Okta (NASDAQ:OKTA) Beats Q2 Sales Expectations, Quarterly Revenue Guidance Slightly Exceeds Expectations

Identity management company Okta (NASDAQ: OKTA) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 12.7% year on year to $728 million. Guidance for next quarter’s revenue was better than expected at $729 million at the midpoint, 0.9% above analysts’ estimates. Its non-GAAP profit of $0.91 per share was 7.6% above analysts’ consensus estimates.

Is now the time to buy Okta? Find out by accessing our full research report, it’s free.

Okta (OKTA) Q2 CY2025 Highlights:

- Revenue: $728 million vs analyst estimates of $711.6 million (12.7% year-on-year growth, 2.3% beat)

- Adjusted EPS: $0.91 vs analyst estimates of $0.85 (7.6% beat)

- Adjusted Operating Income: $202 million vs analyst estimates of $184.1 million (27.7% margin, 9.7% beat)

- The company slightly lifted its revenue guidance for the full year to $2.88 billion at the midpoint from $2.86 billion

- Management raised its full-year Adjusted EPS guidance to $3.36 at the midpoint, a 3.1% increase

- Operating Margin: 5.6%, up from -2.9% in the same quarter last year

- Free Cash Flow Margin: 22.3%, down from 34.6% in the previous quarter

- Market Capitalization: $15.99 billion

“Okta’s unified identity platform is winning customers ranging from the world’s largest global organizations to massive government agencies,” said Todd McKinnon, Chief Executive Officer and co-founder of Okta.

Company Overview

Named after the meteorological measurement for cloud cover, Okta (NASDAQ: OKTA) provides cloud-based identity management solutions that help organizations securely connect their employees, partners, and customers to the right applications and services.

Revenue Growth

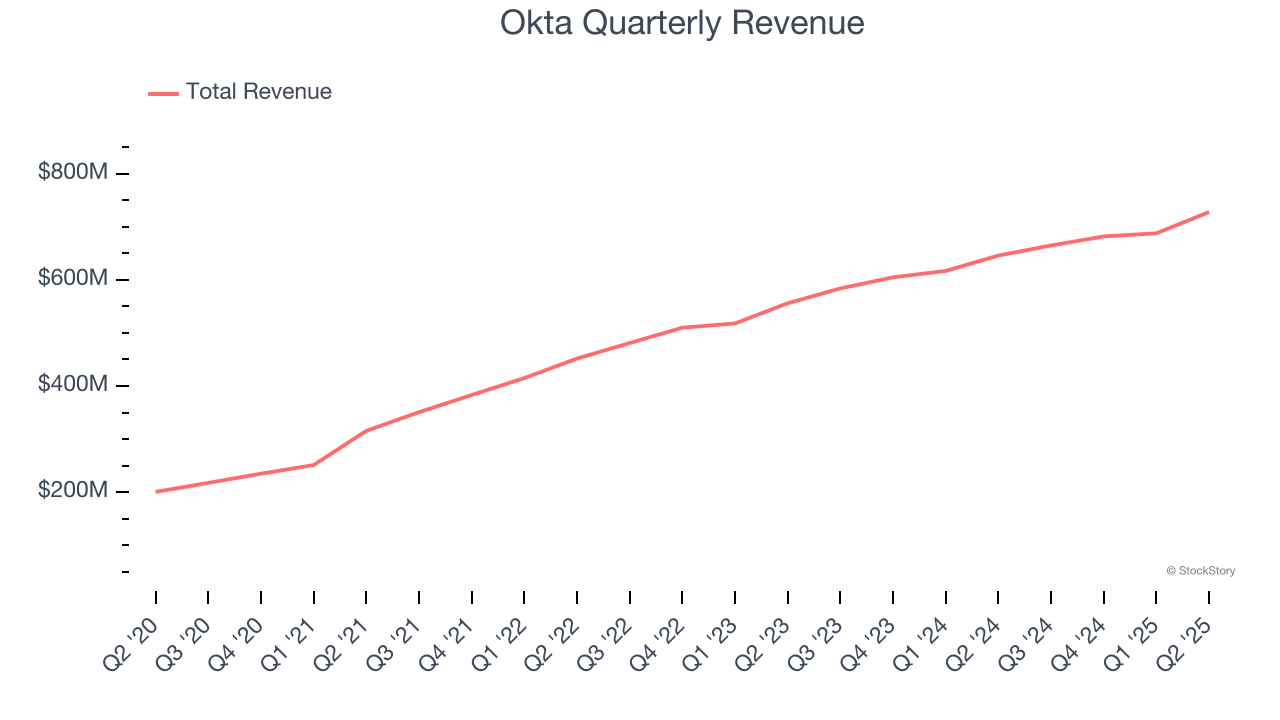

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Okta grew its sales at a 20% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Okta reported year-on-year revenue growth of 12.7%, and its $728 million of revenue exceeded Wall Street’s estimates by 2.3%. Company management is currently guiding for a 9.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.2% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Customer Acquisition Efficiency

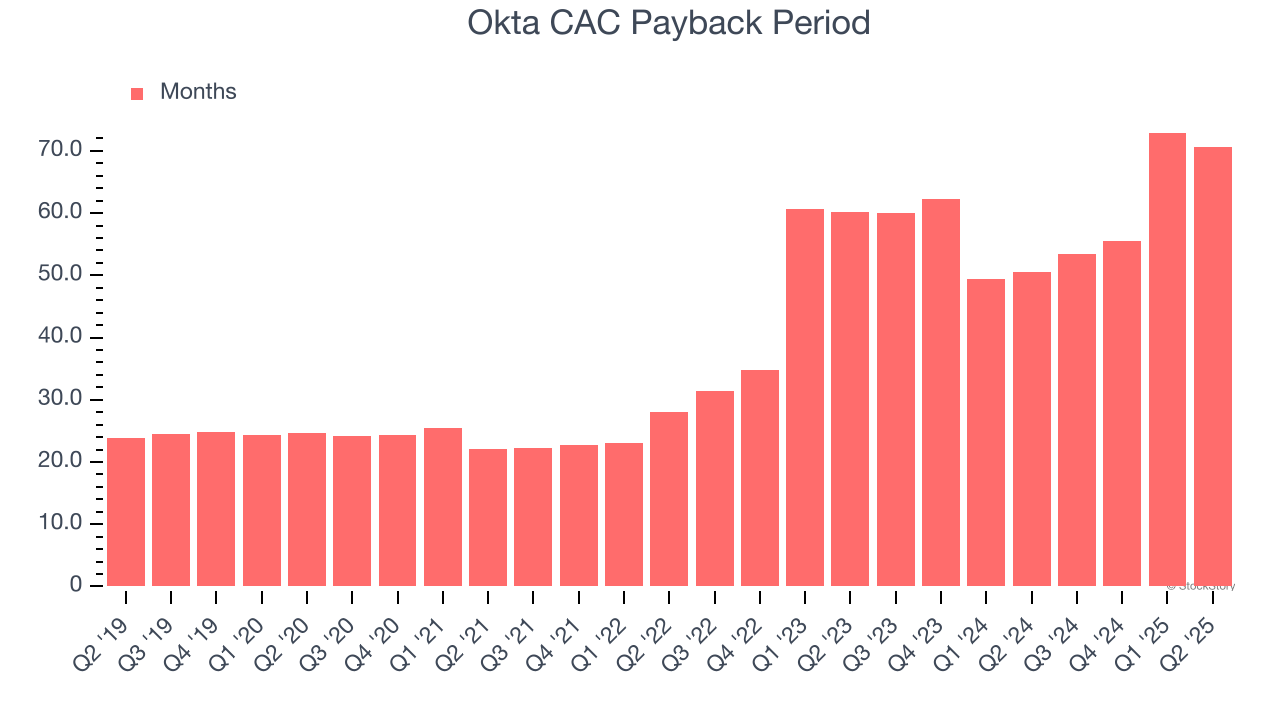

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Okta to acquire new customers as its CAC payback period checked in at 70.7 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from Okta’s Q2 Results

It was great to see Okta’s full-year EPS guidance top analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 2% to $93.48 immediately after reporting.

So do we think Okta is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.