Rocket Companies (NYSE:RKT) Delivers Impressive Q2, Stock Soars

Fintech mortgage provider Rocket Companies (NYSE: RKT) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 4.6% year on year to $1.36 billion. On top of that, next quarter’s revenue guidance ($1.68 billion at the midpoint) was surprisingly good and 6.9% above what analysts were expecting. Its non-GAAP profit of $0.04 per share was $0.01 above analysts’ consensus estimates.

Is now the time to buy Rocket Companies? Find out by accessing our full research report, it’s free.

Rocket Companies (RKT) Q2 CY2025 Highlights:

- Net Interest Income: $32.62 million vs analyst estimates of $33.37 million (2.2% miss)

- Revenue: $1.36 billion vs analyst estimates of $1.29 billion (4.6% year-on-year growth, 5.8% beat)

- Adjusted EPS: $0.04 vs analyst estimates of $0.03 ($0.01 beat)

- Revenue Guidance for Q3 CY2025 is $1.68 billion at the midpoint, above analyst estimates of $1.57 billion

- Market Capitalization: $30.84 billion

Company Overview

Born in Detroit during the 1980s and evolving into a tech-driven financial powerhouse, Rocket Companies (NYSE: RKT) is a fintech company that provides digital mortgage lending, real estate services, and personal finance solutions through its technology platform.

Sales Growth

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

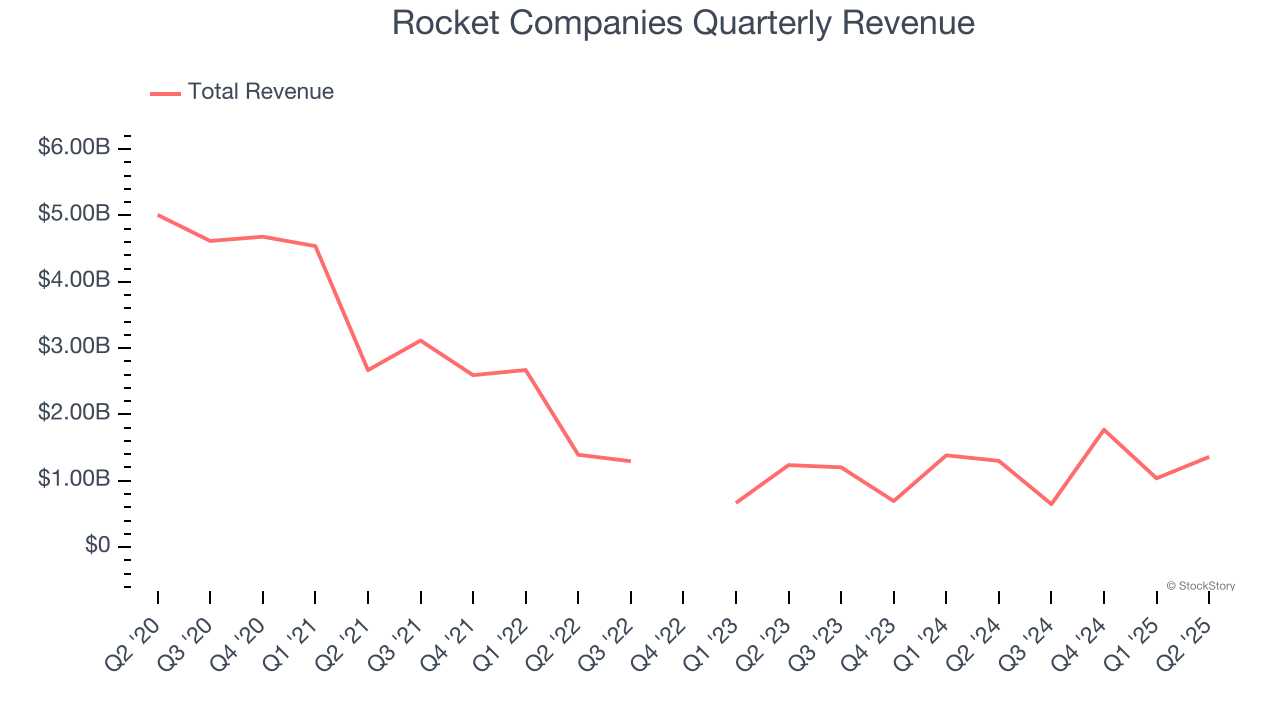

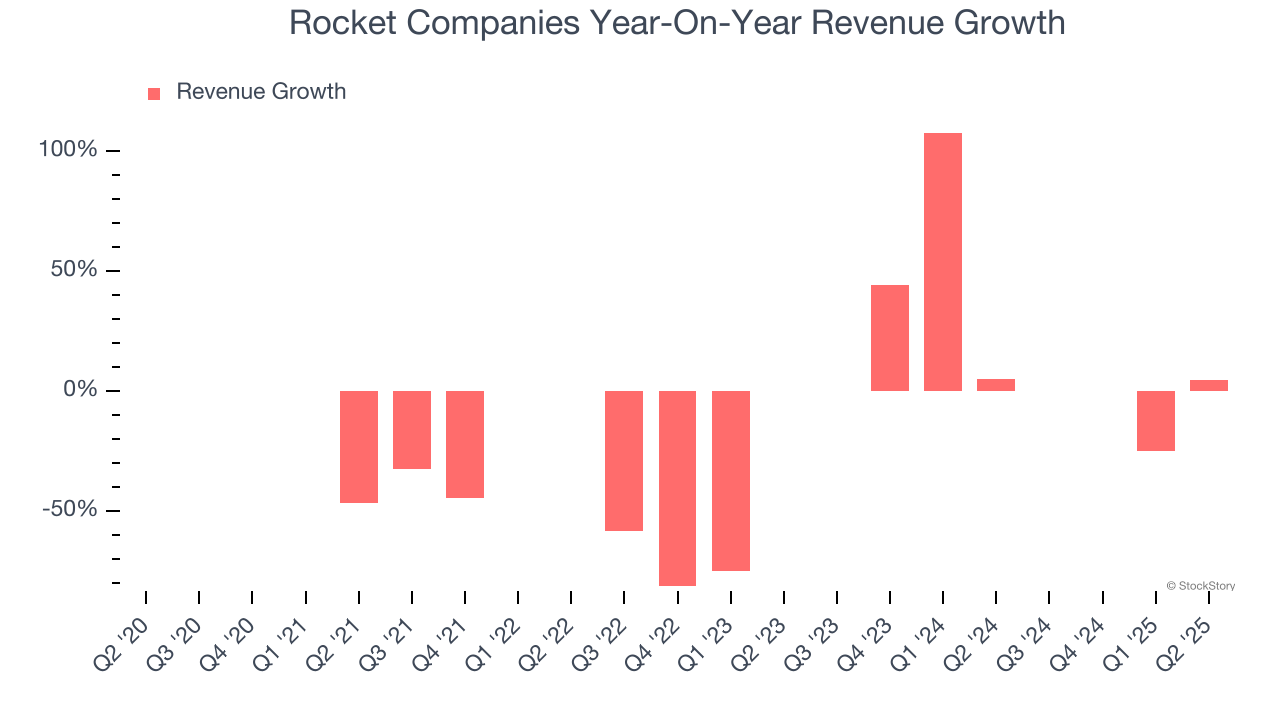

Rocket Companies’s demand was weak over the last five years as its revenue fell at a 13.4% annual rate. This wasn’t a great result, but there are still things to like about Rocket Companies.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Rocket Companies’s annualized revenue growth of 14.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Rocket Companies reported modest year-on-year revenue growth of 4.6% but beat Wall Street’s estimates by 5.8%. Company management is currently guiding for a 159% year-on-year increase in sales next quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Rocket Companies’s Q2 Results

We were impressed by how significantly Rocket Companies blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its net interest income missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 5.8% to $15.62 immediately following the results.

Indeed, Rocket Companies had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.