The Short-Sellers May Be Right About This Red-Hot Pharma Stock

By:

Barchart.com

November 24, 2025 at 11:05 AM EST

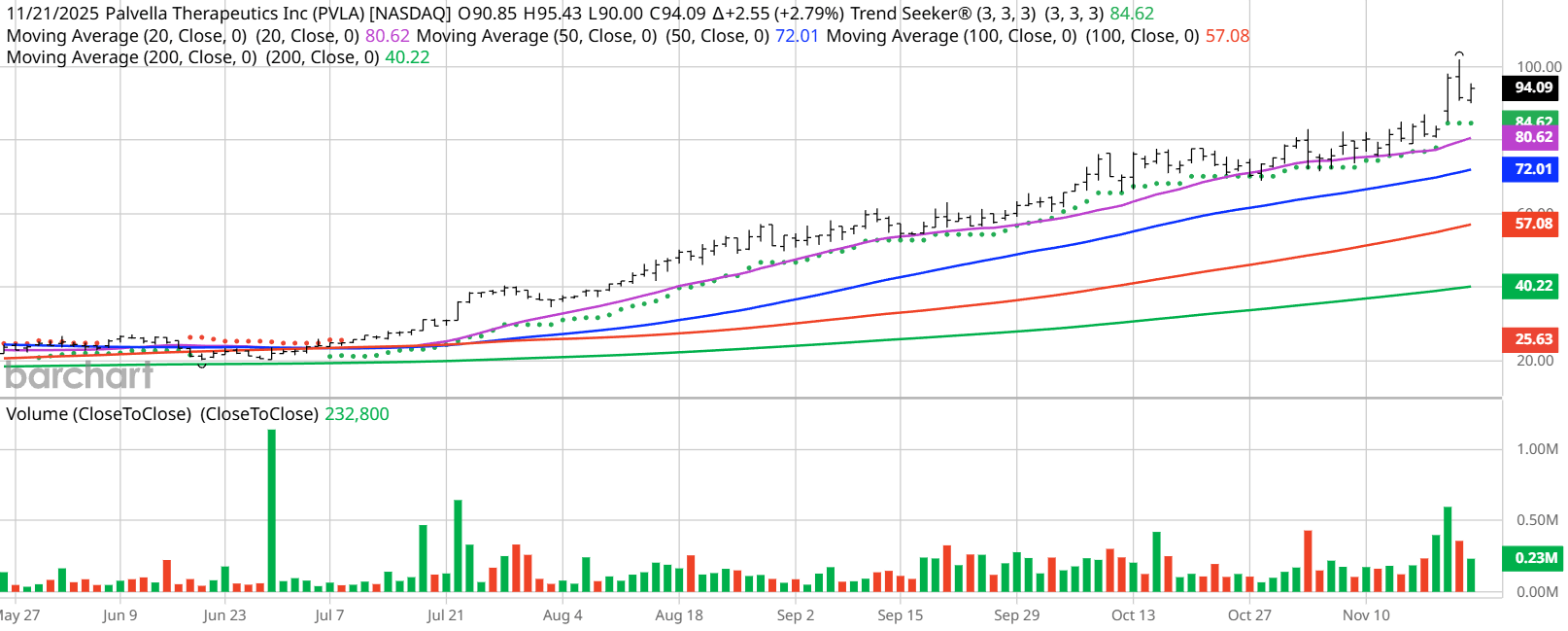

Author’s Note: Remember these articles are entitled “Chart of the Day.” I'm featuring this company for its chart, not its fundamentals, of which there are none. Make sure you read my conclusion at the end of this newsletter. Today’s Featured StockValued at $1.11 billion, Palvella Therapeutics (PVLA) is a clinical-stage biopharmaceutical company focused on developing and commercializing novel therapies to treat patients suffering from serious, rare genetic skin diseases. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

What I’m WatchingI found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. PVLA checks those boxes. Since the Trend Seeker signaled a new “Buy” on July 9, the stock has gained 295.85%.  Barchart Technical Indicators for Palvella TherapeuticsEditor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock. Palvella hit a 2-year of $103 in morning trading on Nov. 24.

Don’t Forget the Fundamentals

Analyst and Investor Sentiment on Palvella TherapeuticsI don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping stock, it’s hard to make money swimming against the tide. It looks like Wall Street forecasts pie in the sky, but individual investors are not interested in this stock.

The Bottom Line on Palvella TherapeuticsAgain, we have a pharma company which has no revenue and no products in the FDA approval pipeline, so why the price momentum? This stock’s momentum seems to be driven by cap-weight ETFs. When it debuted on Wall Street, total market ETFs bought in, driving up prices in the secondary market. As the price rose, the broad market ETFs like those that track the Russell 3000 and now the Russell 2000, and so on, have bought in. Watch to see if the short interest keeps growing. Wall Street is betting long, but the shorts may be right. PVLA is for speculators, not investors. Today’s Chart of the Day was written by Jim Van Meerten. Read previous editions of the daily newsletter here. Additional disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance. On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

Warner Bros. Sale Rumors Heat Up: What Investors Need to Know ↗

Today 18:23 EST

Via MarketBeat

From Science Project to Solvent: WeRide’s 761% Revenue Surge ↗

Today 17:48 EST

Via MarketBeat

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|