Footwear Retailer Stocks Q2 Teardown: Designer Brands (NYSE:DBI) Vs The Rest

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Designer Brands (NYSE: DBI) and the best and worst performers in the footwear retailer industry.

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

The 4 footwear retailer stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.6% below.

In light of this news, share prices of the companies have held steady as they are up 1.5% on average since the latest earnings results.

Designer Brands (NYSE: DBI)

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE: DBI) is an American discount retailer focused on footwear and accessories.

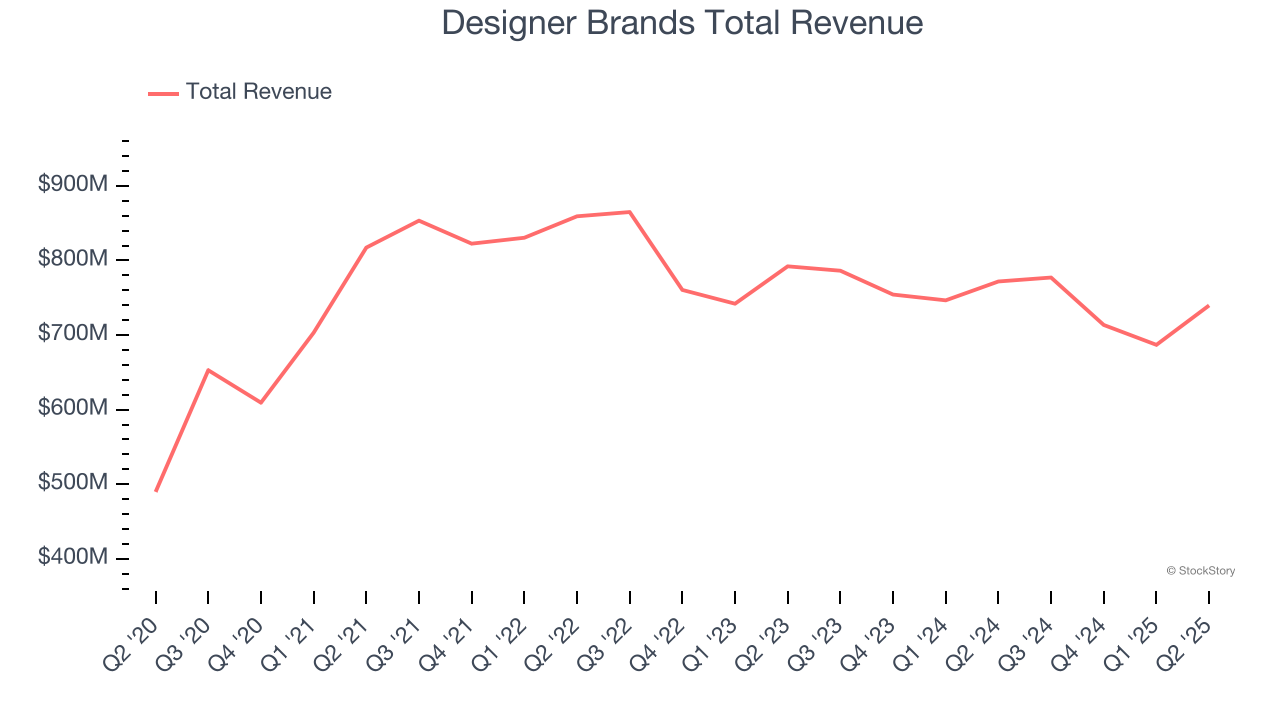

Designer Brands reported revenues of $739.8 million, down 4.2% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates and gross margin in line with analysts’ estimates.

"Our second quarter results were highlighted by a 280-basis point sequential improvement in comparable sales from the first quarter, underscoring the impact of our targeted operational initiatives," stated Doug Howe, Chief Executive Officer.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $4.20.

Is now the time to buy Designer Brands? Access our full analysis of the earnings results here, it’s free.

Best Q2: Shoe Carnival (NASDAQ: SCVL)

Known for its playful atmosphere that features carnival elements, Shoe Carnival (NASDAQ: SCVL) is a retailer that sells footwear from mainstream brands for the entire family.

Shoe Carnival reported revenues of $306.4 million, down 7.9% year on year, falling short of analysts’ expectations by 2.5%. However, the business still had a strong quarter with an impressive beat of analysts’ gross margin estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 10.2% since reporting. It currently trades at $23.70.

Is now the time to buy Shoe Carnival? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Foot Locker (NYSE: FL)

Known for store associates whose uniforms resemble those of referees, Foot Locker (NYSE: FL) is a specialty retailer that sells athletic footwear, clothing, and accessories.

Foot Locker reported revenues of $1.86 billion, down 2.3% year on year, falling short of analysts’ expectations by 0.6%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and gross margin estimates.

As expected, the stock is down 9.3% since the results and currently trades at $24.02.

Read our full analysis of Foot Locker’s results here.

Boot Barn (NYSE: BOOT)

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE: BOOT) is a western-inspired apparel and footwear retailer.

Boot Barn reported revenues of $504.1 million, up 19.1% year on year. This print surpassed analysts’ expectations by 1.5%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ gross margin estimates.

Boot Barn delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is up 4.5% since reporting and currently trades at $179.55.

Read our full, actionable report on Boot Barn here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.