Meridian Reports Shallow High-Grade Drill Results and 1km Step Out From Cabaçal

By:

ACCESSWIRE

July 11, 2023 at 06:30 AM EDT

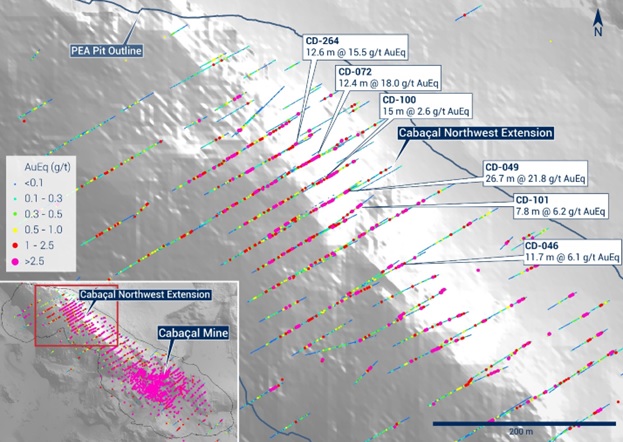

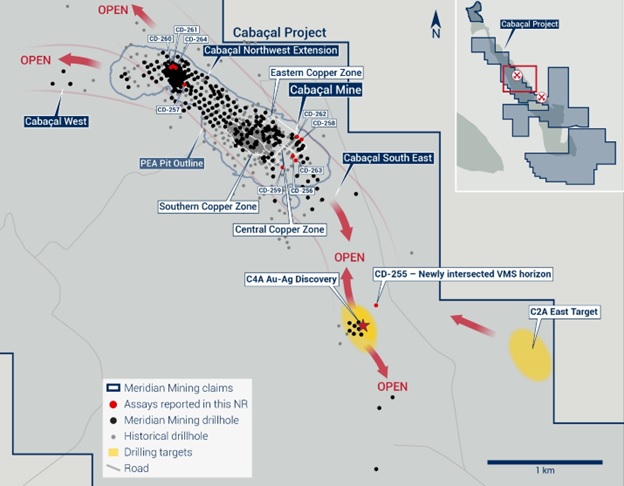

CD-264 returns 12.6m @ 15.5g/t AuEq from 43.3m in Northwest Extension LONDON, UK / ACCESSWIRE / July 11, 2023 / Meridian Mining UK S (TSX:MNO)(OTCQX:MRRDF)(Frankfurt/Tradegate:2MM) ("Meridian" or the "Company") is pleased to provide an update on its programs at Cabaçal, where CD-264 has returned further strong results from the Cabaçal Northwest Extension ("CNWE"). CD-264 has intersected a high-grade zone of 12.6m @ 15.5g/t AuEq (15.3g/t Au, 0.2% Cu & 0.6g/t Ag) from 43.3m, representing a northern extension of similar high-grade results (CD-049, CD-072[1]). This and additional results in the mine area show the potential to better define the projection of higher grade trends across the deposit. In parallel with the resource development program, the Company is advancing with exploration of near-mine extensions, with a copper gossan identified at surface, located 350m southeast of CD-240's copper feeder zone. Drilling has also confirmed the mineralized position of the VMS horizon in a 1km step-out to the southeast of the Cabaçal mine. Highlights Reported Today

Dr. Adrian McArthur, CEO, comments: "The CD-264 high-grade result of 12.6m @ 15.5g/t AuEq from 43.3m shows the value of infill drilling in achieving better definition of shallow high-grade trends within the Cabaçal deposit. The result continues to build on the importance of the CNWE as a focal point for early production scenarios. We are advancing Cabaçal vigorously on multiple fronts, with drilling, with geotechnical evaluation, and with environmental studies to support expanded production scenarios to be evaluated in a PEA update. Our goal remains to continue moving Cabaçal on its pathway to development, whilst laying the foundation to realize the broader discovery potential of this under-explored belt." Cabaçal Resource and Extensions   Additional drilling has been conducted in the Eastern Copper Zone ("ECZ"), where it was noted that the high-grade trends in the block model clustered around drill holes in areas of wider spacing, dropping off in-between. The new drill results show that basal concentrations of high-grade mineralization continue in these intervening areas (CD-256 & CD-263; Table 1). The cumulative effect of such results is expected to present a more accurate depiction of the higher grade population across the deposit as the drilling advances for the next resource update. The Company is currently conducting a Mise-a-la-Masse survey to follow up on the geophysical response of stringer sulphide mineralization in the ECZ, with the survey currently targeting extensions to the CD-254 result of 17.7m @ 1.6% CuEq / 2.4g/t AuEq from 50.0m[2]. Exploratory evaluation of the extensions of the Cabaçal system continues. CD-255 was a 1km step-out along the Cabaçal trend (Figure 3). It intersected a base metal horizon interpreted to be correlative with the Cabaçal system (5.3% Zn, 0.1% Cu, 0.2g/t Au & 32.4g/t Ag over 0.3m from 119.9m). The drill hole adds useful context for further planning of exploration for VMS sulphide mounds over time. The Company awaits the arrival of a down-hole probe from Geonics to assist in targeting thicker Cu-Zn-Ag-Au sulphide accumulations, which are less conductive than the copper dominant end member. Recent prospecting by the geological team has also located some copper gossan at the south-west flank of the resource area (Figure 4). Drilling in this area is sparse, with wide-spaced historical BP holes not sampled systematically from surface. The gossan is located ~350m southeast of CD-240's copper feeder zone, possibly in an up-dip position to the Cabaçal South FLTEM conductivity anomaly[3], where the Company has drilled just one hole. Following recognition of the gossan, trenching will be undertaken to guide further drilling and evaluate possible links to the feeder system.  Santa Helena Project Development  Table 1: Drilling results

About Meridian

Cabaçal is a gold-copper-silver rich VMS deposit with the potential to be a standalone mine within the 50km VMS belt. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within deformed metavolcanic-sedimentary rocks. A later-stage sub-vertical gold overprint event has emplaced high-grade gold mineralization cross-cutting the dipping VMS layers. The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold, 0.3% copper and 1.4g/t silver and Inferred resources of 10.3 million tonnes at 0.7g/t gold, 0.2% copper & 1.1g/t silver (at a 0.3 g/t gold equivalent cut-off grade), including a higher-grade near-surface zone supporting a starter pit. The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and 58.4% IRR from a pre-production capital cost of USD 180 million, leading to capital repayment in 10.6 months (assuming metals price scenario of USD 1,650 per ounces of gold, USD 3.59 per pound of copper, and USD 21.35 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 671 per ounce gold equivalent for the first five years, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.1:1, and the low operating cost environment of Brazil (see press release dated March 6, 2023). Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianminig.co and under the Company's profile on SEDAR at www.sedar.com. The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral. On behalf of the Board of Directors of Meridian Mining UK S Dr. Adrian McArthur Technical Notes • Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856 • Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686 • Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037 Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield The Mise-a-la-Masse survey is being conducted using the Company's in-house team, utilizing its GDD GRx8‐16c receiver and 5000W‐2400‐15A transmitter. Data is processed by the Company's independent consultancy Core Geophysics. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit. Qualified Person Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/ Follow Meridian on Twitter: https://twitter.com/MeridianMining Further information can be found at: www.meridianmining.co FORWARD-LOOKING STATEMENTS [1] Meridian News Release of November 29, 2021, September 7, 2021, May 3, 2022. [2] Meridian News release June 14, 2023 [3] Meridian News release April 12, 2021 SOURCE: Meridian Mining UK S View source version on accesswire.com: https://www.accesswire.com/766759/Meridian-Reports-Shallow-High-Grade-Drill-Results-and-1km-Step-Out-From-Cabaal More NewsView More

MP Materials Stock Soared After Earnings—Here’s the Real Reason ↗

November 22, 2025

Via MarketBeat

Why Palantir Slide May Be a Setup for a Long-Term Opportunity ↗

November 22, 2025

Via MarketBeat

Attention Income Investors: This REIT Is on Sale ↗

November 22, 2025

Rocket Lab Just Had Its First Real Crash—The Rebound Could Be Bigger ↗

November 22, 2025

Via MarketBeat

Tickers

RKLB

MarketBeat Week in Review – 11/17 - 11/21 ↗

November 22, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|