Winners And Losers Of Q2: LifeStance Health Group (NASDAQ:LFST) Vs The Rest Of The Outpatient & Specialty Care Stocks

Looking back on outpatient & specialty care stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including LifeStance Health Group (NASDAQ: LFST) and its peers.

The outpatient and specialty care industry delivers targeted medical services in non-hospital settings that are often cost-effective compared to inpatient alternatives. This means that they are more desired as rising healthcare costs and ways to combat them become more and more top-of-mind. Outpatient and specialty care providers boast revenue streams that are stable due to the recurring nature of treatment for chronic conditions and long-term patient relationships. However, their reliance on government reimbursement programs like Medicare means stroke-of-the-pen risk. Additionally, scaling a network of facilities can be capital-intensive with uneven return profiles amid competition from integrated healthcare systems. Looking ahead, the industry is positioned to grow as demand for outpatient services expands, driven by aging populations, a rising prevalence of chronic diseases, and a shift toward value-based care models. Tailwinds include advancements in medical technology that support more complex procedures in outpatient settings and the increasing focus on preventive care, which can be aided by data and AI. However, headwinds such as reimbursement rate cuts, labor shortages, and the financial strain of digitization may temper growth.

The 7 outpatient & specialty care stocks we track reported a satisfactory Q2. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

While some outpatient & specialty care stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.1% since the latest earnings results.

LifeStance Health Group (NASDAQ: LFST)

With over 6,600 licensed mental health professionals treating more than 880,000 patients annually, LifeStance Health (NASDAQ: LFST) provides outpatient mental health services through a network of clinicians offering psychiatric evaluations, psychological testing, and therapy across 33 states.

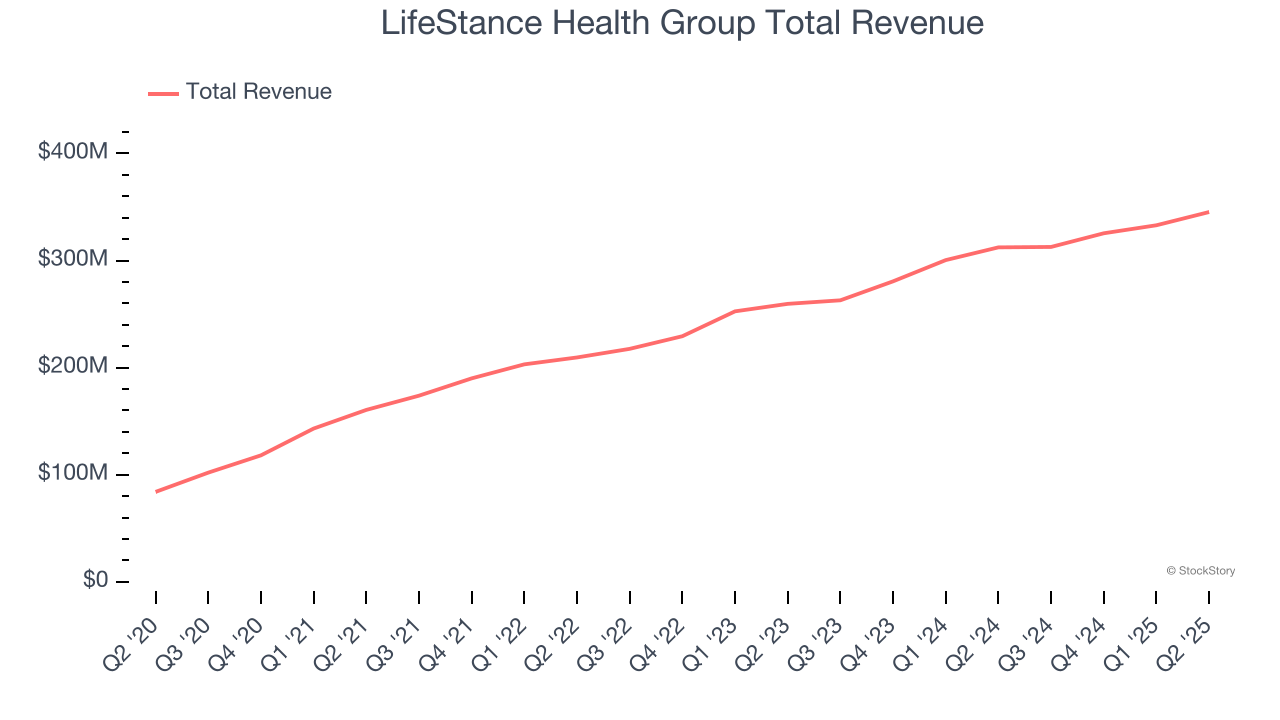

LifeStance Health Group reported revenues of $345.3 million, up 10.6% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with full-year EBITDA guidance topping analysts’ expectations but EPS in line with analysts’ estimates.

“I am incredibly proud of the LifeStance team for the strong results achieved in the second quarter,” said Dave Bourdon, CEO of LifeStance.

Interestingly, the stock is up 35.5% since reporting and currently trades at $5.29.

Is now the time to buy LifeStance Health Group? Access our full analysis of the earnings results here, it’s free.

Best Q2: U.S. Physical Therapy (NYSE: USPH)

With a nationwide footprint spanning 671 clinics across 42 states, U.S. Physical Therapy (NYSE: USPH) operates a network of outpatient physical therapy clinics and provides industrial injury prevention services to employers across the United States.

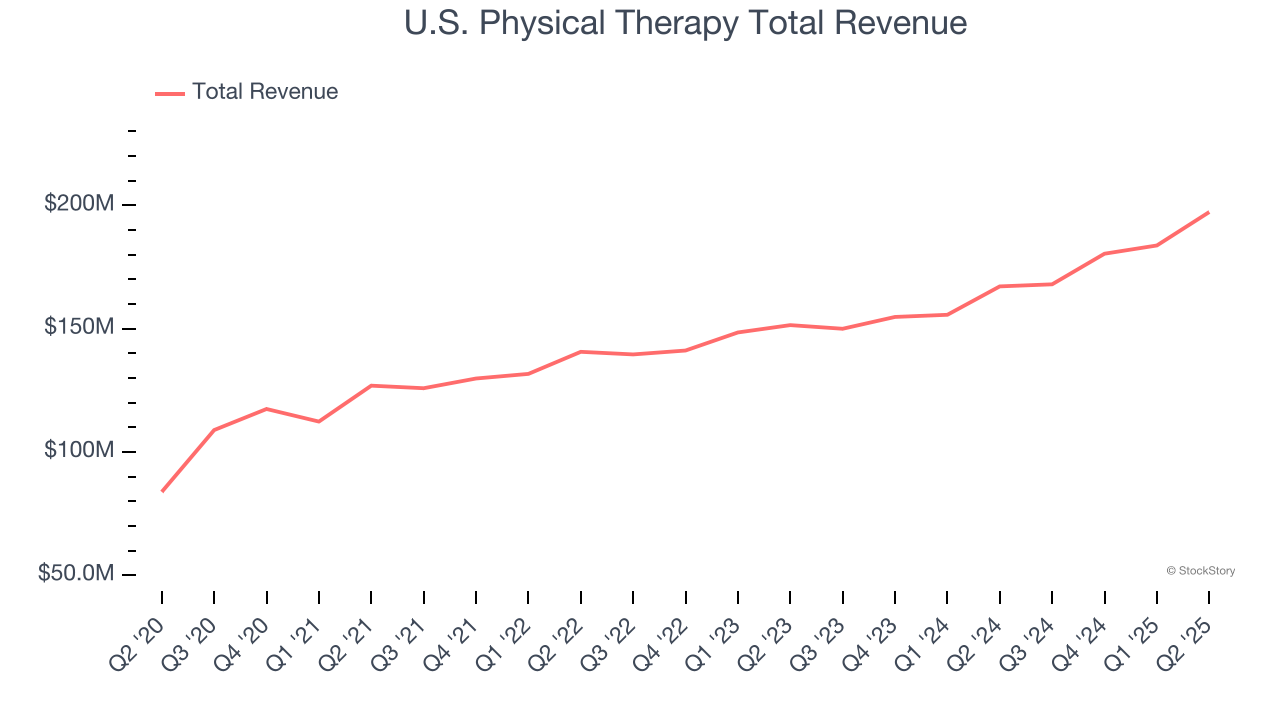

U.S. Physical Therapy reported revenues of $197.3 million, up 18% year on year, outperforming analysts’ expectations by 2.1%. The business had a very strong quarter with an impressive beat of analysts’ sales volume and EPS estimates.

U.S. Physical Therapy delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 8.5% since reporting. It currently trades at $79.30.

Is now the time to buy U.S. Physical Therapy? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: agilon health (NYSE: AGL)

Transforming how doctors care for seniors by shifting financial incentives from volume to outcomes, agilon health (NYSE: AGL) provides a platform that helps primary care physicians transition to value-based care models for Medicare patients through long-term partnerships and global capitation arrangements.

agilon health reported revenues of $1.39 billion, down 5.9% year on year, falling short of analysts’ expectations by 4.8%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates and customer base in line with analysts’ estimates.

agilon health delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company added 7,000 customers to reach a total of 498,000. As expected, the stock is down 38.8% since the results and currently trades at $1.11.

Read our full analysis of agilon health’s results here.

DaVita (NYSE: DVA)

With over 2,600 dialysis centers across the United States and a presence in 13 countries, DaVita (NYSE: DVA) operates a network of dialysis centers providing treatment and care for patients with chronic kidney disease and end-stage kidney disease.

DaVita reported revenues of $3.38 billion, up 6.1% year on year. This print beat analysts’ expectations by 0.7%. Taking a step back, it was a mixed quarter as it also logged a beat of analysts’ EPS estimates but a slight miss of analysts’ sales volume estimates.

The stock is down 7.1% since reporting and currently trades at $130.95.

Read our full, actionable report on DaVita here, it’s free.

Select Medical (NYSE: SEM)

With a nationwide network spanning 46 states and over 2,700 healthcare facilities, Select Medical (NYSE: SEM) operates critical illness recovery hospitals, rehabilitation hospitals, outpatient rehabilitation clinics, and occupational health centers across the United States.

Select Medical reported revenues of $1.34 billion, up 4.5% year on year. This number was in line with analysts’ expectations. It was a strong quarter as it also recorded a solid beat of analysts’ full-year EPS guidance estimates.

Select Medical had the weakest full-year guidance update among its peers. The stock is down 17.4% since reporting and currently trades at $12.24.

Read our full, actionable report on Select Medical here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.