Winners And Losers Of Q2: Sallie Mae (NASDAQ:SLM) Vs The Rest Of The Consumer Finance Stocks

As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer finance industry, including Sallie Mae (NASDAQ: SLM) and its peers.

Consumer finance companies provide loans and credit products to individuals. Growth drivers include increasing consumer spending, financial inclusion initiatives in developing markets, and digital lending platforms reducing distribution costs. Challenges include credit risk during economic downturns, regulatory scrutiny of lending practices, and intensifying competition from traditional banks and fintech firms offering innovative credit solutions.

The 18 consumer finance stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.5%.

In light of this news, share prices of the companies have held steady as they are up 2.8% on average since the latest earnings results.

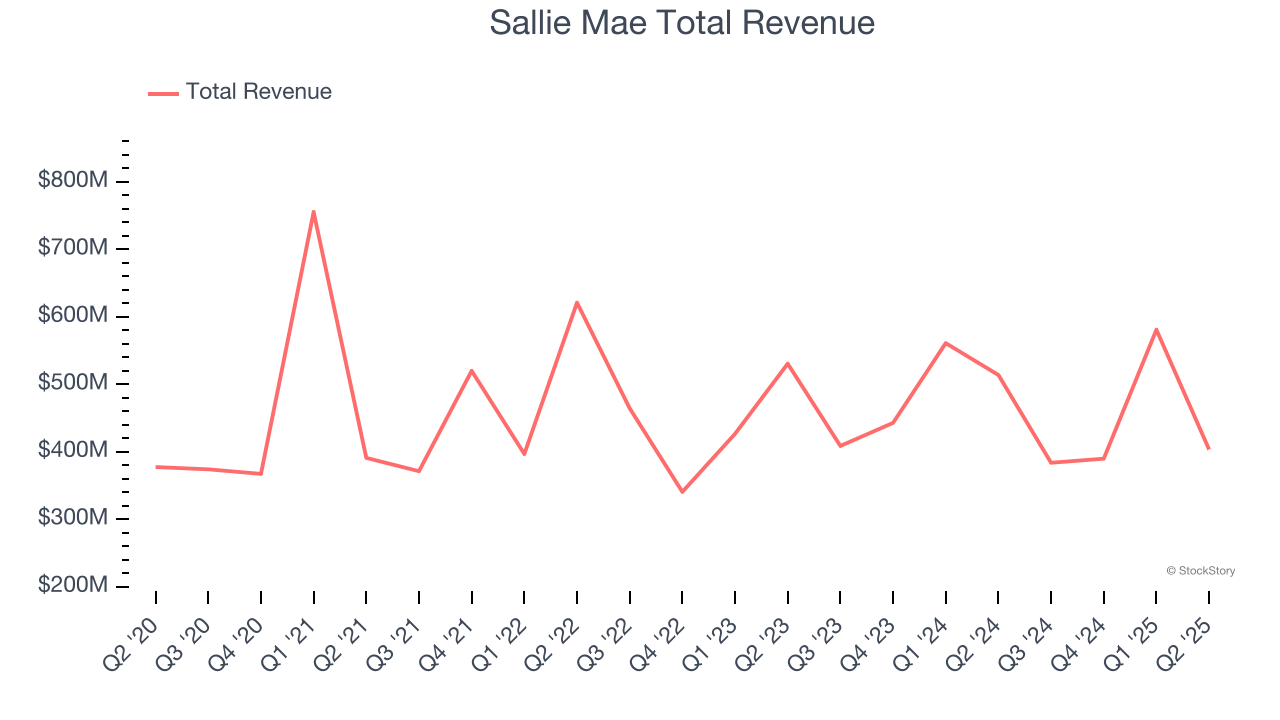

Slowest Q2: Sallie Mae (NASDAQ: SLM)

Originally created as a government-sponsored enterprise before privatizing in 2004, Sallie Mae (NASDAQ: SLM) is a financial services company that provides private education loans, savings products, and educational resources to help students and families pay for college.

Sallie Mae reported revenues of $403.6 million, down 21.5% year on year. This print was in line with analysts’ expectations, but overall, it was a softer quarter for the company with a significant miss of analysts’ EPS estimates.

Sallie Mae delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 3.3% since reporting and currently trades at $30.94.

Read our full report on Sallie Mae here, it’s free.

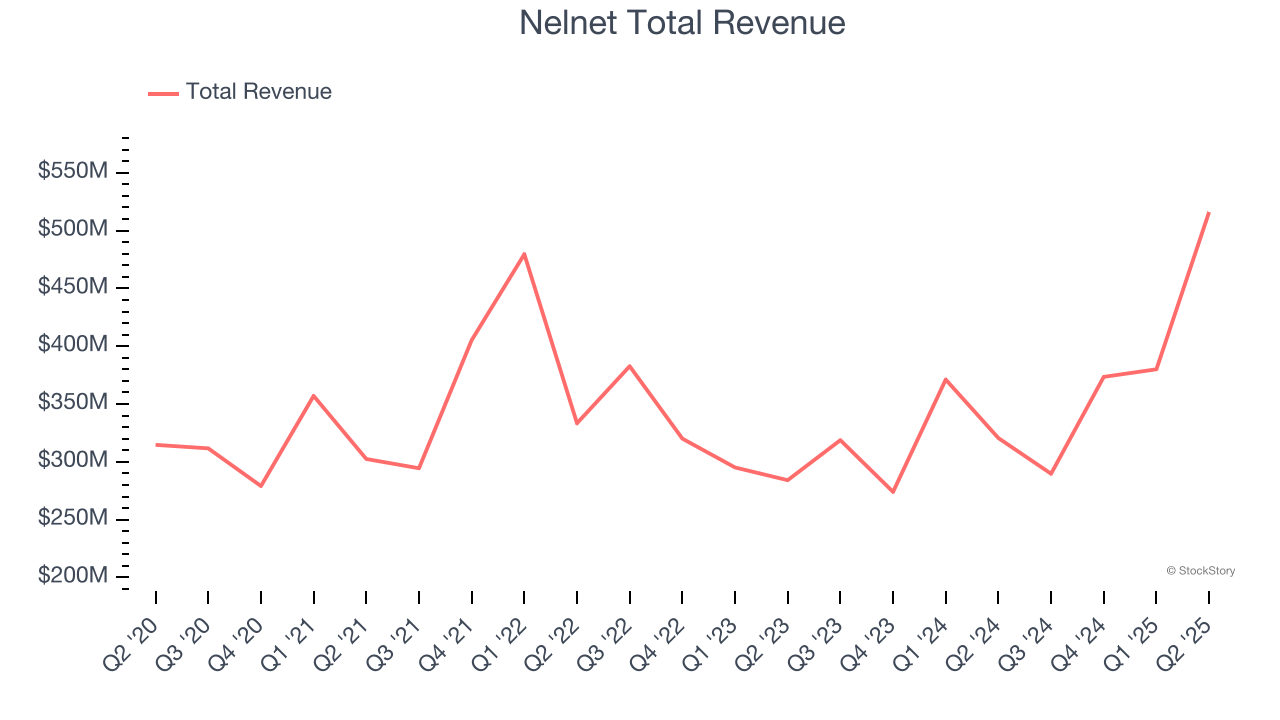

Best Q2: Nelnet (NYSE: NNI)

Starting as a student loan servicer in the 1970s and evolving through the changing landscape of education finance, Nelnet (NYSE: NNI) provides student loan servicing, education technology, payment processing, and banking services while managing a portfolio of education loans.

Nelnet reported revenues of $516.1 million, up 61% year on year, outperforming analysts’ expectations by 36.2%. The business had an incredible quarter with a beat of analysts’ EPS estimates.

Nelnet pulled off the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 2.5% since reporting. It currently trades at $129.10.

Is now the time to buy Nelnet? Access our full analysis of the earnings results here, it’s free.

Credit Acceptance (NASDAQ: CACC)

Founded in 1972 by Donald Foss to serve customers overlooked by traditional lenders, Credit Acceptance (NASDAQ: CACC) provides auto financing solutions that enable car dealers to sell vehicles to consumers with limited or impaired credit histories.

Credit Acceptance reported revenues of $583.8 million, up 48.5% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 4.7% since the results and currently trades at $512.33.

Read our full analysis of Credit Acceptance’s results here.

American Express (NYSE: AXP)

Recognizable by its iconic green logo and the slogan "Don't leave home without it," American Express (NYSE: AXP) is a global payments company that issues credit and charge cards, processes merchant transactions, and offers travel and lifestyle benefits to consumers and businesses.

American Express reported revenues of $13.24 billion, up 9.4% year on year. This result was in line with analysts’ expectations. It was a satisfactory quarter as it also logged .

The stock is flat since reporting and currently trades at $316.10.

Read our full, actionable report on American Express here, it’s free.

Bread Financial (NYSE: BFH)

Formerly known as Alliance Data Systems until its 2022 rebranding, Bread Financial (NYSE: BFH) provides credit cards, installment loans, and savings products to consumers while powering branded payment solutions for retailers and merchants.

Bread Financial reported revenues of $929 million, down 1.1% year on year. This print lagged analysts' expectations by 0.6%. Taking a step back, it was still a very strong quarter as it logged a beat of analysts’ EPS estimates.

The stock is down 2.1% since reporting and currently trades at $62.85.

Read our full, actionable report on Bread Financial here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.