Specialty Finance Stocks Q1 Teardown: DigitalBridge (NYSE:DBRG) Vs The Rest

Looking back on specialty finance stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including DigitalBridge (NYSE: DBRG) and its peers.

Specialty finance companies provide targeted lending or financial services for specific industries or needs. They benefit from expertise in particular sectors, often reduced competition in specialized niches, and tailored underwriting that can yield higher margins. Challenges include concentration risk in specific industries, difficulty achieving scale efficiencies, and potential vulnerability during sector-specific downturns affecting their specialized markets.

The 13 specialty finance stocks we track reported a mixed Q1. As a group, revenues were in line with analysts’ consensus estimates.

Thankfully, share prices of the companies have been resilient as they are up 7.4% on average since the latest earnings results.

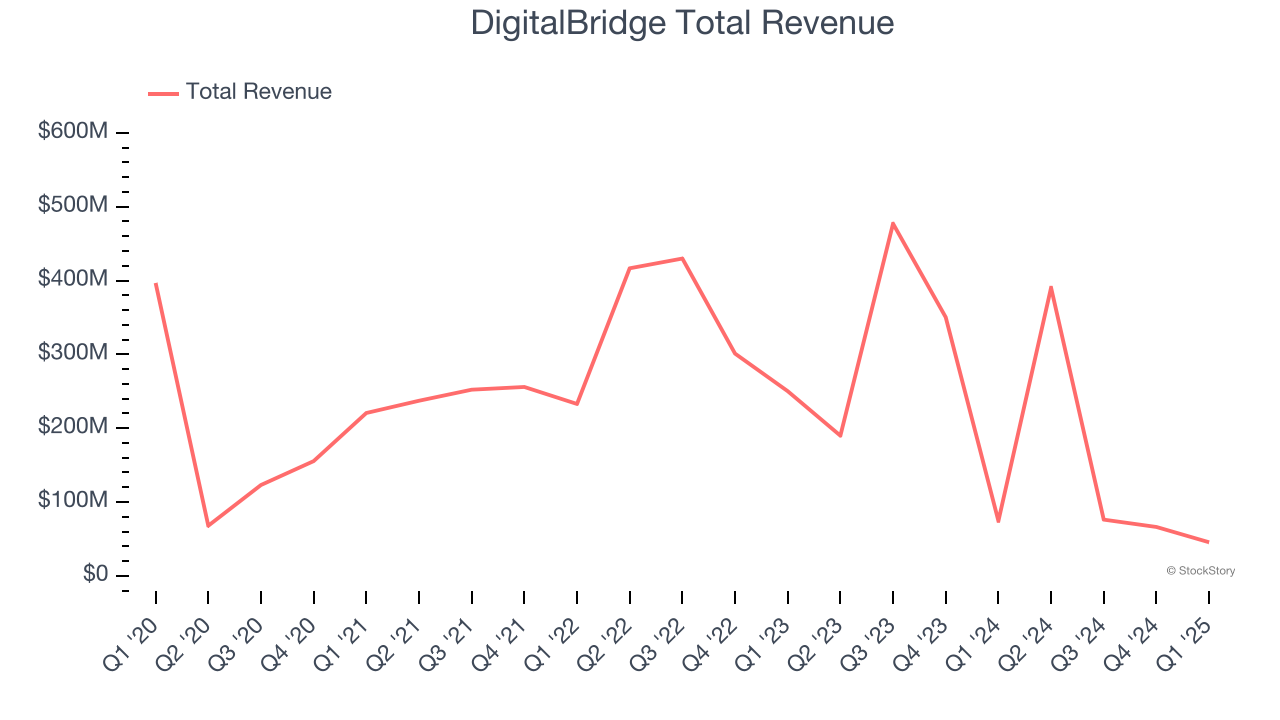

DigitalBridge (NYSE: DBRG)

Transforming from a traditional real estate investor to a digital-focused powerhouse in 2021, DigitalBridge Group (NYSE: DBRG) is a global digital infrastructure investment firm that manages capital and operates assets across data centers, cell towers, fiber networks, and edge infrastructure.

DigitalBridge reported revenues of $45.45 million, down 38.9% year on year. This print fell short of analysts’ expectations by 42.8%. Overall, it was a disappointing quarter for the company with EPS in line with analysts’ estimates.

DigitalBridge delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Interestingly, the stock is up 34.3% since reporting and currently trades at $11.26.

Read our full report on DigitalBridge here, it’s free.

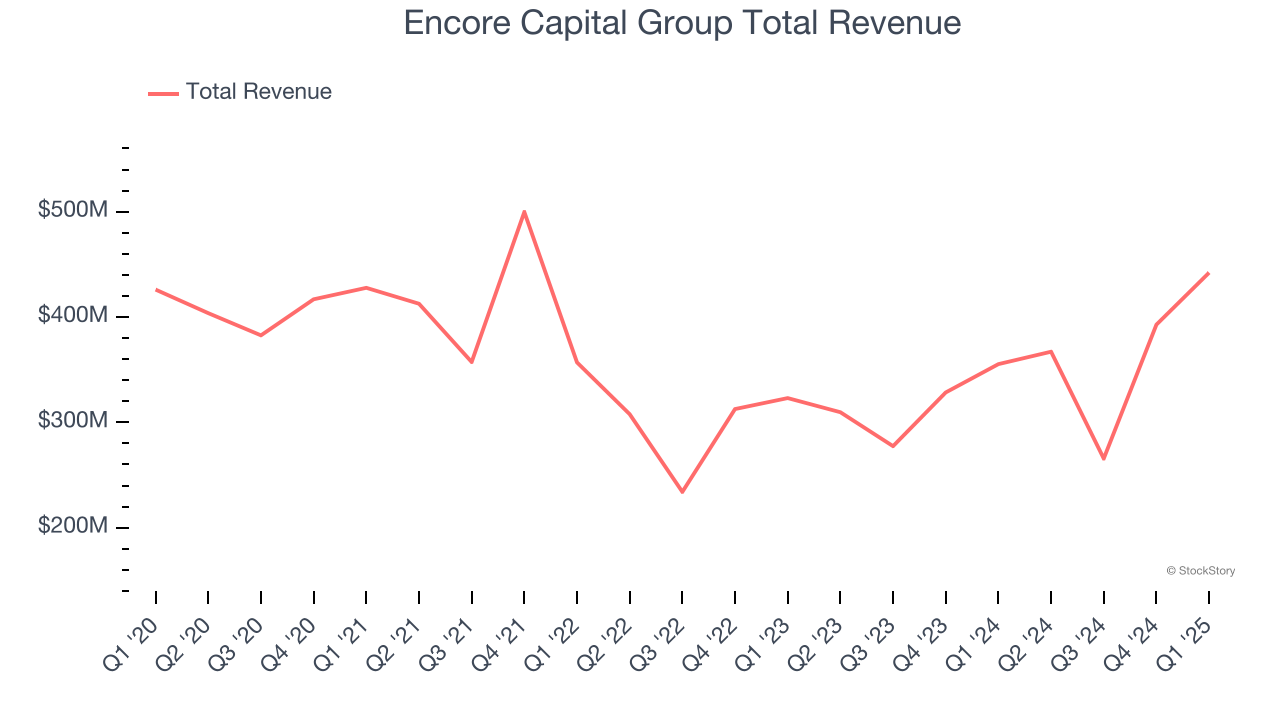

Best Q1: Encore Capital Group (NASDAQ: ECPG)

Operating in the often misunderstood world of debt collection since 1999, Encore Capital Group (NASDAQ: ECPG) purchases portfolios of defaulted consumer debt at deep discounts and works with individuals to recover these obligations while helping them toward financial recovery.

Encore Capital Group reported revenues of $442.1 million, up 24.4% year on year, outperforming analysts’ expectations by 15.3%. The business had an incredible quarter with a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 10.4% since reporting. It currently trades at $41.32.

Is now the time to buy Encore Capital Group? Access our full analysis of the earnings results here, it’s free.

Oxford Lane Capital (NASDAQ: OXLC)

Offering monthly dividend payments to income-focused investors, Oxford Lane Capital (NASDAQ: OXLC) is a closed-end management investment company that primarily invests in collateralized loan obligation (CLO) equity and debt securities.

Oxford Lane Capital reported revenues of $117.8 million, up 45.6% year on year, falling short of analysts’ expectations by 10.7%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 6.7% since the results and currently trades at $3.71.

Read our full analysis of Oxford Lane Capital’s results here.

New Mountain Finance (NASDAQ: NMFC)

Operating as a financial bridge for growing businesses that might be overlooked by traditional banks, New Mountain Finance (NASDAQ: NMFC) is a business development company that provides loans and debt financing to middle-market companies in defensive growth industries.

New Mountain Finance reported revenues of $83.49 million, down 11.7% year on year. This print missed analysts’ expectations by 1.6%. Overall, it was a slower quarter for the company.

The stock is up 1.2% since reporting and currently trades at $10.42.

Read our full, actionable report on New Mountain Finance here, it’s free.

HA Sustainable Infrastructure Capital (NYSE: HASI)

With a proprietary "CarbonCount" metric that quantifies the environmental impact of each dollar invested, HA Sustainable Infrastructure Capital (NYSE: HASI) is an investment firm that finances and develops climate-positive infrastructure projects across renewable energy, energy efficiency, and ecological restoration.

HA Sustainable Infrastructure Capital reported revenues of $103.6 million, up 4.2% year on year. This number beat analysts’ expectations by 32.1%. All in all, it was a strong quarter for the company.

HA Sustainable Infrastructure Capital pulled off the biggest analyst estimates beat among its peers. The stock is up 15.1% since reporting and currently trades at $28.08.

Read our full, actionable report on HA Sustainable Infrastructure Capital here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.