Q2 Earnings Outperformers: EVERTEC (NYSE:EVTC) And The Rest Of The Financial Services Stocks

As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the financial services industry, including EVERTEC (NYSE: EVTC) and its peers.

Financial services firms provide various products supporting financial transactions and management. Growth drivers include increasing financial complexity requiring professional guidance, digital transformation reducing service costs, and expanding middle classes globally seeking financial products. Headwinds include fee compression from transparent pricing, regulatory compliance burdens, and competition from automated digital solutions.

The 24 financial services stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2.6%.

In light of this news, share prices of the companies have held steady as they are up 1.8% on average since the latest earnings results.

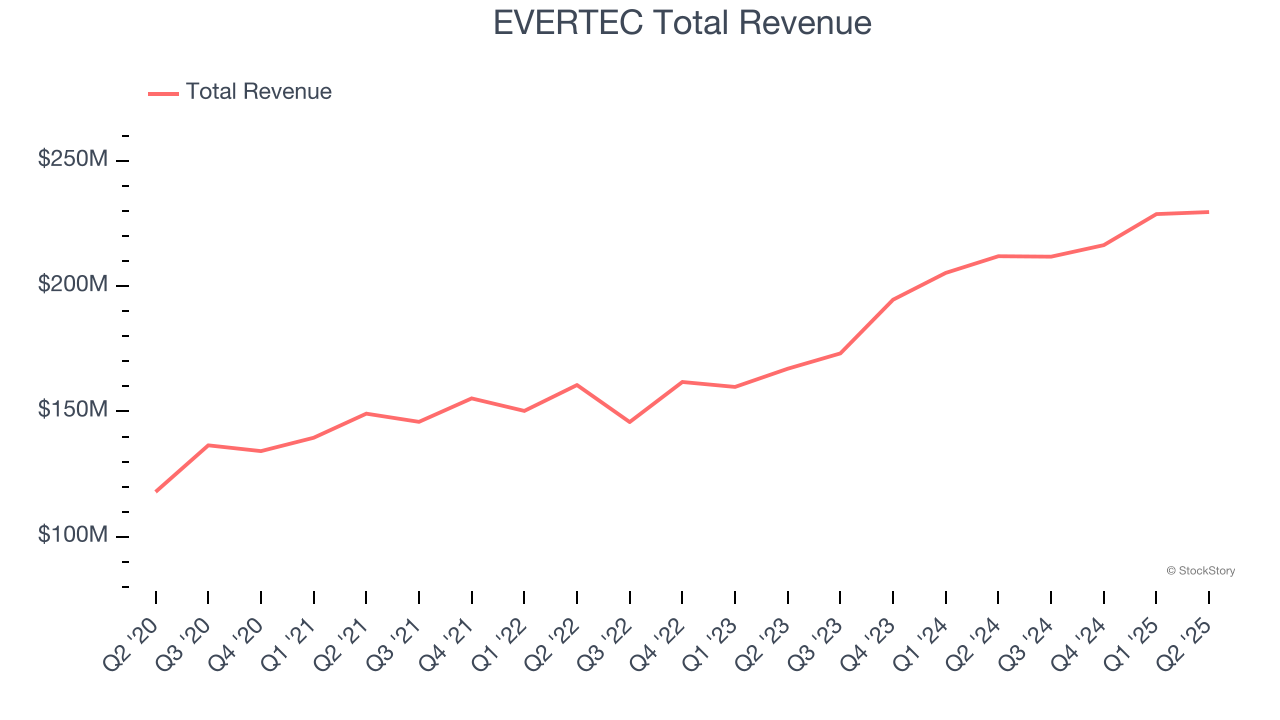

EVERTEC (NYSE: EVTC)

Operating one of Latin America's leading PIN debit networks called ATH, EVERTEC (NYSE: EVTC) is a payment transaction processor and financial technology provider that enables merchants and financial institutions across Latin America and the Caribbean to accept and process electronic payments.

EVERTEC reported revenues of $229.6 million, up 8.3% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a strong quarter for the company with a decent beat of analysts’ EBITDA and EPS estimates.

Interestingly, the stock is up 1.1% since reporting and currently trades at $33.11.

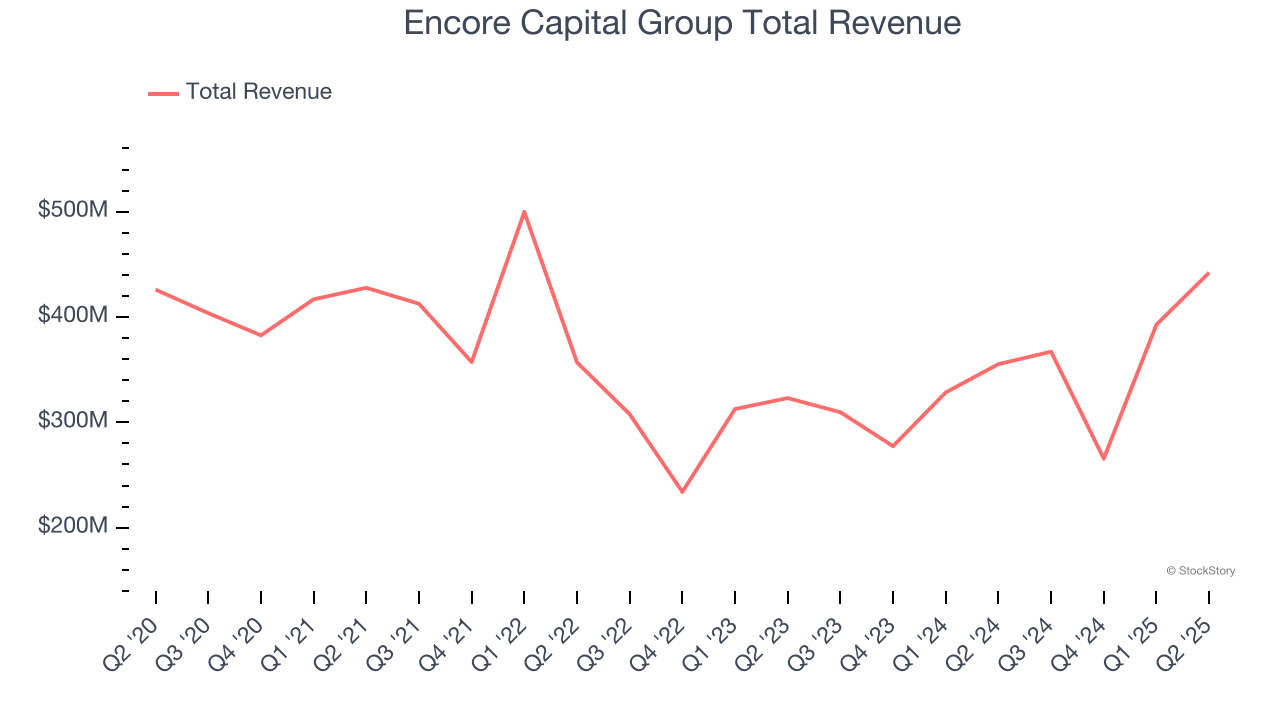

Best Q2: Encore Capital Group (NASDAQ: ECPG)

Operating in the often misunderstood world of debt collection since 1999, Encore Capital Group (NASDAQ: ECPG) purchases portfolios of defaulted consumer debt at deep discounts and works with individuals to recover these obligations while helping them toward financial recovery.

Encore Capital Group reported revenues of $442.1 million, up 24.4% year on year, outperforming analysts’ expectations by 15.3%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 20.6% since reporting. It currently trades at $45.14.

Is now the time to buy Encore Capital Group? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Oaktree Specialty Lending (NASDAQ: OCSL)

Managed by Oaktree Capital Management, one of the world's premier alternative investment firms, Oaktree Specialty Lending (NASDAQ: OCSL) is a business development company that provides customized financing solutions to mid-market companies across various industries.

Oaktree Specialty Lending reported revenues of $75.27 million, down 20.7% year on year, falling short of analysts’ expectations by 4.6%. It was a disappointing quarter as it posted a significant miss of analysts’ AUM and EPS estimates.

As expected, the stock is down 2.3% since the results and currently trades at $13.20.

Read our full analysis of Oaktree Specialty Lending’s results here.

Euronet Worldwide (NASDAQ: EEFT)

Operating a global network of over 47,000 ATMs and 821,000 point-of-sale terminals across more than 60 countries, Euronet Worldwide (NASDAQ: EEFT) provides electronic payment solutions including ATM services, prepaid product processing, and international money transfer services.

Euronet Worldwide reported revenues of $1.07 billion, up 8.9% year on year. This number was in line with analysts’ expectations. Taking a step back, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates.

The stock is down 9.2% since reporting and currently trades at $89.90.

Read our full, actionable report on Euronet Worldwide here, it’s free.

Jack Henry (NASDAQ: JKHY)

Founded in 1976 by two entrepreneurs who saw the need for specialized banking software in the early days of financial computing, Jack Henry & Associates (NASDAQ: JKHY) provides technology solutions that help banks and credit unions innovate, differentiate, and compete while serving the evolving needs of their accountholders.

Jack Henry reported revenues of $615.4 million, up 9.9% year on year. This result beat analysts’ expectations by 1.8%. Taking a step back, it was a mixed quarter as it also logged an impressive beat of analysts’ Processing segment estimates but a slight miss of analysts’ EBITDA estimates.

The stock is down 1.3% since reporting and currently trades at $158.43.

Read our full, actionable report on Jack Henry here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.