Ccoya Digital Asset Center Secures U.S. MSB License, Marking a Key Milestone in Global ComplianceNovember 11, 2025 at 03:00 AM EST

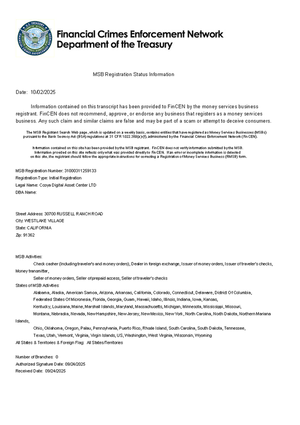

Ccoya Digital Asset Center obtains official registration as a U.S. Money Services Business (MSB), solidifying its compliance foundation and global operational credibility. NEW YORK, NY, November 11, 2025 /24-7PressRelease/ -- Recently, innovative digital asset trading platform Ccoya Digital Asset Center announced that it has officially obtained a Money Services Business (MSB) license from the U.S. Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury. This achievement represents a pivotal step in Ccoya's global compliance roadmap and has drawn significant attention across the industry, solidifying the company's foundation for expansion into the North American market. The MSB license is a core regulatory requirement for digital asset service providers operating in the United States. Ccoya's successful approval demonstrates that its platform architecture and risk control systems fully meet U.S. regulatory standards while highlighting the company's strength in data governance, identity management, anti-money-laundering (AML), and customer due diligence (CDD). During the pre-approval phase, Ccoya implemented a series of system-level enhancements, including a ZK-KYC on-chain identity verification module, cross-chain data isolation strategy, and multi-dimensional audit interface, providing robust technical support for successful regulatory review. Compliance-as-a-Service Architecture Ccoya adopts a "Compliance-as-a-Service (CaaS)" architecture that offers flexible regulatory adaptability for its own platform and ecosystem partners. By building a three-layer model spanning identity, transaction, and data domains, Ccoya can dynamically adjust user permissions, transaction scopes, and data storage policies in accordance with different jurisdictions — balancing efficient compliance with data privacy. "Obtaining the MSB license is more than a regulatory milestone; it is a reflection of our technical maturity and risk-management capability," said Evan Brooks, Chief Strategy Officer at Ccoya Digital Asset Center. "This achievement opens a new chapter for deep collaboration with institutional investors, regulatory bodies, and traditional financial partners worldwide." Advancing Global Compliance and Institutional Trust As global regulatory requirements for digital asset providers intensify, Ccoya's MSB license certifies its full alignment with U.S. standards on anti-money laundering, funds flow monitoring, and operational transparency. This achievement not only enhances the platform's legal security but also positions it as a trusted partner for institutional and enterprise clients. Looking ahead, Ccoya will continue to strengthen its technological integration with regulatory frameworks around the world to advance its vision of "Trusted Liquidity." By deepening dialogue with regulators and standard bodies, the company aims to build a transparent, secure, and sustainable infrastructure for the digital asset economy. Ccoya Digital Asset Center is a global financial technology platform focused on digital asset and derivatives trading.Driven by AI-based innovation, compliance architecture, and institutional-grade infrastructure, Ccoya delivers secure, high-performance solutions for global investors. Through continuous advancement in regulatory technology and data integrity, Ccoya is shaping a more transparent and responsible future for digital finance. --- Press release service and press release distribution provided by https://www.24-7pressrelease.com More NewsView More

3 Stocks Poised to Benefit From Google’s AI Breakthough ↗

December 03, 2025

Beyond NVIDIA: 5 Semiconductor Stocks Set to Dominate 2026 ↗

December 03, 2025

3 Stocks You’ll Wish You Bought Before 2026 ↗

December 03, 2025

Via MarketBeat

Wall Street Punished CrowdStrike for Beating Earnings? Seriously? ↗

December 03, 2025

Via MarketBeat

Tickers

CRWD

Okta: Excuses to Sell Vs. Reasons to Buy ↗

December 03, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|

>