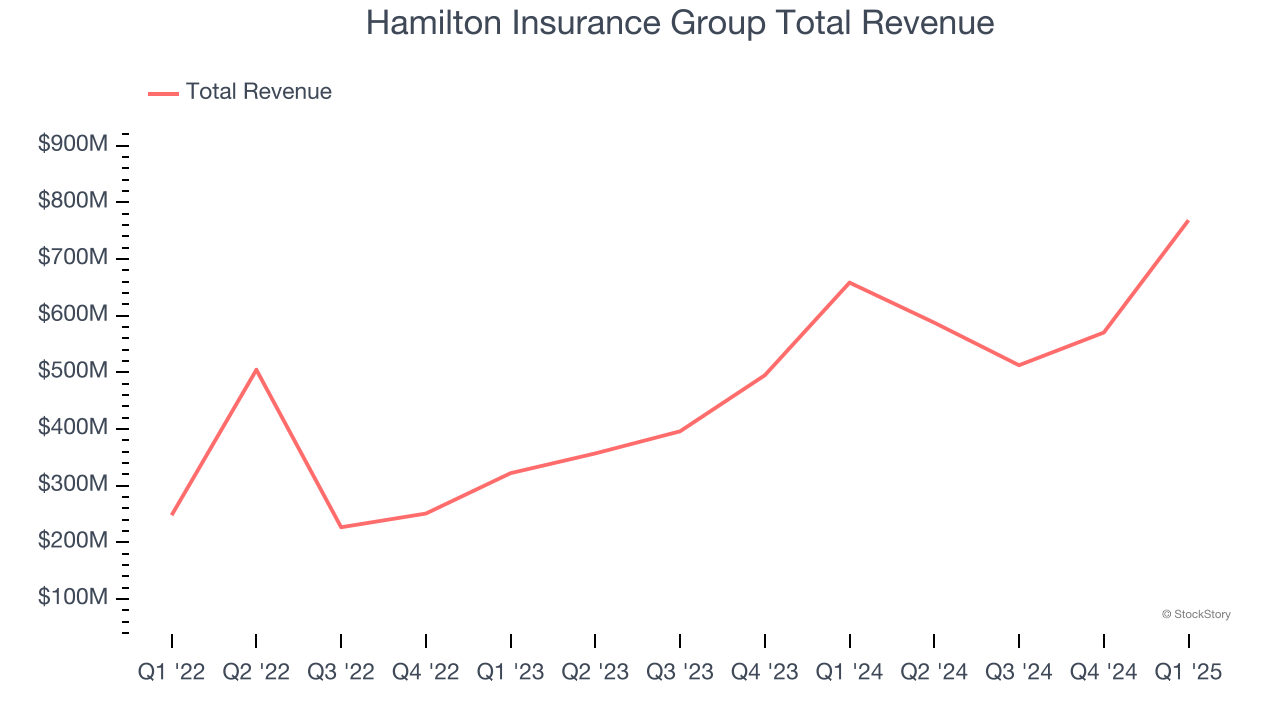

Hamilton Insurance Group reported revenues of $768.8 million, up 16.7% year on year, outperforming analysts’ expectations by 28.3%. The business had an exceptional quarter with a solid beat of analysts’ EPS and net premiums earned estimates.

Hamilton Insurance Group achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 10.1% since reporting. It currently trades at $21.12.

Is now the time to buy Hamilton Insurance Group? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Everest Group (NYSE: EG)

Rebranded from Everest Re in 2023 to reflect its evolution beyond just reinsurance, Everest Group (NYSE: EG) underwrites property and casualty reinsurance and insurance worldwide, serving insurance companies, corporations, and other clients across six continents.

Everest Group reported revenues of $4.26 billion, up 3.1% year on year, falling short of analysts’ expectations by 4.2%. It was a disappointing quarter as it posted a significant miss of analysts’ net premiums earned and EPS estimates.

As expected, the stock is down 3.4% since the results and currently trades at $333.07.

Read our full analysis of Everest Group’s results here.

RenaissanceRe (NYSE: RNR)

Born in Bermuda after the devastating Hurricane Andrew created a crisis in the catastrophe insurance market, RenaissanceRe (NYSE: RNR) provides property, casualty, and specialty reinsurance and insurance solutions to customers worldwide, primarily through intermediaries.

RenaissanceRe reported revenues of $3.47 billion, up 33.5% year on year. This number topped analysts’ expectations by 14.4%. Taking a step back, it was a mixed quarter as it also logged an impressive beat of analysts’ net premiums earned estimates but a significant miss of analysts’ EPS estimates.

RenaissanceRe achieved the fastest revenue growth among its peers. The stock is flat since reporting and currently trades at $235.96.

Read our full, actionable report on RenaissanceRe here, it’s free.

Fidelis Insurance (NYSE: FIHL)

Founded in Bermuda in 2014 and designed to adapt nimbly to evolving market conditions, Fidelis Insurance (NYSE: FIHL) is a global specialty insurer and reinsurer that provides customized coverage across property, specialty, and bespoke risk solutions.

Fidelis Insurance reported revenues of $658.4 million, up 26.6% year on year. This print beat analysts’ expectations by 5.5%. Overall, it was a strong quarter as it also produced a narrow beat of analysts’ book value per share estimates.

The stock is down 6.3% since reporting and currently trades at $15.98.

Read our full, actionable report on Fidelis Insurance here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.