China Wants to Buy U.S. Wheat. How to Play Wheat Futures Now.

By:

Barchart.com

November 03, 2025 at 10:09 AM EST

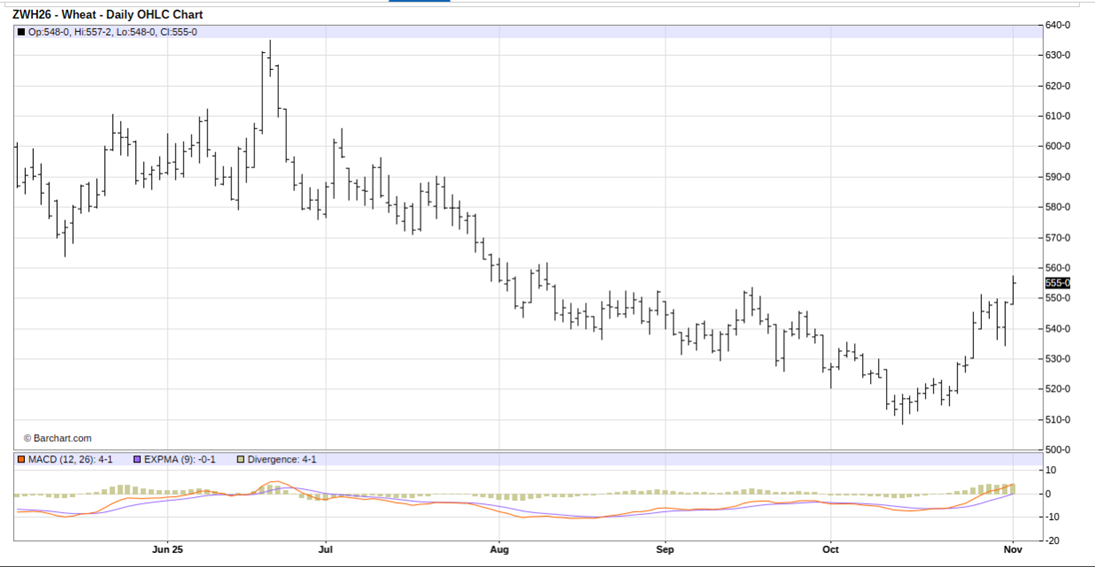

March soft red winter wheat futures (ZWH26) present a buying opportunity on more price strength. See on the daily bar chart for the March soft red winter wheat futures that prices are now trending up and have just hit a 2.5-month high. See, too, at the bottom of the chart that the moving average convergence divergence (MACD) indicator is in a bullish posture as the blue MACD line is above the red trigger line and both lines are trending up. The bulls have the near-term technical advantage and have momentum. Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Fundamentally, the weekend news that China is seeking to buy U.S. wheat, after the U.S.-China trade truce last week, amid easing U.S.-China tensions, has only added to ideas of a tightening global supply and demand balance sheet for wheat. A move in March SRW wheat futures above chart resistance at today’s high of $5.57 1/4 would become a buying opportunity. The upside price objective would be $6.20 or above. Technical support, for which to place a protective sell stop just below, is located at $5.30.  IMPORTANT NOTE: I am not a futures broker and do not manage any trading accounts other than my own personal account. It is my goal to point out to you potential trading opportunities. However, it is up to you to: (1) decide when and if you want to initiate any trades and (2) determine the size of any trades you may initiate. Any trades I discuss are hypothetical in nature. Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading (and I agree 100%):

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. More NewsView More

Is American Express the Credit Stock For a K-Shaped Economy? ↗

Today 15:23 EST

Via MarketBeat

Powering Up: How a Credit Upgrade Fuels Vistra’s AI Ambitions ↗

Today 13:53 EST

Is CrowdStrike Ready to Rally After Its Recent Pullback? ↗

Today 11:33 EST

Via MarketBeat

Tickers

CRWD

SanDisk Joins the S&P 500: Inside the Index Effect Rally ↗

Today 10:45 EST

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|