Ingersoll Rand Stock: Is Wall Street Bullish or Bearish?

By:

Barchart.com

November 02, 2025 at 06:01 AM EST

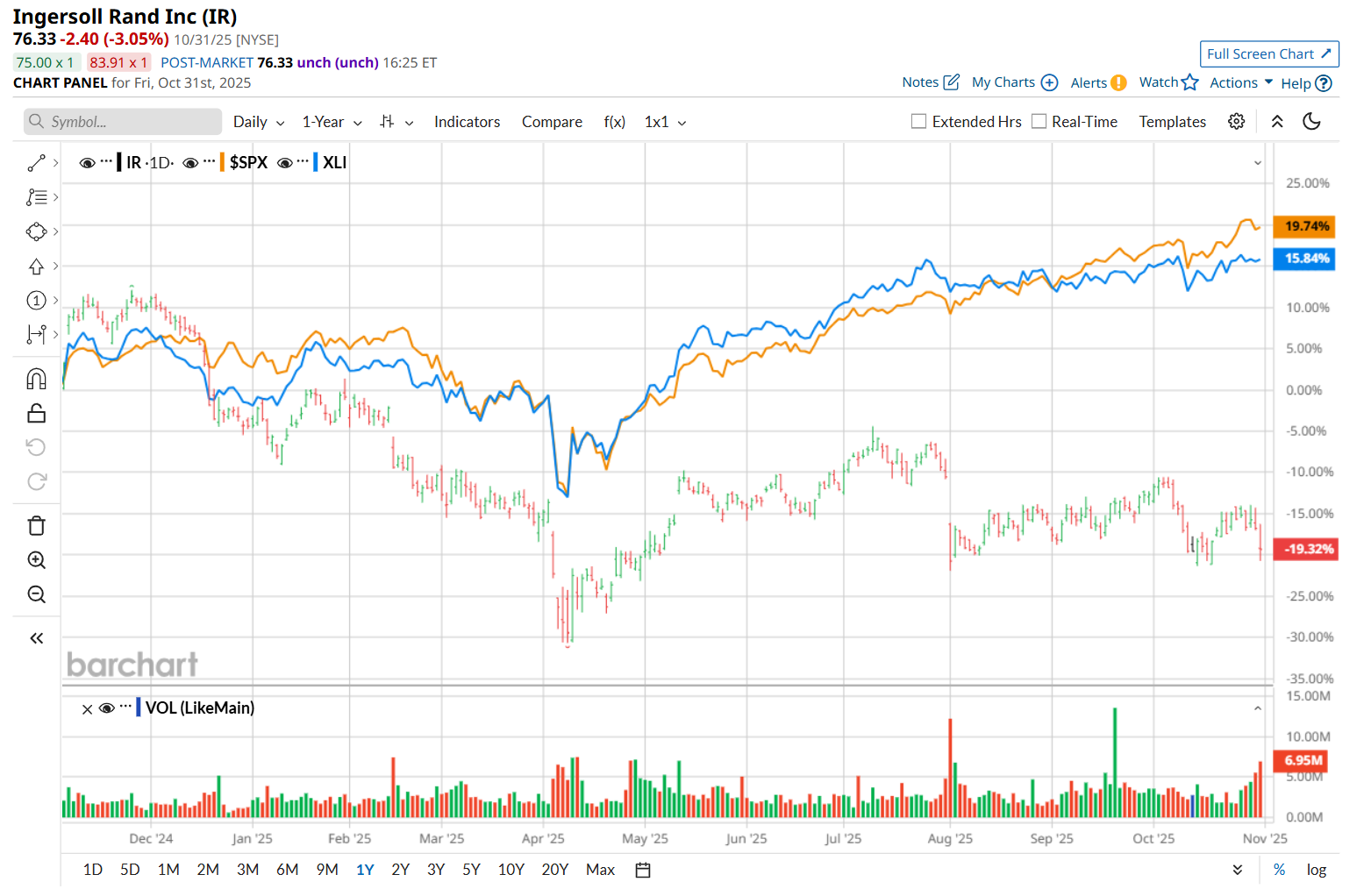

Davidson, North Carolina-based Ingersoll Rand Inc. (IR) provides mission-critical air, fluid, energy, and medical technologies, services, and solutions. Valued at a market cap of $30.3 billion, the company serves a wide range of industries, including manufacturing, oil & gas, aerospace, life sciences, food & beverage, and water treatment. This industrial company has considerably lagged behind the broader market over the past 52 weeks. Shares of IR have declined 21.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 17.7%. Moreover, on a YTD basis, the stock is down 15.6%, compared to SPX’s 16.6% uptick. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

Narrowing the focus, IR has also underperformed the Industrial Select Sector SPDR Fund’s (XLI) 14.5% return over the past 52 weeks and 17.7% surge on a YTD basis.

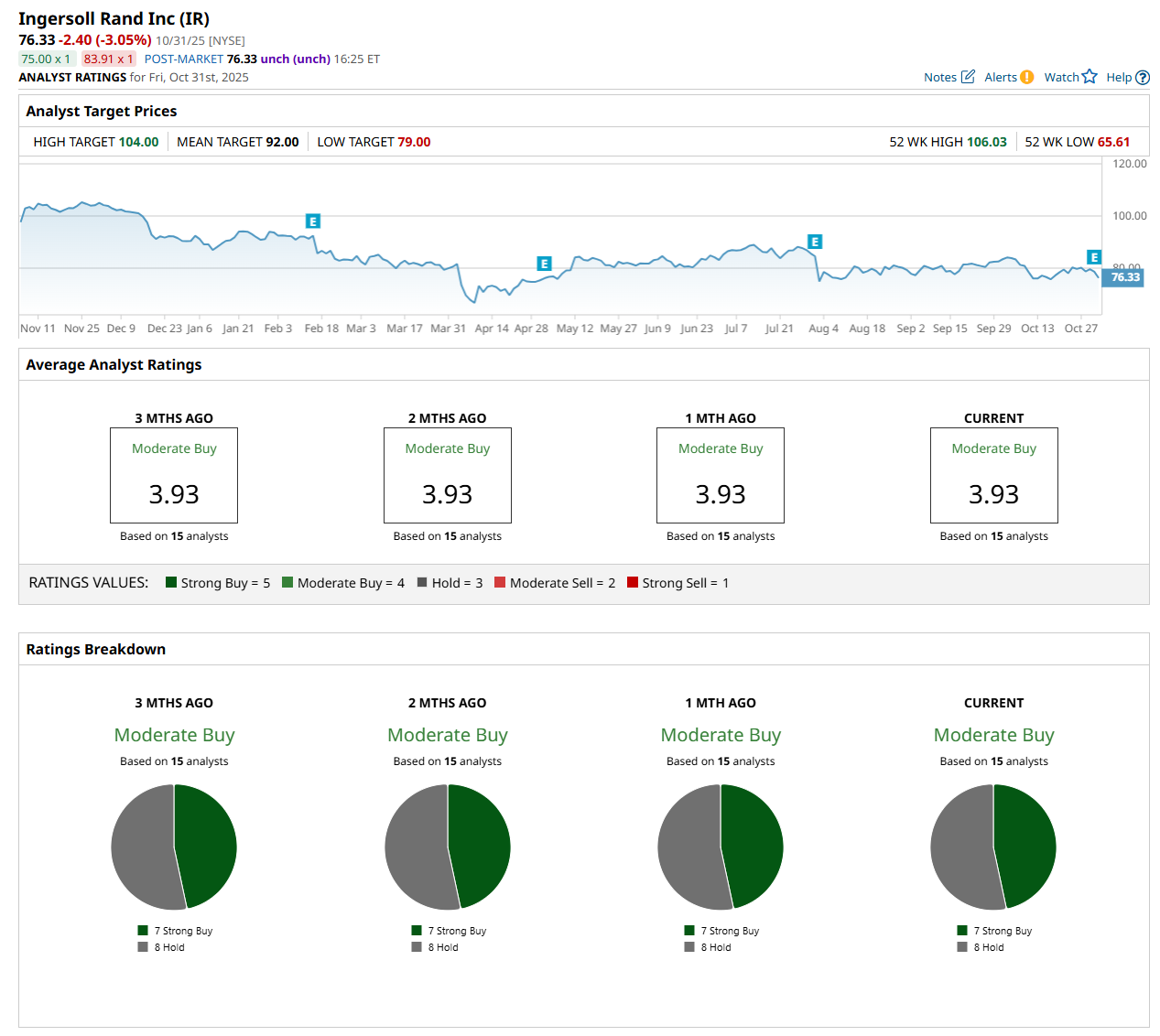

On Oct. 30, IR delivered its Q3 results, and its shares plunged 3.1% in the following trading session. The company’s revenue climbed 5.1% year-over-year to $2 billion, surpassing consensus estimates by a slight margin. Meanwhile, its adjusted EPS improved 2.4% from the year-ago quarter to $0.86, meeting analyst expectations. However, a decline in organic revenue and adjusted EBITDA margin within its Industrial Technologies and Services (IT&S) segment signalled weakness in a key business area, which might have weighed on investor sentiment. For the current fiscal year, ending in December, analysts expect IR’s EPS to grow 1.3% year over year to $3.22. The company’s earnings surprise history is mixed. It met the consensus estimates in three of the last four quarters, while missing on another occasion. Among the 15 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on seven “Strong Buy,” and eight "Hold” ratings.

The configuration has remained consistent over the past three months. On Oct. 31, Nathan Jones from Stifel Financial Corp. (SF) maintained a "Hold" rating on IR, with a price target of $79, indicating a 3.5% potential upside from the current levels. The mean price target of $92 represents a 20.5% premium from IR’s current price levels, while the Street-high price target of $104 suggests an ambitious upside potential of 36.3%. On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

These 3 Little-Known Stocks Are Analyst Favorites ↗

Today 8:48 EST

Via MarketBeat

Via MarketBeat

Rubrik’s Massive Rebound: Why the Next Leg Higher Could Be Fast ↗

December 07, 2025

Five Below and Dollar Tree Earnings Signal a Shopper Shift ↗

December 07, 2025

Via MarketBeat

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

December 06, 2025

Via MarketBeat

Tickers

ULTA

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|