2 Reasons to Watch FFIN and 1 to Stay Cautious

Over the past six months, First Financial Bankshares’s shares (currently trading at $33.85) have posted a disappointing 7.6% loss, well below the S&P 500’s 15.7% gain. This might have investors contemplating their next move.

Following the pullback, is this a buying opportunity for FFIN? Find out in our full research report, it’s free.

Why Does FFIN Stock Spark Debate?

With roots dating back to 1890 and a network spanning over 70 locations across the Lone Star State, First Financial Bankshares (NASDAQ: FFIN) is a Texas-focused regional bank providing commercial banking, trust services, and wealth management across numerous communities throughout the state.

Two Positive Attributes:

1. Long-Term Revenue Growth Shows Momentum

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

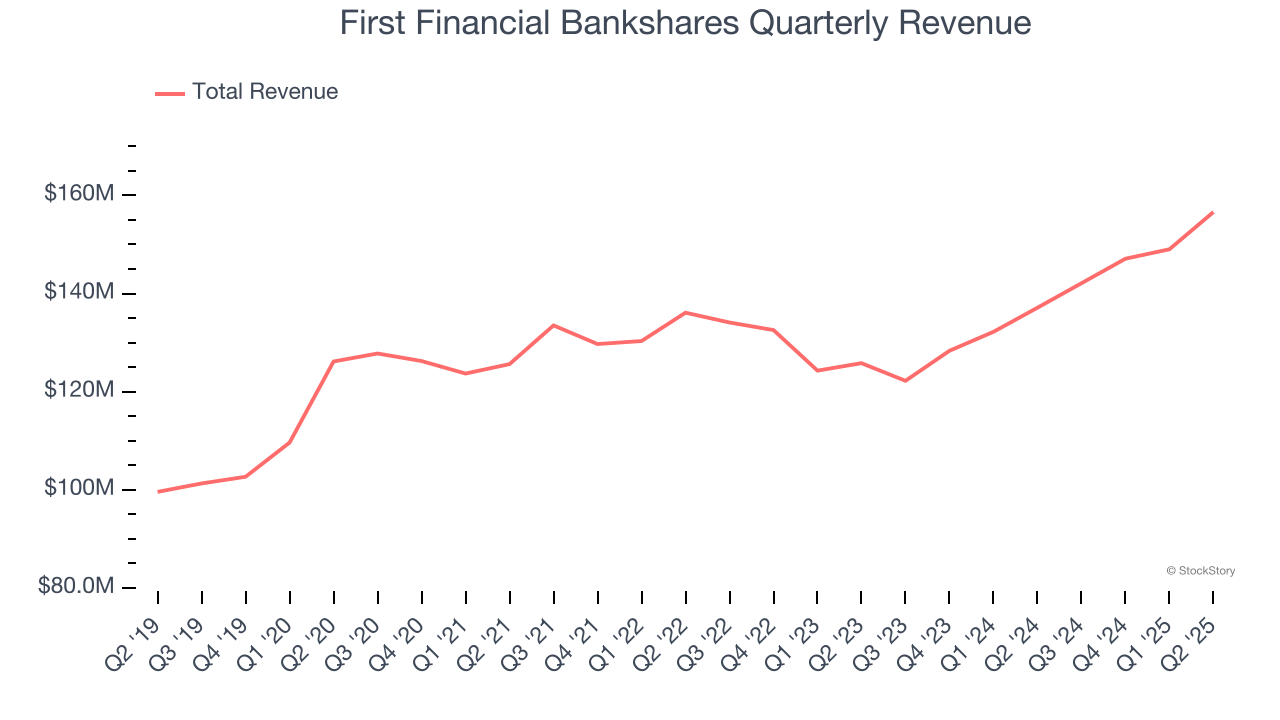

Luckily, First Financial Bankshares’s revenue grew at a decent 6.2% compounded annual growth rate over the last five years. Its growth was slightly above the average banking company and shows its offerings resonate with customers.

2. EPS Increasing Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

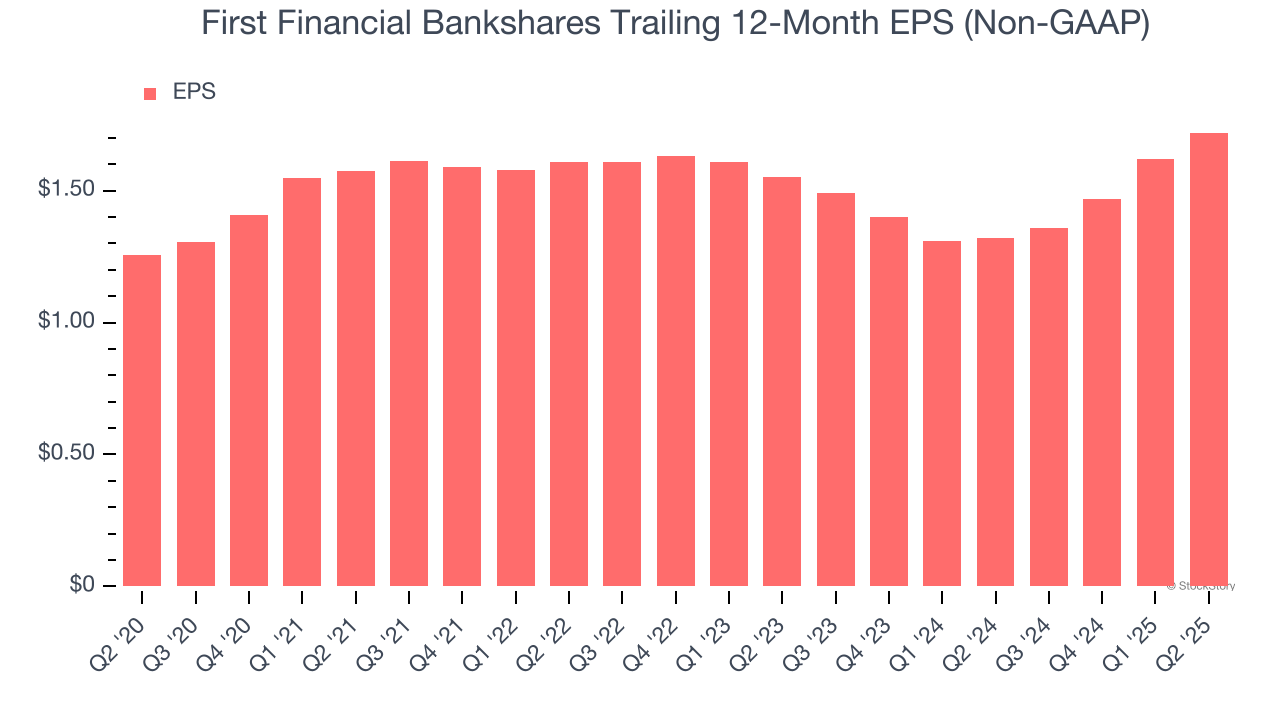

First Financial Bankshares’s solid 6.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

One Reason to be Careful:

Net Interest Income Points to Soft Demand

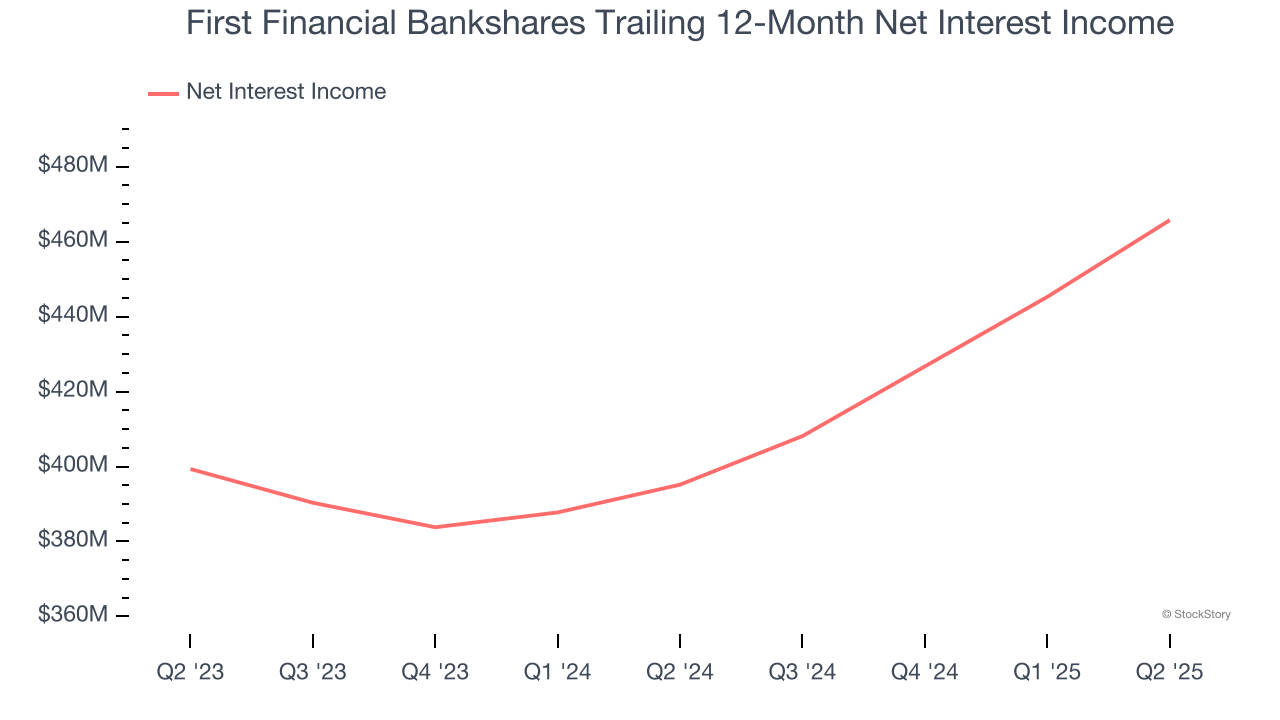

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

First Financial Bankshares’s net interest income has grown at a 7.3% annualized rate over the last five years, slightly worse than the broader banking industry.

Final Judgment

First Financial Bankshares’s merits more than compensate for its flaws. After the recent drawdown, the stock trades at 2.7× forward P/B (or $33.85 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.