Here Is What Options Traders Expect for NVDA Stock After Nvidia Reports Q3 Results This Week

By:

Barchart.com

November 18, 2025 at 11:00 AM EST

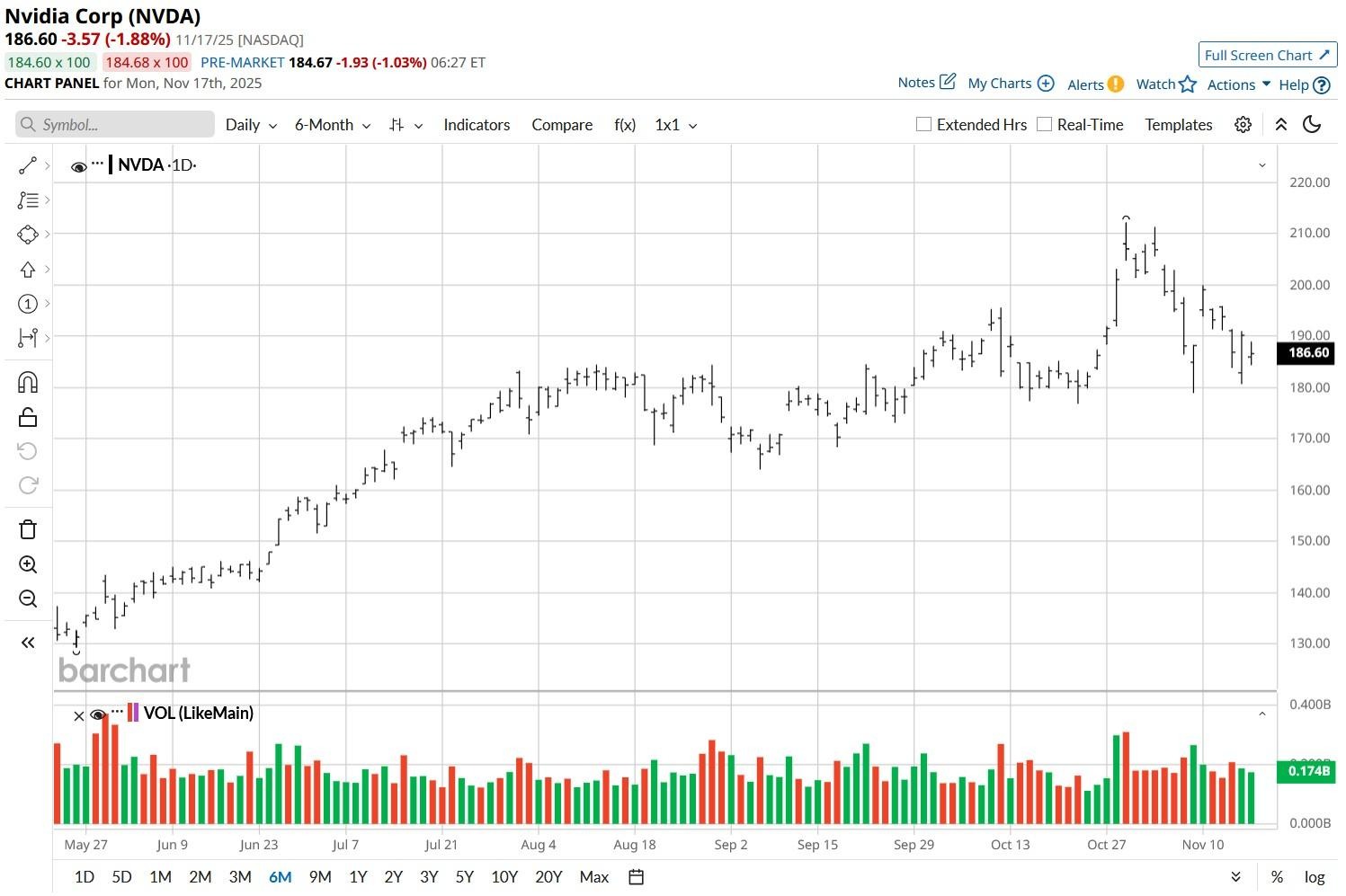

Nvidia (NVDA) shares have pulled back rather significantly in the build-up to the company’s third-quarter (Q3) earnings scheduled for Wednesday, Nov. 19. Consensus is for the artificial intelligence (AI) behemoth to earn $1.18 a share in Q3, which would translate to a little over 51% growth on a year-over-year basis. Can’t Get Enough Options?: Join the list for Barchart’s daily unusual options report, delivered free.

Despite recent weakness, however, Nvidia stock remains up roughly 100% versus its year-to-date low.

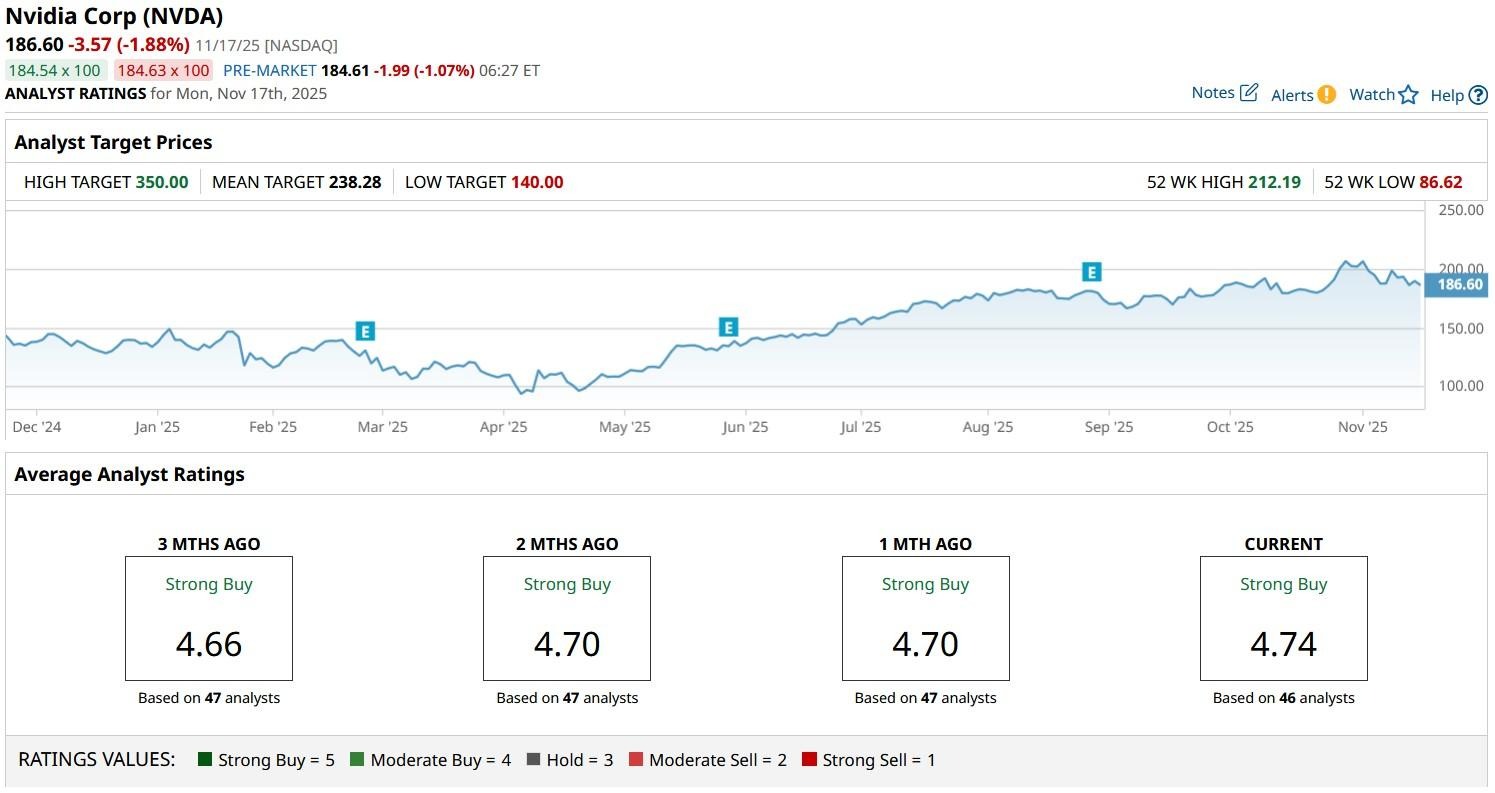

Where Options Data Suggests Nvidia Stock Is HeadedOptions traders seem to believe the ongoing selloff in NVDA stock will prove only temporary. According to Barchart, the implied move through the end of this week is 6.78%, which means the chipmaker could be trading near $192. Longer dated contracts expiring late February also currently suggest upside to roughly $210 or as much as 17% from current levels. While the lower bounds on these derivatives also indicate some downside risk, the put-to-call ratio keeping well below 1x confirms the data is skewed to the upside. Dan Ives Recommends Buying NVDA Shares Ahead of Q3 PrintWedbush’s senior analyst Dan Ives expects Nvidia to come in handily above Street estimates in its fiscal Q3, reflecting strong initial traction for Blackwell. Speaking with CNBC this week, Ives downplayed concerns of an AI bubble as demand-to-supply for NVDA chips currently sits at a whopping 12 to 1. “We’re in the third inning of where this is all playing out, and I think that’s why this is an inflection point.” Ives maintained his “Outperform” rating on Nvidia shares heading into the AI darling’s earnings with a $210 price target indicating potential upside of more than 16% from here. During the same CNBC interview, Deepwater’s senior expert Gene Munster also argued that a rival designing a better chip than NVDA “is not even in the equation” for another six quarters at least. Wall Street Remains Bullish on Nvidia Heading into 2026Other Wall Street analysts are even more bullish on NVDA shares than Dan Ives. The consensus rating on Nvidia stock currently sits at “Strong Buy” with the mean target of roughly $238 indicating potential upside of more than 30% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

3 Emerging Market Stocks to Buy and Hold for 2026 ↗

Today 10:35 EST

Via MarketBeat

4 Memorable Ways to Play the HBM Market Boom ↗

Today 9:41 EST

Salesforce Just Triggered a Powerful Buy Signal for 2026 ↗

Today 8:24 EST

Via MarketBeat

Tickers

CRM

Via MarketBeat

Tickers

CRWD

Why 2026 Could Be the Year D-Wave Breaks Out ↗

December 22, 2025

Via MarketBeat

Tickers

QBTS

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|