Meridian Updates on Granting of Álamo Licence and Cabaçal’s Strong Drill Results

By:

ACCESSWIRE

January 10, 2023 at 06:15 AM EST

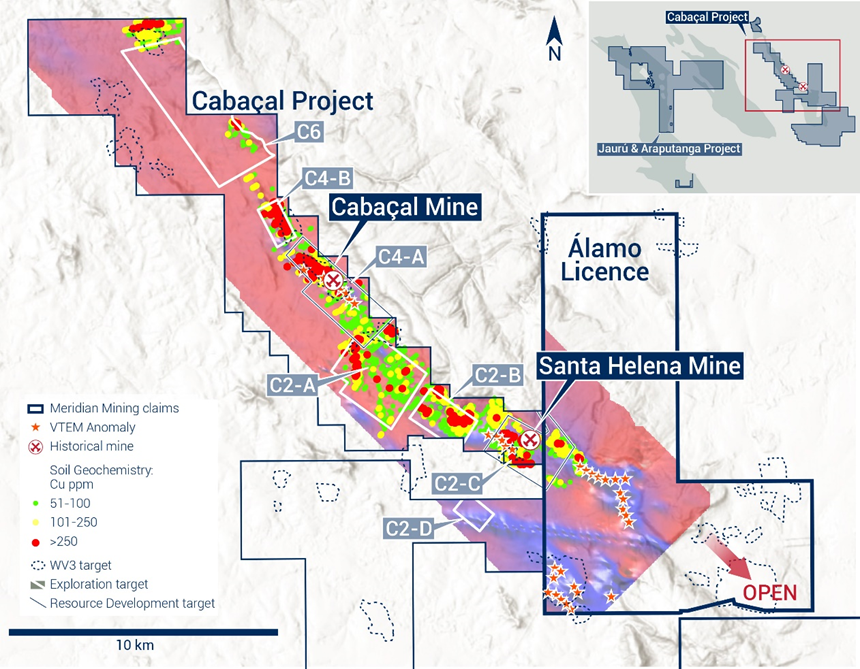

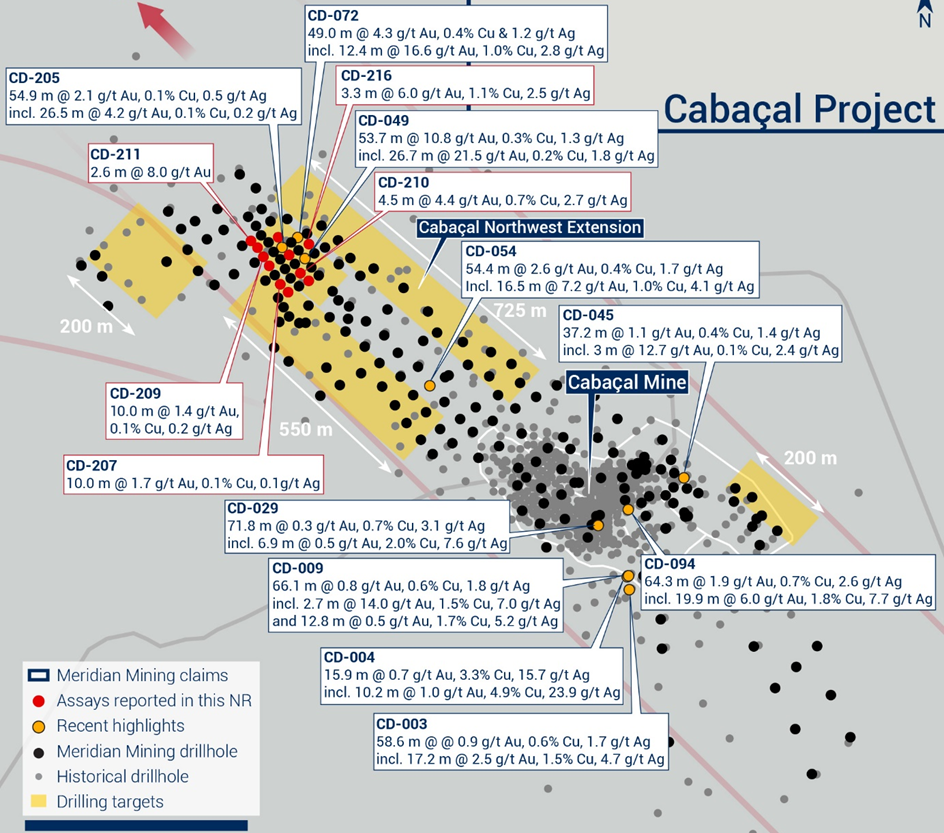

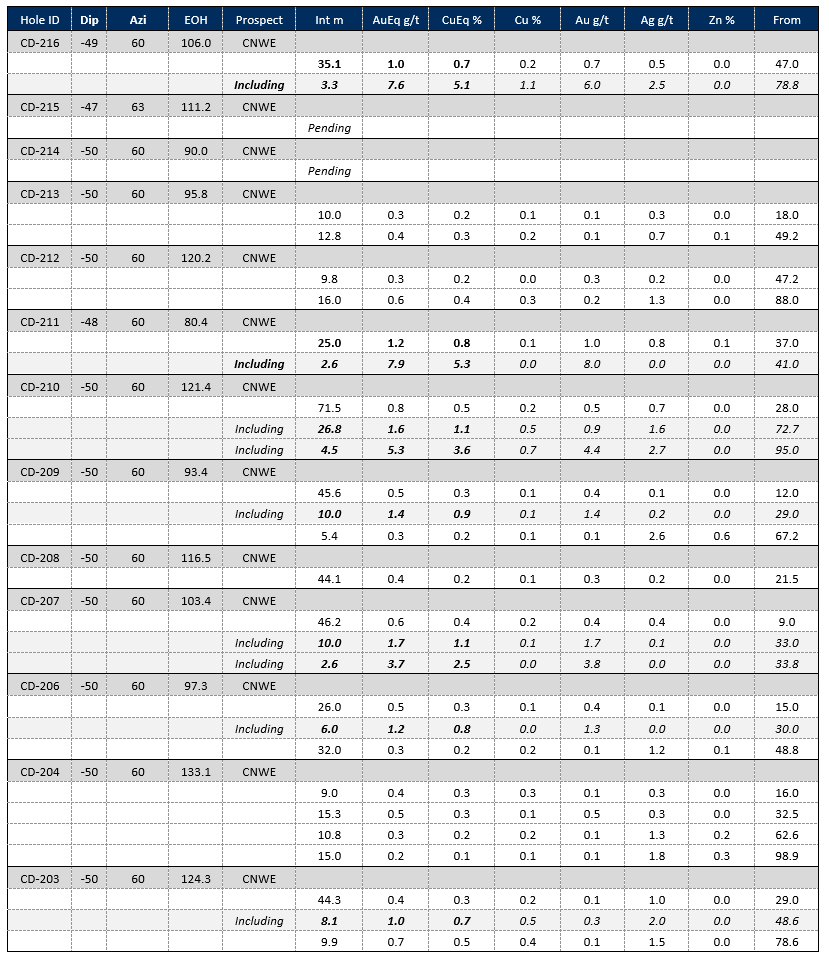

CD-210 returns 26.8m @ 1.6g/t AuEq, including 4.5m @ 5.3g/t AuEq LONDON, UK / ACCESSWIRE / January 10, 2023 / Meridian Mining UK. S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQB:MRRDF) ("Meridian" or the "Company") is pleased to report the granting of the highly prospective Álamo exploration licence ("Álamo"). Álamo hosts multiple open copper-gold soil geochemical targets, VTEM anomalies, and large alteration systems ("Figure 1"). Meridian's initial reconnaissance and field portable XRF readings have identified untested gossans associated with both BP soil survey areas and newly identified large alteration systems. Field work is ongoing. Meridian reports multiple strong drill results from the Cabaçal gold-copper VMS deposit, where the latest infill drilling continues to define strong coherent layers of high-grade gold, copper and silver mineralization ("Figure 2") from Cabaçal's Northwest Extension ("CNWE"). Results include 26.8m @ 1.6g/t AuEq from 72.7m including 4.5m @ 5.3g/t AuEq from 95.0m (CD-210); 25.0m @ 1.2 g/t AuEq from 37.0m including 2.6m @ 7.9g/t AuEq from 41.0m (CD-211), and 35.1m @ 1.0g/t AuEq from 47.1m including 3.3m @ 7.6g/t AuEq from 78.8m (CD-216) ("Table 1"). These results continue to strengthen Cabaçal's open-pit potential and enhance opportunities for a high grade starter pit; further assays are pending. Highlights Reported Today

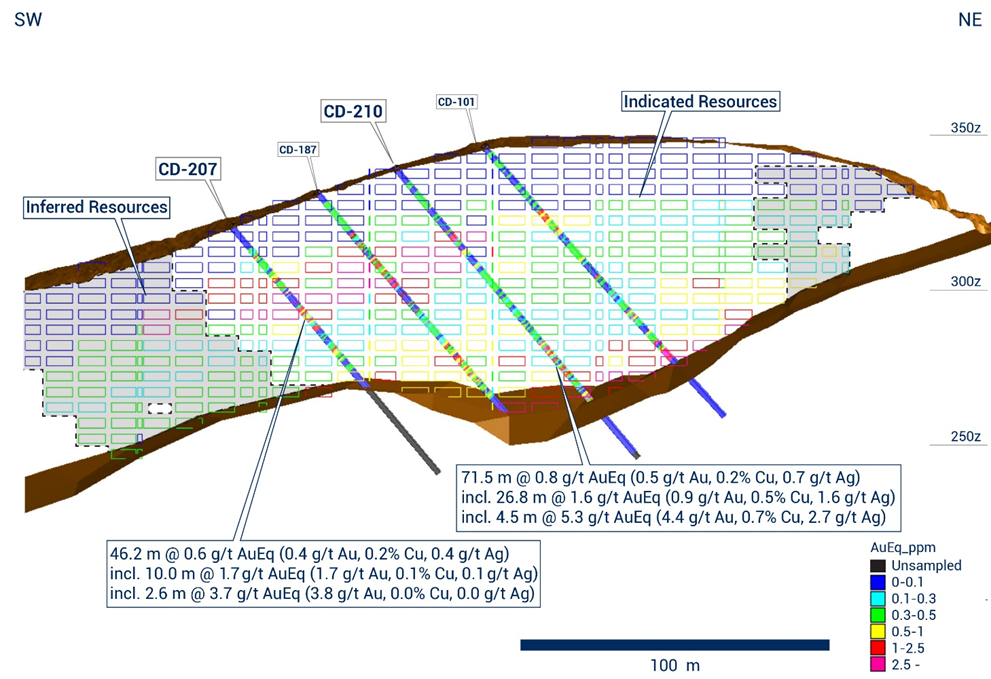

Dr. Adrian McArthur, CEO and President comments: "With the granting of the Álamo licence, Meridian has been given the keys to one of the most prospective zones within the VMS belt and the opportunity to test more of Cabaçal's greenfields upside. We can now launch a systematic program of soil geochemical surveys and geophysics to define future high priority drill targets. The Company is also very pleased with the ongoing infill drill program, as it continues to increase definition of high-grade trends which will be a key driver in unlocking early value in the development of the Cabaçal gold-copper rich VMS deposit. Having recently completed a successful capital raise for gross proceed of CAD 5.9M, Meridian is well financed to further Cabaçal's field work and complete the PEA." [1] Meridian News release of September 26, 2022 Álamo Exploration Licence Granting The Álamo exploration licence (867407/2008) has had its interim exploration report approved and has been renewed for a second three-year term. Álamo is part of the Cabaçal Purchase Agreement[2]. Its approval opens an extensive frontier along the southeast extension of the Mine Corridor, immediately along strike for the Santa Helena VMS deposit. The licence covers an area of 9,813 Ha, measuring 15km north-south and 10km east-west at its maximum extent. BP historically initiated but left open, soil geochemical surveys over the licence, leaving large Copper-Gold trends open to the south-east. Meridian commenced engagement with local landholders for exploration access agreements and initiated field reconnaissance in mid-December. Gossanous float was located along strike from the Santa Helena Mine associated with the projection of the BP Cu-Au-Zn soil anomalies compiled from historical records. Gossanous float was also located in the vicinity of the VTEM conductivity cluster and WorldView 3 satellite target in the southwest quadrant of the licence, where soil sampling has yet to be undertaken. Portable XRF readings detected anomalous copper and zinc readings, with laboratory analytical data pending. The early detection of gossan is encouraging and expanded programs of rock chip sampling, soil sampling, and surface geophysics are planned for 2023, continuing after the new year recess, to define drill targets in this new licence area. The licence was partially covered by a 2007 VTEM helicopter geophysical survey, providing detailed aerial magnetic and conductivity data. The conductivity trend marking the mine corridor position is evident extending southeast from the Santa Helena VMS deposit. A series of conductivity clusters at a similar threshold to the VTEM anomaly detected over the Cabaçal deposit are distributed over a trend of ~4km, commencing ~2.3 km from the limit of the Santa Helena historical resource. These anomalies lie close to where an onlapping younger cover sequence of the Aguapei Group overlie the basement sequence, with basement potentially locally covered by a sedimentary veneer. A second cluster of VTEM anomalies is located in the southwest quadrant of the licence area, where two NW-SE trending conductivity corridors extend over ~1.1 and 2.8 km respectively. These anomalies overlap with large alteration systems mapped by Meridian's 2021 WorldView 3 remote sensing satellite survey. Additional WorldView 3 alteration systems are located in the eastern sector of the licence area, in regions not covered by the VTEM survey or the historical soil sampling program. [2] Meridian News releases of August 26 and November 9, 2020  Figure 1: Location of Álamo licence, on the southeastern extension of the mine corridor, showing extent of geochemical coverage, WorldView 3 Satellite targets, soil coverage, and VTEM anomalies. Gridded conductivity image in the background, with the darker blue areas marking conductive trends. Cabaçal's Infill and Extensional Drill Program Drilling at Cabaçal continues to focus on extending and infilling the multiple higher-grade zones of the deposit which will be targeted for early development. Today's results continue to build on the recommended 25mx25m infill drill pattern for the CNWE's starter zone study area. CD-210 retuned 71.5m @ 0.8g/t AuEq (0.5 g/t Au, 0.2% Cu & 0.7g/t Ag) from 28.0m depth, including 26.8m @ 1.6g/t AuEq (0.9g/t Au, 0.5% Cu & 1.6g/t Ag) from 72.7m, including 4.5m @ 5.3g/t AuEq (4.4g/t Au, 0.7% Cu & 2.7g/t Ag) from 95.0m. The hole is positioned 25m down-dip from CD-101, which retuned 36.2m @ 1.3g/t Au, 0.2% Cu & 0.9g/t Ag from 54.6m including 7.8m @ 5.4g/t Au, 0.6% Cu & 1.8g/t Ag from 83.0m[1], and up-dip from CD-187, which returned 25.3m @ 0.8g/t Au, 0.1% Cu & 0.4g/t Ag from 15.0m[2]. CD-207, a further hole down-dip from CD-187, has retuned 46.2m @ 0.6g/t AuEq (0.4g/t Au, 0.2% Cu & 0.4g/t Ag) from 9.0m, including 10.0m @ 1.7g/t AuEq (1.7g/t Au, 0.1% Cu & 0.1g/t Ag) from 33.0m. Further on-section drilling is required to constrain grade up- and down-dip. The results continue to highlight the wide footprint of mineralization easily accessible to open-pit development. Another strong result delivered from recent drilling in the starter pit study area includes CD-216, which returned 35.1m @ 1.0g/t AuEq (0.7g/t Au, 0.2% Cu & 0.5g/t Ag) from 47.0m, including 3.3m @ 7.6g/t AuEq (6.0g/t Au, 1.1% Cu & 2.5g/t Ag) from 78.8m. The result is 25m up-dip from CD-100, which returned 50.8m @ 0.8g/t Au 0.5% Cu & 1.3g/t Ag from 41.9m, including 15m @ 1.3g/t Au, 1.0% Cu & 2.5g/t Ag from 75.2m[3]. The CD-216 result is much stronger than results immediately along strike (CD-1053, CD-189[4]), highlighting the importance of the 25x25m closure pattern. Additional drilling is being programed to test the shallow up-dip potential from this position. [3] Meridian Mining news release of May 3, 2022 [4] Meridian Mining news release of October 19, 2022 The latest results also include encouraging results in the down-dip infill holes from the 25x25m infill drill pattern for the CNWE's starter zone study area, amongst which include:

The immediate strike projection of the CD-211 position remains to be tested with the modern angled drilling program. Additional drilling is planned to both infill and extend the drilling pattern on peripheral areas of the deposit (both up-dip, down-dip, and along strike) where the resource is currently inferred or unclassified. Drilling has commenced to test the strike projection of the CD-193 position, with assays pending. This will test for potential extensions to shallow copper-gold mineralization. The CD-193 returned 15.6m @ 1.6 g/t AuEq (0.4 g/t Au, 0.8% Cu & 1.3 g/t Ag) from 42.0m, including 7.5m @ 3.0g/t AuEq (0.8g/t Au, 1.5% Cu & 2.1g/t Ag) from 48.9m6. Resource drilling will be interspersed with periodic exploration drilling, with an initial focus in the C2-A target area to the south-east of Cabaçal. Assays are pending from CD-218, a hole drilled as an initial test of a satellite IP / geochemical target over 600m along strike from the C4-A Gold-Silver precious metal discovery zone. Exploration agreements have been confirmed with various landholders in this region to conduct further exploratory drilling and the Company will liaise with the landholders to confirm optimal timing of drilling within the current wet-season conditions. Cabaçal's drilling activity is now in its annual recess until late January when the two rigs will recommence the infill, extensional and exploratory drilling program. [5] Meridian Mining news release of April 26, 2022 [6] Meridian Mining news release of November 21, 2022 [7] Grade difference in Au vs. AuEq grade due to factor for metallurgical recovery, reference to Notes.  Figure 2: Resource enhancement program, highlighting target corridors for resource conversion with recent post-resource intersections illustrated.  Figure 3: Cross section showing new results from CD-210 and CD-207 in relation to the resource block model coloured by AuEq. About Cabaçal In November 2020, Meridian signed a Purchase Agreement to acquire 100% ownership of certain licences covering the historical Cabaçal and Santa Helena mines and the along-strike licences, from two, private Brazilian companies ("Vendors"). Subsequently, Meridian expanded its land tenure to today's 50km of strike length. Cabaçal had two historical, shallow, high-grade selectively mined underground mines that cumulatively produced ~34 million pounds of copper, ~170,108 ounces of gold, ~1,033,532 ounces of silver and ~103 million pounds of zinc via conventional flotation and gravity metallurgical processes. Meridian has defined an open trend of shallow copper-gold mineralization centred on the Cabaçal Mine. This mineralization trends Northwest-Southeast, sub-crops along its Northeast limits, dips to the southwest at 26° and is up to 90m thick; presenting excellent open-pit geometry and mineral endowment. Meridian is currently focused on infill drilling along a 2,000m corridor along this trend. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within units of deformed metavolcanic-sedimentary rocks ("VMS"). A later-stage sub-vertical gold overprint event has emplaced high-grade gold mineralization truncating the dipping VMS layers. It was explored and developed by BP Minerals/Rio-Tinto from 1983 to 1991 and then by the Vendors in the mid-2000's. This historical exploration database includes over 83,000 metres of drilling, extensive regional mapping, soil surveys, metallurgy from production reports, and both surface and airborne geophysics. The majority of Cabaçal's prospects remain to be tested. Cabaçal has excellent infrastructure with access by all-weather roads, clean electricity provided by nearby hydroelectric power stations, and local communities provide mining services and employees. Cabaçal consists of 1 mining license, 1 mining lease application, and 7 exploration claims which total 44,265 hectares. The September 2022 Cabaçal mineral resource estimate consists of Indicated resources of 52.9Mt @ 0.6g/t Au, 0.3% Cu and 1.4g/t Ag and Inferred resources of 9.0Mt @ 0.7g/t Au, 0.2% Cu & 1.1g/t Ag (0.3 g/t AuEq cut-off grade), with strong optionality for targeting higher grade mineralization using a 0.5 AuEq cut-off for the future development studies. About Meridian Meridian Mining UK S is focused on the acquisition, exploration, and development activities in Brazil. The Company is currently focused on resource development of the Cabaçal VMS gold‐copper project, the regional scale exploration of the Cabaçal VMS belt, the exploration in the Jaurú & Araputanga Greenstone belts all located in the state of Mato Grosso, and exploring the Espigão polymetallic project in the State of Rondônia Brazil. On behalf of the Board of Directors of Meridian Mining UK S Dr. Adrian McArthur Email: info@meridianmining.net.br Technical Note Gold equivalents are calculated as: AuEq(g/t) = (Au(g/t) * %Recovery) + (1.492*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), where:

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield. Qualified Person Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/ Follow Meridian on Twitter: https://twitter.com/MeridianMining Further information can be found at: www.meridianmining.co FORWARD-LOOKING STATEMENTS Table 1: Dill results reported today.  SOURCE: Meridian Mining UK S View source version on accesswire.com: https://www.accesswire.com/734612/Meridian-Updates-on-Granting-of-lamo-Licence-and-Cabaals-Strong-Drill-Results More NewsView More

DoorDash’s Recent Stock Dip Equals 60% Upside ↗

Today 12:15 EST

Via MarketBeat

Tickers

DASH

Wall Street Loves Williams-Sonoma Right Now—Here’s Why the Stock Could Soar in 2026 ↗

Today 10:22 EST

Via MarketBeat

Tickers

WSM

Meta Wins FTC Fight, Keeps Instagram Growth Machine Intact ↗

Today 10:17 EST

Via MarketBeat

Tickers

META

Via MarketBeat

Tickers

SBUX

MP Materials Stock Soared After Earnings—Here’s the Real Reason ↗

November 22, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|