Gaby Inc. Reports Q1 2021 Revenue of $3.4MM and Record First Quarter 2021 Pro Forma Revenue of $12.3MM

By:

GABY Inc. via

AccessWire

May 26, 2021 at 07:00 AM EDT

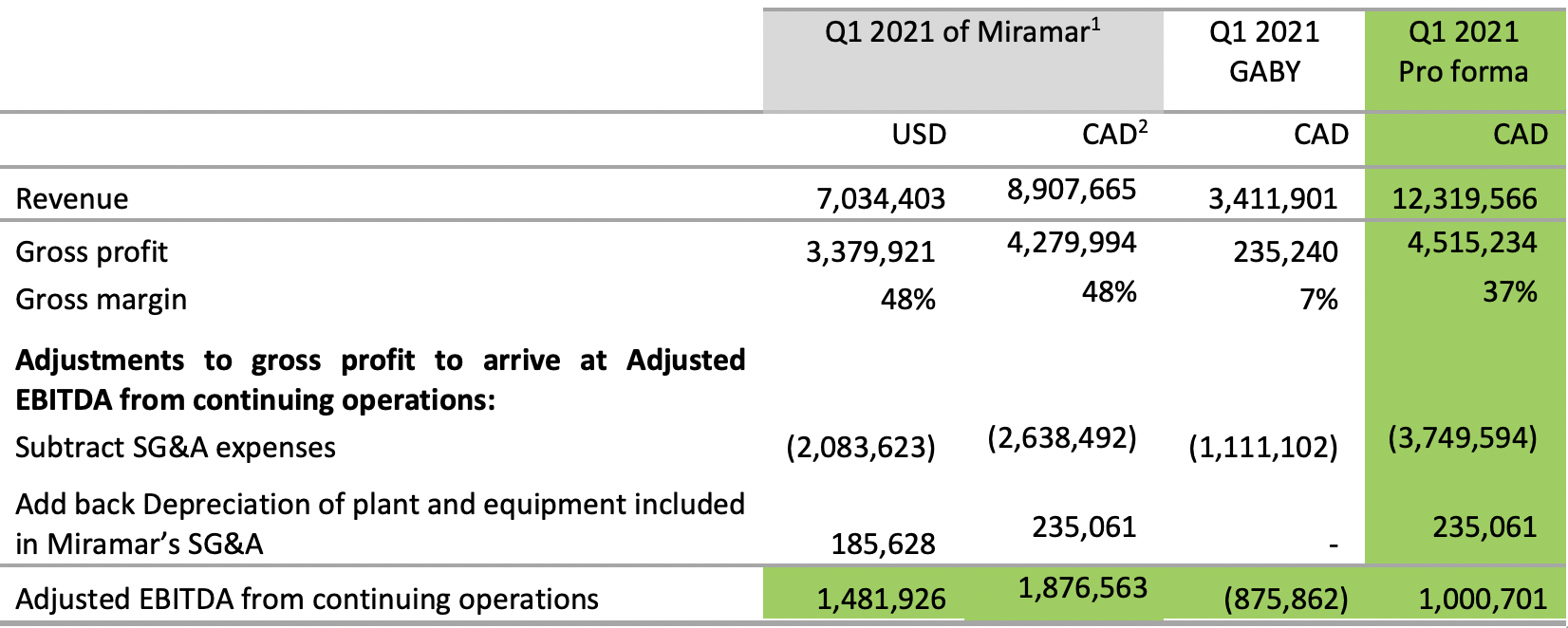

SANTA ROSA, CA / ACCESSWIRE / May 26, 2021 / GABY Inc. ("GABY" or the "Company") (CSE:GABY)(OTCQB:GABLF), a cannabis retail consolidator operating exclusively in California is pleased to announce first quarter revenue was $3.4 million, up 135% from the same quarter last year and its Q1 2021 pro forma revenue[i] was $12.3 million, up 8.5 times over Q1 2020 revenue[ii]. Further, GABY's gross margin for Q1 2021 was 7% and its pro forma gross margini for Q1 2021 was 37% compared to negative 15% in Q1 2020. Adjusted EBITDA from continuing operations ("EBITDA")i for Q1 2021 was negative $0.9 million and Pro Forma EBITDAi for Q1 2021 was $1.0 million compared to negative $2.5 million for Q1 2020. "It is gratifying to see GABY finally starting to reap the reward of its cost cutting measures and business reengineering commenced in Q1, 2020. And better still to know the best is yet to come, as we have yet to see the full benefit of the synergies to be realized with the acquisition of the Mankind Dispensary," said Margot Micallef, Founder, President and Chief Executive Officer of GABY. With the acquisition of the Mankind Dispensary, GABY's proprietary products (Sonoma Pacific™ and Lulu's™) joined Mankind's proprietary products on shelf at its dispensary. Proprietary brands currently make up 20% of all flower sold in Mankind. GABY plans to increase this number to 30% by year end and to add additional proprietary brands in other product categories, starting with concentrates later this month. GABY is also leveraging Mankind's supplier relationships for the benefit of its other verticals, including its distribution and manufacturing platforms offering and end to end solution for such suppliers from harvest to consumer all the while harvesting additional margin from each of its three verticals: manufacturing, distribution and retail. Specifically:

In addition, with the benefit of the experience which the GABY management team brings to operating retail stores, since closing the Miramar transaction, GABY has been working on integrating and streamlining Mankind operations. Specifically, management has:

"I've done this before", said Margot Micallef. "Before moving into the cannabis world, I was involved in multiple retail consolidations. Proper integration is painstaking work but well worth the effort. Mankind will be the template for each of the dispensaries we bring on board as we aggressively consolidate the highly fragmented retail vertical in California", she concluded. Led by TJ Finch, former head of Business Developments at Cresco (one of the largest and most acquisitive multi-state operators in the United States) GABY now has three merger and acquisition (M&A) experts aggressively sourcing and negotiating opportunities for GABY. About GABY GABY's shares trade on the CSE under the symbol "GABY" and on the OTCQB under the symbol "GABLF". For more information on GABY, visit www.GABYInc.com. For general inquiries, please contact Margot Micallef, Founder, President & CEO at margot@GABYInc.com or 403-313-4645. For media inquiries, please contact: For investor inquiries, please contact: iSee Non-GAAP Disclosure below: NON-GAAP DISCLOSURE Below is a reconciliation of the non-GAAP measures highlighted in green in the following table:

1Revenue, gross profit, SG&A and depreciation of plant and equipment as reported in USD in Miramar's Condensed Interim Consolidated Financial Statements (UNAUDITED) for the three months ended December 31, 2020 included in GABY's CSE Form 2A Listing Statement filed on SEDAR April 21, 2021. 2USD in preceding column translated using average foreign exchange rate of 1.2663 CAD per USD used in translating GABY's Q1 2021 USD income statement line items. Cautionary Statement The purpose of forward-looking statements is to provide the reader with a description of management's expectations, and such forward-looking statements may not be appropriate for any other purpose. In particular, but without limiting the foregoing, disclosure in this press release as well as statements regarding the Company's objectives, plans and goals, including future operating results and economic performance may make reference to or involve forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Certain of the forward-looking statements and other information contained herein concerning the cannabis industry, its medical, adult-use and hemp-based CBD markets, and the general expectations of the Company concerning the industry and the Company's business and operations are based on estimates prepared by the Company using data from publicly available governmental sources as well as from market research and industry analysis and on assumptions based on data and knowledge of this industry which the Company believes to be reasonable. However, although generally indicative of relative market positions, market shares and performance characteristics, such data is inherently imprecise. While the Company is not aware of any misstatement regarding any industry or government data presented herein, the cannabis industry involves risks and uncertainties that are subject to change based on various factors. A number of factors could cause actual events, performance or results to differ materially from what is projected in the forward-looking statements. You should not place undue reliance on forward-looking statements contained in this press release. Such forward-looking statements are made as of the date of this press release. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. The Company's forward-looking statements are expressly qualified in their entirety by this cautionary statement. Neither the CSE nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release. [ii] Selected financial and operational information is outlined above and should be read in conjunction with GABY's unaudited condensed consolidated interim financial statements and management's discussion and analysis for the quarter ended March 31, 2021 which are available on SEDAR at www.sedar.com and the Company's website www.GABYinc.com. SOURCE: GABY Inc. View source version on accesswire.com: https://www.accesswire.com/649106/Gaby-Inc-Reports-Q1-2021-Revenue-of-34MM-and-Record-First-Quarter-2021-Pro-Forma-Revenue-of-123MM More NewsView More

Microsoft Stock Faces An AI-Driven Physics Problem ↗

Today 12:49 EST

Via MarketBeat

Is It Time to Invest in Your Kid's Favorite Gaming Platform? ↗

Today 11:42 EST

Via MarketBeat

5 Stocks to Buy Before Santa Claus Comes to Town ↗

Today 9:35 EST

History Says These are 3 Stocks to Buy for December ↗

Today 7:13 EST

Via MarketBeat

Warner Bros. Sale Rumors Heat Up: What Investors Need to Know ↗

November 25, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|