What Are Wall Street Analysts' Target Price for United Rentals Stock?

By:

Barchart.com

November 24, 2025 at 08:58 AM EST

With a market cap of $50.9 billion, United Rentals, Inc. (URI) is a leading equipment rental company operating through its General Rentals and Specialty segments across the United States, Canada, Europe, Australia, and New Zealand. The company provides a wide range of construction and industrial equipment rentals, sales, and related services to contractors, industrial clients, municipalities, and homeowners. Shares of the Stamford, Connecticut-based company have lagged behind the broader market over the past 52 weeks. URI stock has fallen 5.1% over this time frame, while the broader S&P 500 Index ($SPX) has risen 11%. However, shares of the company have soared 14.4% on a YTD basis, outpacing SPX’s 12.3% gain. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

Focusing more closely, shares of the equipment rental company have underperformed the Industrial Select Sector SPDR Fund’s (XLI) 4.9% return over the past 52 weeks.

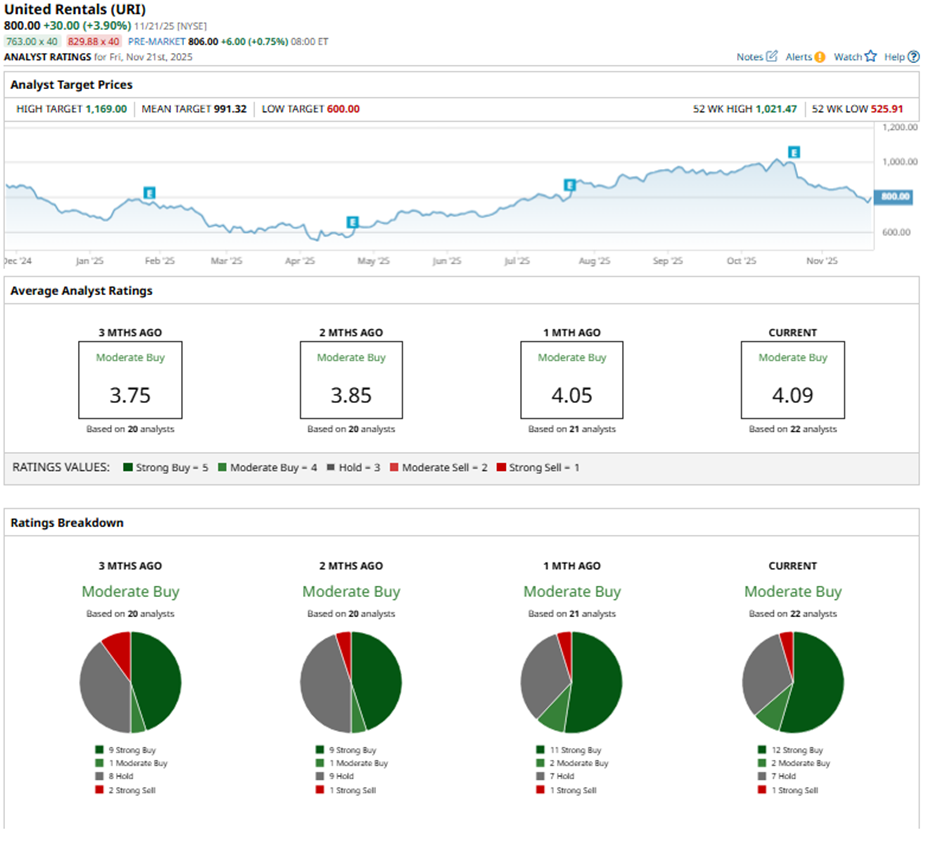

Despite reporting better-than-expected Q3 2025 revenue of $4.23 billion on Oct. 22, shares of URI tumbled 7.8% the next day as the company posted adjusted EPS of $11.70 missed expectations. Investor sentiment weakened further as inflation, elevated interest rates, and rising operating costs squeezed margins and reduced profitability. For the fiscal year ending in December 2025, analysts expect United Rentals’ adjusted EPS to decrease marginally year-over-year to $43.13. The company's earnings surprise history is United Rentals. It topped the consensus estimates in one of the last four quarters while missing on three other occasions. Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, two “Moderate Buys,” seven “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with nine “Strong Buy” ratings on the stock. On Nov. 12, Argus Research analyst Kristina Ruggeri raised its price target on United Rentals to $945 and reiterated a “Buy” rating. The mean price target of $991.32 represents a 23.9% premium to URI’s current price levels. The Street-high price target of $1,169 suggests a 46.1% potential upside. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

Warner Bros. Sale Rumors Heat Up: What Investors Need to Know ↗

Today 18:23 EST

Via MarketBeat

From Science Project to Solvent: WeRide’s 761% Revenue Surge ↗

Today 17:48 EST

Via MarketBeat

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|