SCVX Unveil Validator Economy Prototype ModelOctober 03, 2025 at 03:00 AM EDT

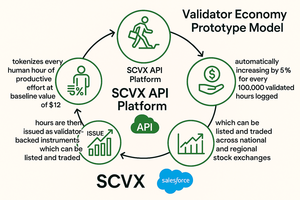

Based on Salesforce Technology to Pilot Across AfCFTA Member States and Integrate with African Stock Exchanges BOTSWANA, October 03, 2025 /24-7PressRelease/ -- Social Capital Virtual Exchange (SCVX), licensed digital capital market in Botswana, today announced the launch of the Validator Economy Prototype Model, based on Salesforce technology, a first-of-its-kind financial innovation designed to validate human productivity and anchor it within sovereign capital markets across Africa. This model will be piloted under the Validator Economy Bill, establishing a legal and technological framework for AfCFTA-wide adoption, with stock exchanges across the continent serving as the infrastructure for validator-based financial instruments. The Validator Economy Prototype Model At its core, the Validator Economy prototype model validates every human hour of productive effort at a baseline value of $12, automatically increasing by 5% for every 100,000 validated hours logged. These hours are then issued as validator-backed instruments, which can be listed and traded across national and regional stock exchanges. Key design features of the prototype include: • Effort-Backed Instruments: Productivity hours are transformed into sovereign-grade assets, eliminating reliance on speculative finance. • Integration with Stock Exchanges: Validator-backed products will be listed on existing African exchanges, starting with the SADC Stock Exchanges, and expanding to other AfCFTA markets. • Cross-Border Recognition: Standardized through AfCFTA protocols, validator assets will be interoperable across all 54 member states. Pilot Across AfCFTA Member States During this phase, SCVX will collaborate with regulators from SADC, ECOWAS, and EAC blocs to observe, harmonize, and extend validator protocols to their markets. Following the Sandbox phase: • Regional Workshops: Validator Economy Awareness Workshops will prepare regulators, enterprises, and stock exchange operators for adoption. • Legislative Rollout: AfCFTA member states will adapt the Validator Economy Bill into local statutes, ensuring uniform governance. • Pan-African Scaling: Validator prototypes will evolve into fully tradable sovereign assets within AfCFTA's integrated financial markets. "This is not just a pilot in Africa," said Ssemakula Peter Luyima, CEO of SCVX. "It is the AfCFTA's entry point into a productivity-based economy. By embedding validator logic into stock exchanges, we are creating an unbreakable link between human effort, sovereign reserves, and capital market growth." Salesforce's Role Salesforce will integrate MuleSoft, Tableau, and Einstein AI to power the validator infrastructure. This will enable: • Real-Time Logging: Seamless tracking of productive hours across industries. • Exchange Integration: Automated flows between validator ledgers and trading systems. • Cross-Border Compliance: Harmonized reporting for AfCFTA regulators and exchanges. Catalyst for African Stock Exchanges The Validator Economy Prototype will open a new category of listings for African exchanges: • Validator Bonds: Effort-backed sovereign securities. • Validator Equities: productivity-tied shares for enterprises. • Validator ETFs: Regional funds pooling hours across AfCFTA member states. This innovation allows exchanges to: • Expand listings beyond resource commodities. • Attract FDI into productivity-based instruments. • Anchor valuations in measurable human effort rather than speculative flows. Scaling Africa's Financial Sovereignty The Validator Economy Prototype positions Africa as a global leader in post-capitalist financial design, offering a blueprint for sovereign independence, sustainable growth, and inclusive wealth creation. The Social Capital Virtual Exchange (SCVX) is the world's first licensed digital capital market dedicated to pioneering the Validator Economy—anchoring value in human productivity hours and reshaping global finance for sovereign independence, sustainability, and inclusive growth. --- Press release service and press release distribution provided by https://www.24-7pressrelease.com More NewsView More

Can Waystar Still Stand Up to Rising Competition? ↗

February 04, 2026

Via MarketBeat

Is Chipotle’s 2026 Playbook the Secret Sauce for a Reversal? ↗

February 04, 2026

Via MarketBeat

Tickers

CMG

SMCI Soars Post-Earnings: Head Fake, Or Sign of True Recovery? ↗

February 04, 2026

Via MarketBeat

T-Mobile: The Buyback King’s Safe Haven Strategy ↗

February 04, 2026

Via MarketBeat

Tickers

TMUS

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|

>