Meridian Delivers Strong Economics for Cabaçal's PEA:

By:

ACCESSWIRE

March 06, 2023 at 06:15 AM EST

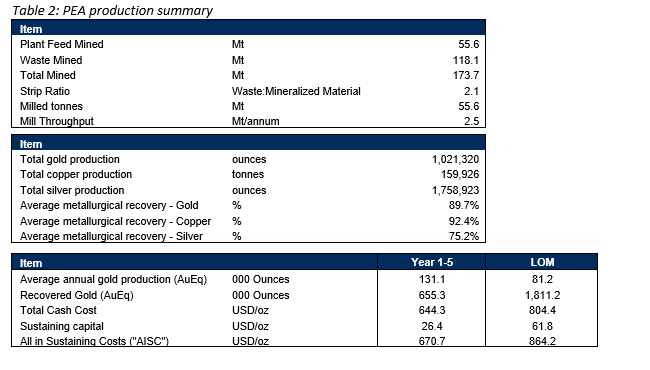

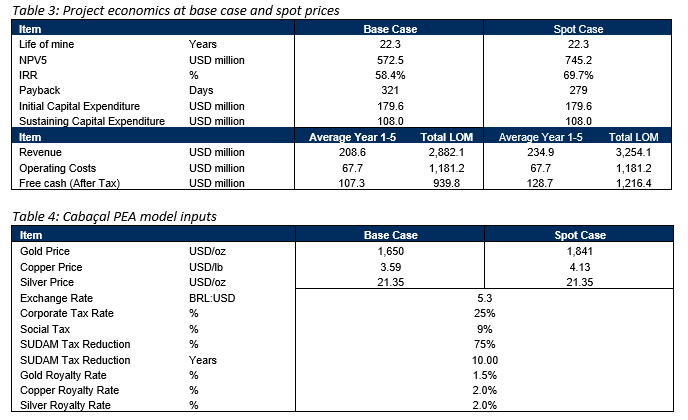

After-Tax NPV5 of USD 573 million, 58.4% IRR & 10.6 Month Payback LONDON, UK / ACCESSWIRE / March 6, 2023 / Meridian Mining UK S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQB:MRRDF) ("Meridian" or the "Company") is pleased to announce the positive results of the Preliminary Economic Assessment led by Ausenco Engineering Canada Inc. ("Ausenco") for the Cabaçal gold-copper deposit in Brazil ("Cabaçal" or the "Project"). The PEA study confirms the economic potential of the project, positioning it as a promising growth opportunity for the company. Cabaçal 2023 PEA Highlights: (All amounts are in United States Dollars unless otherwise stated)

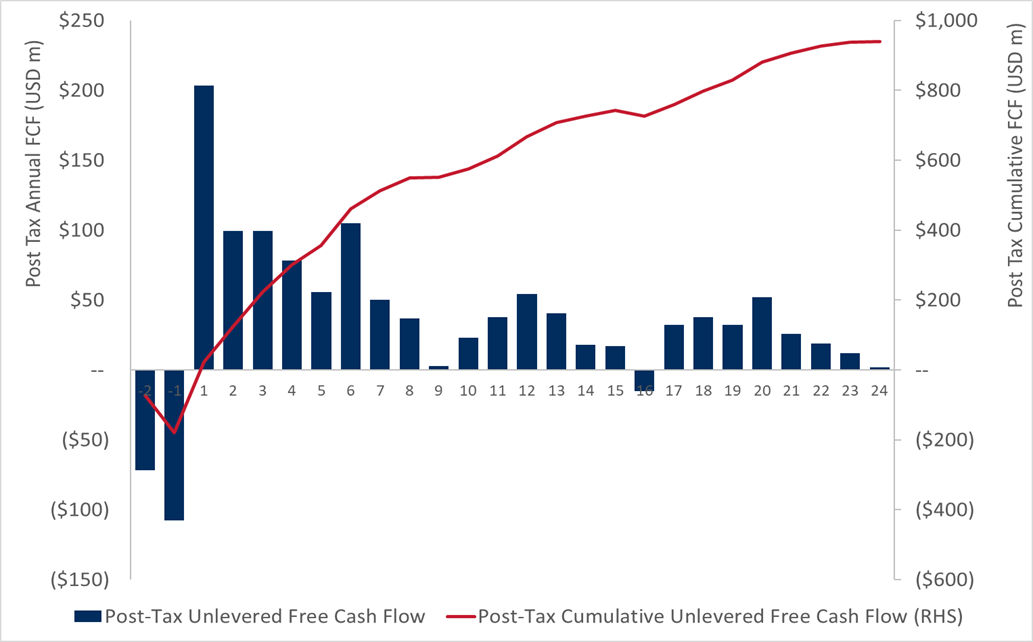

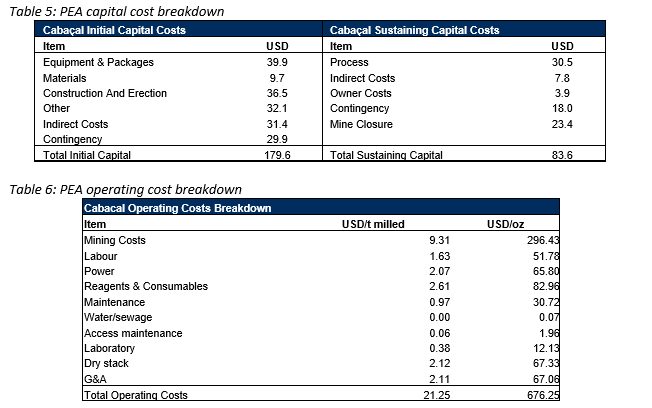

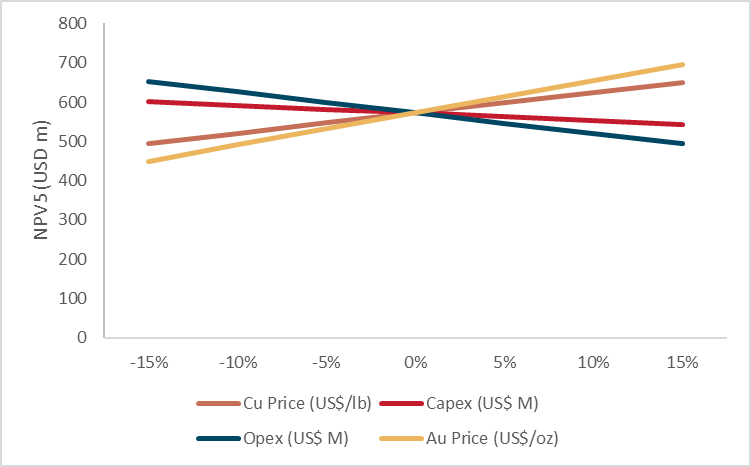

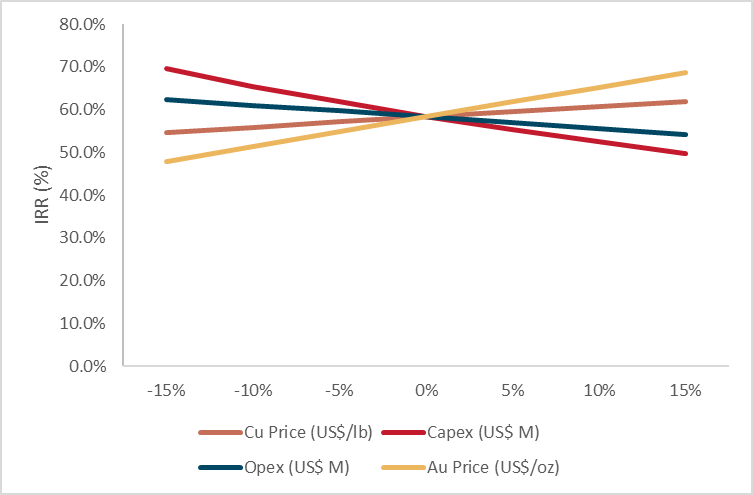

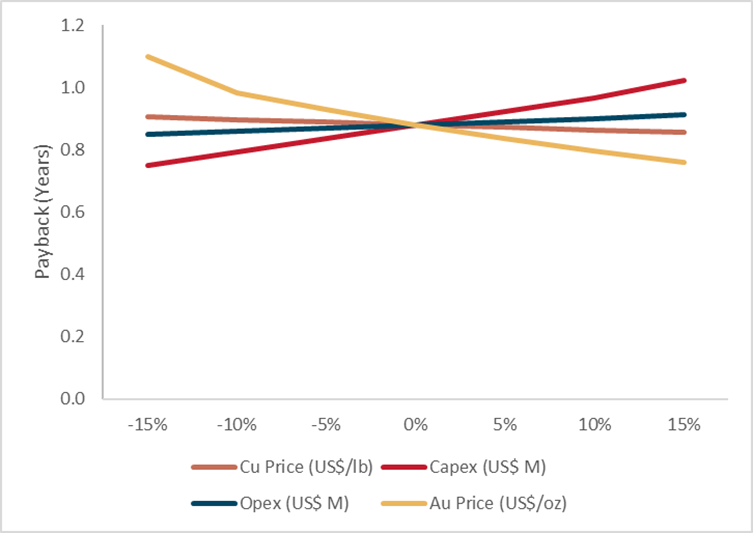

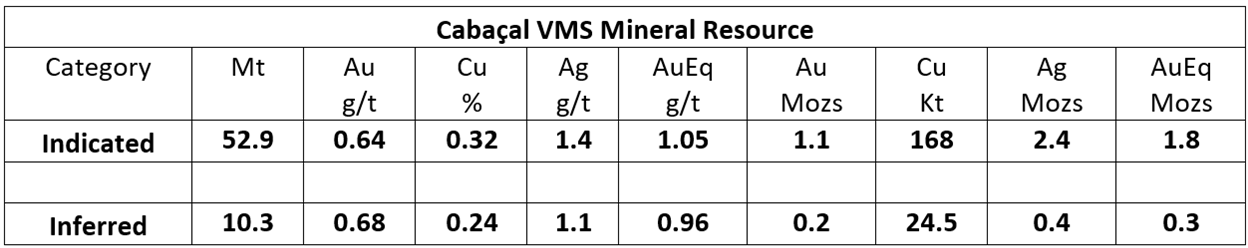

Meridian will host a Live Webcast to discuss the Cabaçal PEA Results on March 6, 2023 at 10:30am EST (7:30am PST). A presentation by management will be followed by Q&A. Conference Call Webcast and Dial in Details: Dr. Adrian McArthur, Meridian's CEO commented, "The PEA demonstrates Cabaçal's exceptional potential as a sustainable, low-cost open-pit mining operation capable of supplying both industrial and precious metals to the global market. The PEA study has shown exceptionally high-margin and meaningful returns, confirming both the quality of the asset and the expertise of our technical team. Within just two years of acquiring Cabaçal, we have produced our first economic study, outlining an after-tax NPV5 of $573m, which is a testament to our commitment to swift and effective progress. "The PEA lays a solid foundation for expansion, as the Company anticipates that optimization studies will confirm the potential for superior economic returns by increasing annual throughput from 2.5Mt to ~4Mt after year four, while still using the same resource. What excites us even more is the potential for further growth, not only at Cabaçal, but also at our other satellite targets, including the nearby St Helena mine within trucking distance. This presents a genuine opportunity for us to advance Cabaçal, as outlined in our PEA, and to systematically develop a cornerstone asset in a significant new gold and copper camp over time." "We are pleased to have a team of mining professionals already stationed in Brazil to advance Cabaçal through feasibility following the completion of the PEA. We extend our gratitude to Meridian's team, as well as Ausenco and GE21, for their role in delivering this report and contributing to the revival of the Cabaçal gold and copper mine." Table 1: Summary of Cabaçal PEA's NPV5 and IRR sensitivities to metal prices  PEA Results Summary   Figure 1: Cabaçal project annual and cumulative cash flow   Figure 2: NPV5 Sensitivity to costs and metal prices.  Figure 3: IRR sensitivity to costs and metal prices.  Figure 4: Payback sensitivity to costs and metal prices.  Study Contributors The PEA team was led by Ausenco, a global provider of consulting and engineering services for mining projects. Ausenco were supported by H&S Consultants Pty Ltd (resource estimation), GE21 Mineral Consultants Ltd (mine plan and schedule), SGS Lakefield Canada (metallurgy), Sete Soluções e Tecnologia Ambiental Ltda (environmental studies) and Hidrovia Hidrogeologia e Meio Ambiente Ltda (hydrological studies). Cabaçal Resource Estimate1 Table 7: Cabaçal Mineral Resource (Effective Date August 21st, 2022, 0.3 g/t AuEq cut-off)  Estimates are based on the Technical Report titled, "Independent Technical Report, Mineral Resource Estimate for the Cabaçal VMS deposit, Cabaçal Project, State of Mato Grosso, Brazil". The Mineral Resource estimate in the table above was prepared by specialist group, H&S Consultants Pty Ltd ("H&SC") and announced by Meridian on September 26, 2022. A technical report was filed on the Company's website and SEDAR within 45 days of this disclosure.

Significantly, the Mineral Resource is near-surface, and extends over 1.9km along strike with a prominent high-grade shallow gold zone in the Cabaçal Northwest Extension. Ongoing drilling on the margins of the Mineal Resource has intercepted significant zones of copper-gold mineralization. Further drill results are pending. The Mineral Resource estimate included in the PEA is reported according to the classification criteria set out in the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards for Mineral Resources and Reserves ("CIM Definition Standards"). These standards are internationally recognized and allow the reader to compare the Mineral Resource with that reported for similar projects. The PEA is preliminary in nature. The PEA mine schedule and economic assessment includes numerous assumptions and is based on both Indicated and Inferred mineral resources. Inferred resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the project economic assessments described herein will be achieved or that the PEA results will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Additional exploration will be required to potentially upgrade the classification of the Inferred Mineral Resources to be considered in future project evaluation studies. Mining

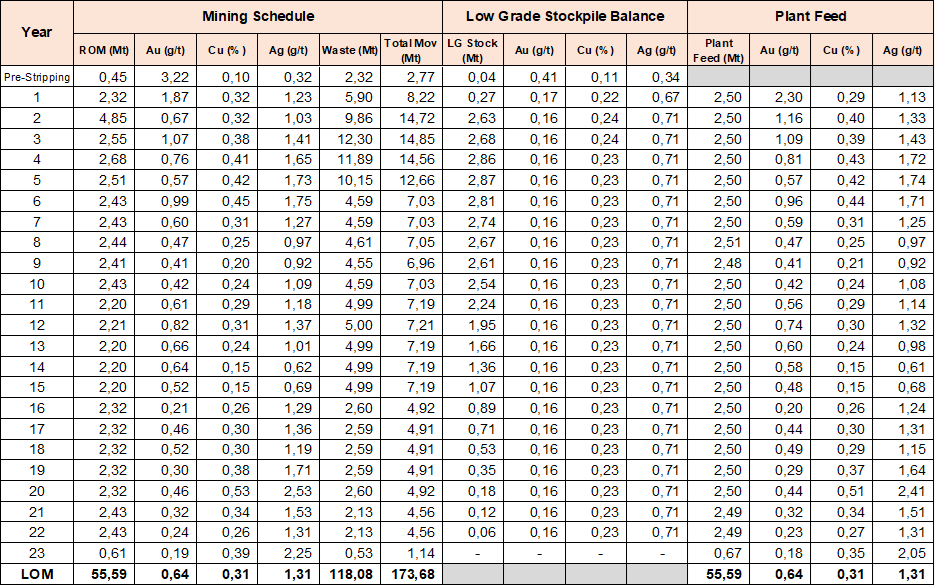

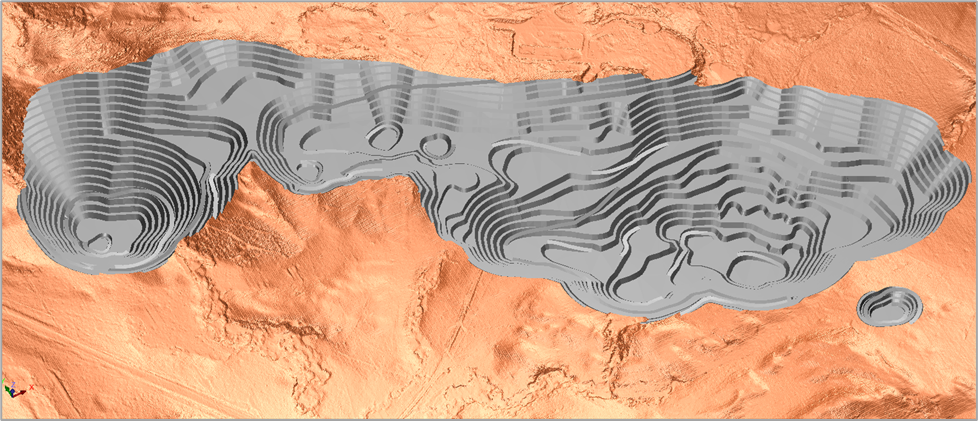

Cabaçal will be mined using the open pit method in 3 alternating shifts, operating 24 hours a day, 365 days a year. The mining movements were designed to produce enough ROM to feed a mineralized material processing plant with a nominal capacity of 2.5Mtpy and LOM of 22 years and 4 months. The mining will operate with block model of 10x10x5m and slope angle in the hang wall of 48º and following the mineralized material slope in the foot wall. Mining will be fully outsourced in the operations of mechanical blasting, loading and haulage. With a soft mineralized material - average WI of 11.8 - blasting will be carried out with a load ratio of 350g/t for mineralized material and 280g/t for waste. A dilution factor of 3% and mining recovery of 97% were considered. The transport distance from the mine to the ROM yard varies from 1.49Km in the pre-stripping to a maximum of 2.50Km in year 18. For the waste the transport distance will range from 1.02Km to 4.02Km in year 18. The transport of the mineralized material and waste will be carried out by 42t trucks manufactured in Brazil, a fact that contributes to the reduction of CAPEX and OPEX costs. For work associated with these trucks, 8.1t hydraulic excavators were dimensioned, which means 4.7 passes per truck loaded with mineralized material and 5.1 passes per truck loaded with waste. Trucks will transport the mineralized material for discharge directly into the crusher or to the ROM stockyard. When necessary to recover mineralized material from the ROM stockyard, a 13.7t wheel loader will be used. The waste will direct to the 3 projected waste dumps, each trip being directed to the pile closest to the pit region in mining activities at that time. From the 16th year onwards mining in the northwest extension of the pit will have been completed, thus permitting the return of waste material to this area and thereby reducing costs and environmental impacts. The table below shows annually, since pre-stripping, the mining plan (0.3 g/t AuEq. Cut-off) and the mineralized material feeding plan in the beneficiation plant. A mining plan was adopted that allows the plant to be fed with mineralized material of high gold content equivalent in the first years of production, storing low-grade mineralized material (LG) to be fed later. This allowed the elaboration of a plan optimizing the economic model of the project. The mining strip ratio results in an average value of 2.12. Table 8: Cabaçal mining schedule  Figure 5: The final pit shell of the Cabaçal mine.  Metallurgical Testing

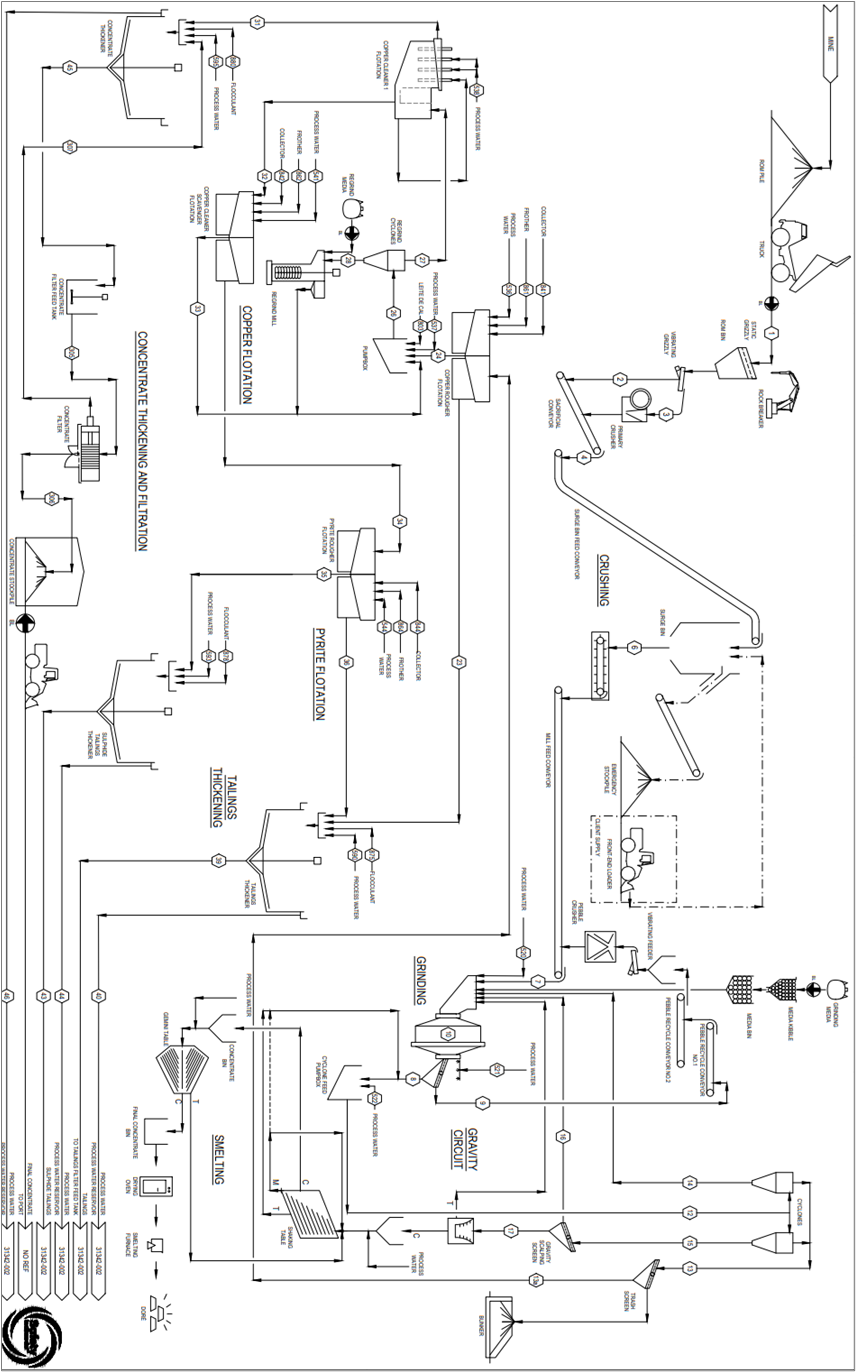

In 2022, Meridian selected samples from seven metallurgical drill holes to confirm historical Cabaçal process performance in a testwork program at SGS Lakefield, Canada. The holes provided samples from the four known main VMS systems at Cabaçal and most of the samples were within the expected head grade range for the deposit. A key feature of the Cabaçal mineralization is the low S:Cu ratio, which implies low pyrite/pyrrhotite content. The average feed would be expected to be ~ 1.5 S:Cu which confirms the historical mineralogy, suggesting that chalcopyrite is about 65% of the sulphides in the sulphide assemblage. Comminution tests were conducted. The average Bond Work Index was 11.2 which is considered to be relatively soft and not atypical for VMS deposits. The average Abrasion Index was 0.28 which suggests moderate abrasion. Samples were considered to be of medium to hard competency for SAG milling (average SMC A x b was 44.5). A three stage Gravity Recoverable Gold ("GRG") test was conducted on the Master Composite sample. The final GRG number is 64.3, which is considered quite high and is an indication that this material is amenable to gravity gold recovery. It is anticipated that gold not recovered in the gravity circuit will be picked up in the downstream flotation circuit. Rougher conditions for flotation testwork used natural pH, potassium amyl xanthate ("PAX") collector and Methyl Isobutyl Carbinol ("MIBC") frother. Sulphur recovery was typically around 95% leaving a non-acid generating tailing, which was typically less than 0.1% in sulphur content. Mass pull for the Master Composite was around 5 to 6 percent by weight. The rougher flotation was conducted mostly in solids percent around 35%. The slope between recovery and concentrate grade is quite flat, which indicates that the Cabaçal mineralization could produce higher grade concentrates. A 24.8 % copper concentrate was produced with 94.4% copper recovery, 87.2% gold recovery (gravity + float) and 81.9% silver recovery (gravity + float). The recoveries achieved are in line with the historic metallurgy. A pyrite concentrate was produced from the cleaner tailings to remove the acid generating minerals. The concentrate assayed 44% of sulphur with notable levels of gold and silver which could have market potential. A gravity circuit recovers the free gold which is converted to a doré product for sale. The sulphide minerals including copper, in the form of chalcopyrite, and associated gold and silver will be recovered by rougher flotation. The rougher concentrate is reground to 40 microns to separate the gangue material and lime is added to suppress the pyrite. The rougher and cleaner tails are expected to be low in sulphides, therefore non-acid generating and are combined for disposal together in a dry stacked facility. The pyrite float will either be sold or separately stored. Mineral Processing

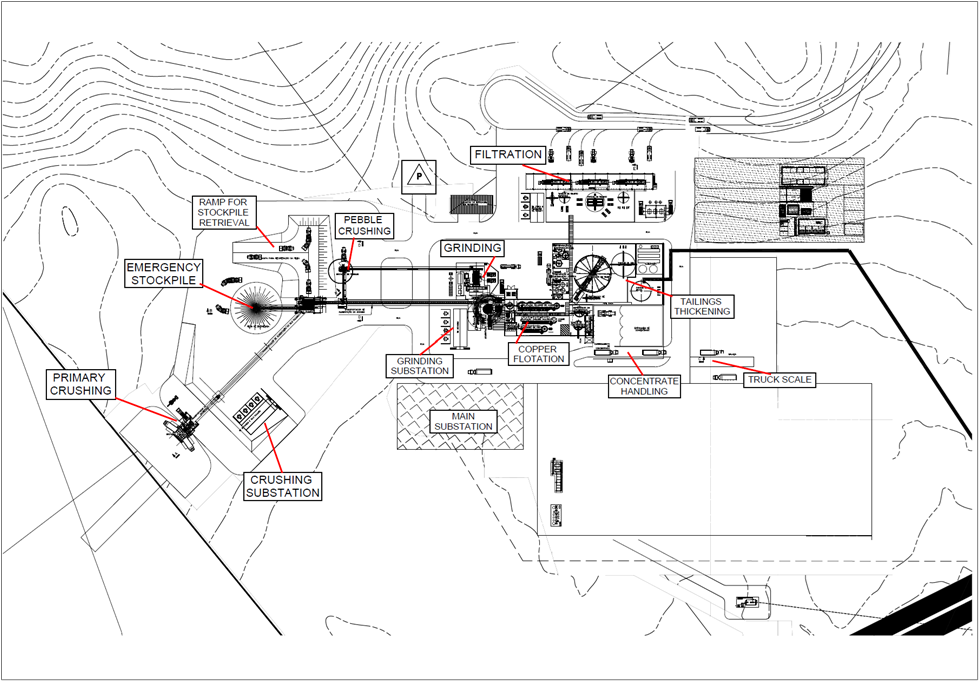

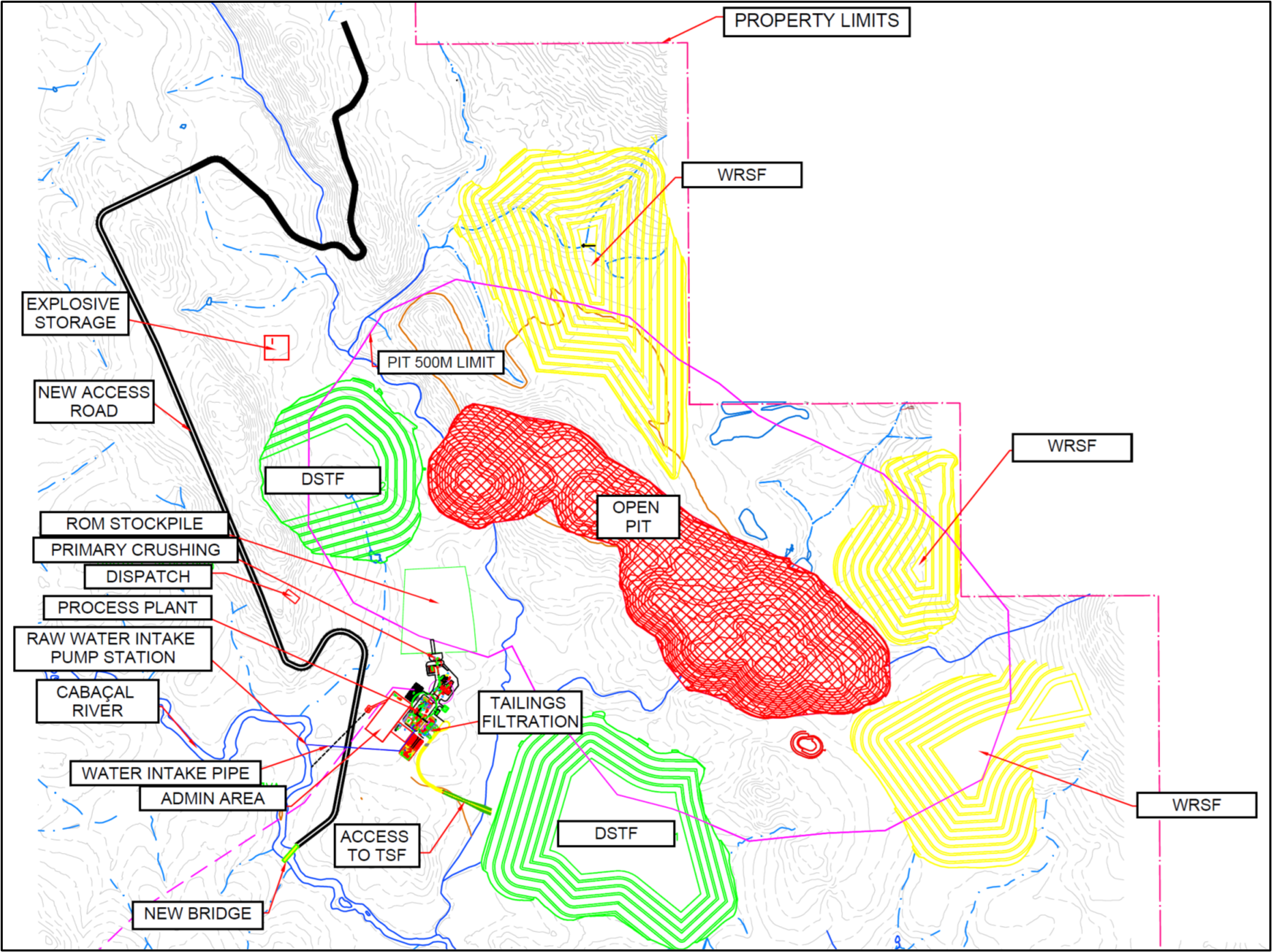

Based on the SGS testwork results, Ausenco designed a new process plant to process 2.5Mtpa of run-of-mine (ROM) feed from the Cabaçal open pit. The process comprises crushing and grinding to reduce the RoM material to a characteristic grind (P80) of 200 microns (µ). Cleaning then occurs in a Jameson cell followed by a single stage cleaner flotation cell. The Process flowsheet is illustrated in Figure 6. Figure 6: Cabaçal Process flowsheet diagram  Figure 7: Cabaçal process plant layout  Access and infrastructure Infrastructure associated with the historic Cabaçal Mine has been removed from site, aside from some old buildings which are being converted to field offices and core processing / storage facilities. The PEA therefore assumes that the new Cabaçal mine is effectively a greenfields project. Cabaçal is well supported by existing public infrastructure. It is located in the State of Mato Grosso, Brazil. It is accessed by sealed roads approximately 320 km west-north-west of the state capital Cuiabá, then a 30km all-weather gravel road from the Company's administrative base in the town of São José dos Quatro Marcos. The region is currently supplied by a high-voltage 34.5kV power line. Several hydroelectric power stations operate in the region. A potential route for the construction of an electric line of sufficient capacity for the Cabaçal project from the Araputanga substation to the Project area has been identified, extending over 21 km. Subject to permitting, water is potentially available from the nearby Cabaçal river. The process facility aims to recover and re-use as much process water as possible. All rainwater that comes in contact with mining operations is planned to be collected and either used on site or treated to required standards then released. Mine services and labour are readily available, primarily from nearby towns. The Cabaçal site plan is shown in Figure 8. The major project facilities include the open pit mines, tailings management facility (TMF), waste rock facilities, mine services and access roads. Site selection took into consideration the following factors:

Figure 8: Cabaçal mine site layout  Several areas have been identified to store waste rock from the mine. Three waste rock storage facilities (WRSF) have been identified in the PEA. The tailings will be filtered to produce a dry cake that will be trucked from the filter plant and stacked in two DSTFs. The DSTFs have been design to international standards for the PEA. Initial studies indicate that waste rock and tailings are potentially non-acid generating. Detailed waste material characterisation studies are planned for optimization of the long-term storage facility design for construction, safe operation and eventual closure. Environmental, Permitting & Stakeholder Engagement Meridian commenced baseline environmental and social impact data collection in January 2022. Meridian has engaged the Sete Soluções e Tecnologia Ambiental Ltda to undertake environmental studies, Hidrovia Hidrogeologia e Meio Ambiente Ltda has been engaged to undertake hydrogeological studies and Totem Consultoria em Arqueologia Ltda has been engaged to perform archaeological studies of the Cabaçal project area. These studies are ongoing and expected to be completed this year to enable the permitting application process to commence later this year. Meridian also undertakes its own stakeholder engagement processes which commenced on acquiring the Cabaçal project in 2021. The Cabaçal project is located within farming land, with no artisanal mining activity. Aside from local farmhouses, there are no settlements or population clusters within the project's active area. The nearest indigenous land is located 80km distant from Cabaçal to the northwest (Terra Indígena Figueiras). The project is located more than 25 km away from areas classified as Quilombolas (settlements first established by escaped slaves in Brazil, whose descendants have recognized land rights). No areas classified as of special tourist importance are present. Since commencement of activities, the Company has established written or verbal exploration access agreements with thirty-one landowners and continues to engage with others progressively along the trend of the licences. Upside and optimisation The PEA results provide a high-level estimate of the potential economic value of the mineral resources discovered to August 2022. In completing the PEA a number of opportunities were identified that would potentially enhance the Cabaçal project, subject to completing the necessary assessment. Some of this work is already underway These include:

Non-International Financial Reporting Standards ("IFRS") Financial Measures The Company has included certain non-IFRS financial measures in this news release, such as initial capital cost, sustaining capital cost, total capital cost, AISC, and capital intensity, which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. As a result, these measures may not be comparable to similar measures reported by other corporations. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Non-IFRS financial measures used in this news release and common to the gold mining industry are defined below. Total Cash Costs and Total Cash Costs per Ounce Total cash costs are reflective of the cost of production. Total cash costs reported in the PEA include mining costs, processing and water treatment costs, general and administrative costs of the mine, off-site costs, refining costs, transportation costs and royalties. Total cash costs per ounce is calculated as total cash costs divided by payable gold ounces. AISC and AISC per Ounce AISC is reflective of all of the expenditures that are required to produce an ounce of gold from operations. AISC reported in the PEA includes total cash costs, sustaining capital, closure costs and salvage, but excludes corporate general and administrative costs. AISC per ounce is calculated as AISC divided by payable gold ounces. Qualified Person Statement The PEA Study has an effective date of 01 March, 2023. It was authored by independent Qualified Persons and is in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects. The following Qualified Persons ("QPs") are responsible for the PEA Study and have reviewed the information in this news release that is summarized from the PEA Study in their areas of expertise:

Dr Adrian McArthur, Chief Executive Officer of Meridian Mining UK, a QP as defined in NI 43-101, has reviewed the PEA Study on behalf of the Company and has approved the technical disclosure contained in this news release. The PEA Study is summarized into a technical report that will be filed on the Company's website at www.meridianmining.co and on SEDAR at www.sedar.com in accordance with NI 43-101 within 45 days of this news release. Technical Notes Gold equivalents are calculated as: AuEq(g/t) = (Au(g/t) * %Recovery) + (1.492*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), where:

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield. Cautionary Statement on Forward-Looking Information All statements, other than statements of historical fact, contained in this press release constitute "forward-looking information" and "forward-looking statements" within the meaning of certain securities laws and are based on expectations and projections as of the date of this press release. Forward-looking statements contained in this press release include particularly, but without limitation, those related to the PEA Study results (as such results are set out in the various graphs and tables featured above, and are commented in the text of this press release), such as the Project's production profile, LOM, construction and payback periods, NPV, IRR, (direct/indirect, before/after tax) capital costs, contingency, industry leading operating costs, AISC, sustaining capital costs, free cash flows, M&I resources, open pit mineralization and waste extraction, mill feed, milling process and recovery, power supply arrangements and power consumption, and closure costs.

Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements. As future events and results could differ materially what is currently anticipated by the Company, notably (but without limitation) in the PEA Study, there can be no assurance that the PEA Study results will prove to be accurate as actual results and future events can differ materially from those anticipated in the PEA Study. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. Forward-looking statements are provided for the purpose of providing information about management's expectations and plans relating to the future. Readers are cautioned not to place undue reliance on these forward-looking statements as several important risk factors and future events could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions, and intentions expressed in such forward-looking statements. All forward-looking statements made in this press release are qualified by these cautionary statements and those made in the Company's other filings with the securities regulators of Canada including, but not limited to, the cautionary statements made in the relevant section of the Company's Management Discussion & Analysis. The Company cautions that the foregoing list of factors that may affect future results is not exhaustive, and new, unforeseeable risks may arise from time to time. The Company disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law. About Cabaçal In November 2020, Meridian signed a Purchase Agreement to acquire 100% ownership of certain licences covering the historical Cabaçal and Santa Helena mines and the along-strike licences, from two private Brazilian companies ("Vendors"). Subsequently, Meridian expanded its land tenure to today's 50km of strike length. Cabaçal had two historical, shallow, high-grade selectively mined underground mines that cumulatively produced ~34 million pounds of copper, ~170,108 ounces of gold, ~1,033,532 ounces of silver and ~103 million pounds of zinc via conventional flotation and gravity metallurgical processes. Meridian has defined an open trend of shallow copper-gold mineralization centred on the Cabaçal Mine. This mineralization trends Northwest-Southeast, sub-crops along its Northeast limits, dips to the southwest at 26° and is up to 90m thick; presenting excellent open-pit geometry and mineral endowment. Meridian is currently focused on infill drilling along a 2,000m corridor along this trend. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within units of deformed metavolcanic-sedimentary rocks ("VMS"). A later-stage sub-vertical gold overprint event has emplaced high-grade gold mineralization truncating the dipping VMS layers. It was explored and developed by BP Minerals/Rio-Tinto from 1983 to 1991 and then by the Vendors in the mid-2000's. This historical exploration database includes over 83,000 metres of drilling, extensive regional mapping, soil surveys, metallurgy from production reports, and both surface and airborne geophysics. The majority of Cabaçal's prospects remain to be tested. Cabaçal has excellent infrastructure with access by all-weather roads, clean electricity provided by nearby hydroelectric power stations, and local communities provide mining services and employees. Cabaçal consists of 1 mining license, 1 mining lease application, and 7 exploration claims which total 44,265 hectares. The September 2022 Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9Mt @ 0.6g/t Au, 0.3% Cu and 1.4g/t Ag and Inferred resources of 9.0Mt @ 0.7g/t Au, 0.2% Cu & 1.1g/t Ag2, with strong optionality for targeting higher grade mineralization for the future development studies. About Meridian Meridian Mining UK S is focused on the acquisition, exploration, and development activities in Brazil. The Company is currently focused on resource development of the Cabaçal VMS gold‐copper project, the regional scale exploration of the Cabaçal VMS belt, the exploration in the Jaurú & Araputanga Greenstone belts all located in the state of Mato Grosso and exploring the Espigão polymetallic project in the State of Rondônia Brazil. About Ausenco Engineering Ausenco is a global company ‘redefining what's possible'. Its team is based across 26 offices in 14 countries, with projects in over 80 locations worldwide. Combining their deep technical expertise with a 30-year track record, Ausenco provides innovative, value-add consulting and engineering studies and project delivery, asset operations and maintenance solutions to the mining & metals, oil & gas, and industrial sectors. On behalf of the Board of Directors of Meridian Mining UK S Dr. Adrian McArthur Email: info@meridianmining.net.br Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/ 1See Meridian news release September 26, 2022 https://meridianmining.co/press-releases/ 2Meridian Mining News Release of September 26, 2022 SOURCE: Meridian Mining UK S View source version on accesswire.com: https://www.accesswire.com/742083/Meridian-Delivers-Strong-Economics-for-Cabaals-PEA More NewsView More

MP Materials Stock Soared After Earnings—Here’s the Real Reason ↗

November 22, 2025

Via MarketBeat

Why Palantir Slide May Be a Setup for a Long-Term Opportunity ↗

November 22, 2025

Via MarketBeat

Attention Income Investors: This REIT Is on Sale ↗

November 22, 2025

Rocket Lab Just Had Its First Real Crash—The Rebound Could Be Bigger ↗

November 22, 2025

Via MarketBeat

Tickers

RKLB

MarketBeat Week in Review – 11/17 - 11/21 ↗

November 22, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|