AmeriTrust Announces First Quarter 2025 Financial Results

By:

ACCESS Newswire

May 21, 2025 at 07:00 AM EDT

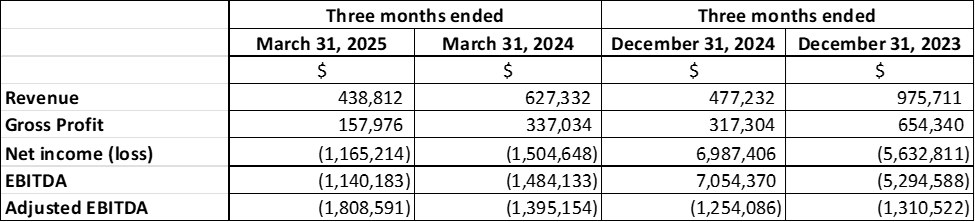

TORONTO, ON / ACCESS Newswire / May 21, 2025 / AmeriTrust Financial Technologies Inc. (TSXV:AMT)(OTCQB:AMTFF)(Frankfurt:1ZVA) ("AmeriTrust", "AMT" or the "Company"), a fintech platform targeting automotive finance, is announcing that it has filed its interim Consolidated Financial Statements and Management's Discussion and Analysis report for the three months ended March 31, 2025. These documents may be viewed under the Company's profile at www.sedarplus.ca. Cash on hand at March 31, 2025, was $7,874,401 compared to $10,231,191 as at December 31, 2024. The cash balance includes the cash collected from lease holders on the lease portfolios that are serviced by the Company and reported as accounts payable. At March 31, 2025, the Company reported a working capital surplus of $3,899,053 as compared to $4,002,995 at December 31, 2024. Revenue for the first quarter of 2025 decreased to $438,812 in comparison to Q4/2024 revenue of $477,232 as well as Q1/2024 revenue of $627,332. Adjusted EBIDTA loss for the first quarter of 2025 increased in comparison to Q4/2024 as well as Q1/2024 due to the increased in costs relating to personnel from an increase in head counts.  About AmeriTrust Financial Technologies Inc. For further information, please visit the AmeriTrust website or contact: Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release. Non-IFRS Measures: "EBITDA" is defined as Earnings before Interest, Taxation, Depreciation and Amortization. Management believes this is a useful metric in evaluating the ongoing operating performance of the Company. "Adjusted EBITDA" is defined as Earnings before Interest, Taxation, Depreciation, Amortization, Share Based Compensation expense, Provision for expected credit loss on lease contracts and revision to the provision, foreign exchange loss, and other one-time costs is an additional measure used by management to evaluate cash flows and the Company's ability to service debt. Adjusted EBITDA is a non-IFRS measure and should not be considered an alternative to operating income or net income (loss) in measuring the Company's performance. FORWARD-LOOKING STATEMENTS The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. As a result, we cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as at the date of this news release, and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law. This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws, unless an exemption from such registration is available. SOURCE: AmeriTrust Financial Technologies Inc. View the original press release on ACCESS Newswire More NewsView More

Wall Street’s Sleeping Giant: Is Amazon About to Wake Up? ↗

Today 18:29 EST

Via MarketBeat

Checkmate in the Cloud: ServiceNow's Shopping Spree ↗

Today 18:16 EST

Via MarketBeat

The Contrarian Case for MSTR Amid MSCI Delisting Debacle ↗

Today 17:46 EST

Via MarketBeat

Tickers

MSTR

Worried About Mag 7 Concentration Risk? This ETF Could Help ↗

Today 16:16 EST

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|