This Blue-Chip Stock Is a Heavy Weight in Weight-Loss Drugs

By:

Barchart.com

November 19, 2025 at 10:55 AM EST

Today’s Featured StockValued at $973.8 billion, Eli Lilly (LLY) is one of the world’s largest pharmaceutical companies. It boasts a diversified product profile including a solid lineup of new successful drugs. It also has a dependable pipeline as it navigates through challenges like patent expirations and rising pricing pressure on its U.S. diabetes franchise. Its pharmaceutical product categories are neuroscience, diabetes, oncology, immunology, and others. Eli Lilly has also made waves in the weight-loss drug space with its GLP-1, called Zepbound, and an experimental oral medicine called orforglipron. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

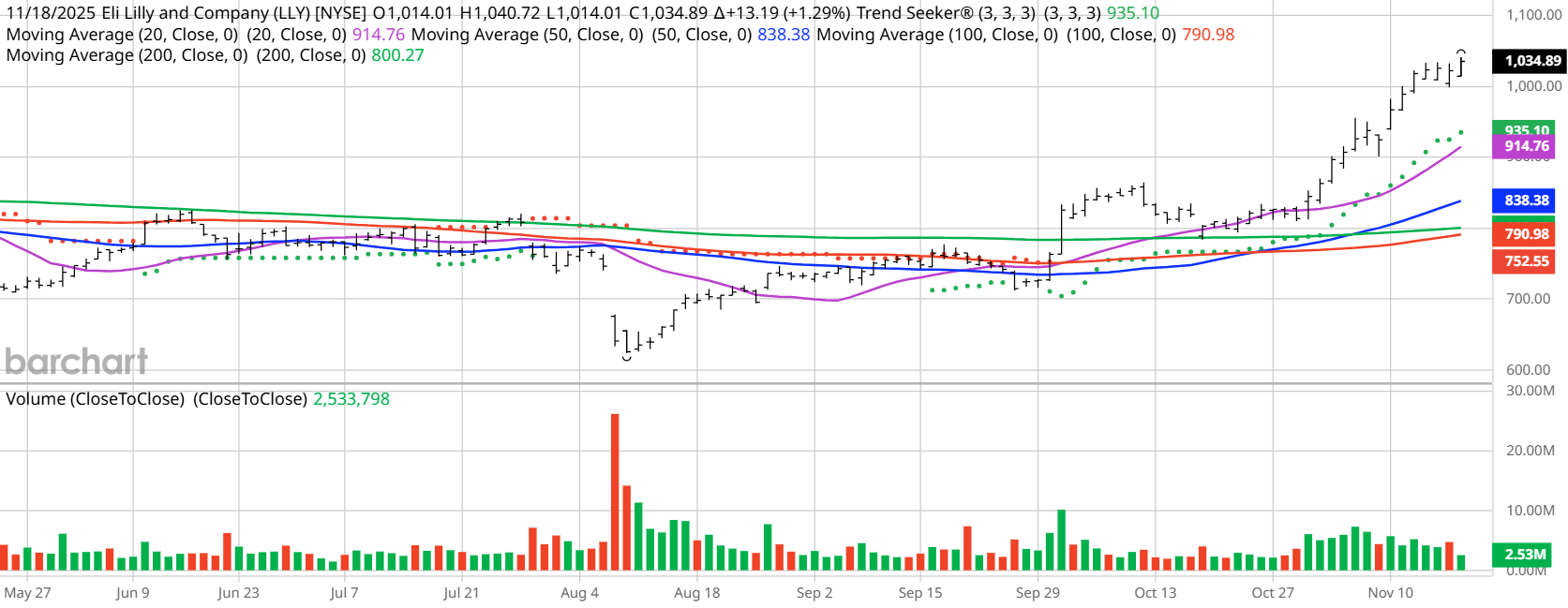

What I’m WatchingI found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. LLY checks those boxes. Since the Trend Seeker signaled a new “Buy” on Oct. 1, the stock has gained 26.3%.  Barchart Technical Indicators for Eli LillyEditor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock. Eli Lilly hit an all-time high of $1,045.60 in morning trading on Nov. 19.

Don’t Forget the Fundamentals

Analyst and Investor Sentiment on Eli LillyI don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping stock, it’s hard to make money swimming against the tide. It looks like both Wall Street and individual investors like this stock.

The Bottom Line on Eli LillyWith very high financial strength and inventory of products customers like, long-term investors might want to put this on a dividend reinvestment (DRIP) plan. Today’s Chart of the Day was written by Jim Van Meerten. Read previous editions of the daily newsletter here. Additional disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance. On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

Worried About Inflation? These 3 ETFs Offer Real Protection ↗

Today 11:10 EST

Klarna's Crypto Play: A Plan to Fix Its Profit Problem ↗

Today 8:36 EST

Via MarketBeat

Meta Platforms May Ditch NVIDIA Chips—Here’s Why Investors Care ↗

November 29, 2025

Via MarketBeat

SoFi Technologies: From Fintech Speculation to Profit Engine ↗

November 29, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|