Environmental and Facilities Services Stocks Q2 Results: Benchmarking Veralto (NYSE:VLTO)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Veralto (NYSE: VLTO) and the best and worst performers in the environmental and facilities services industry.

Many environmental and facility services are non-discretionary (sports stadiums need to be cleaned after events), recurring, and performed through longer-term contracts. This makes for more predictable and stickier revenue streams. Additionally, there has been an increasing focus on emissions and water conservation over the last decade, driving innovation in the sector and demand for new services. Despite these tailwinds, environmental and facility services companies are still at the whim of economic cycles. Interest rates, for example, can greatly impact commercial construction projects that drive incremental demand for these services.

The 13 environmental and facilities services stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 1.4% on average since the latest earnings results.

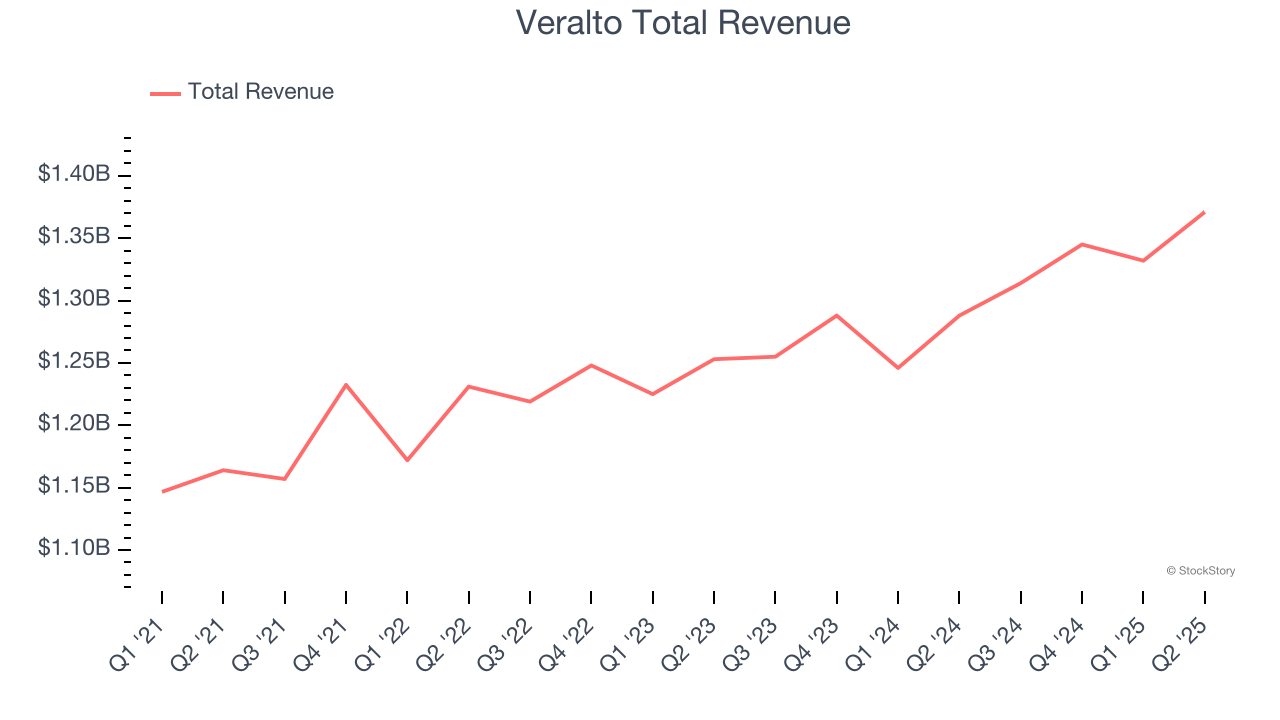

Veralto (NYSE: VLTO)

Spun off from Danaher in 2023, Veralto (NYSE: VLTO) provides water analytics and treatment solutions.

Veralto reported revenues of $1.37 billion, up 6.4% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ adjusted operating income estimates and a decent beat of analysts’ EBITDA estimates.

"We delivered a strong second quarter led by outstanding commercial execution and steady, broad-based customer demand. Our rigorous application of the Veralto Enterprise System continued to support global growth and operating discipline, while also helping mitigate impacts from changes in global trade policies," said Jennifer L. Honeycutt, President and Chief Executive Officer.

Interestingly, the stock is up 5.8% since reporting and currently trades at $109.10.

Is now the time to buy Veralto? Access our full analysis of the earnings results here, it’s free.

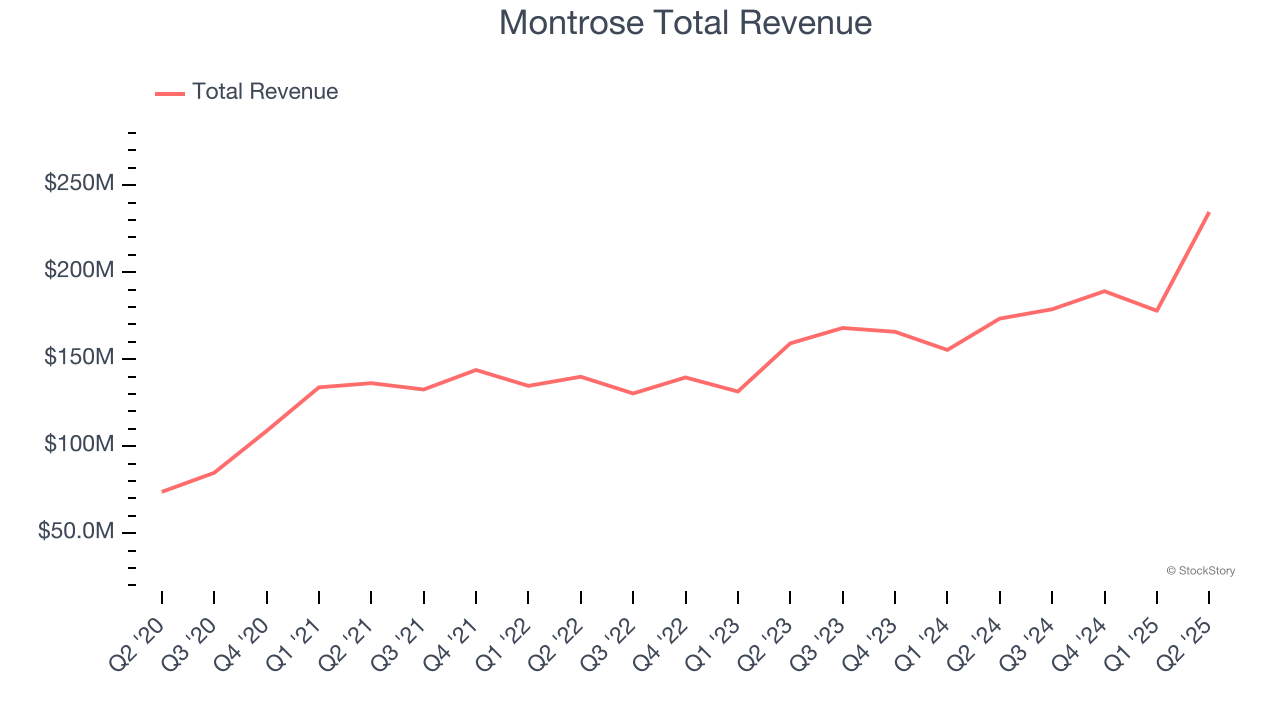

Best Q2: Montrose (NYSE: MEG)

Founded to protect a tree-lined two-lane road, Montrose (NYSE: MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

Montrose reported revenues of $234.5 million, up 35.3% year on year, outperforming analysts’ expectations by 24.4%. The business had an incredible quarter with a solid beat of analysts’ organic revenue and EPS estimates.

Montrose achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 34.5% since reporting. It currently trades at $30.41.

Is now the time to buy Montrose? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Enviri (NYSE: NVRI)

Cooling America’s first indoor ice rink in the 19th century, Enviri (NYSE: NVRI) offers steel and waste handling services.

Enviri reported revenues of $562.3 million, down 7.8% year on year, falling short of analysts’ expectations by 2.5%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and a significant miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 41.2% since the results and currently trades at $12.24.

Read our full analysis of Enviri’s results here.

Aris Water (NYSE: ARIS)

Primarily serving the oil and gas industry, Aris Water (NYSE: ARIS) is a provider of water handling and recycling solutions.

Aris Water reported revenues of $124.1 million, up 22.7% year on year. This print beat analysts’ expectations by 3.1%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ sales volume estimates.

The stock is up 3.3% since reporting and currently trades at $24.08.

Read our full, actionable report on Aris Water here, it’s free.

Waste Connections (NYSE: WCN)

Operating a network of municipal solid waste landfills in the U.S. and Canada, Waste Connections (NYSE: WCN) is North America's third-largest waste management company providing collection, disposal, and recycling services.

Waste Connections reported revenues of $2.41 billion, up 7.1% year on year. This result topped analysts’ expectations by 0.7%. Overall, it was a satisfactory quarter as it also put up a solid beat of analysts’ adjusted operating income estimates.

The stock is down 3.4% since reporting and currently trades at $178.14.

Read our full, actionable report on Waste Connections here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.