Reflecting On Telecommunication Services Stocks’ Q2 Earnings: Iridium (NASDAQ:IRDM)

Looking back on telecommunication services stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Iridium (NASDAQ: IRDM) and its peers.

The sector is a tale of two cities. Satellite telecommunication is generally buoyed by rising global demand for connectivity in costly-to-connect and remote areas. On the other hand, terrestrial telecommunication companies face an uphill battle, as they mostly sell into a deflationary market, where the price of moving a bit tends to decrease over time with better technology. Despite the differences in demand drivers, companies across the entire industry must contend competition from larger telecom conglomerates and hyperscalers expanding their own networks as well as newer entrants such as SpaceX's StarLink.

The 6 telecommunication services stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.6%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.9% since the latest earnings results.

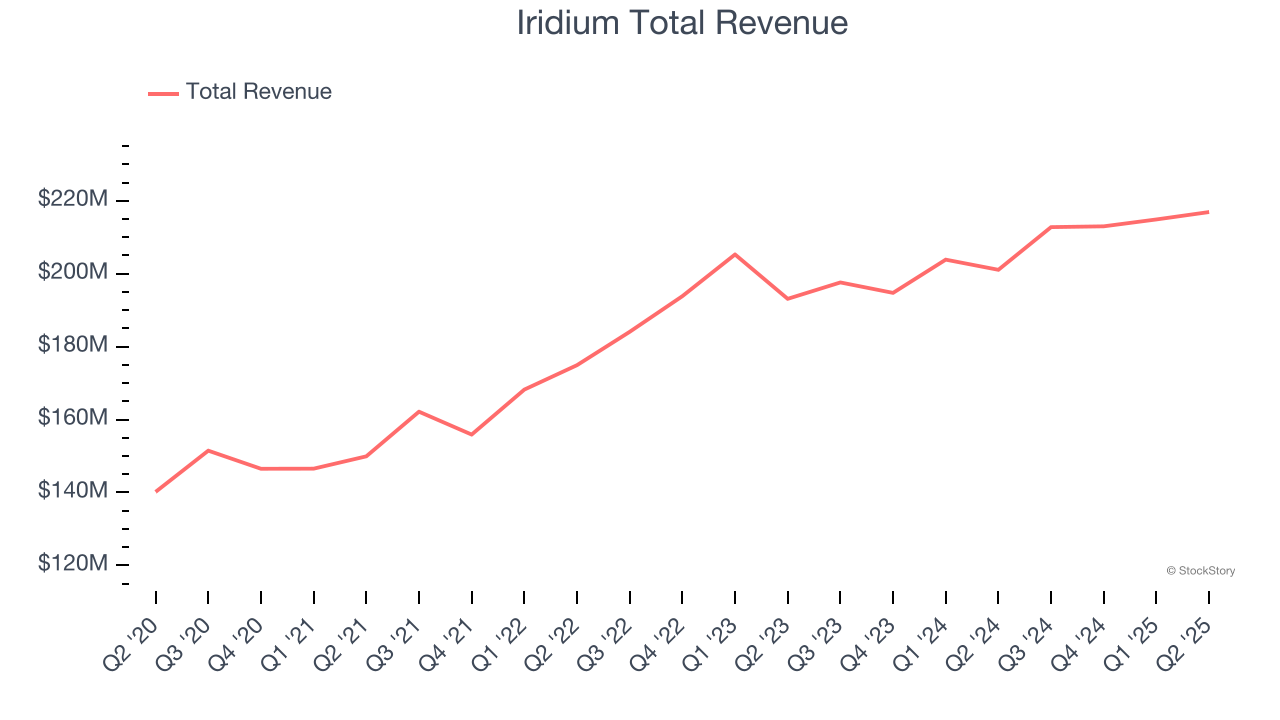

Iridium (NASDAQ: IRDM)

With a constellation of 66 low-earth orbit satellites providing coverage to every inch of the planet, Iridium Communications (NASDAQ: IRDM) operates a global satellite network that provides voice and data services to customers in remote areas where traditional telecommunications are unavailable.

Iridium reported revenues of $216.9 million, up 7.9% year on year. This print exceeded analysts’ expectations by 1.6%. Despite the top-line beat, it was still a softer quarter for the company with a significant miss of analysts’ EPS estimates.

"We're making great progress on our direct-to-device service with testing now underway and are also finding exciting, innovative applications for our new PNT service," said Matt Desch, CEO, Iridium.

Unsurprisingly, the stock is down 22.9% since reporting and currently trades at $25.01.

Is now the time to buy Iridium? Access our full analysis of the earnings results here, it’s free.

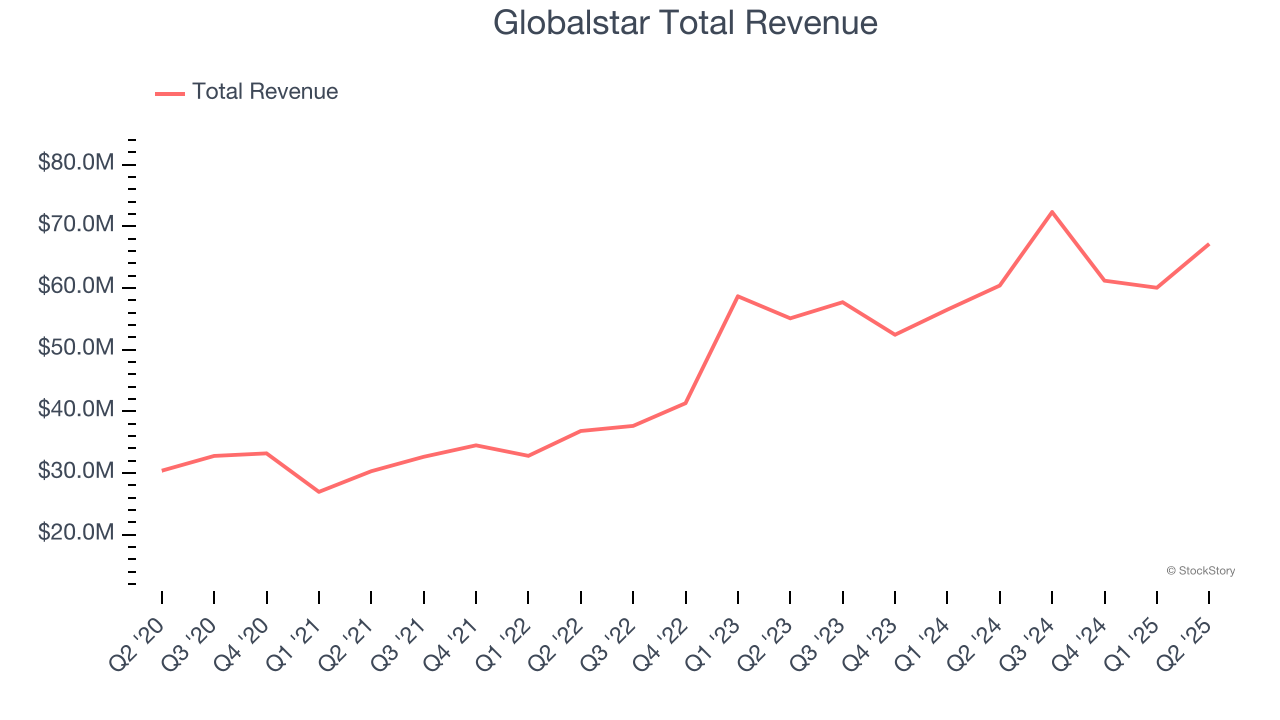

Best Q2: Globalstar (NASDAQ: GSAT)

Known for powering the emergency SOS feature in newer Apple iPhones, Globalstar (NASDAQ: GSAT) operates a network of low-earth orbit satellites that provide voice and data communications services in remote areas where traditional cellular networks don't reach.

Globalstar reported revenues of $67.15 million, up 11.2% year on year, outperforming analysts’ expectations by 6.4%. The business had an incredible quarter with a beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

Globalstar scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 5.6% since reporting. It currently trades at $26.60.

Is now the time to buy Globalstar? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Telephone and Data Systems (NYSE: TDS)

Operating primarily through its majority-owned subsidiary UScellular and wholly-owned TDS Telecom, Telephone and Data Systems (NYSE: TDS) provides wireless, broadband, video, and voice communications services to 4.6 million wireless and 1.2 million broadband customers across the United States.

Telephone and Data Systems reported revenues of $1.19 billion, down 4.2% year on year, exceeding analysts’ expectations by 1.5%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

The stock is flat since the results and currently trades at $38.50.

Read our full analysis of Telephone and Data Systems’s results here.

Lumen (NYSE: LUMN)

With approximately 350,000 route miles of fiber optic cable spanning North America and the Asia Pacific, Lumen Technologies (NYSE: LUMN) operates a vast fiber optic network that provides communications, cloud connectivity, security, and IT solutions to businesses and consumers.

Lumen reported revenues of $3.09 billion, down 5.4% year on year. This number lagged analysts' expectations by 0.7%. Taking a step back, it was still a very strong quarter as it recorded a beat of analysts’ EPS estimates.

The stock is up 1.9% since reporting and currently trades at $4.56.

Read our full, actionable report on Lumen here, it’s free.

Cogent (NASDAQ: CCOI)

Operating a massive network spanning 20,000 miles of fiber optic cable and connecting to over 3,200 buildings worldwide, Cogent Communications (NASDAQ: CCOI) provides high-speed Internet access, private network services, and data center colocation to businesses and bandwidth-intensive organizations across 54 countries.

Cogent reported revenues of $246.2 million, down 5.5% year on year. This result came in 0.7% below analysts' expectations. Zooming out, it was actually a very strong quarter as it logged a beat of analysts’ EPS estimates.

Cogent had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 22.8% since reporting and currently trades at $33.88.

Read our full, actionable report on Cogent here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.