Ladder Capital (LADR): Buy, Sell, or Hold Post Q2 Earnings?

Since March 2025, Ladder Capital has been in a holding pattern, posting a small return of 0.8% while floating around $11.50. The stock also fell short of the S&P 500’s 18.6% gain during that period.

Is there a buying opportunity in Ladder Capital, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Ladder Capital Will Underperform?

We're swiping left on Ladder Capital for now. Here are three reasons why LADR doesn't excite us and a stock we'd rather own.

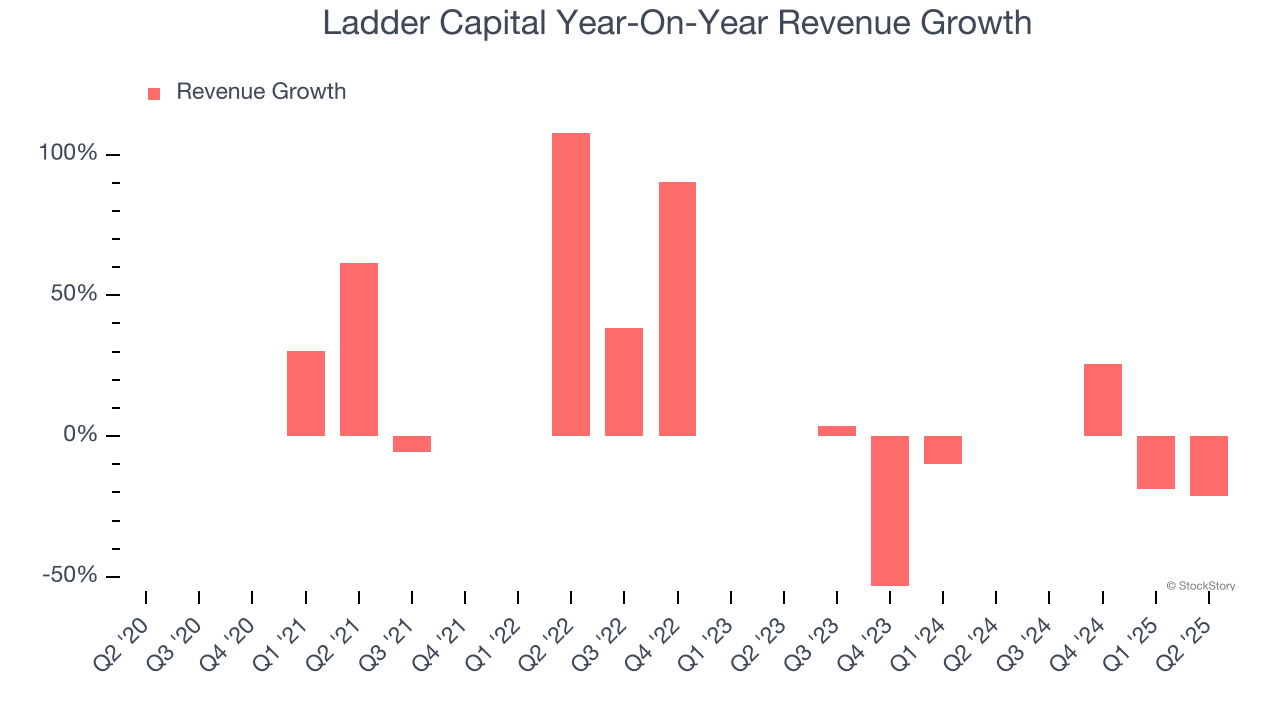

1. Revenue Tumbling Downwards

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Ladder Capital’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 13.2% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

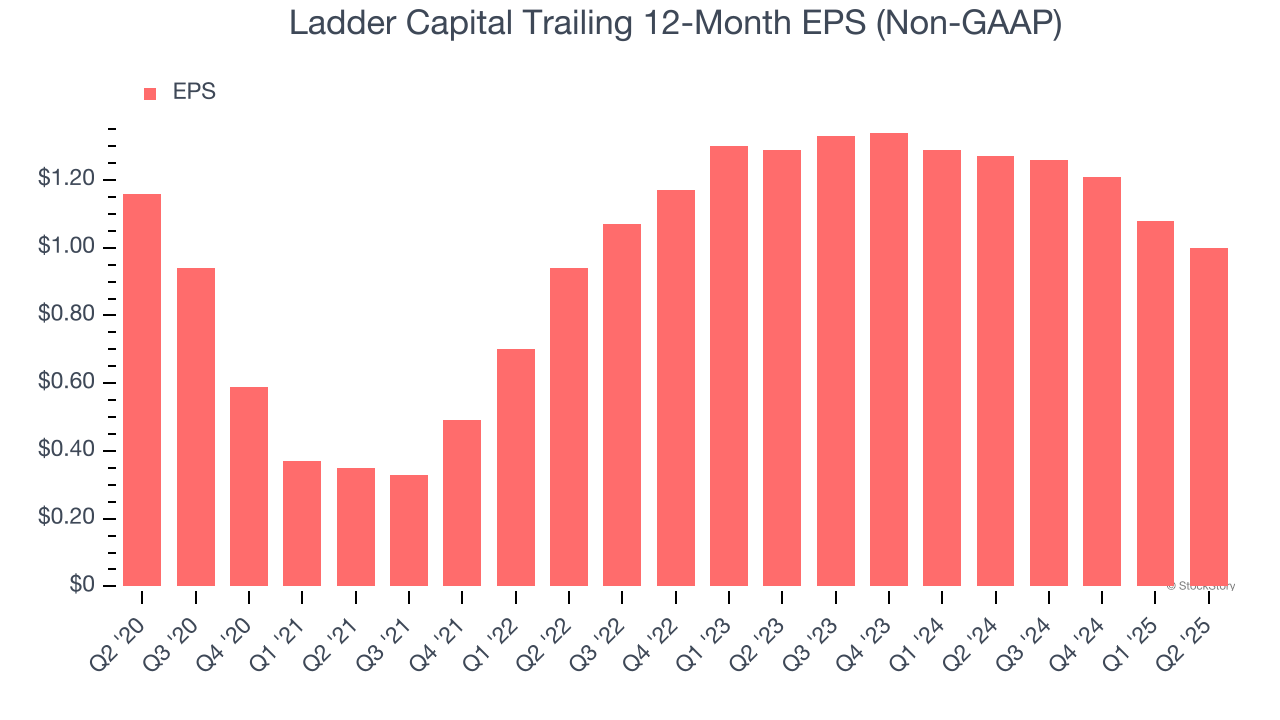

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Ladder Capital, its EPS declined by 2.9% annually over the last five years while its revenue grew by 17.1%. This tells us the company became less profitable on a per-share basis as it expanded.

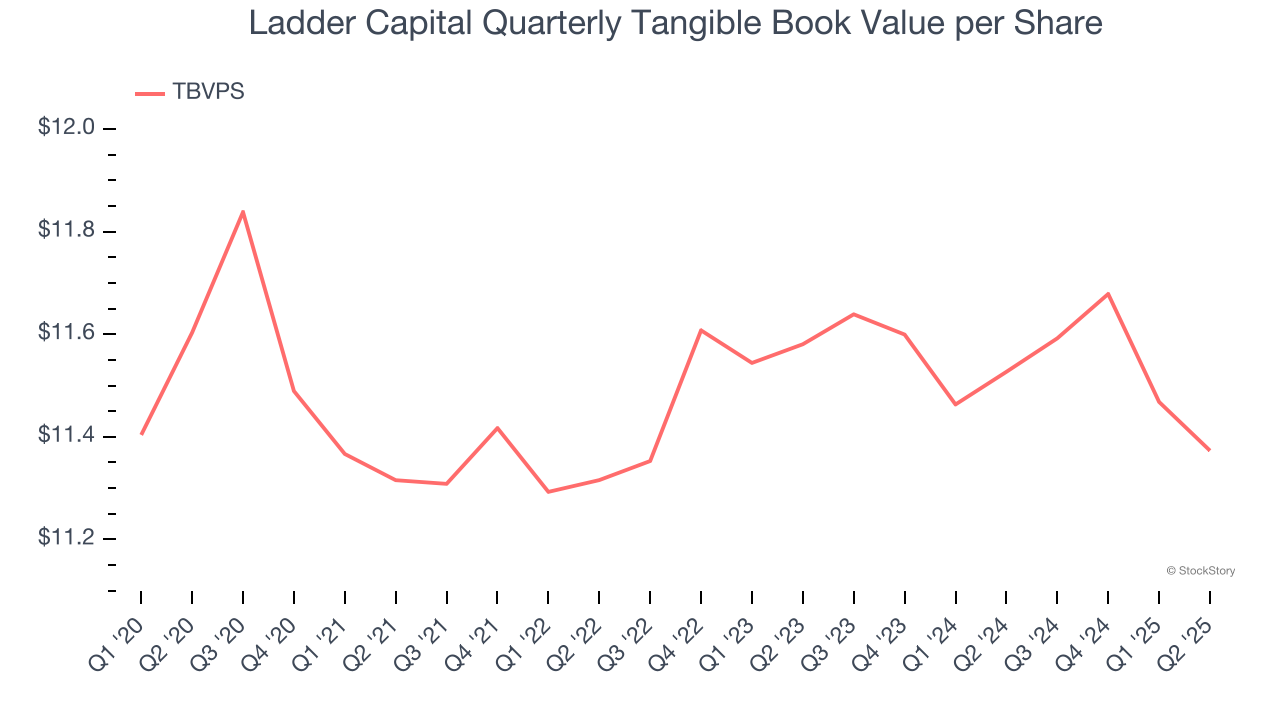

3. TBVPS Has Plateaued, Reflecting Stagnating Assets

Tangible book value per share (TBVPS) serves as a key indicator of a bank’s financial strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during financial distress.

To the detriment of investors, Ladder Capital’s TBVPS was flat over the last two years.

Final Judgment

Ladder Capital falls short of our quality standards. With its shares underperforming the market lately, the stock trades at 1× forward P/B (or $11.50 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Ladder Capital

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.